Over the past 20 years, China has become more and more open. Sex is still a sensitive subject but consumer attitudes and the policies of the Chinese government are more flexible. The adult toys market in China is unfolding and is largely untapped.

Download our report on China’s adult toys market

E-commerce, brand image, strong consumer demand: the sex toys market in China is promising

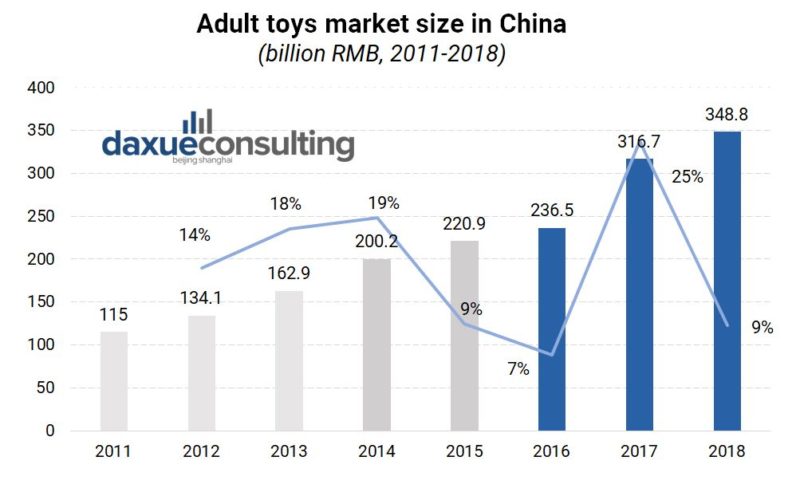

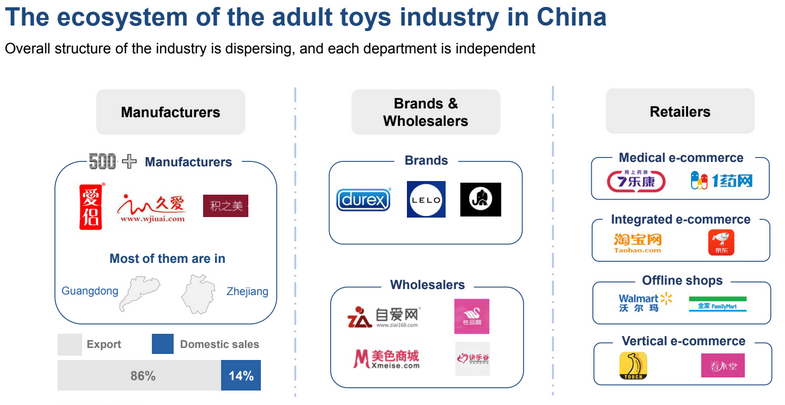

The adult toys market in China is booming. As the world’s largest exporter, producing more than 70% of these items, China is one of the countries where the market is exploding. After an export-oriented industry up to 86%, the trend is now to satisfy domestic demand. Consumption trends for adult toys in China remain low in contrast to its Asian neighbors such as Japan (38% against 75%). Nevertheless, the market is promising and represented 350 billion RMB in 2018.

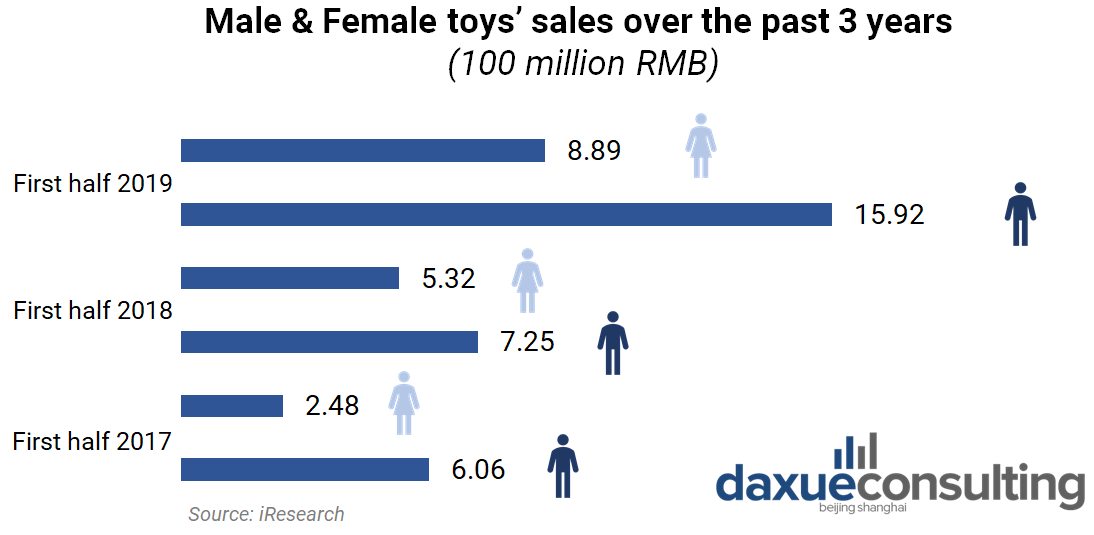

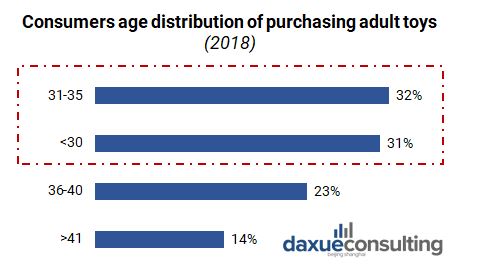

The Middle Kingdom attracts foreign investors through its production potential, which explains an increase in the number of startups between 2015 and 2017 (+87,15%). The number of consumers is increasing especially within young adults under 35 years old, which make up 63% of sales. At the same time, women’s consumption has doubled in two years and represented 15.92 million RMB toys sales in China. Sales are higher in large, first-tier cities. However, there is strong demand from second-tier cities, which account for nearly 31% of sales.

[Source: Daxue Consulting, adult toys market size in China]

Preferences of Chinese adults toys consumers

Previously considered as a medical tool, the adult toy has become an object associated with pleasure. Traditionally a masculine purchase, sex toys in China has succeeded in attracting a female clientele in China. If consumers of adult toys express a real interest for these objects, the buyers are even prudish and they want it to be confidential. The typical profile is as follows: male, 26-35 years old, with a good financial situation and a high level of education. He has sexual relations with his partners and is married or single without children. He lives and works in a first-tier city.

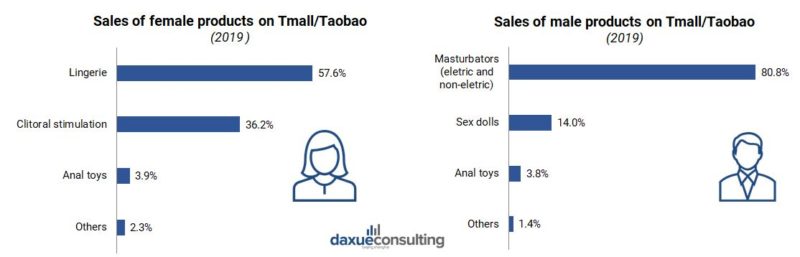

Even though men are the primary consumers, the gap between genders is narrowing. Consumer habits between men and women are different. Woman tends to prefer lingerie and objects allowing clitoral stimulations (i.e. 90% of individual sales) whereas men prefer masturbators objects (i.e. 90% of sales). Among the selection criteria, consumers prefer cheap products. However, most of them are paying attention to quality of the accessories. It also applies for innovation, packaging and experience user. Peak consumption occurs twice a year during Valentine’s Day and e-commerce festivals. Consumers used to ordering one to two months in advance, which explains the drop in sales during this period of activity when demand is supposed to be strong. More than 2/3 adult toys buyers have already used sex toys. Therefore, the more experienced consumers are, the more they are a prime target for industrialists.

[Data Source: Research.Moojing. Image source: Daxue Consulting, sales distribution of sex toys in China by gender]

[Data source : Tryfun. Image source: Daxue Consulting, sales distribution of sex toys in China by age]

E-commerce: a success business model

Faced with a booming Chinese e-commerce market, there are tremendous opportunities for brands. The adult toys market in China includes different types of intermediaries such as manufacturers, brands and wholesalers and retailers as well. 58.7% of sales are carried out offline against 41.3% online. At present, offline toy sales are still the most significant channel of China’s adult toys retail. Nevertheless, the consumption trend could be reversed with the current direction of e-commerce growth. According to forecast, e-commerce will surpass offline stores. This one is very popular because it can effectively protect users’ privacy by not marking products’ names without disclosing information about the consumer during the delivery of the product. Distribution channels of adult toys are not limited to offline stores anymore. E-commerce is the most diversified distribution channel; it includes official websites, mobile apps, and social media. Meanwhile, multiform marketing modes promote sales volume growth.

[Source: Daxue Consulting, distribution channels for the adult toys market in China]

Products on the adult toy market in China

Following the removal of political and cultural barriers, many companies have set up to conquer the adult toys market in China. There are several families of products such as: basics items (condoms, lubricants, massage gels), lingerie, women’s and men’s product (masturbatory objects, sexual accessories). Other adult toys could be developed in China as consumers are eager for innovation. There are a small number of competitors on the market, which leads to higher prices.

[Source: Daxue Consulting, adult toys product family]

[Data source: Taosj.com, sales of male vs female products in China]

How brands adapt to Chinese consumers

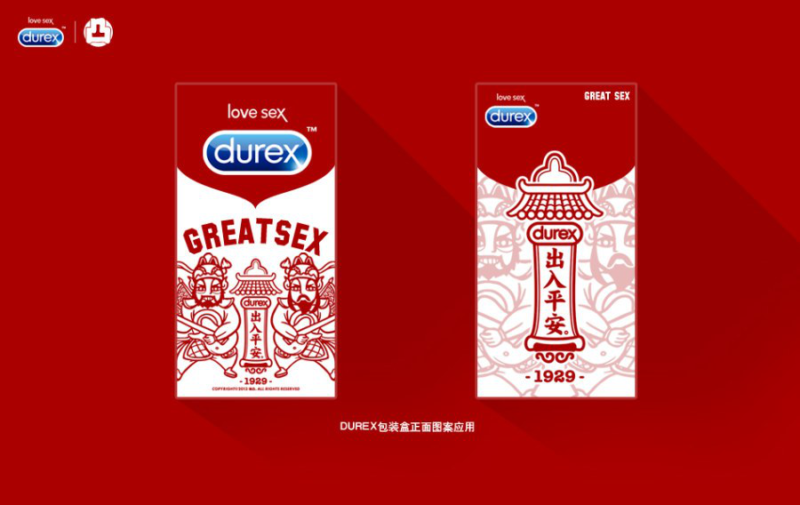

Among leading brands in China, ones find Durex, Tryfun and Touch that have different positioning and segmentation. As the most popular condom brand in China, Durex specializes in the production and sale of condoms worldwide. It has about 40% of the Chinese condom market. The English brand relies on its reputation and its marketing and advertising actions to gain notoriety. The latter seeks to interact with the public with the implementation of small games, videos and a creation of its online platform called Weibo, which brings together more than 3 million Internet users. Driven by its success, the brand’s latest video has been viewed by more than 5 million people. The brand plays on humor, the authenticity of its products and the notion of pleasure among young adults. Although the condom is the brand’s flagship product, the other adults toys are less exposed.

[Source: China Social Media, Durex’s marketing campaign in China]

Conversely, the Chinese brand Tryfun bank on the plurality of its distribution channels via e-commerce platforms and the design of its products which reinforce its positioning innovative. TryFun has rethought its marketing content in order to break down stereotypes, which has significantly improved its brand image. The trademark relies on a sober and less provocative representation than some trademarks. In 2018, Tryfun has won the Design Intelligence Award in China for its latest innovation called “Xingshi”, a woman’s vibrator recognized for its attractive design.

[Source: Daxue Consulting, Tryfun’s marketing campaign in China]

Another running brand, Touch’s is an interactive mobile application that allows users to purchase their products directly. Its brand strategy is based on e-commerce platforms, its online community and customer satisfaction. In 2017, App lets users rent ‘warmed up’ second-hand sex dolls the brand also created a line of plastic dolls. However, its strategy was not appreciated by everyone as many considered it vulgar.

[Source: New-York Post, Touch line of rentable sex dolls on display at a promotional event in Beijing]

The adult toys market copes with macro and micro economic threats

What adult toys offer is confusing in the consumer’s mind. Indeed, they raise an issue of a low differentiation because most products are copied and they are indistinguishable from the competition. On the other hand, the policies flead by the Chinese government is weighing on businesses such as rules in terms of advertising law, intellectual property, counterfeiting, and taxation. Hence, the costs of advertising are very high and companies can’t invest. Some companies adopt unsuitable methods of marketing promotion, it showed the impression of the low-end brand image to customers. The phenomenon of low quality products is widespread and the rules that regulate the industry are too vague, which is another significant reason caused low user. However, China has production capacities that can enable it to become the market leader. However, the market is little exploited and sees development opportunities slipping through its fingers.

See our full adult toy market in China report

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes