Aldi’s strategic positioning in China

In China’s fiercely competitive retail landscape, international giants like Carrefour and Tesco have struggled to gain traction. Yet, the German discount supermarket chain Aldi has defied the odds and carved out a successful niche in China. The chain achieved RMB 2 billion in sales in 2024, a 100% increase year-on-year.

Aldi was launched in China through the Tmall Global Platform in 2017. Its first official physical store in Shanghai was opened in 2019, and focused on consolidating its presence in Shanghai. By 2025, Aldi will have grown to operate over 60 stores in Shanghai alone, with recent expansions into neighboring Jiangsu province cities like Suzhou and Wuxi. What makes Aldi’s success particularly remarkable is how it has adapted its global “hard discount” model and localized it to Chinese consumer preferences.

Download our report on the She Economy in China

Why Aldi resonates with Chinese consumers

Aldi’s success in China stems from its understanding of evolving consumer priorities. In a market where food safety remains a major concern, Aldi’s “Made in Germany” brand association conveys quality and reliability. Stores are strategically located in residential areas, near subways, and business districts, with many just a five-minute walk from homes. This particularly appealed to Shanghai’s time-pressed urban professionals and young families. The convenience factor is amplified by digital integration, where groceries can be delivered within 30 minutes for orders within a 3km radius.

Moreover, Aldi tapped into China’s consumption downgrading trend. While maintaining quality, prices are significantly lower than competitors. This was made possible by its range of private-label products, which made up nearly 90% of its store-keeping-unit (SKU) mix, and its local sourcing strategy. The managing director of Aldi China, Roman Rasinger, stated that over 80% of products are directly sourced from local suppliers. By eliminating middlemen, the cost savings could be passed to consumers. The value proposition has earned strong word-of-mouth, which shoppers enthusiastically share their finds on social platforms like Xiaohongshu (also known as RedNote). There are also daigou and Taobao resellers of Aldi products, as most of the stores are located in Shanghai and neighboring cities.

The key to Aldi’s success in China

Neighborhood integration

Aldi stores function as community hubs, with café counters serving quick meals like rice bowls that professionals grab during lunch breaks. Early morning deliveries, starting as early as 7 am, with incentives like free eggs for orders placed before 10 am, directly compete with traditional wet markets.

Product strategy and packaging

The SKUs are curated to carry fewer selections than other supermarket chains but items with a higher potential for repeated purchase. The packaging is also smaller as compared to bulk formats at Costco or Walmart. This is to fit single-person or small-family households that are typical in Shanghai. Beyond adapting package sizes, Aldi’s product development emphasizes Chinese tastes. Aldi in China features local specialties like hotpot ingredients alongside German beers and wines. Aldi even stocks treats from popular Shanghai temples and iconic butterfly pastries from the Park Hotel that are typically hard to find.

Localized marketing and branding

Aldi’s marketing blends German efficiency with Shanghainese cultural cues. The company hired Xueyi, a local Shanghainese personality, to connect with older generations. Guerrilla marketing in subway stations targets office workers. Furthermore, giveaways during new store openings feature practical items like eggs, milk, and cooking oil that Chinese consumers appreciate.

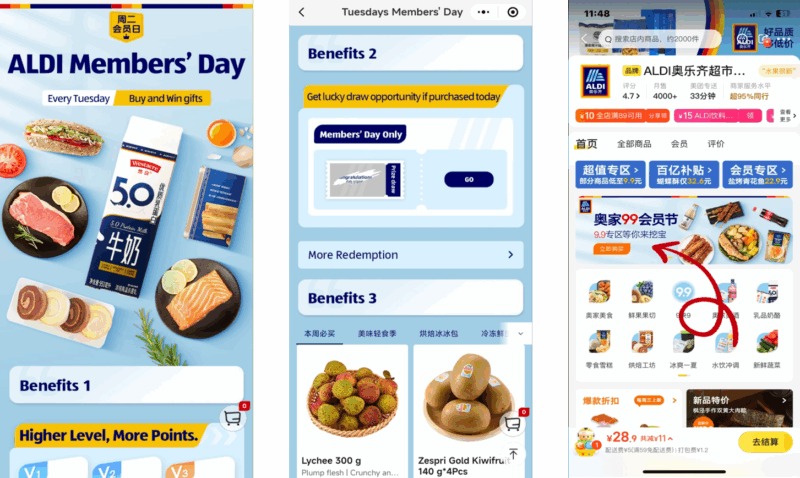

Digital-first loyalty programs

Rather than requiring paid memberships like Costco and Sam’s Club, Aldi offers free membership through WeChat mini-programs. It was then used to foster customer loyalty through shopping occasions like “Tuesday Members’ Day” and special discounts through mini-program orders. Aldi also created private traffic through a chatbot, “Xiao Ao” that provides instant chat support, discount updates, and QR‑code sharing for referral discounts.

Leveraging on the consumption downgrade trend

China’s retail landscape has witnessed a fundamental shift in consumer priorities—from chasing the lowest prices (“性价比” or value-for-money) to demanding reliable quality at reasonable costs (“质价比” or quality-to-price ratio). This nuanced but powerful evolution reflects a more sophisticated Chinese shopper who balances budget consciousness with heightened expectations for product safety and consistency. Aldi’s private-label model, with third-party audits and strict IFS-quality certification for suppliers, delivers that promise.

Competitive landscape and future outlook of Aldi in China

Aldi’s closest competitor in China is Alibaba’s Hema NB (Freshippo Neighborhood). Hema pioneered the “new retail” concept, blending online and offline experiences. Hema NB is Hema’s discount grocery chain, which sells near-expiry products from regular Hema stores and offers more white-labelled products. It has been expanding aggressively with over 250 outlets across China by the first quarter of 2025. Nonetheless, Aldi’s smaller and curated SKU line targets more regular repeat purchases that are better aligned with upper-middle-class shoppers in its targeted cities.

Inside Aldi’s China playbook: Localization, convenience, and trust

- Aldi in China adapted its global private-label discount strategy to Chinese preferences by focusing on smaller package sizes, local flavors, and curated SKUs for frequent repeat purchases.

- The brand strategically locates stores in residential areas, metro stations, and business districts with high foot traffic. It also offers fast delivery within 30 minutes for users located 3km from the store to capture more consumers.

- Aldi stores function as neighborhood hubs with services like breakfast deliveries and café counters. Localized marketing through influencers, metro ads, and culturally resonant giveaways strengthened its appeal.

- Aldi capitalized on China’s “quality-to-price ratio” trend by offering reliable, locally sourced products at an affordable price. Over 80% of products are sourced directly from domestic suppliers to reduce costs.

- Through WeChat mini-programs, Aldi offers free memberships, referral rewards, and chatbot support. The mini-program also hosts “Tuesday Members’ Day” to boost customer loyalty and cut down on middle-men.