Although wine consumption was not traditionally significant in Chinese culture, the adoption of westernized lifestyles in major urban areas has sparked an increasing interest in wine among Chinese consumers. However, in 2020, with restrictions in the catering industry, including restaurant and bars, and the cancellation of social dining occasions, China’s wine market suffered a sharp decline. Its market size declined to 49.8 billion RMB. Nevertheless, the Chinese wine market has since shown signs of recovery.

The future demand for Chinese wine market is likely to rebound, with Chinese Millennials and Gen Z becoming the primary consumers. In China, wine is widely considered to have health benefits including anti-aging properties and positive effects on digestion. As consumption levels and health-awareness continue to rise, an increasing number of people are becoming interested in the wine culture, leading to higher standards for product quality and flavor. As a result, wine has progressively become an essential item on many customers’ shopping lists. The trend in purchasing habits is shifting away from gifting wine and towards its consumption as a daily product by customers in their everyday lives.

Rising demand for quality: Chinese consumers embrace premiumization in wine consumption

Wine drinking habits in China have evolved over the last ten years, with consumers becoming increasingly curious and knowledgeable in wine. This can be attributed to the rise of the middle class and the increasing adoption of more westernized lifestyles. As a result, more consumers are willing to pay for high-quality mid-ranged bottles of wine.

People are also demanding wine for its perceived association with health benefits. According to HKTDC, 54% of respondents (1,440 in total) stated that they purchase and drink wine because they feel it is good for their health. This belief was particularly common among respondents in the 36-45 (59%) and 46-55 (55%) age groups. In addition, the wine market in China has experienced a significant boost due to the increasing availability of wines on e-commerce platforms and mobile apps. As a result, it is not surprising to witness a decrease in import volume in recent years, accompanied with a slight increase in value.

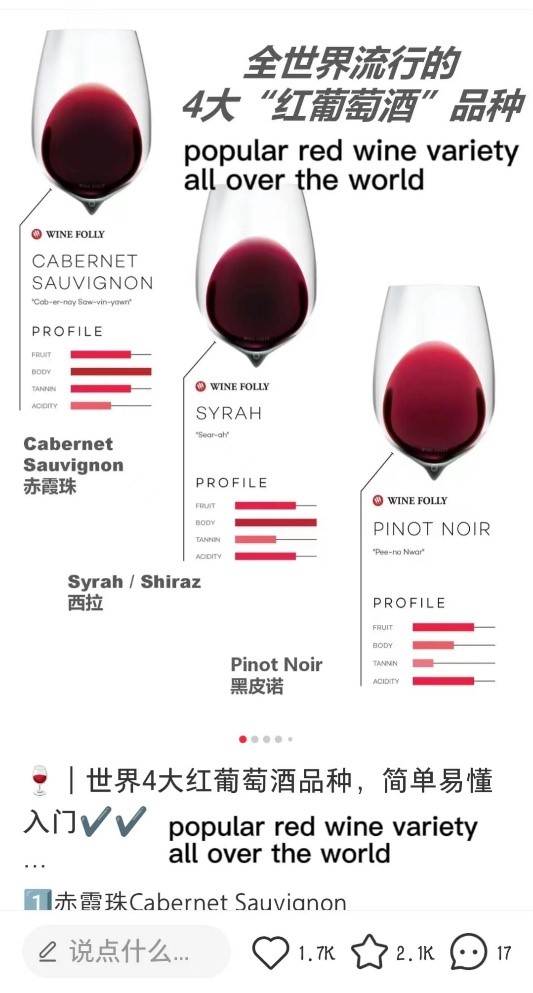

China’s most loved varietal: Cabernet Sauvignon

Despite the growing interest in other wine categories, than red wine continue to dominate in China, with Cabernet Sauvignon standing out as the most popular varietal. The preference for red wine can be attributed to its perceived health benefits and its association with cultural traditions, making it the most preferred wine style among consumers in China.

Increasingly more consumers buy wine online

In the “new normal”, purchasing wine online is becoming a trend. China has fully embraced the potential of wine e-commerce, surpassing many other countries in the world. The 2021 IWSR E-commerce Study predicted that the Chinese alcohol e-commerce market value will have a compound annual growth rate of 15.8% between 2019 and 2024. The pandemic has accelerated the expansion of this fast-growing channel. In 2020, Baijiu and imported wine accounted over 80% of the online sales via e-commerce websites and online purchases accounted for 20% of all wine sales, indicating the huge potential of this channel.

In 2020, Tmall dominated China’s online wine market, holding a share of 50%, followed by JD.com with nearly 25% of all online alcohol sales. Therefore, many brands have opted for establishing partnerships with these two giants due to their enormous reach of consumers and advanced infrastructure. However, it is worth noting that other platforms, such as Douyin, have been gaining prominence in recent years, presenting new opportunities for brands in the wine market.

Leveraging new media platforms: Douyin’s role in wine marketing and communication

In recent times, numerous brands have recognized the importance of engaging with young consumers through new media platforms like Douyin. These platforms have proven to be effective in establishing communication channels with the target customer segment. Douyin has experienced a significant surge in the beverage sector, with wine sales volume increasing by 2.5 times between 2020 and 2021. For wine-making enterprises, leveraging Douyin provides opportunities to capitalize on celebrity promotions and live stream shopping, which can enhance brand visibility and sales.

However, wine selling in Douyin live streaming rooms has faced criticism from industry professionals. Some accounts have been accused of misrepresenting wines as original imports or providing false information about grape selection rates. Therefore, Douyin has taken steps to tighten its platform oversight and improve wine management, issuing the Norms for the Management of Alcohol and Tonic Health Care Industry in March 2022 to optimize wine-related practices on the platform.

The domestic wine industry doesn’t take off though imports are decreasing

While imports are declining, made-in-China wines don’t seem to be taking off. A comparison between 2019 and 2022 data reveals a significant decrease in domestic wine production from l from 43.97 million liters to 2.14 million liters, a decrease of 51.39%. Likewise, sales dropped from 14.28 billion RMB to 9.19 billion RMB, reflecting a decrease of 35.62%. Profits were negatively affected, declining from 1.02 billion RMB to 340 million RMB, a decrease of 66.65%.

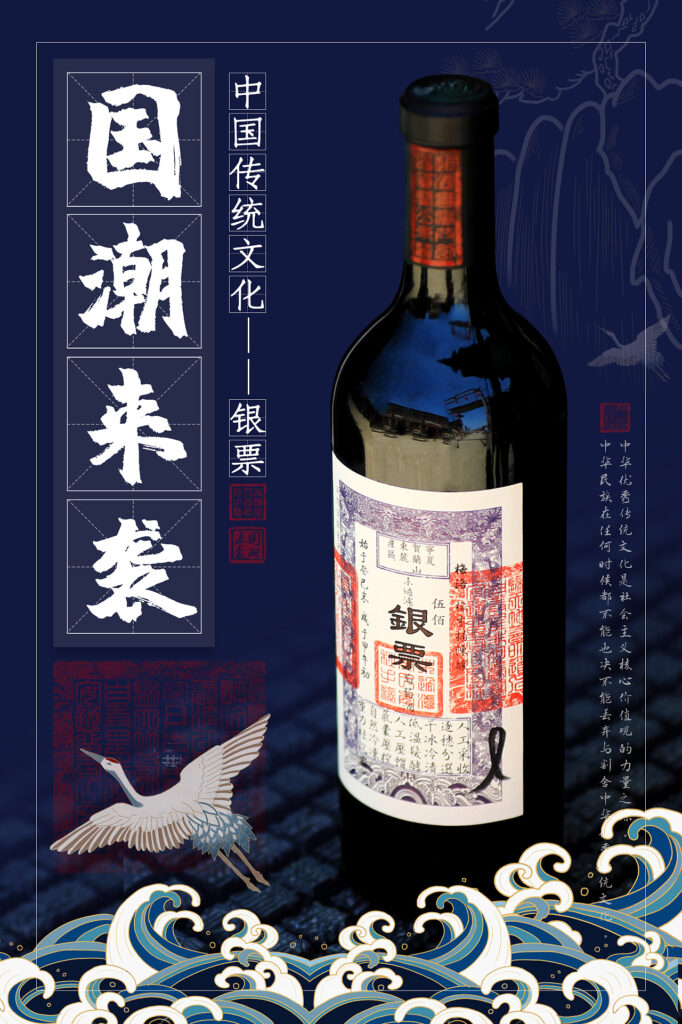

Despite these declines, there are positive signals within the domestic wine market. An increasing number of customers prefer to drink local wine influenced by the Guochao trend. This has contributed to the emergence of domestic wine brands, some of which are now recognized for their quality on par with international counterparts. As a result, more consumers and distributors are showing interest in domestic wines in recent years. In 2022, the domestic wine sector experienced a rebound in revenue and total profit, indicating that there are chances for growth.

Adapting to change: How Covid-19 reshaped China’s wine market

- Chinese wine market faced a sharp decline in the short term due to the pandemic. However, with Chinese Millennials and Gen Z becoming the primary consumers and placing an increasing emphasis on health, the future demand for the China’s wine market is likely to rebound.

- The demand for quality is rising among Chinese consumers, driven by the growing middle class and adoption of westernized lifestyles.

- Red wine holds a special place in China, revered for its health benefits and cultural significance, making it the preferred wine style. Within the realm of red wine varietals, Cabernet Sauvignon takes the crown as the most beloved choice.

- COVID-19 and politics have reshaped the Chinese wine market. Online sales have emerged as a crucial driver of growth, with platforms like Douyin and influencer marketing strategies playing a pivotal role in capturing the growing digital market.

- Despite declining imports, the domestic wine industry in China has yet to gain significant traction. However, there are positive signs emerging. More customers are opting for local wines influenced by the Guochao trend, and the quality of some domestic wine brands is being recognized as on par with international counterparts.

Author: Lyu Ai

Learn more about China’s wine and spirits industry