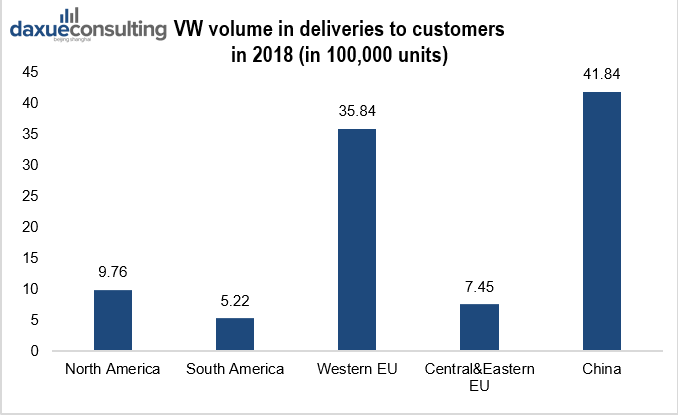

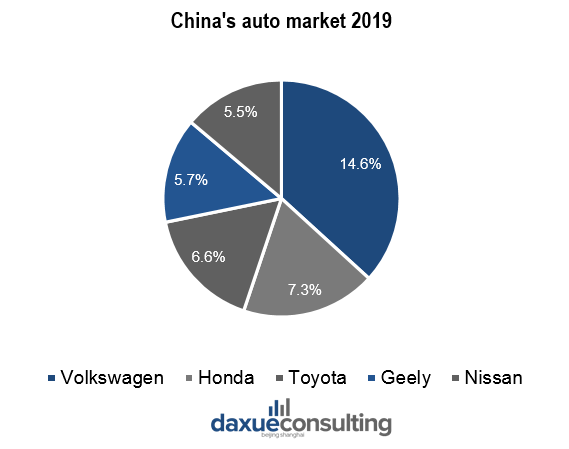

China has the more Volkswagen deliveries than any other country. Volkswagen takes 14.6% share in China’s car market. The German car brand has become the standard household car, what is the secret recipe of Volkswagen in China?

History of Volkswagen in China

On March 28th, 1937, ‘Gesellschaft zur Vorbereitung des Deutschen Volkswagens GmbH’ was founded in Germany. Later on Sep 16th, 1938, it got a name ‘Volkswagenwerk GmbH’. It is now one of the world’s largest international automobile companies, which produces and sells automobiles throughout the world. Today, the German company owns several world-known car brands such as Audi, Skoda, Lamborghini, Bentley, Porsche, Bugatti, Seat, and Scania.

In 1978 Volkswagen (VW) became one of the first international automobile manufacturers to enter the Chinese market. At that time, the development of the Chinese automotive industry was still in its infancy. In October 1984, Volkswagen Automotive Co., Ltd. established as the first Volkswagen Group joint venture in China. Today, the Group has 16 representative companies in the country, undertaking parts delivery and service provision for both customers and industry in addition to vehicle production and import. The Chinese market is one of the main markets of the Volkswagen Group. Operations of Volkswagen in China include the production, sales and services of whole cars, parts and components, engines and transmission systems.

China is the new center of power

The Chinese auto market is a special one in several respects – not only for its size and rapid growth. Government incentives and regulations play a role in controlling sales. For example, in 2015 the Chinese authorities temporarily cut taxes on cars in half with displacements of up to to stimulate sales for this class of vehicle.

Among the German carmakers, the Volkswagen Group has been a pioneer on the Chinese market. China is the biggest single market for the Volkswagen Group. Volkswagen in China produces and sells Volkswagen (e.g. Polo, Touran, Passat) and ŠKODA (e.g. Fabia, Superb, Kodiaq among others) brand models. Additionally, there are vehicles purposefully designed for China such as the Teramont SUV and the Phideon luxury sedan.

[Data Source: Volkswagen Group report 2018, ‘VW volume in deliveries to customers’]

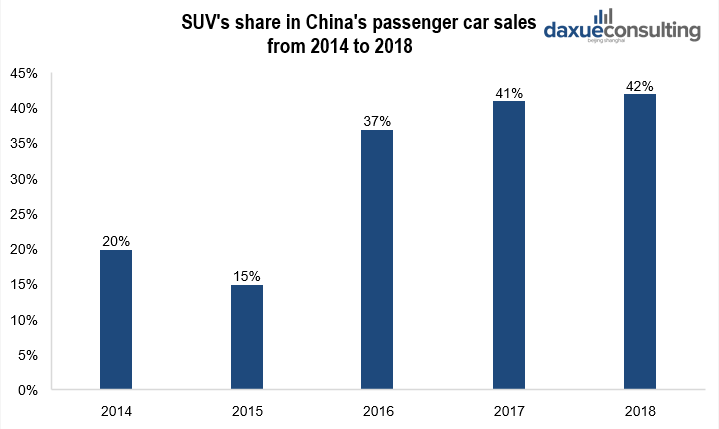

Volkswagen in China: Demand for SUVs continues to grow

China’s automobile market is undergoing a period of slow growth as China’s economic growth slows down slowly recovers from the COVID-19 pandemic. However, the high growth rate of the SUV (Sport Utility Vehicle) market has attracted the attention of many automakers. From 2013 to 2017, SUV sales grew rapidly in China, with the growth rate reaching 27%. The share of SUV in the Chinese market continues to grow.

[Data Source: Statista, ‘SUVs share in China’s passenger car sales from 2014-2018’]

Teramont and Phideon reflect the major trends on the Chinese car market. The Teramont answers the growing demand for SUV-class vehicles. Around four in ten newly registered cars in China are currently SUVs, and that figure is rising. The Volkswagen brand alone will have more than ten models on the SUV market by the end of 2020. The year 2018 saw the launch of the Tharu, Tayron, Touareg and T-Roc. In 2021 Volkswagen plans to invest more than $4.4 billion to add more SUVs to its lineup.

Volkswagen in the battle for China’s green vehicles market

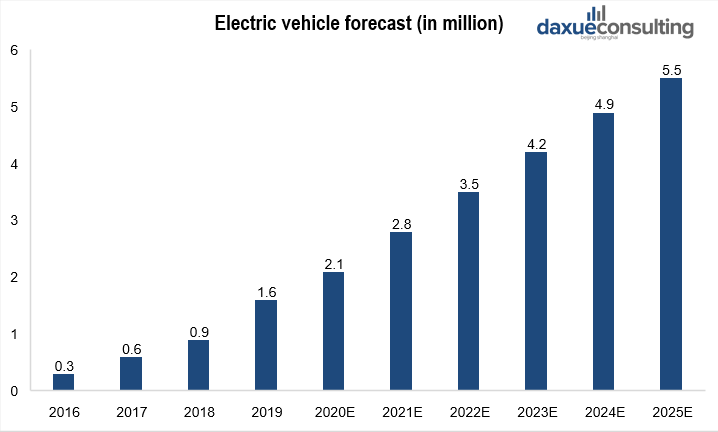

China has an important role as the world’s trendsetter and largest market for e-mobility. It alone accounted for 60 percent of worldwide demand for electric cars and plug-in hybrids in 2018. In 2018 around one million passenger cars with electric drives found buyers in China. That figure rose by 50 percent in 2019.

[Data Source: Business insider, ‘Electric vehicle sales in China forecast’]

The government is giving much attention to the field of electric mobility in China. By 2020 the fleet average fuel consumption is supposed to lie at five liters per 100 kilometers. To further advance e-mobility, the Chinese government introduced an electric car quota. Manufacturers that sell more than 30,000 cars a year in China must ensure that 10% of them are electric. All cars in the quota category receive credit points.

Volkswagen plans to invest in EV in China

The Volkswagen Group wants to lead the EV trend with a model campaign. By 2020 Volkswagen in China seek to bring 30 new fully electric and hybrid vehicles. By 2025 sales of electric models should reach 1.5 million units. Volkswagen China plans to invest more than US$12 billion in building and developing new-energy vehicles. It is the latest sign that competition for green cars in the world’s largest auto market will escalate. In 2019 Volkswagen claimed that it will introduce a new-energy vehicle portfolio of 40 locally produced models in China by 2025. Volkswagen in China has also teamed up with Anhui Jianghuai Automobile Group for a third joint venture. The joint venture will help the company to reach its goal of setting up a portfolio of pure battery cars.

Volkswagen – auto market leader in China

According to Volkswagen financial report 2019, the total profit of Volkswagen in the Chinese market was EUR 3.33 billion. By 2018 the Volkswagen Group built seven new plants in China. By then, the annual production capacity rose from 2.6 million to over 4 million. Volkswagen has the largest market share in the Chinese market during many years. In 2019 it was 14.6%.

[Data Source: carsalesbase.com, ‘China’s auto market 2019’, VW has the largest market share in China’s auto market]

Volkswagen in Shanghai

Volkswagen entrance into China formally began in March 1985, when it established its first facility in Shanghai (上海). Shanghai Volkswagen is a jointly-owned enterprise, with China and Germany each holding half of the initial investment. It is now the biggest modern automobile production base in China. Under the two major brands, Volkswagen and Skoda, it is covering markets of A0, A, B and SUV. Despite its success, it also faces competition from other foreign automobile manufacturers. For example, Santana Motor, a Spanish car manufacturer, has experienced country-wide success since it entered the country nearly 30 years ago in 1984.

Volkswagen in Changchun

With the success of Shanghai Volkswagen, the company turned its eyes to northern China and founded FAW-Volkswagen in Changchun (长春) in the Jilin(吉林) Province. By 2019, the company had more than 100,000 employees working there. After the establishment of its facility in Changchun (长春), the company created another two branches in China: one in Chengdu (成都) and one in Foshan (佛山). The Changchun plant of Volkswagen FAW Engine is an important powertrain production base for the Volkswagen Group. The annual production capacity is 300,000 units of the EA 888 engine.

Volkswagen in Tianjin

To keep up with demand for both SUVs and electric cars, Volkswagen in China opened three new factories in 2018: in Qingdao, Foshan and Tianjin. Tianjin plant produces electric vehicles based on the MQB platform. The factory in Tianjin also make high numbers of new models from FAW-Volkswagen, especially SUVs. Volkswagen Tianjin Plant will produce SUV models for both the Volkswagen brand and the Audi brand. The facility’s daily production capacity will be 1,200 units, with an annual production capacity of 300,000 units.

As a green factory, the new Tianjin plant will introduce a number of state-of-the-art sustainability measures. It includes world-leading volatile organic compounds (VOC) emissions control technologies and solar photovoltaic technologies. The facility will also focus on reusing water, with a reuse rate of 98%. By recycling and utilizing the waste water, the Tianjin plant will save up to 300,000 tons of water annually.

The location of the new plant near the Volkswagen Platform Tianjin Branch and Volkswagen Automatic Transmission Plant Tianjin will reduce delivery times, resulting in lower supply costs and CO2 emissions in the supply chain.

[Source: Volkswagen Group, ‘Volkswagen group in China’]

Competition in the Chinese auto market

Tesla and Volkswagen: EV price competition

Manufacturers such as Tesla and Volkswagen are ramping up operations in China to nab a piece of growing EV market. Volkswagen is readying two Chinese factories to build electric cars in 2020. The Chinese plants will have a production capacity of 600,000 vehicles. This will enable Volkswagen to leapfrog Tesla and make China the key battleground.

Tesla in China is still trying to reach its goal of making more than 500,000 cars a year by building a factory in Shanghai. VW relies on an established workforce in two of its plants in Anting and Foshun to build zero-emission cars.

Tesla’s cars have a sophisticated software algorithm to control how much electricity goes to the electric motor, air conditioning, seat heaters. Volkswagen China uses price and massive economies of scale to gain a competitive advantage.Volkswagen’s lower price comes from the car maker’s ability to place large orders.

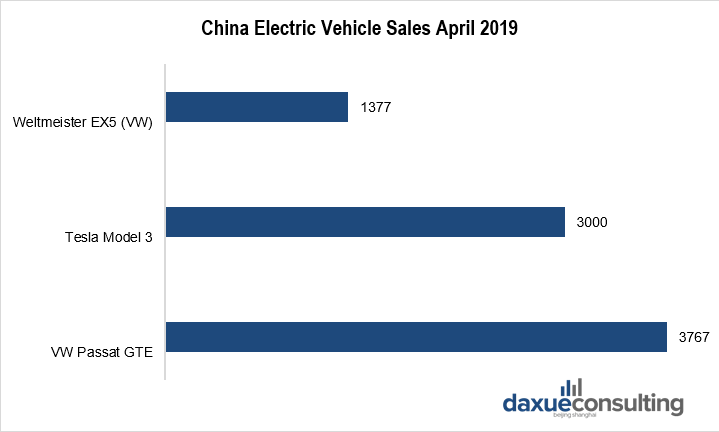

[Data Source: Cleantechnica, ‘China Electric Vehicle Sales April 2019’, VW EV car sales surpass Tesla’s EV car sales in China’]

Battle between GM and VW

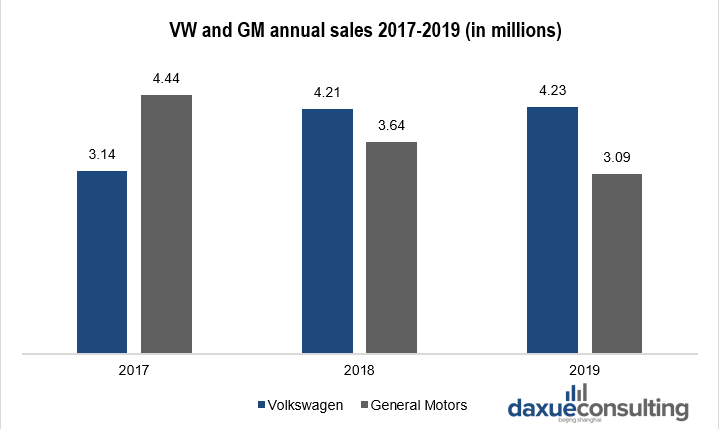

General Motors run of strong sales in China recorded its highest September sales result ever. In 2017, GM’s sales jumped 6.3% year over year as key rivals lost some ground. General Motors’ strongest non-Chinese competitor in the market is Volkswagen Group. Despite posting a similarly strong with deliveries rising 7.5%, VW’s volume was just around 315,000 vehicles in 2017. The driving force for GM’s gains was SUV sales. From 2018 Volkswagen in China continues to outperform General Motors, as GM posted another double-digit decline in volume.

[Data Source: Volkswagen Group, General Motors reports, ‘VW and GM annual sales 2017-2019’]

COVID-19 impact on Volkswagen in China

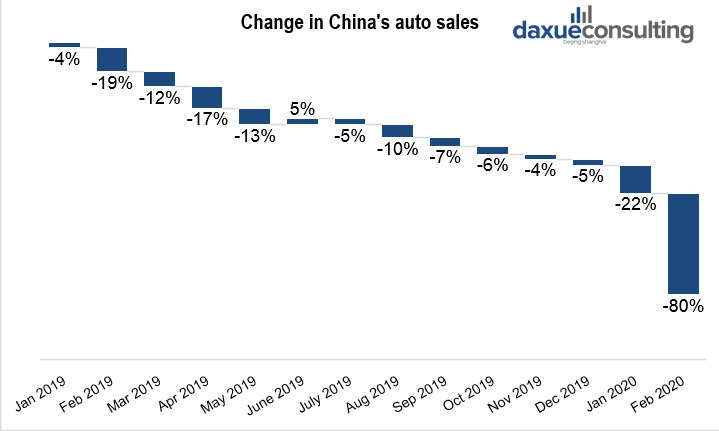

The COVID-19 outbreak has exposed several challenges for the automotive sector in China. 80 percent of automotive and related companies report that coronavirus will have a direct impact on their 2020 revenues. 78 percent of companies do not have enough staff to run a full production line. In February 2020 China’s car sales plunged by 18 percent. Automotive plants in China remained closed until mid-March 2020.

[Data Source: Bloomberg, ‘Change in China’s auto sales’, Sales drop in the Chinese auto market due to COVID-19 impact’]

Volkswagen in the Chinese market saw dropped car sales by 23% in the January to March 2020 period. The decline in sales in April 2020 was between 15% and 20% from a year earlier, while the drop in March, at the height of the pandemic, had been 40%.

Volkswagen factory in Changsha resumed operations in March, putting all but one of VW Group’s 33 car and component plants in China back in business. Volkswagen claimed showroom traffic in the end of March had rebounded to year-earlier levels. However, in 2020, Volkswagen in the Chinese market expects a decline of 3-15%.

Author: Valeriia Mikhailova

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast