The Middle East, particularly the Gulf region, stands out for its opulent lifestyle, extravagant architecture, and high-end attractions. Notably, the United Arab Emirates (UAE), with cities like Dubai and Abu Dhabi, is a beacon of luxury, boasting upscale developments, lavish hotels, premium shopping malls, and extravagant entertainment options. The region’s allure extends to affluent Chinese moving to the Middle East, seeking not only a luxurious lifestyle but also lucrative business opportunities and quality education.

From China to the Gulf: HNWIs flock to the UAE in record numbers

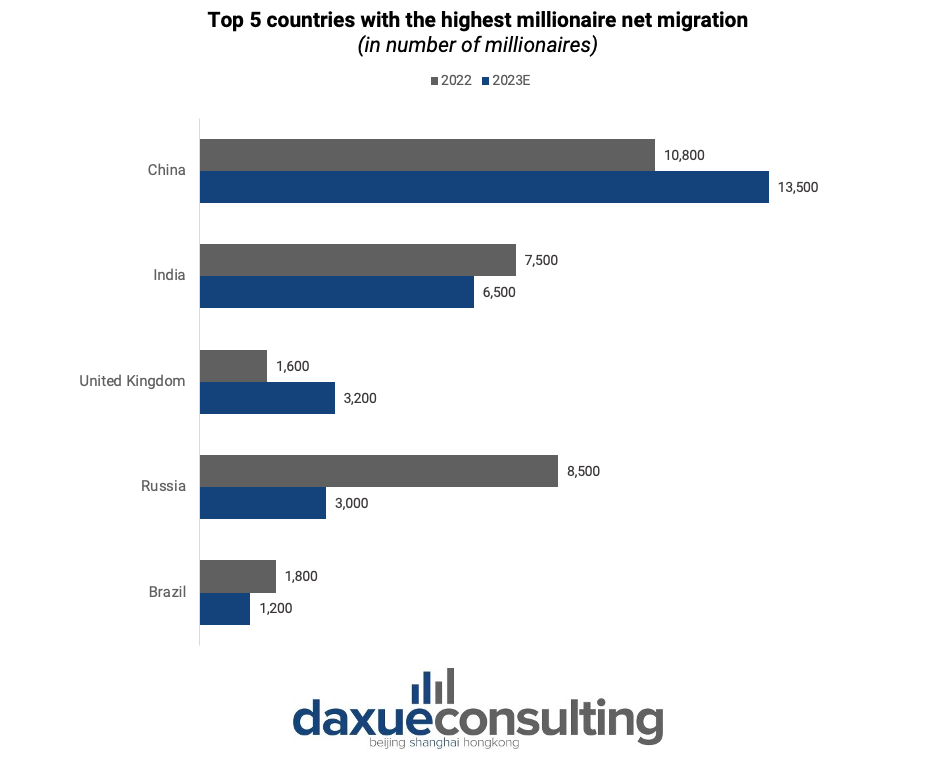

In 2022, a record number of High-Net-Worth Individuals (HNWIs), around 10,800, left China—a trend set to intensify in 2023 with an estimated outflow of 13,500. Notably, many HNWIs are eyeing the UAE as their new home, with an expected influx of 5,200 individuals in 2023, surpassing the projected 1,500 heading to the United States. This underlines the Gulf region’s growing appeal as a top choice for HNWIs seeking new opportunities. Several key drivers contribute to this trend, reflecting the shifting preferences and priorities of HNWIs such as travel and lifestyle preferences, business prospects, and educational opportunities.

Middle Eastern destinations shine as magnets for affluent Chinese individuals and luxury shoppers

Chinese visitors are increasingly becoming a focal point for Middle Eastern destinations to achieve ambitious tourism goals. A survey that investigated HNWI and affluent Chinese individuals in May 2023 showed that over 20% of China’s millionaires are planning to visit the Persian Gulf in the next 12 months. The Middle East’s appeal is attributed in part to government policies and active promotion of the destination in China.

For instance, Dubai has adopted measures such as visa-free policies and “China-ready” strategies, with a focus on marketing to attract Chinese visitors. Similarly, countries like Saudi Arabia aim to welcome 4 million Chinese tourists by 2030 through initiatives like electronic visas and 96-hour transit visas. In addition, Chinese online travel platforms like Ctrip (now known as Trip.com) have partnered with destinations like Saudi Arabia, Qatar, and Abu Dhabi to further boost the appeal of these regions to affluent Chinese moving to the Middle East.

Impact on luxury sales in the Middle East

Chinese tourists, who previously contributed 10% to 15% of luxury sales in Dubai before the pandemic, are expected to significantly impact luxury sales in the Middle East. Chinese HNWIs exhibit a preference for purchasing beauty, alcohol, watches, and jewelry. Given that luxury products like watches and jewelry are more affordably priced in Dubai, renowned brands such as Cartier and Van Cleef & Arpels in the hard luxury sector, characterized by high-end, enduring items celebrated for craftsmanship, exclusivity, and artistic excellence, are poised to experience significant gains.

Dubai’s affordable product prices stem from its low taxes, minimal customs duties, and competitive retail environment. The market’s high purchasing power, driven by affluent residents, also enables businesses to negotiate favorable deals with manufacturers, resulting in lower prices for consumers.

China-UAE economic collaboration: A growing partnership and investment opportunities

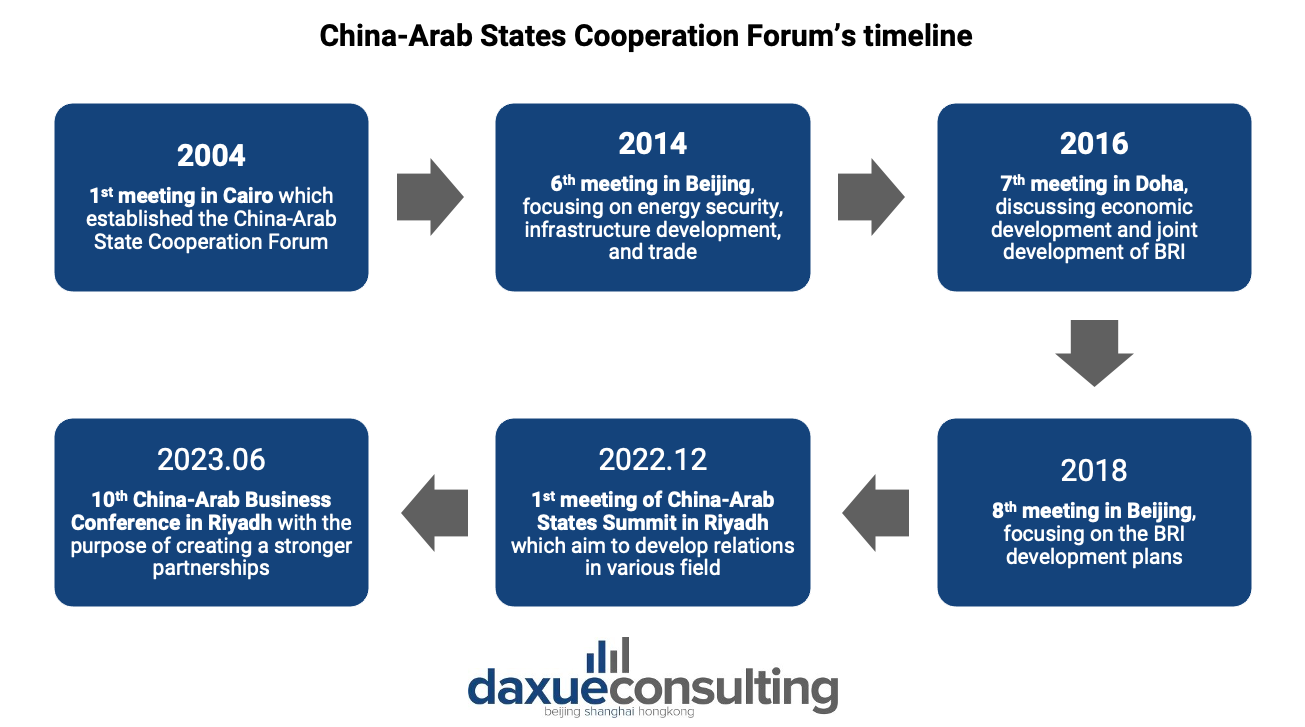

China and the UAE have strengthened their collaboration, attracting Chinese entrepreneurs. The Gulf Cooperation Council (GCC) actively engages in the Belt and Road Initiative (BRI), emphasizing economic collaboration. GCC countries contribute significantly to the BRI by investing in key infrastructure projects, particularly in ports and transportation.

Riyadh’s Arab-China Conference spurs USD 10 billion in investments

In June 2023, Riyadh hosted the 10th Arab-China conference aimed at enhancing economic ties. The event led to the signing of more than 30 investment agreements totaling over USD 10 billion. The agreements span various sectors, including technology, renewables, agriculture, real estate, minerals, supply chains, tourism, and healthcare.

Green investments take center stage in Middle East banking and sovereign wealth funds

Approximately 57% of central banks and 25% of Sovereign Wealth Funds (SWFs) in the Middle East are directing their attention toward green infrastructure investments and allocations to green bonds. Notably, the government-to-business (G2B) agreements at the 2023 Arab-China Riyadh conference featured a significant USD 5.6 billion deal between the Ministry of Investment of Saudi Arabia (MISA) and Human Horizons, a Chinese automotive technology company known for its HiPhi brand. This agreement focuses on establishing a joint venture for automotive research, development, manufacturing, and sales.

Dubai’s luxury residences soar in popularity among Chinese investors

With the real estate market in China stagnating and facing challenges such as the Evergrande default, Chinese buyers are actively seeking new and promising opportunities with the Gulf region being one of them. Amidst a substantial increase in Chinese arrivals to the Persian Gulf, Savills, a real estate company, reported in October 2023 that Dubai stands out as the premier hotspot for branded residences. Chinese investors have notably boosted Dubai’s real estate, accounting for 13% of transactions in H1 2023, up from 8% the prior year. This trend is projected to persist, given Dubai’s stability, economic vigor, global prominence, and attractive living environment. Regarding the type, Chinese buyers favor luxury apartments, villas, and commercial spaces in the city.

Dubai’s educational allure: Chinese enrollment surges 20% annually

The UAE has become a preferred destination for Chinese students seeking higher education abroad, with enrollment steadily increasing since 2012. The region’s robust job market and recognition of degrees by the Chinese Ministry of Education add to its appeal, providing opportunities for internships and employment. Dubai, in particular, has witnessed a remarkable 20% annual growth in Chinese student enrollment, with leading institutions like the University of Birmingham and Middlesex University anticipating a significant influx. The diverse academic offerings, especially in finance, accounting, and business management, further contribute to Dubai’s attractiveness for Chinese students.

Beyond higher education, the influx of affluent Chinese residents in the Gulf has also driven the demand for private international schools to cater to their children’s education. The UAE stands out globally with the largest private school market, boasting 725 international schools and 696,600 pupils in 2021. Dubai, as an educational hub, leads with a remarkable 333 of these schools. Notably, China secures the second position in pupil enrollment, just behind the UAE, with 419,000 students attending international schools according to the National News in 2021.

Strengthening ties through cultural exchanges in the UAE beyond universities

In addition to a growing number of Chinese students pursuing higher education in the UAE, cultural collaboration between schools is flourishing. As part of initiatives to strengthen ties, over 45 students from Beijing Tsinghua Primary School engaged in a cultural exchange at Dubai’s Al Salam Private School during Chinese President Xi Jinping’s state visit in 2018. Organized by the Language and Culture Enrichment Institute, the program included performances, language lessons, and collaborative activities, fostering mutual understanding. Similarly in that year, a delegation of ten students from Tsinghua University visited the UAE to explore corporate culture and cross-cultural communication, contributing to insights into businesses along the Belt and Road Initiative and fostering cross-cultural friendships. These efforts go beyond university education, promoting global competence and understanding.

Seamless transitions: Mandarin agents, educational services, and QR codes in Dubai

The UAE is set to see an increase in Chinese-speaking real estate agents, easing the transition for Chinese newcomers. These agents help bridge language gaps and provide insights into local property options. With Mandarin-speaking professionals at hand, Chinese expats can more easily find and settle into homes in the UAE. Notably, companies like Huaxia Real Estate, founded by Chinese entrepreneurs, have already made a mark in Dubai’s property market.

Network International welcomes WeChat Pay for Chinese visitors in the UAE

In a strategic move to enhance the transaction experience for Chinese visitors, Network International, a digital commerce enabler in the Middle East and Africa, has introduced WeChat Pay acceptance on its POS terminals across the UAE. With 5,000 terminals already accepting WeChat Pay and plans to extend this feature to all Android-powered terminals, the initiative aligns with the UAE’s thriving tourism sector, particularly benefiting from the surge in Chinese visitors. Notably, Network International is set to further expand its offerings by soon introducing Alipay+, providing more choices for seamless mobile payments.

Educational organization helping smooth transition of Chinese students

Oriental Wise Educational Consultancy (OWEC) specializes in offering educational services to Chinese students interested in studying in the UAE and China. Led by Jenny Zhou, OWEC annually assists over 200 Chinese students in pursuing their education in Dubai. Recognized and accredited by KHDA, OWEC stands out as the sole Chinese agency with such accreditation in the UAE. Beyond facilitating individual student journeys, the consultancy actively promotes Sino-Arab educational and cultural collaboration, with plans to expand its comprehensive educational network to provide tailored services to a broader audience.

QR codes transforming short-term rentals for Chinese visitors

Dubai has introduced a QR code system for holiday homes to enhance transparency and instill confidence in investors and tourists in the short-term rental sector. Property owners are now required to display QR codes at key entry points, offering visitors crucial details about the accommodations and contact information for relevant authorities. This initiative caters to the preferences of Chinese tourists for digital solutions, providing easy access to essential information and contributing to a more seamless and secure travel experience. It aligns with Dubai’s commitment to consumer protection and its broader digital transformation strategy, making the city an attractive destination for tech-savvy Chinese travelers seeking modern and transparent travel experiences.

The reasons behind affluent Chinese moving to the Middle East

- In 2022, around 10,800 HNWIs left China, with a projected increase to 13,500 in 2023. The UAE, particularly Dubai, attracts a significant number, surpassing the projected 1,500 heading to the United States.

- Over 20% of affluent Chinese individuals plan to visit the Persian Gulf in the next 12 months.

- 57% of Middle Eastern central banks and 25% of sovereign wealth funds prioritize green infrastructure investments. The 2023 Arab-China Riyadh conference led to a USD 5.6 billion deal in autonomous driving technologies and electric car manufacturing.

- Chinese investors account for 13% of real estate transactions in Dubai, up from 8% the previous year. Luxury residences in Dubai, particularly branded properties, are highly sought after by Chinese buyers.

- The UAE, especially Dubai, experiences a 20% annual growth in Chinese student enrollment. Recognized degrees, diverse academic offerings, and robust job markets contribute to the appeal.