The Coronavirus’ impact on the Chinese economy hit some industries more than others. While some businesses still struggle to recover from shutdown; there is clear evidence for hope in China’s recovery from the Coronavirus. The Economist Intelligence Unit predicts China will be one of three G20 nations without an economic recession. Current predictions of China’s 2020 GDP growth range from 1.0-2.6%. As of April 10th, Trivium’s National Business Activity Index puts china at 81.8% of typical economic output.

Economic recovery is uneven across regions

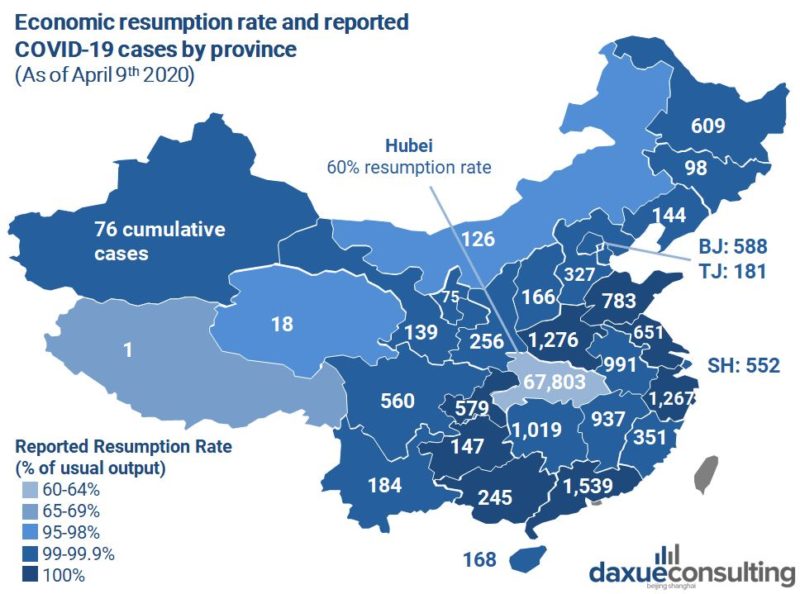

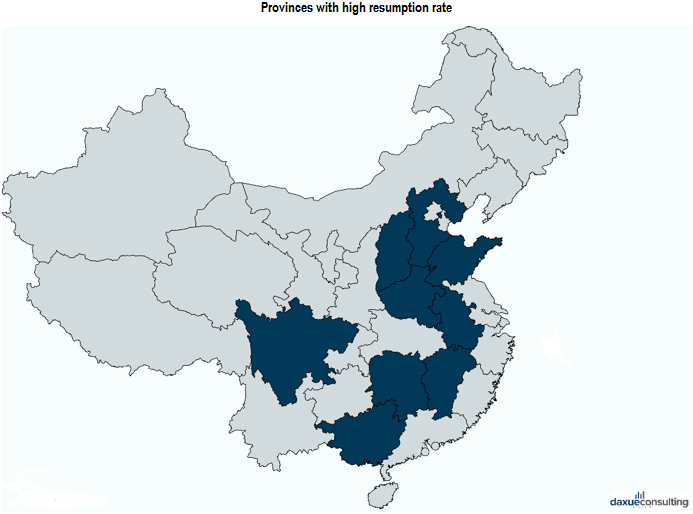

There is not a direct correlation with the number of cumulative cases and pace of economic recovery. Rather, it could be explained by the main industries of provinces. Inner Mongolia and Qinghai, where mining is an important part of the economy, seemed recover a bit slower due to decreased energy demand. Tibet, visited by over 30 million tourists a year, is second slowest to recover, despite only having one reported case. However, with the exception of Tibet and Hubei, all provinces are only a few percentage points, or fractions of percentage points away from regular output.

[Data sources: Trivium China, National and provincial health commissions, daxue consulting analysis]

Industries most hit by Coronavirus

As of April 10th, 95% of large companies have resumed operations. However, most companies are not yet at full production. Large corporations have been around the 80% mark since the last week of March, and may linger for a while until demand returns to normal. The service industry and SMEs are bearing the brunt of the impact, especially those in the tourism, catering, and transportation. SME’s, have been trailing behind large corporations in their recovery.

Manufacturing: may see some irreversible changes

Motor vehicle manufacturing was the most impacted according to China’s national statistics. General Motors, Nissan, Renault, and PSA (the owner of Peugeot) all have factories in Hubei province. After factories re-opening, China’s auto manufacturers may still face a decreased demand. According to China’s Association of Automobile Manufacturers estimations, car sales will be down 10% in the first half of 2020, and down 5% during the whole year. This is assuming the outbreak remains under control.

Many computer and electronic manufacturing is also concentrated near Hubei, the epicenter of the outbreak. 290 out of 800 plants named in Apple’s global supplier list were located in regions in China that had major delays in returning to work.

[Daxue Consulting CEO, Matthieu David-Experton, interview with FranceTVInfo.com on China’s economic recovery after COVID-19]

The delayed impact of supply chain

Supply chain delays may be felt up to five weeks after manufacturing plants re-opened. Shipment between Asia and Europe or the US can take around a month, meaning that we are not yet finished with the delays despite plants in Hubei opening up again. Additionally, many factory workers are migrant workers, and were not able to return to their jobs for an extended period, even if operations had resumed.

Many countries interpreted the COVID-19 supply chain impact as a sign that they had put all their eggs in one basket. The Japanese government announced that it would provide $2 billion in loans for companies shifting production back to Japan.

Back in 2019, an AmCham survey results showed 39.7% of companies were either considering or actively moving their supply chains out of China. In the midst of the trade war, the pandemic may be a nudge for companies to move manufacturing.

None the less, Chinese factories are resuming operations. According to a Bloomberg report, Apple’s iPhone 12 will be released on time, contrary to early rumors. The phone was not scheduled to start being manufactured in China until May. Assuming there is no second rise in the pandemic, China’s factories will in the clear by then.

Logistics: continued positive trend for container volumes

The logistics industry is reflective of China’s recovery from the Coronavirus. In the first week of March, Chinese ports had a 9.1% jump in container volumes. Among them, the growth rate of Dalian, Tianjin, Qingdao and Guangzhou ports was 10%. However, the ports in Hubei are recovering slowly and face a lack of staff and workers. Apart from ports in Hubei, the epicenter of the virus outbreak, other ports along Yangtze river have returned to normal operation. The cargo throughput of three major ports at Yangtze river, Nanjing, Wuhan (in Hubei) and Chongqing increased 7.7%, while the container throughput increased 16.1%.

Shipping rates have increased 20-fold

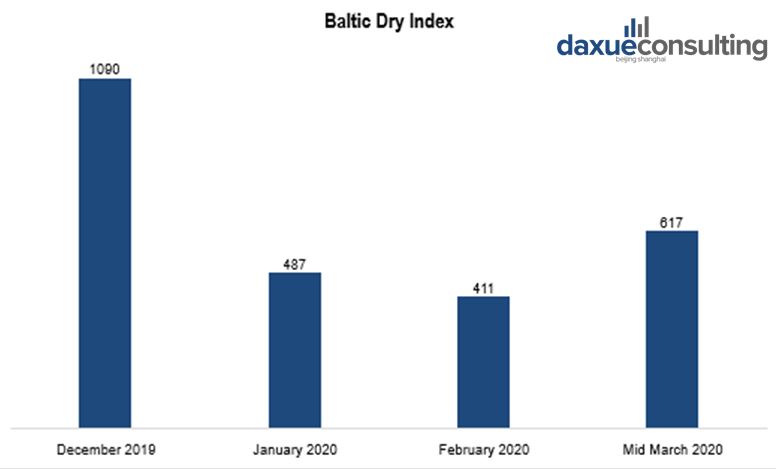

Freight shipping rates for dry bulk and crude oil have begun to show early signs of recovery as Chinese industries recover from Coronavirus. The Baltic Dry Index, which is a proxy for dry bulk shipping stocks and the general shipping market, has risen by 50 percent to 617 on March 6, while on February 10 it was 411. Charter rates for very large crude carriers have also regained some footing in recent weeks. It forecasts daily rates for Capesize ships, or large dry-cargo ships, to rise from about US $2,000 a day in 2020 first quarter, to US $10,000 in the second quarter, and to more than US $16,000 by the fourth quarter.

[Data Source: sofreight.com, China’s recovery from Coronavirus Report by Daxue Consulting, growing BDI in March 2020]

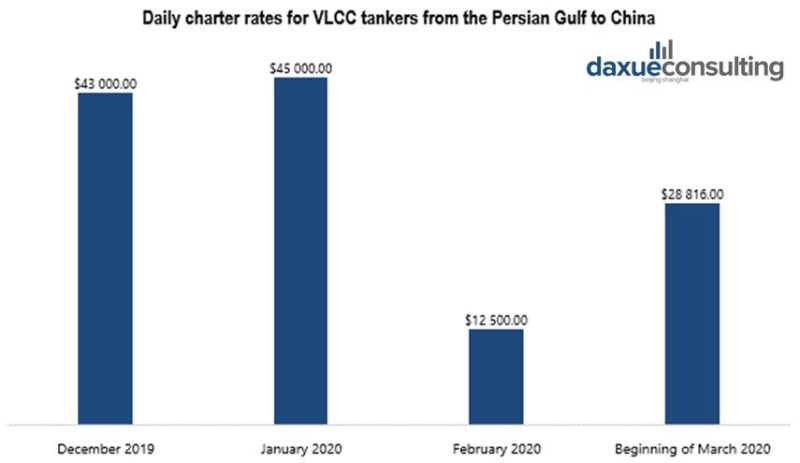

Daily charter rates for the VLCC tankers from the Persian Gulf to China have risen to US$28,816 per day on March 5th from US$12,500 the previous month. A March 2nd report by IHS Markit noted that as Chinese industries recovering from Coronavirus, the final week of February saw a resumption of industrial production in China. Container cargo lines may have to wait longer for resumption, as it takes time for manufactured goods to roll out of factories for export. It is expected that the recovery time will be in the second or third quarter.

[Data Source: China Ports Association, China’s recovery from Coronavirus Report by Daxue Consulting]

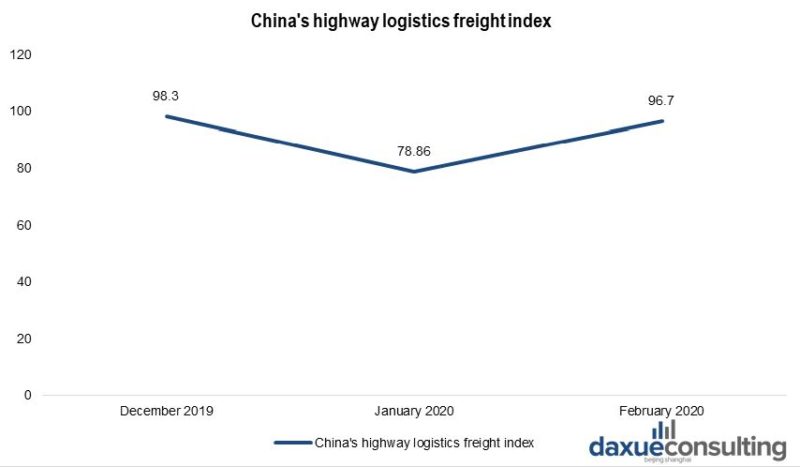

While Chinese industries recover from Coronavirus, highway logistics also getting on track to recover. From March 16 to March 20, 2020, the China Highway Logistics Freight Index, was 984.41 points, up from last week; the LTL light cargo index was 967.94 points, an increase of 0.01% from last week. From March 23, the demand for highway logistics is stable and the highway freight index rebounded slightly. From the perspective of later trends, the demand for highway logistics is expected to rise steadily, and the freight index may fluctuate and rise.

[Data Source: China Federation of Logistics and Purchasing, China’s recovery from Coronavirus by Daxue Consulting, growing China’s highway logistics freight index]

Retail and restaurants: customers return to shops

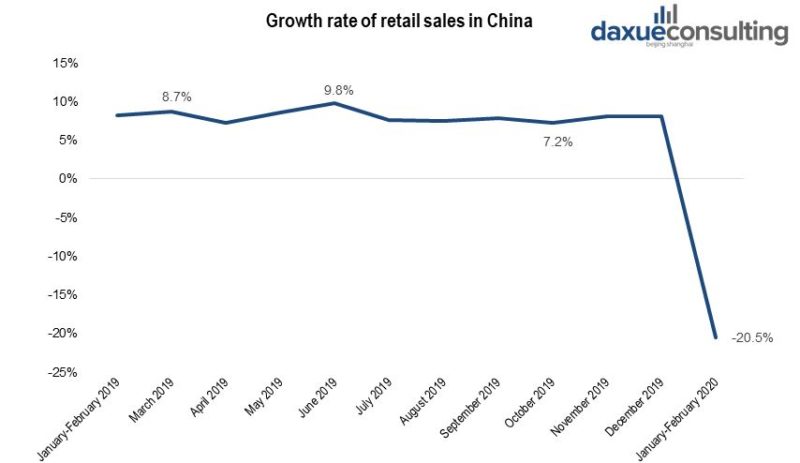

The Coronavirus impacted Chinese consumption in the long-run, and many of those impacts are still unfolding. However, during the pandemic, we are saw retail sales in China shrink by a fifth in the first two months of 2020, compared to a year earlier. In terms of China’s recovery from the Coronavirus, offline retail has a large uphill climb ahead of them. However, restaurants and supermarkets are indicators of the positive trend ahead.

[Data source: qianzhan, China’s recovery from Coronavirus by Daxue Consulting]

Offline restaurants and shops reopening

The Chinese offline retail industry is recovering from Coronavirus, on March 13th all 42 official Apple retail stores opened for hundreds of shoppers. IKEA, which opened three of its Beijing stores on March 8, also saw high visitor numbers and queues. Earlier, on February 27 Starbucks opened 85% of its stores.

[Source: daxue consulting, Starbucks coffee shop in Shanghai, China enforcing social distancing by blocking off chairs]

Some restaurants narrowly avoided disaster

Had the pandemic shutdowns lasted two months longer in China, many more restaurants would have been in serious trouble. Over half of restaurants in China reportedly do not have enough cash to cover operating costs for more than six months. Normally, the restaurant industry makes 15% of their annual revenue during the lunar new year holiday. But this year, the China cuisine association reported that the restaurant industry lost 78% of revenue during the 2020 lunar New Year season.

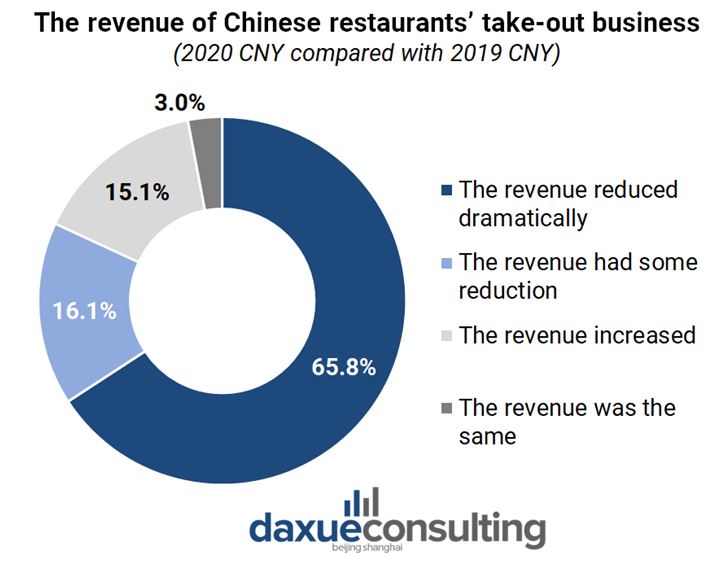

Although China has a sophisticated meal delivery ecosystem, which has measures to ensure sanitary and contactless delivery, delivery alone was not enough to save the F&B industry. 65.8% of restaurants reported to the World Federation of the Chinese Catering Industry that their revenue reduced dramatically compared to the lunar New Year period of 2019. However, 15.1% of restaurants actually experienced a revenue increase.

[Data source: World Federation of the Chinese Catering Industry, daxue consulting’s Coronavirus economic impact in China report]

As of March 24th, Yum China reported 95% of its stores were either partially or fully open. Around 10-20% of stores either with restricted hours or serving delivery only. Also as of March 24th, Starbucks had also opened 95% of its stores in China, after being closed for 40-60 days.

Super market chains

As of February 20th, the average opening rate of large-scale supermarket chains nationwide exceeded 95%, and the average opening rate of convenience stores has also been around 80%. However, large-scale shopping malls such as department stores and shopping malls currently have a relatively low opening rate of about 50%.

Baidu search statistics show that after a month-long lockdown, China’s consumer demand is increasing. At the beginning of March, information on “resumption” on the Chinese search engine increased by 678%.

China’s recovery from Coronavirus in the travel industry: surge in domestic tourism

The tourism industry felt the most immediate impact of the epidemic. According to our Coronavirus economic impact in China report, the damage to the Chinese tourism industry was equivalent to a loss of 1 trillion yuan GDP.

Despite only having one reported COVID-19 case, Tibet Autonomous Region has the second lowest economic resumption rate after Hubei. Tibet’s economy, growing a double digit speed for twelve years straight, is largely dependent on tourism. According to China Daily reports, in 2018 Tibet’s tourism revenue was nearly 50 billion yuan, constituting around 30% of the province’s GDP.

Plane tickets are selling again

From March 1st to March 8th, more than 300 Chinese scenic areas reopened. In Hainan, tourism contributed to around 20% of the local GDP in 2018. Since the Hainan tourist sites’ reopening, they have received over 74 thousand tourists and 23 thousand tourism workers have returned to work.

As more and more places have no new reported cases, the domestic tourism market is accelerating the pace of recovery. Qunar and Ctrip, two of China’s biggest online travel service providers, have resumed bookings for travel packages and attraction tickets after a two-month hiatus.

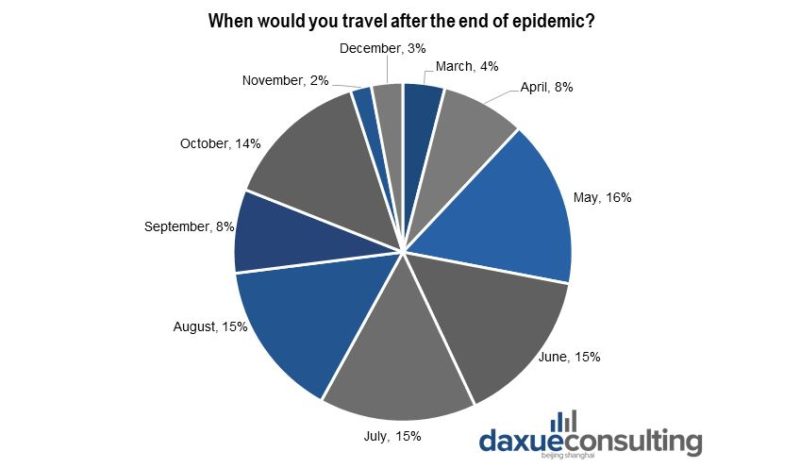

Ctrip started selling travel packages and attraction tickets on its app last week as the country accelerated the pace of reopening parks and tourist spots. As of March 17, tickets to 1,449 well-known tourist spots across the country could be bought online while 40 percent of China’s top national tourist spots have reopened, according to Ctrip. Results from a recent Ctrip online survey of nearly 15,000 netizens showed that 78 percent expressed willingness to travel in the near future.

[Data Source: China Institute of Travel Studies, Ctrip, China’s recovery from Coronavirus Report by Daxue Consulting, Chinese people are willing to start traveling in late spring and summer]

Where Chinese tourists are itching to travel after the Coronavirus outbreak

According to Ctrip Global Play Platform statistics, as of March 11, the number of scenic spots reopened and resumed on the Ctrip platform has exceeded 1,000, and the resumption rate is more than 25%. There are more than 100 scenic spots open nationwide.

[Data Source: China Institute of Travel Studies, Ctrip, China’s recovery from Coronavirus Report by Daxue Consulting, growing demand for domestic tourism in China]

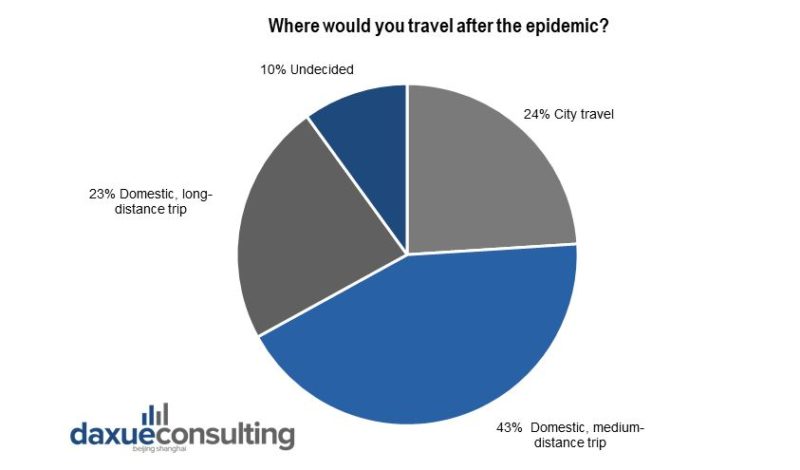

Additionally, Chinese customers can now book presale travel packages for April and May on Qunar’s app and website. Qunar is now offering 1,000 domestic travel packages for regions including Shanghai, Xinjiang and Sichuan, based on the respective local government guidelines for the resumption of tourism. According to Qunar’s data, as of the end of February, more than 90% of hotels in China (excluding Hong Kong, Macao and Taiwan) have resumed operations.

Qunar claimed that online searches for China’s upcoming May 1st holiday soared 76 percent at the beginning of March compared to the previous week. The words “scenic area”, “museum”, “tourism” and “landscape” have become the key words of the national tourism industry network information in February.

For the full year of 2020, Analysys is forecasting that the proportion of domestic tourism in the country’s travel market will increase from 47% last year to 60%. However, that number depends on how long international travel restrictions remain in place.

Industries that may explode post Coronavirus outbreak

Online retail: outbreak encouraged the rapid movement from offline stores to digital

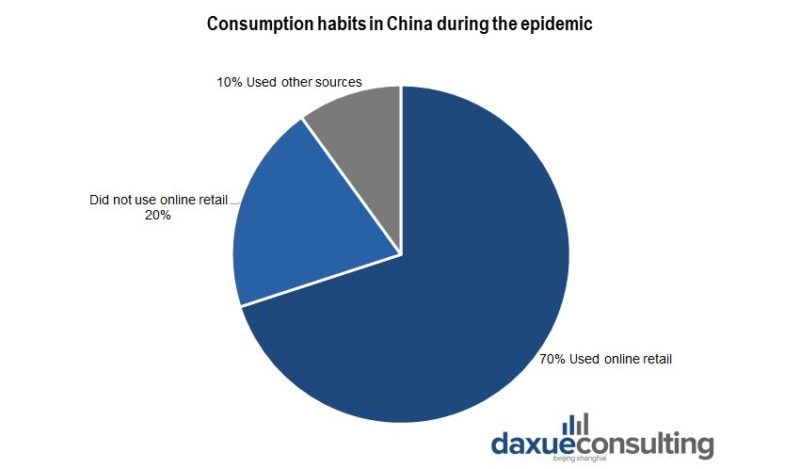

Since the outbreak of the Coronavirus epidemic, most people in China spend more time at home. Even consumers living in third to fifth tier cities are becoming keen to shop online. Surveys show that this group made twice as many online purchases for the first time during the epidemic than consumers living in first-tier cities. According to the GfK China Consumer Confidence Study of February 2020, more than 40% of consumers use online shopping more frequently, resulting in a surge in demand for online shopping and home delivery. More and more consumers are also shopping for the first time through platforms such as third-party apps, official brand websites, and WeChat communities.

[Data Source: qianzhan, China’s recovery from Coronavirus Report by Daxue Consulting, more people choose online shopping during the epidemics]

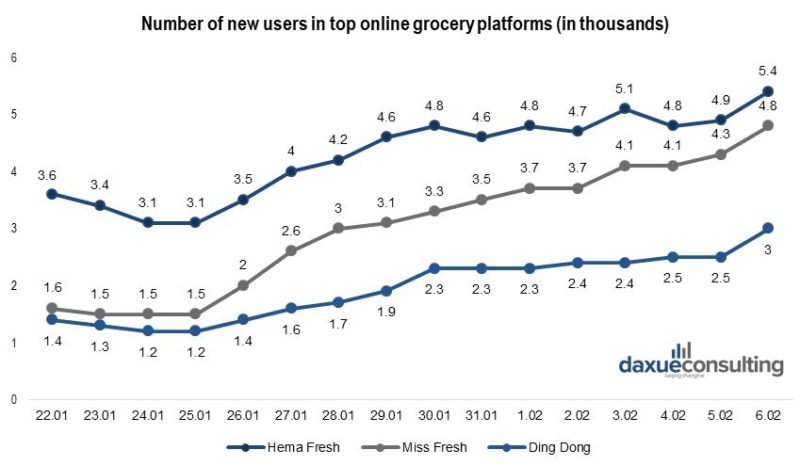

Carrefour reported vegetable deliveries growing 600 percent year-over-year during the Lunar New Year period and JD.com saw an increase of 215 per cent in online shopping grocery sales to 15,000 tons in just the first 10 days of February 2020. According to the Mob data center, from January 22 to February 6, 2020, the number of new users in Hema Fresh, Daily Fresh, and Ding Dong’s continued to grow.

[Data Source: qianzhan, China’s recovery from Coronavirus Report by Daxue Consulting]

As for online shopping in the future, half of consumers look forward to home delivery, and 40% of the respondents (mainly younger and wealthier consumers) want environmentally friendly packaging for their products.

Great potential of online catering industry

The food delivery market in China experienced high growth from the end of February to the end of April. More and more customers choose to order food home instead of eating out.

The survey shows that among the merchants that were in business in early February 2020, more than 70% of orders from their restaurants and shops accounted for online food delivery. In the short term, online food delivery has become an important driver for catering businesses to survive the crisis. Whereas in the long run, the epidemic has accelerated the digitalization of the catering industry.

In January 2020 Meituan Waimai announced in-app feature for contactless delivery, allowing the courier to leave an order in a convenient spot for the customer to pick up without interaction. So far Meituan Waimai claimed that contactless delivery has been launched in 184 cities across the country and is expected to cover the whole country.

As some food enterprises gradually recover their food delivery services, hoping to compensate some financial losses, contactless food delivery in China growth will last for a period of time

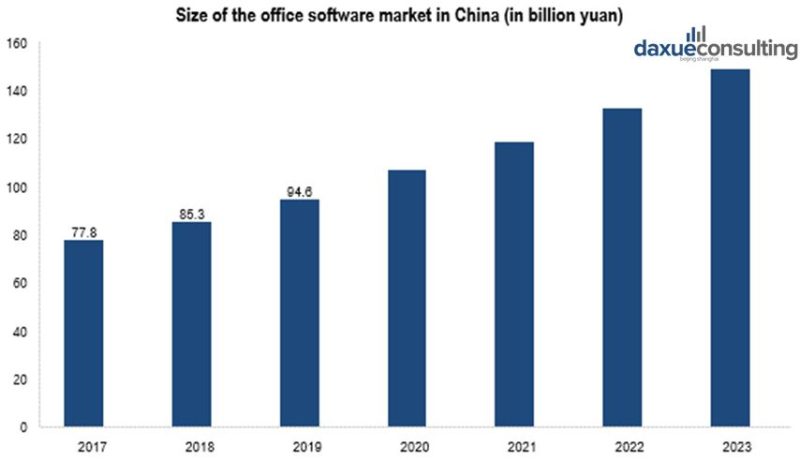

The demand for epidemic prevention drives the demand of the cloud video industry

During the new Coronavirus epidemic, many companies and schools adopted remote office work and online teaching. It is expected that telecommuting at this stage will help to increase the recognition of video conferencing.

[Data Source: qianzhan, China’s recovery from Coronavirus by Daxue Consulting]

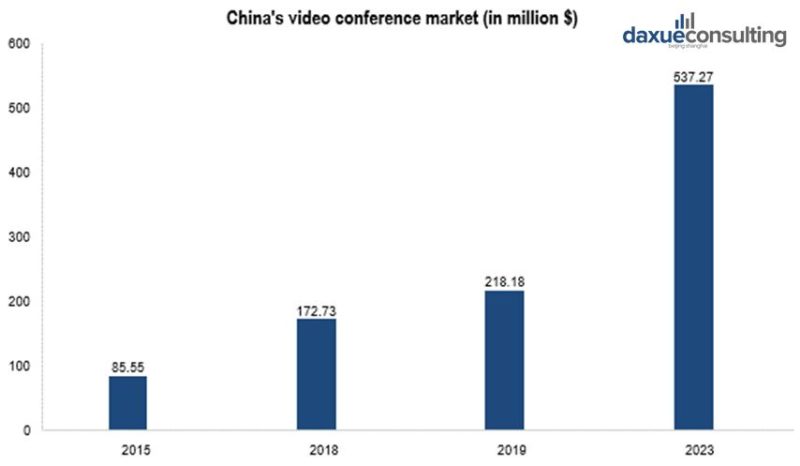

At present, the domestic software market represented by cloud video conferences is US $173 million, but the growth rate is considerable, with a CAGR of 25% in the next five years. It is estimated that the size of the domestic software video conference market in 2023 will reach 537 million US dollars, which is three times more than current one.

[Data Source: qianzhan, China’s recovery from Coronavirus Report by Daxue Consulting]

The demand for epidemic prevention and control is expected to drive the demand for the cloud video industry, and the industry penetration rate is expected to gradually increase. At present, the penetration rate of video conferences for about 35 million small and medium-sized enterprises in China is less than 5%. China’s video conferencing market is not the only technology to receive a boost from the virus, some AI technologies were advanced during COVID-19 as well.

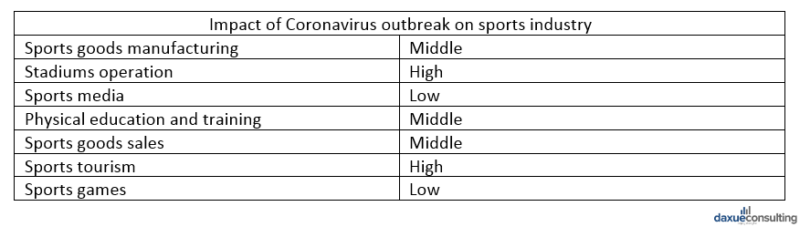

Sport industry: in the long run, the epidemic will not change its’ development

One of the Chinese industries recovering from Coronavirus is sport industry. In 2018, the total scale of China’s sports industry (total output) reached 265.9 billion yuan, and the added value of the sports industry reached 107.8 billion yuan. In 2018, the added value of the sports service industry was 653 billion yuan, and its share in the sports industry increased from 57% in 2017 to 64.8%. According to the data of the State Sports General Administration, the added value of China’s sports goods and related products manufacturing in 2018 was 339.9 billion yuan, accounting for 33.7% of the total added value of the sports industry.

In the short term, the new coronavirus epidemic will have a more significant impact on the development of the sports service industry and it will be prominent in offline clusters such as sports competition performances, stadium operations, sports equipment and related product manufacturing. It has less influence on the online sports.

[Data Source: qianzhan, China’s recovery from Coronavirus Report by Daxue Consulting]

In the long run, the epidemic will not change the vigorous development of China’s sports industry. On the contrary, people will pay more attention to their physical health and increase their enthusiasm for participating in physical exercise.

China goes back to work: Signs of recovery from Coronavirus

Manufacturing: top manufacturing companies resumed production

From February 18th to 20th 2020 China Enterprise Confederation set up a research group to conduct a targeted survey on the resumption of production. It showed that China’s top 500 manufacturing companies resumed work and resumed production at 97%. Among the enterprises that have resumed work and resumed production, the average employee turnover rate was 66%. The average capacity utilization rate was 59%.

Chinese SME’s recovery from Coronavirus

As the largest employer, China’s recovery from the Coronavirus is not complete until SME’s are back on track. SME’s are the hardest hit from the Coronavirus outbreak in China. According to a survey by Beijing and Tsinghua universities, 85% of SME’s say they would only last three months without a regular income. However, as of April 10th, SMEs are over 80% recovered.

China’s state owned enterprises recovery from the Coronavirus

In general, the indicators of state-owned enterprises are significantly better than those of private enterprises, and there are more difficulties and problems in resuming production and production in private enterprises.

In terms of different industries, technology-intensive industries, and capital-intensive industries have a higher resumption rate, while labor-intensive industries have a lower recovery rate.

From the perspective of regional distribution, Guangxi, Anhui, Jiangxi, Hunan, Sichuan, Henan, Shandong, Hebei, Shanxi have higher rates of resumption.

[Source: Xinhua, China’s recovery from the Coronavirus by Daxue Consulting]

The capacity utilization rate in labor shortage regions such as Jiangsu and Zhejiang and the Yangtze River Delta and Pearl River Delta regions is lower.

Tech supply chain is gradually recovering

As Chinese industries recovering from Coronavirus, there is a hope for the resumption of the global supply chain. For example, Foxconn Technology claimed that the company’s factories in China would be running at their normal pace by the end of March. Compal Electronics and Wistron expect that by the end of March computer components production capacity will return to the usual low-season levels. Philips, whose supply chain was disrupted by Coronavirus, is also recovering now. At present, the factory capacity has been restored to 80%.

China auto sales fell significantly. However, Volkswagen, Toyota Motor and Honda Motor resumed production on February 17. On February 17 BMW also officially resumed work at Shenyang’s world’s largest production-based subway West Plant, and nearly 20,000 employees returned to work. Tesla’s Chinese factory claimed that it has exceeded the pre-outbreak level and since March 6 more than 91% workers returned to work.

[Source: Reuters, an employee wears a face mask to work on a car seat assembly line in Shanghai]

As Apple prohibited its engineers to travel to Asian countries, the launch of Apple’s new phone may be postponed from September to October. However, Apple’s CEO Tim Cook called this “temporary condition” and suggested iPhone makers wouldn’t make quick moves out of China.

During China’s recovery from the Coronavirus, the upstream and downstream of the industrial chain gradually link up again. Foreign firms are more and more confident in their businesses in China.

Assistant Author: Valeriia Mikhailova

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes