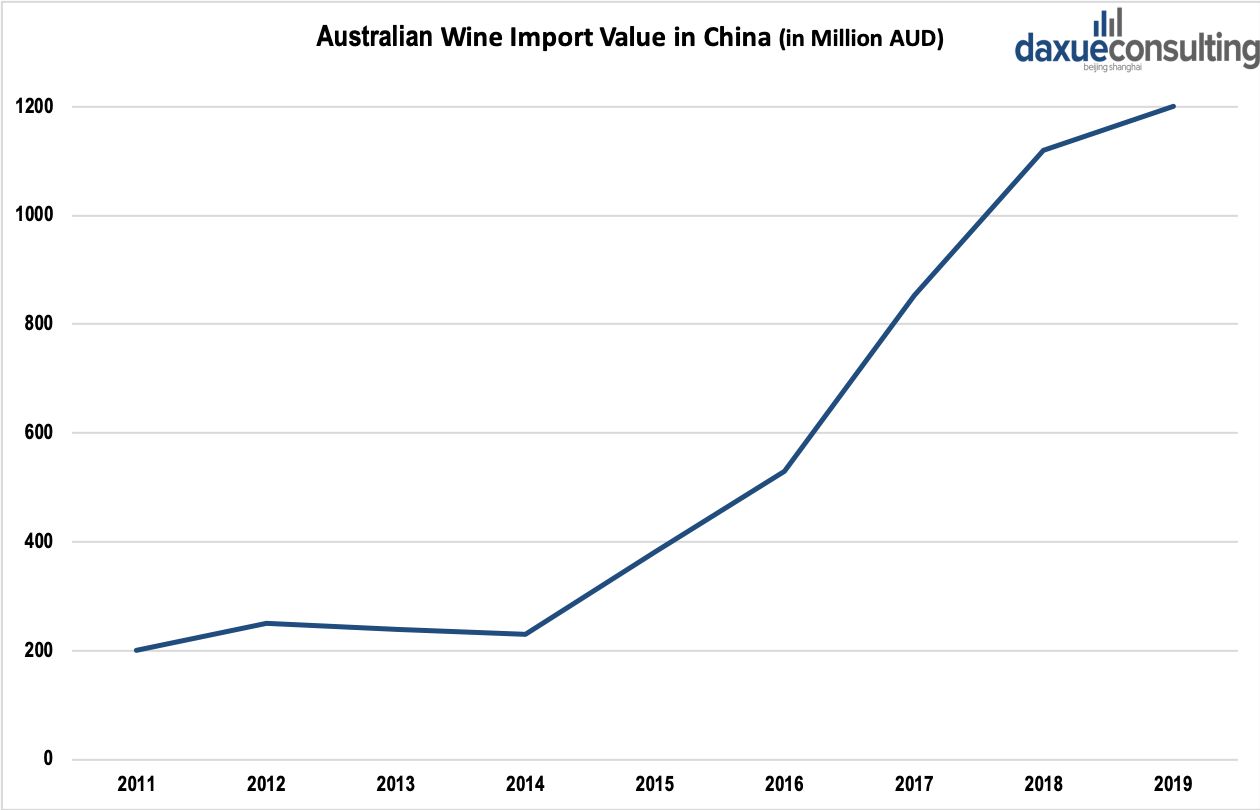

China is the largest import market of Australian wines

China has become the largest import market of Australian wines, overtaken the traditional markets such as the United States and the United Kingdom. From 2014 onwards, the import value has increased rapidly and surged by 533% during 2014-2018. In 2019, the import value of Australian wines reached 1.2 billion AUD. These figures have revealed the evolving size of the Australian wine market in China.

In 2012, China was Australia’s third-largest international market. From June 2011 to June 2012, the value of China’s import of Australian wines increased by 20%, but the quantity dropped by 24%. The reason was that Chinese consumers focused more on high-end luxury wines, according to Tony Spotonm, professor at the University of South Australia. The return of Australian wines in China will show in the long run. Chinese consumers still maintain curiosity about Australian wines.

[Data source: Wine Australia, ‘Import Value of Australian Wine in China’]

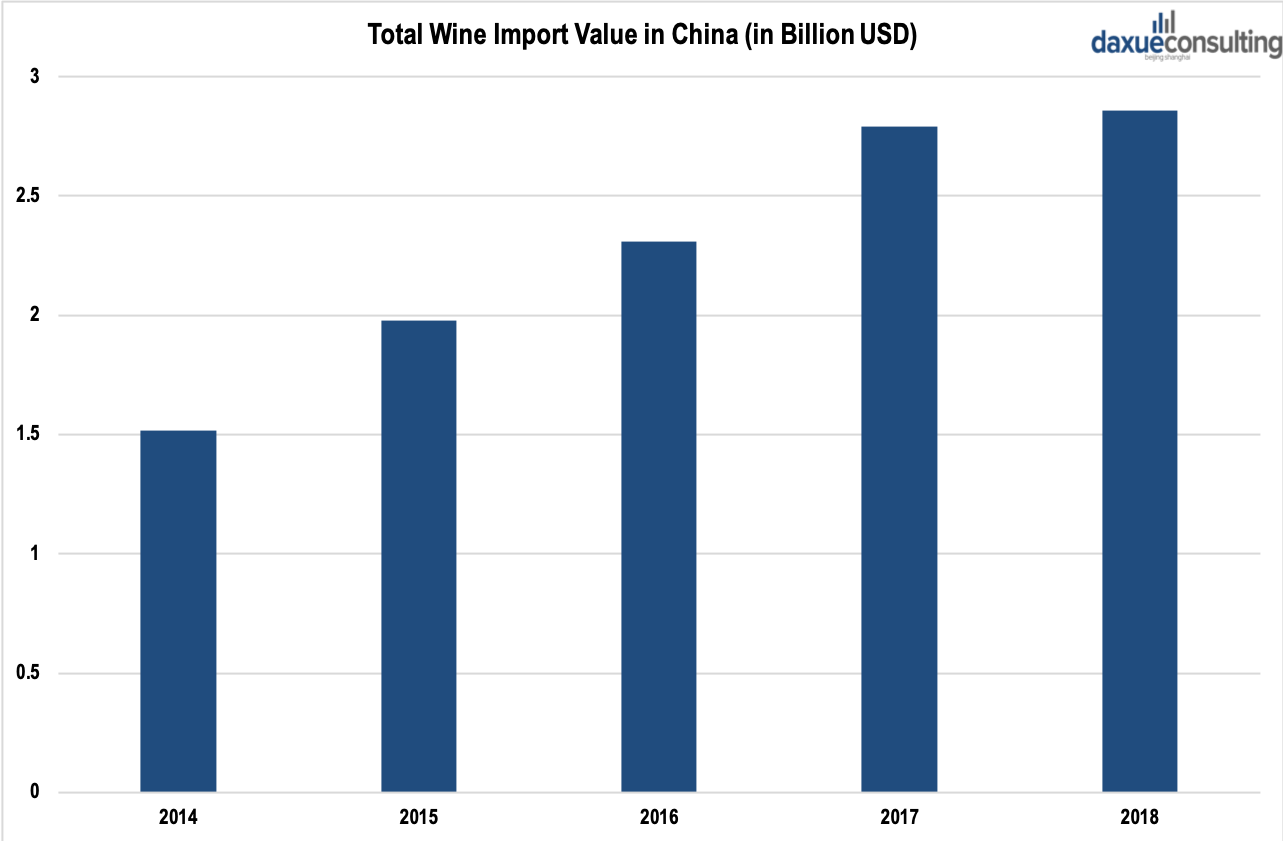

Australian wines account for a large market share in the import wine market in China

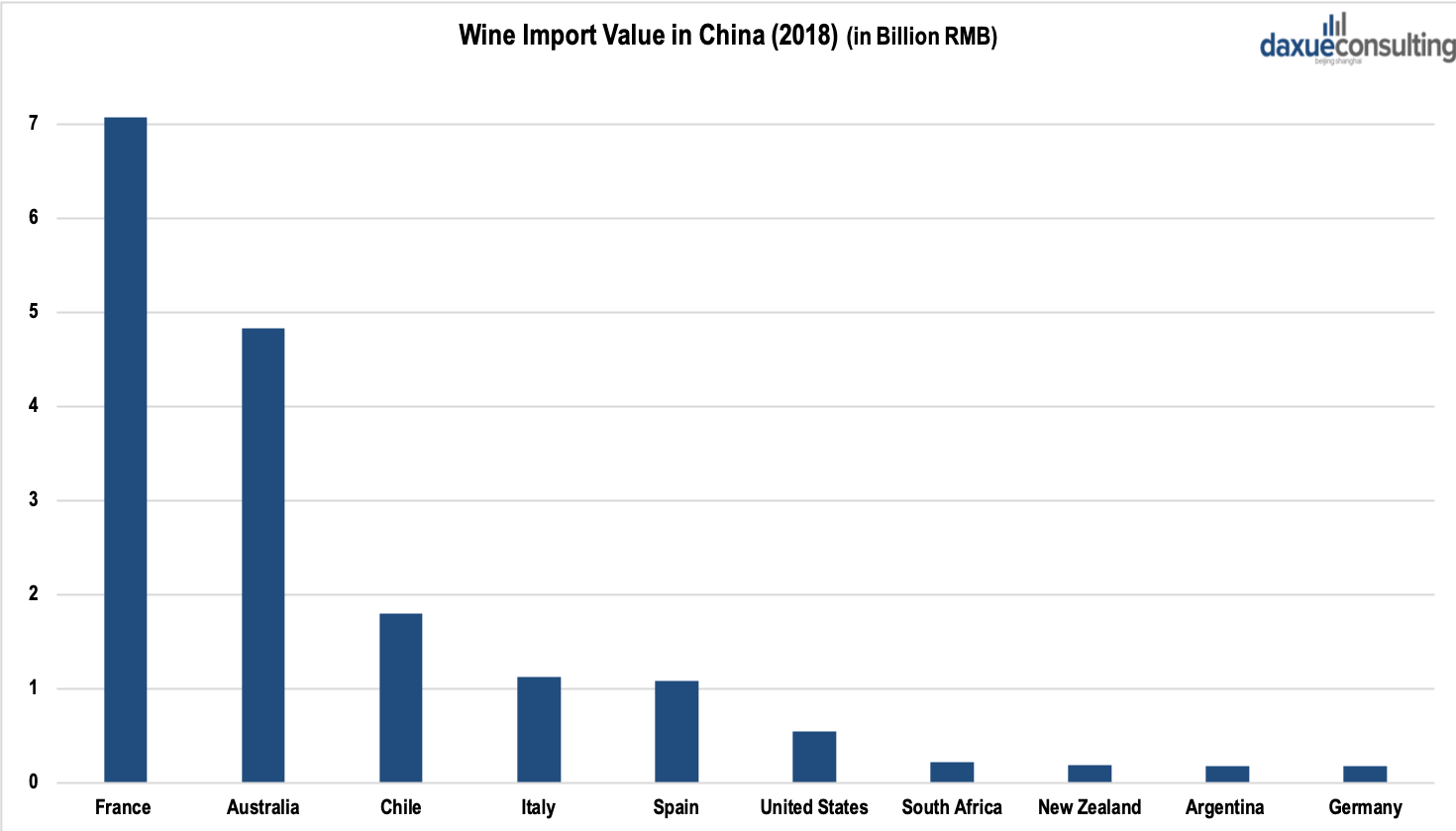

Regarding the import wine market in China, from 2014 to 2017, the total volume and value of import wine had increased gradually. In 2017, China imported 0.746 billion liters of wines with a value of 2.789 billion USD. In 2018, the figure slightly decreased to 0.688 billion liters with a value of 2.85 billion USD.

[Data source: qianzhan, ‘Total Wine Import Value in China’]

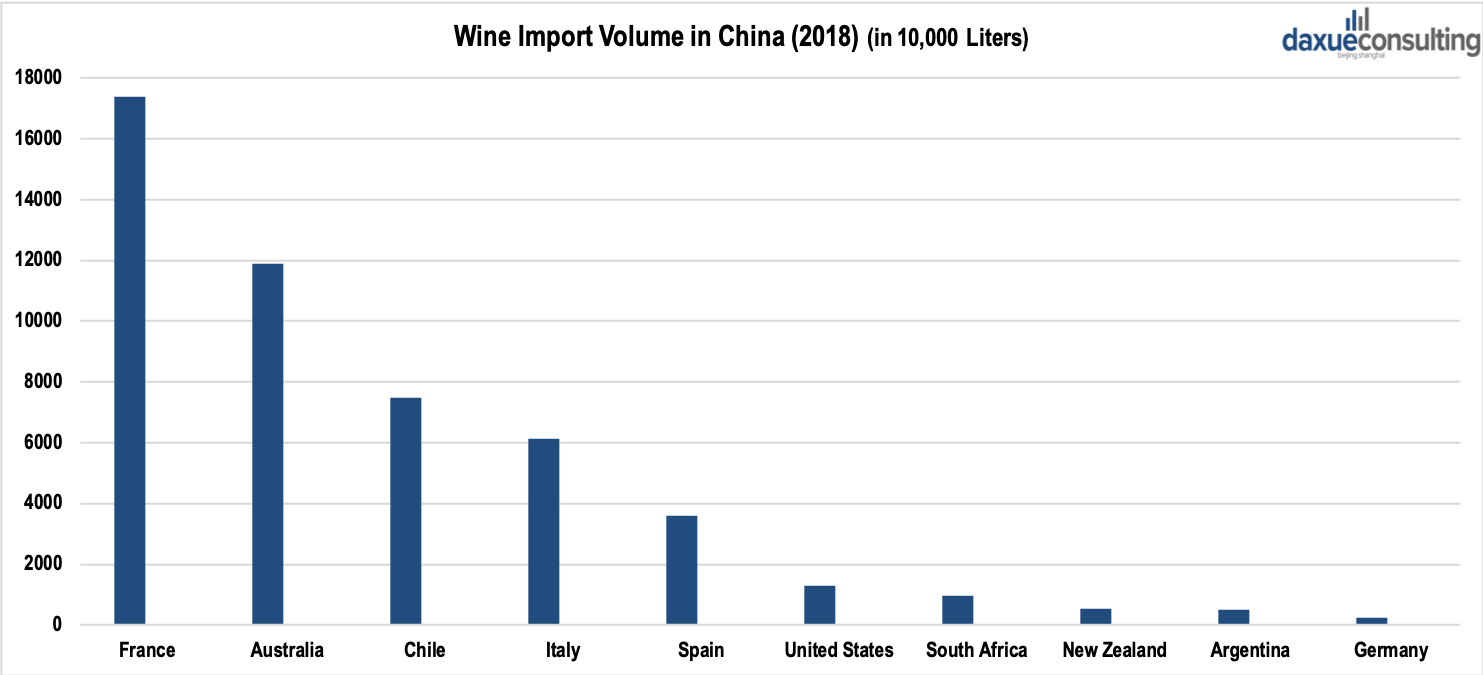

Specifically, Australian wines have accounted for a large proportion of the import wine market in China. In 2018, Australia, France and Chile were the top-3 import partners in the wine market in China, and Australia ranked at the second.

[Data source: qianzhan, ‘Wine Import Volume in China by Country (2018)’]

[Data source: qianzhan, ‘Wine Import Value in China (2018)’]

Australian wine sells for a medium price in China

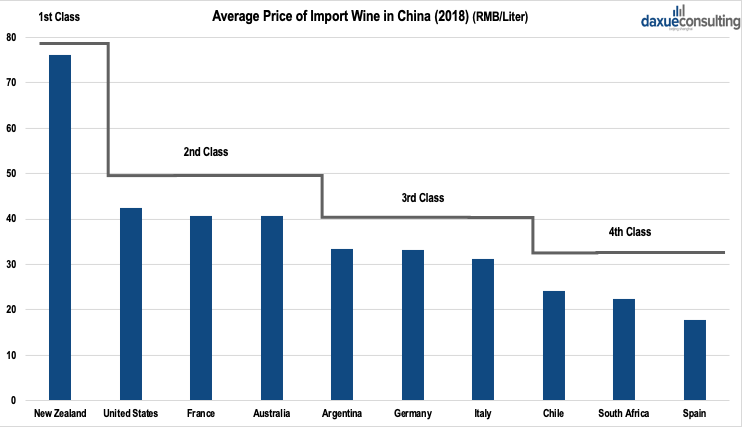

In 2015, China became the fourth largest wine consumption market in the world. Nevertheless, the average price of the import wine was 3.3 EUR (25.56 RMB) per liter, which was higher than that in some traditional markets such as France and Russia. This indicates that Chinese consumers are more likely to purchase costlier wines.

In 2018, the Australian wine was positioned in the second class in the import wine market in China with an average price of 40.6 RMB per liter. Additionally, it had approximately 30-RMB gap compared with the average price of Zelanian wines, which indicates that Australian wines in China are not considered high end.

[Data source: qianzhan, ‘Average Price of Import Wine in China (2018)’]

How Australian wine companies in China leverage E-commerce

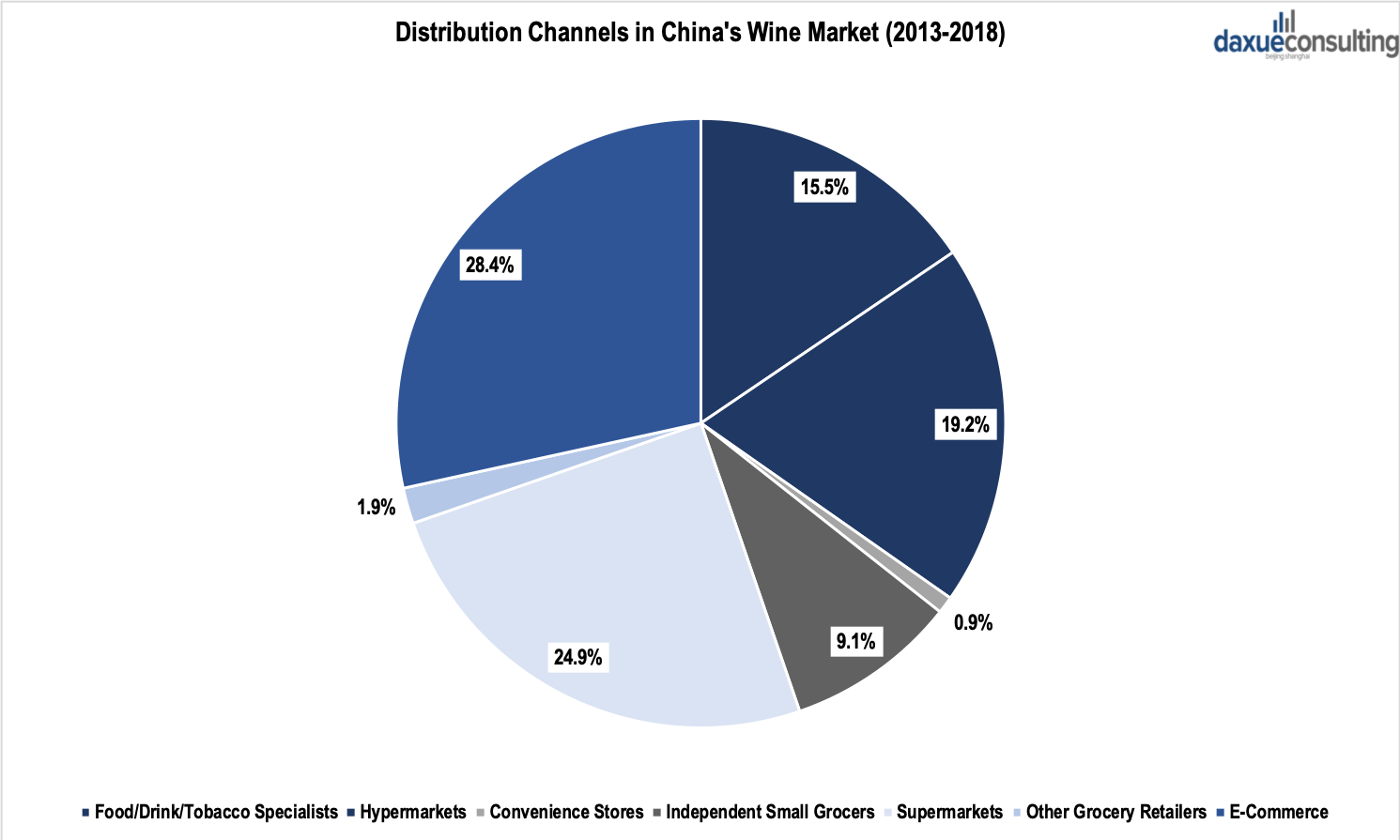

According to Euromonitor, store-based retailing and online selling are the main distribution channels of the wine market in China. Moreover, China’s E-commerce sector has accounted for more than ¼ of the total sales volume owing to its growing trend. To keep pace with E-commerce trends, Australian wine companies in China have utilized the online sector to promote their products. Meanwhile, they can increase brand exposure via traditional distribution channels. By 2017, there have been 32 Australian wines sellers on Tmall, 26 of them are flagship stores.

[Data source: Euromonitor, ‘Distribution Channels in China’s Wine Market (2013-2018)’]

For example, Treasury Wine Estates has established 3 official online distribution channels. 2 of them are online flagship stores on Tmall and JD respectively. The last one is an authorized self-operated store on JD. Also, Treasury Wine Estates has operated brick and mortar stores in different cities and collaborated with hypermarkets and supermarkets in China such as Metro AG, Walmart, Sam’s Club, Yonghui Superstores and Ole.

[Photo source: Tmall, ‘Online Store of Treasury Wine Estates’]

[Photo source: JD, ‘Online Store of Treasury Wine Estates’]

Casella, another famous wine producer in Australia, has also set up its online store on Tmall. By collaborating with Telford China, a well-known import agent, Casella can promote its products effectively in the wine market in China.

[Photo source: vinehoo, ‘Casella’s Collaboration with Telford China’]

[Photo source: Tmall, ‘Online Store of Casella’]

The reason behind the popularity of Australian wines in China: driven by cost-effectiveness and acceptable tastes

China imposes zero tariffs on Australian wines

It is easy to see that Australian wines are gaining recognition from wine consumers in China. Wine producers there are fully aware of this, as they say, ’If we are not in China, we are on the way to China.’

As a representative of the new world’s wines, Australian wines receive much welcome in the wine market in China. They are Hardy’s, Yellow Tail, Jacob’s Creek, Lindemans, Rosemount, Penfolds, Wolfblass, and Banrock Station.

Penfolds

[Photo source: Treasury Wine Estates, ‘Logo of Treasury Wine Estates’]

According to IBISWorld, Penfolds is a part of Treasury Wine Estates Limited (TWE), an Australian-owned wine manufacturer and distributor. In 2010, Foster’s Group split its wine and beer sectors and created TWE. After its demerger, TWE became one of the world’s largest wine producers. The brand has vineyards across Australia, New Zealand, the United States and Italy. The company’s brands include Penfolds, Lindeman’s, Wolf Blass, Rosemount Estate, Beringer Vineyards and Matura.

Penfolds is one of the oldest and most representative wines in Australia. The company has developed a variety of products under the Penfolds brand to tailor to different social occasions and consumers’ needs. Penfolds vineyards also cover a range of climates, soil and regions to grow various types of wines.

[Photo source: Penfolds, ‘Products of Penfolds’]

Yellow Tail

[Photo source: Casella, ‘Logo of Casella’]

According to IBIS World, Yellow Tail is affiliated with Casella Wines Pty Limited, a family-owned winery established in 1965 in the Riverina region of New South Wales. Over the past five years, Casella Wines has extensively utilized its acquisition strategy by purchasing several vineyards and wineries across Australia.

Yellow Tail is the result of the persistent business vision, making wines to bring families and friends on any occasion. Bearing this in mind, the founders of the brand have created an approachable wine that everyone could enjoy. Yellow Tail wines are cost-effective while maintaining the average quality.

[Photo source: Yellow Tail, ‘Products of Yellow Tail’]

Jacob’s Creek

[Photo source: Pernod Ricard, ‘Logo of Pernod Ricard’]

In 1989 and 1990, Pernod Ricard acquired Orlando Wines and Wyndham Estate and merged the two entities into Orlando Wyndham Group (OWG). In 2013, Premium Wine Brands changed its trading name to Pernod Ricard Australia.

Jacob’s Creek has a long history of making wines. In 1976, the brand was born. Since then, the brand has dedicated to innovating novel products. From the blend of Shiraz and Cabernet Sauvignon to French-style rose, they have embodied founders’ effort and passions.

[Photo source: Jacob’s Creek, ‘Products of Jacob’s Creek’]

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes