Since establishing its first store in Shanghai in 2002, Uniqlo has woven itself into the fabric of China’s retail landscape. As of April 2024, the brand operates a vast network of 920 directly operated stores across more than 200 cities throughout Mainland China. The number of stores in China surpassed even the number of stores in its home country, Japan, with only 800 stores. This impressive expansion underscores Uniqlo’s commitment to the Chinese market, with plans to open 80 to 100 new stores annually. This underlines its commitment to broadening its reach and influence across the diverse and dynamic Chinese retail landscape.

China as Uniqlo’s “accelerator”

The growth of Uniqlo in China

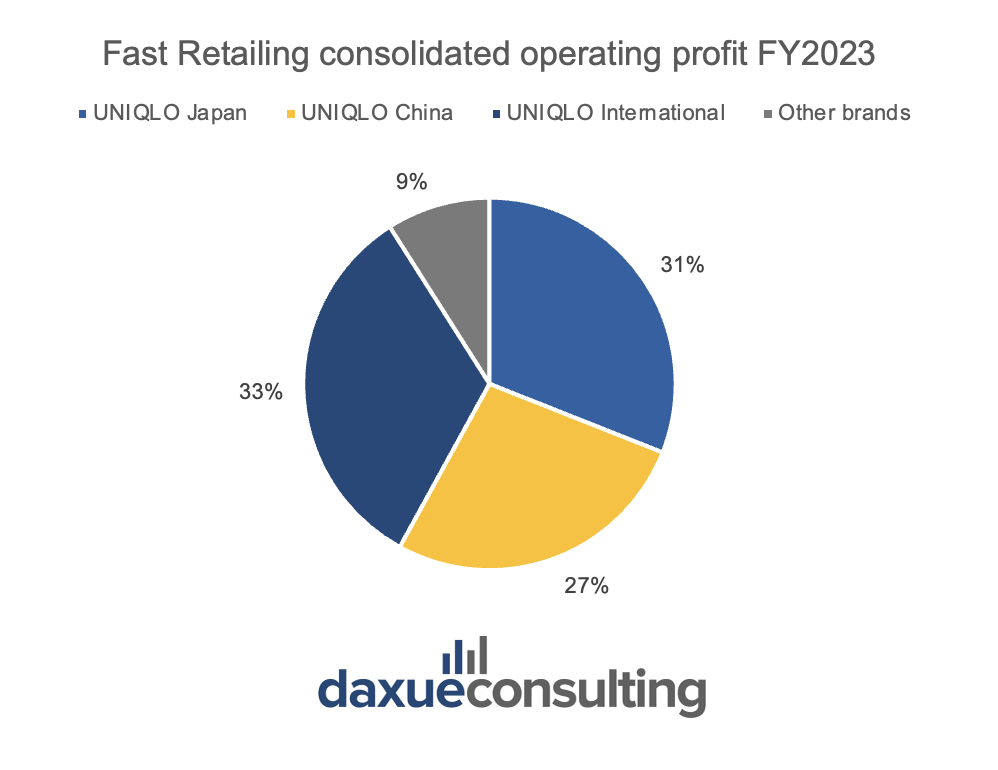

The Chinese market plays a pivotal role in Uniqlo’s global strategy, significantly contributing to its financial health. As reported in Fast Retailing’s 2023 performance review, sales from China comprised 27% of the group’s total operating profit. This amounted to approximately RMB 30.3 billion, which marked a robust year-over-year increase of 15.2%. Additionally, the operating profit from China surged by 25%, reaching approximately RMB 4.8 billion. The momentum continued into the first half of fiscal year 2024, with Greater China’s revenue climbing 12.3% to around RMB 17 billion. This makes up 22.5% of the group’s total revenue.

Despite having more stores in China than in Japan, revenue from China trails behind that of Japan. This prompted a strategic adjustment in the store network. Uniqlo is set to open 80 new stores and close 50 unprofitable stores this year. This is to maintain its long-standing “scrap and build” strategy of optimizing store locations for greater profitability.

Expansion strategy in China

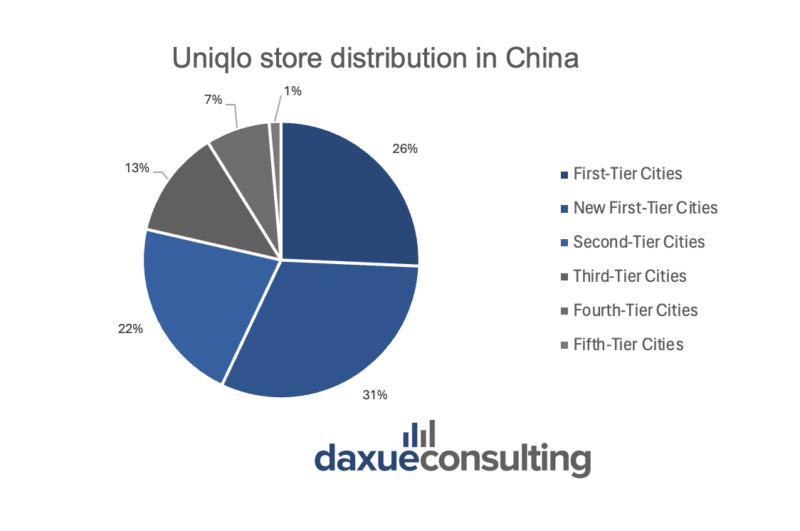

At present, the majority of Uniqlo stores are located in Tier-1 cities in China. Meanwhile, the company is focusing significantly on expanding its presence in Tier-3 cities where there is potential for rapid growth. Recognizing the sinking market phenomenon in China, the company has been strategically opening new stores in these lower-tier cities as part of a broader expansion plan to tap into less saturated markets. As of Summer 2023, nearly half of the newly opened Uniqlo stores in China are located in third-tier and fourth-tier cities. This approach is driven by the potential for growth in these areas. where the market is not as densely populated with international retailers as in top-tier cities, highlighting Uniqlo’s commitment to strengthening its presence and enhancing store performance in the crucial Chinese market.

Digital dominance and e-commerce mastery fuel growth of Uniqlo in China

E-commerce excellence

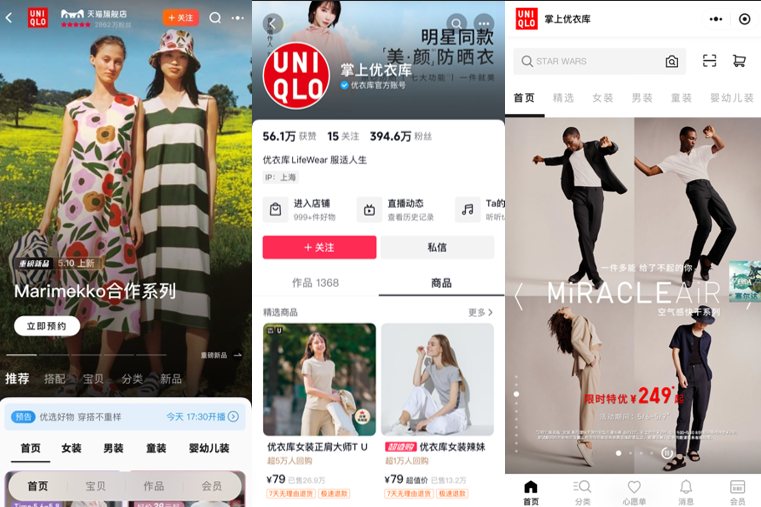

Moreover, the success of Uniqlo in China is significantly fueled by its strong e-commerce presence. With 84% of internet users in China shopping online, platforms like Tmall, Douyin Shop, and WeChat Mini Programs are vital to reaching consumers. Uniqlo’s strategic utilization of these platforms has paid off handsomely. It was evidenced by its top-10 sales ranking on Tmall for three consecutive months as of February 2024.

Furthermore, Uniqlo has clinched the Tmall Double Eleven championship for six years in a row. The brand also saw a remarkable 25% year-on-year increase in live broadcast sales during the first half of fiscal year 2024. As such, it amounted to RMB 390 million and accounted for 20% of total e-commerce sales.

Uniqlo’s strong online presence in China

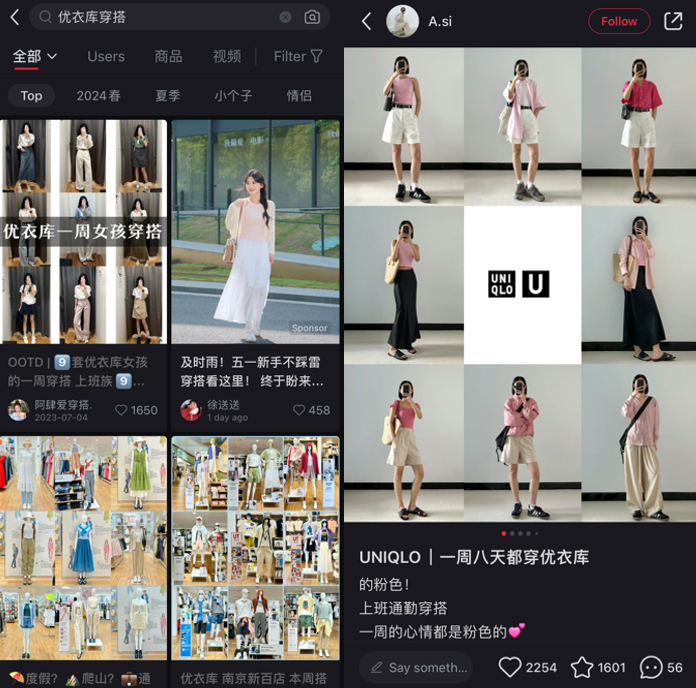

Uniqlo has cultivated a robust digital footprint on popular Chinese social platforms. On 小红书 (Little Red Book), the number of posts for “优衣库“ (Uniqlo) and “优衣库穿搭“ (Uniqlo outfit) reached nearly 1.3 million and 700k posts respectively. Uniqlo outfits frequently take the spotlight on Chinese social media. KOLs often pair Uniqlo items with tips for mix-and-match pieces, which enhance the brand’s visibility and engagement.

Its WeChat official account also sees significant engagement, with each article attracting over 100,000 readers. This online engagement is pivotal in maintaining a strong connection with consumers and reinforcing Uniqlo’s brand identity in the digital space.

Uniqlo’s timeless minimalism is seamlessly integrating into the Chinese lifestyle

The steadfast position of Uniqlo in China is largely attributable to its minimalist aesthetic, which resonates deeply with Chinese millennials. Besides, this design philosophy emphasizes simplicity, functionality, and versatility. This aligned perfectly with the contemporary lifestyle in China that values both practicality and style. This subtle integration into daily life helps solidify Uniqlo as an irreplaceable brand in the hearts and closets of many Chinese shoppers.

Technology integration in apparel

Uniqlo has transcended its role as merely a fashion retailer by integrating cutting-edge technology into its products. Lines such as HeatTech, AIRism, 3D knit, UV cut, and LifeWear not only showcase Uniqlo’s commitment to innovation but also emphasize quality, affordability, and simplicity. These technological advancements make Uniqlo’s clothing adaptable to various environmental conditions, enhancing the brand’s appeal to consumers who value functionality in their apparel.

Diversity in product offerings

Uniqlo’s wide range of products caters to diverse consumer needs, spanning from work attire and activewear to leisure wear. The brand’s focus on classic, timeless pieces aligns well with the preferences of Chinese consumers. The casual style was among the most preferred type of clothing among Chinese consumers in 2023, with the hashtag #cleanfit reaching 140 million views on Xiaohongshu. Uniqlo’s adherence to the concept of “LifeWear suitable for life” resonates with this trend, emphasizing clothes that are practical and stylish for everyday use.

Uniqlo and the strategic significance of the Chinese market

- Uniqlo in China is contributing for more than a quarter of Fast Retailing’s revenue, with a year-to-year growth of 15.2%.

- By building a strong online presence in e-commerce like T-mall and WeChat mini program, Uniqlo managed to stand out from its competitors.

- The online presence of Uniqlo in China and interactive initiatives like live streaming sales events have solidified its market position. E-commerce reached a 25% year-on-year of its sales in fiscal year 2024.

- As a part of its “scrap and build” strategy, Uniqlo is expanding to lower-tier cities to strengthen its presence in the Chinese market.

- The adaptability of Uniqlo’s product lines to the preferences and lifestyles of Chinese consumers. This emphasizes quality, affordability, and style — ensuring its continued relevance and appeal.