GU (极优) is a Japanese brand founded in 2006 specializing in affordable and casual clothing. It is a subsidiary of Fast Retailing, the parent company of the retail giant Uniqlo. The brand’s name, “GU”, is a pun on the Japanese word “jiyū” (自由), “freedom” in English, signifying an escape from high-priced clothing. As of August 31, 2023, the company has a network of 463 stores throughout Japan.

The fast-fashion brand went global in 2013 with the opening of their Shanghai store. They now have five stores in China, including four in Shanghai and one in Guangzhou. They recently entered the US market in 2022 through a pop-up store in New York City, its first store outside Asia. In 2022, sales of GU clothing and accessories reached USD 1.9 billion, accounting for 12% of Fast Retailing’s total revenue. This underscores the significance of the brand within Fast Retailing’s overall financial performance.

Download our report on the future of sustainable fashion in China

GU’s strategies to capture the younger market

1. Mix and match of basics and trends

Like its sister brand Uniqlo, GU offers simple items such as low-key and neutral-colored t-shirts and sweaters, minimalist footwear, and smart casual trousers easy to mix and match. However, they cater to the younger demographic by offering some trendier clothing items, like super-wide cargo pants and bucket hats, a 90’s style embraced by the Gen Z.

2. Embracing gender-neutral fashion

To attract Chinese Gen Z consumers, the brand is also emphasizing a gender-neutral concept in its product lines. GU’s design styles are now welcoming unisex models, catering to the “gender fluid” preferences of the Gen Z demographic. CBNData’s report highlights a 341% growth in the market for gender-neutral styles within popular brands, a figure that outpaces the overall clothing market by 2.5 times in recent years.

3. The promotion of diversity and inclusivity

Furthermore, the brand has adjusted its strategy by featuring a more diverse group of models in its advertisements, to answer Gen Z’s preference for inclusivity and representation. This empowers both men and women to create their own unique styles by blending various items, reflecting a more inclusive and versatile approach to fashion.

GU leverages Uniqlo’s expertise for its fast-fashion strategy

GU’s brand message is “Making fashion freer”, reflecting its dedication to making fashionable yet affordable clothing. To achieve this goal, the fast-fashion retailer has established a streamlined process encompassing planning, design, production, inventory management, production adjustment, and store operations. This process draws upon the SPA (Specialty retailer of Private-label Apparel) expertise inherited from UNIQLO.

Resilience amidst supply chain challenges

As a fast-fashion brand, any delays in GU’s product delivery can result in missed sales opportunities. In 2022, lockdowns and restrictions in China disrupted international production and distribution channels, leading to delayed product deliveries and a decrease in overall yearly revenue and profit. However, the brand was able to bounce back and enhance its process by reducing the number of products and focusing on items that reflect popular fashion trends.

Leveraging Uniqlo’s expertise for affordability

GU offers more budget-friendly clothing options compared to Uniqlo, evident through its brand ethos of “buy with ease, wear with ease” and the statement on its website about delivering products at unbelievable prices. This affordability model gained traction with the introduction of the “990 yen jeans” in 2009, which drew long queues of customers at its retail outlets in Japan. The brand leverages the extensive networks and expertise acquired by Uniqlo over the years to maintain these competitive price points.

A winning social media strategy

GU is very active on Chinese social media platforms including Weibo, WeChat and Xiaohongshu.

WeChat engagement strategy

The Japanese brand regularly shares updates on their new products, outfit recommendations, upcoming partnerships, and ongoing promotions on their official WeChat account. To encourage interaction, the brand selects one fortunate netizen each week from the comment section, with the chosen customer having the opportunity to receive a special prize.

Powering brand engagement with KOLs

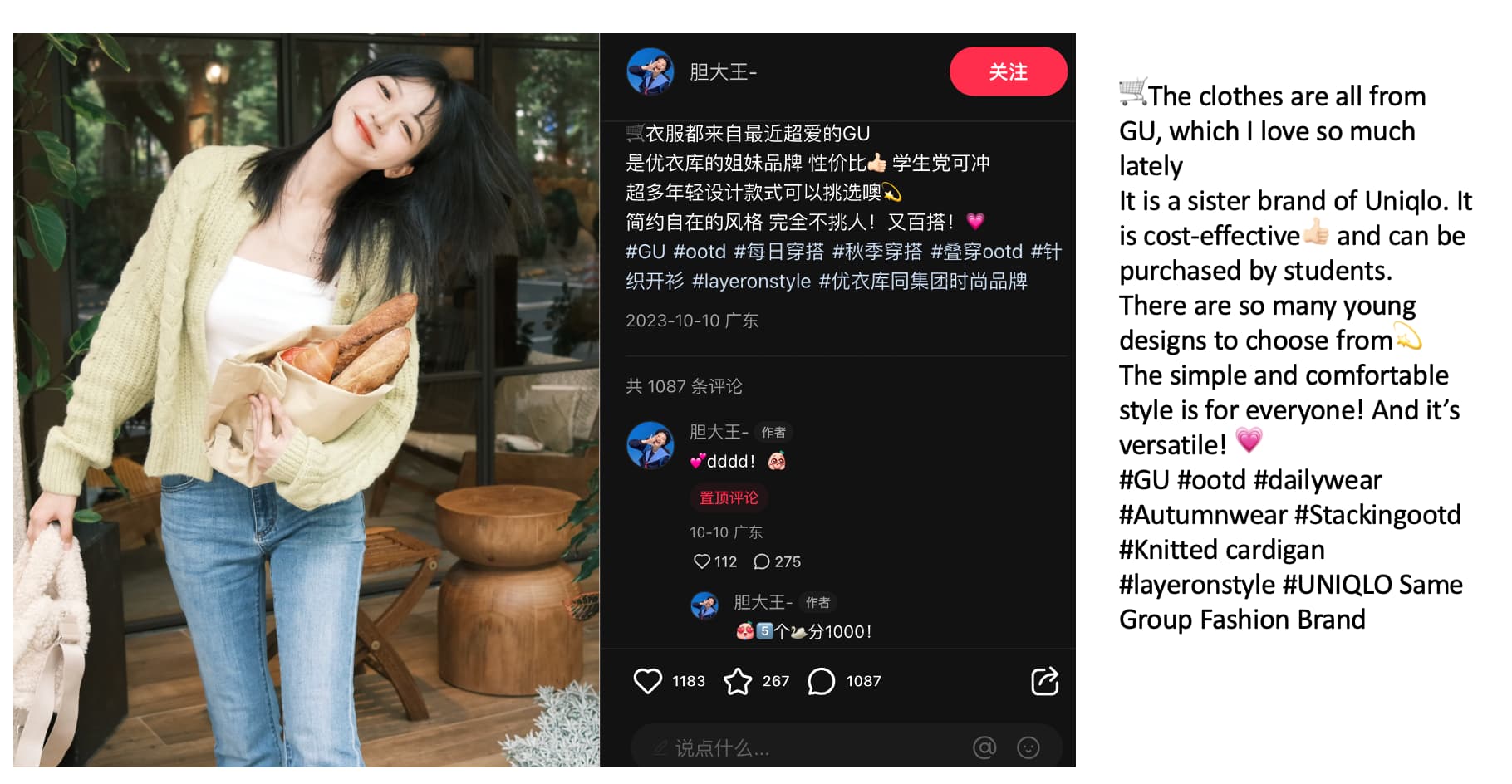

The use of Key Opinion Leaders (KOLs) in GU’s marketing and promotional strategies is an important component of their brand engagement efforts. It collaborates with influencers and fashion bloggers to amplify its reach and connect with its target audience, Gen Zs. They help create content that showcases the brand’s latest collections, providing their followers with style inspiration. For example, on Xiaohongshu (小红书), Uniqlo’s sister company has partnered with several fashion bloggers, one with over 1 million followers, who showcases how she styles a GU knitted cardigan for fall. The post is available both on the blogger’s page and the official page of the Japanese brand.

GU’s partnership success with iconic franchises

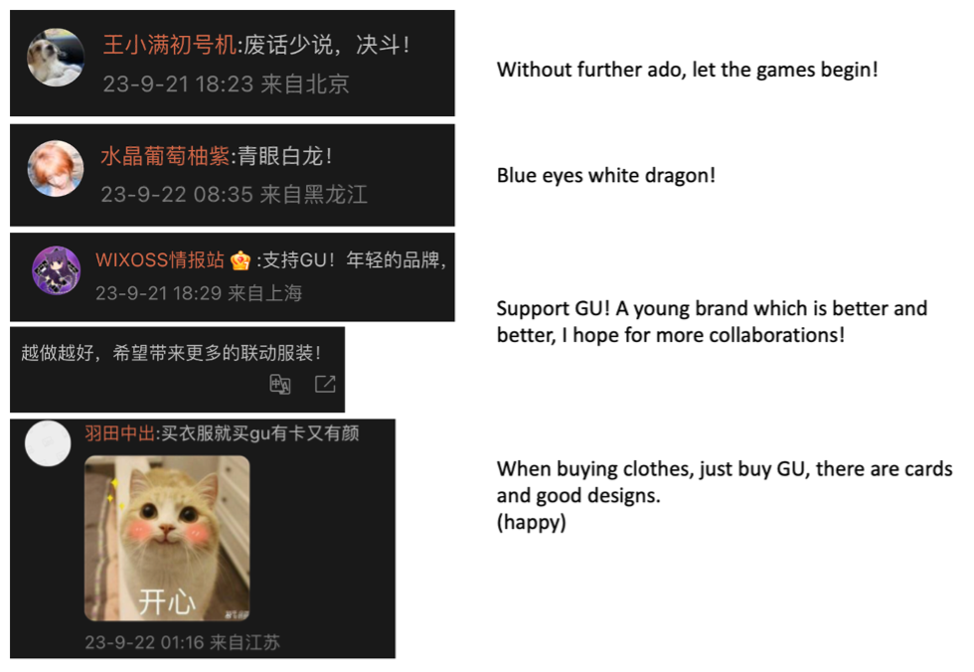

GU has engaged in many collaborations, including with iconic franchises like Yu-Gi-Oh, Kirby, and Snoopy. The integration of Yu-Gi-Oh cards in their designs brought a touch of nostalgia, capturing the interest of consumers who fondly remember the classic card game and cartoon. The comments on GU’s Weibo posts make references to the franchise’s characters and iconic catchphrases. This partnership taps into a deep well of sentimental value, fostering a strong connection with fans.

Similarly, collaborating with the beloved characters of Kirby and Snoopy offered the Japanese fast-fashion chain the opportunity to leverage popular culture and the Meng economy, attracting customers who are looking to express themselves and their interests through clothing.

Differences between Uniqlo and GU: demographics, pricing, collaborations, and global reach

Uniqlo often targets a more mature and discerning audience, with an emphasis on minimalist and versatile clothing, including items like HeatTech, AIRism, and high-quality basics. GU, on the other hand, caters to a younger and trendier demographic. While the brand also offers basics, it focuses more on fast-fashion, frequently introducing new, trend-driven items to keep up with the latest styles.

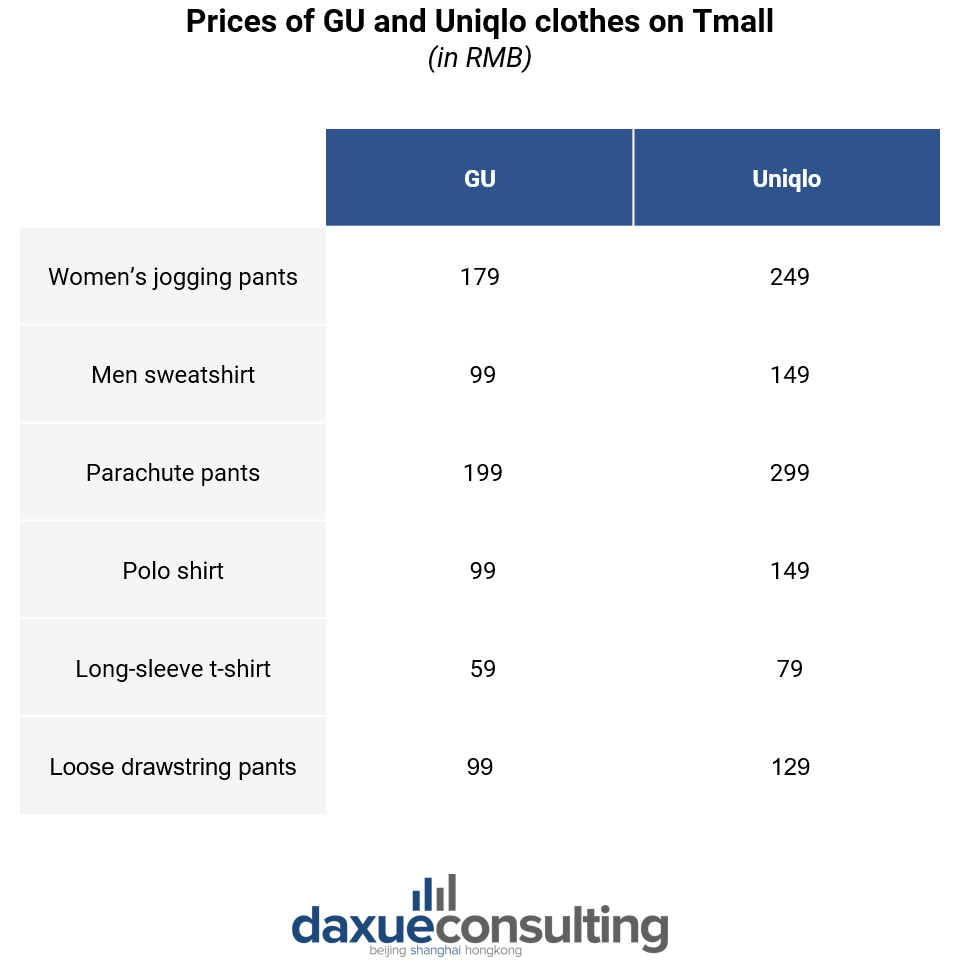

Secondly, both brands’ pricing strategy follows their target audience. Uniqlo is generally considered a more premium, yet affordable, brand compared to GU. Uniqlo offers a wide range of high-quality, basic clothing items at slightly higher price points. GU, on the other hand, is known for its affordability and budget-friendly fashion options.

When it comes to their co-branding initiatives, Uniqlo has a history of collaborating with renowned designers and artists, such as Keith Haring and Ray Eames, producing limited-edition collections. GU also engages in collaborations, but they tend to be more youth-oriented and pop-culture-focused, often featuring characters from popular franchises like Yu-Gi-Oh and Kirby, appealing to a younger audience.

Lastly, Uniqlo has stronger brand awareness and global presence with stores in more than fifteen countries, making it more internationally recognized. GU, while gradually expanding, has a more limited global presence, with a primary focus on the Asian market.

Decoding the success of GU in China

- GU, a Japanese brand under Fast Retailing, distinguishes itself by targeting a younger demographic with a mix of basics and trendy pieces, including gender-neutral fashion and diverse models.

- Its brand ethos, “Making fashion freer,” centers on affordable yet stylish clothing, powered by Uniqlo’s streamlined process. Despite supply chain challenges, the fast-fashion retailer managed to adapt by focusing on trending items.

- The Japanese band’s successful WeChat engagement and partnerships with KOLs, as well as its collaborations with popular and cute franchises amplify its presence among Gen Z consumers.

- Differences between Uniqlo and GU encompass their demographics, pricing, collaborations, and global reach.

- While GU is still predominantly present in the Asian market, it has entered the US market in 2022, marking its desire to expand its reach.