Over the last ten years, China has been making up for lost time in terms of wine consumption, knowledge, and production. Although the country has a longer history with beer and hard liquor, wine drinking habits in China are evolving.

E-commerce and westernized lifestyles: The wine market in China is changing at a quick pace

Profile of wine consumers in China

Wine drinking habits in China are changing. In the old days, wine has played the role of a social indicator; it was considered expensive prestigious. Hence, the perception of wine has aroused the curiosity of its consumers through its hedonistic, self-expressive motivations. Traditionally a masculine drink and consumed in the north of the country, wine has succeeded in establishing itself and seducing a new clientele: women and young adults. On the other hand, the increase of the middle class has favored this growth with the increase in purchasing power. The consumer is willing to pay for a quality mid-range bottle without spending a fortune.

China will drive world wine consumption

The wine and spirits market in China is flourishing. High-end spirits, such as Moutai, Chivas, and Martell, are common guests on Chinese tables. However, Baijiu, the local spirit of China still dominates the Chinese spirits market. Despite significant progress over the past decade, regular wine consumption in China remains relatively low compared to countries such as France, Italy, Spain and even the United States. According to some studies, the market for daily alcohol consumption will increase in the coming years and it will become a much more common consumer product than it is currently in China.

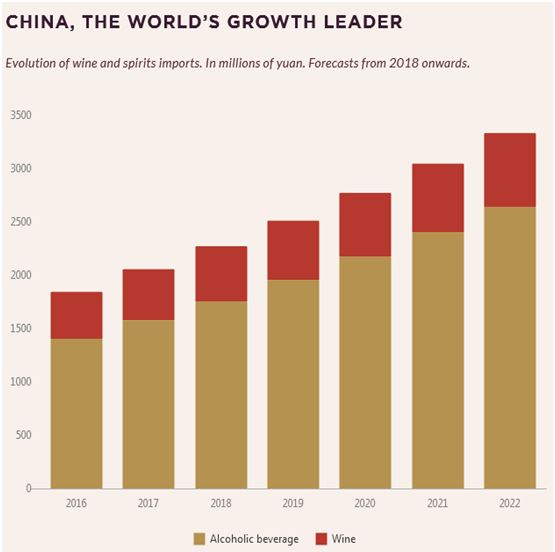

According to the latest figures, there is no doubt about its consumption. The Chinese drink 1.46 billion liters of wine every year or a little more than one liter per capita, according to a study by Vinexpo, an organizer of international trade fairs. China ranks 5th in the world, behind the Americans, French, Italians and Germans. The Middle Kingdom imported nearly 690 million liters of foreign wines in 2018 against 750 in 2017. Their market share of imported wine make 50% of the volume today. According to forecasts, China will become the world’s second largest consumer by 2021 and will be the world’s most dynamic market with an estimated 18.5% increase in consumption.

[Source: Euromonitor, evolution of the wine and spirits market]

What are the consumer preferences of Chinese consumers?

Among the most popular wines are: fruity, flavored white and sparkling. Red wine is at the top of the best-selling due to cultural traditions and the health benefits associated with it. But according to experts, the Chinese thirst for white wines could increase in the coming years as the western lifestyle becomes more widespread. Drinking alcohol in China has moved into the mainstream culture, beyond just an activity at family gatherings and dinners .

In addition, drinking during the day and, especially drinking during official working hours, is uncommon in China.). It is to be mentioned that the after-work drinks with colleagues are becoming popular and familiar amongst Chinese urbanites, especially among young professional people. Among the selection criteria, Chinese distributors give priority to the origin over the label and the color of the beverage, which favors Bordeaux and Champagne in particular. Price comes second, followed by taste and designation of origin . The organic segment is becoming more and more prominent as a result of the growing environmental concerns.

E-commerce: a non-negligible distribution channel

The Middle Kingdom expresses a keen interest in viticulture, which obliges companies to adapt. As brands continue to appeal to Chinese consumers, specialist stores have become increasingly popular as famous international brands make their way through these retail venues into the Chinese marketplace. Indeed, new consumption habits have emerged thanks to digital technology. Simultaneously, many specialized shops have recently opened outside the main cities; the development of purchases on the Internet takes on a new dimension.

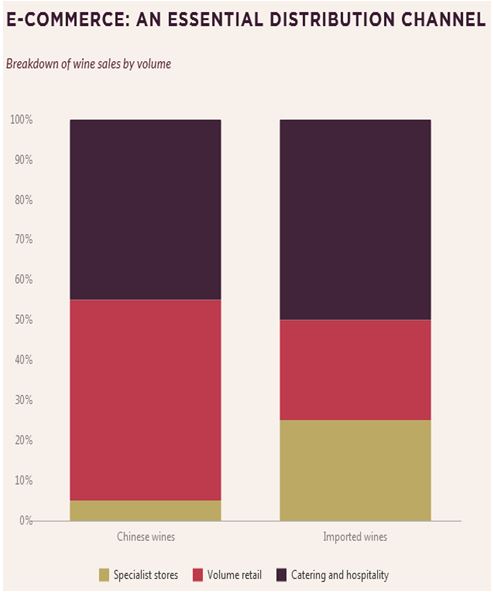

[Source: Vinexpo’s official website, breakdown of wine sales by volume, imported vs Chinese wines]

Online sales and the creation of platforms available on smartphones have accelerated this phenomenon. According to studies, the online wine market on platforms dominated by Tall (Alibaba) represent the second most used distribution channel behind hypermarkets. In China, 40% of the alcohol is sold online (d.ii). 50% of imported wines are resold in restaurants against 25% in specialist stores and 25% in retailers. Converserly, Chinese wines are sold mainly to retailers (50%), 45% to restaurants and 5% to specialized shops

The wine market in China shows promise

Chinese wine production

After having invested in French vineyards for a long time, European companies have a chance to invest in Chinese wine-growing. Due to the favorable farming climate in certain regions in northeastern China and the size of the agricultural areas, wine production in China is attractive because of its potential for growth. Investors such as LVHM (Moet and Chandon) and Domaines Barons Rothschild Lafite have invested heavily in China. Both firms are developing their own Chinese vineyards and tweaking flavours to best serve the Chinese market.

[Source: Bloomberg ‘Domaine de Barons de Rothschild in Shandong, China]

International events exported in China

China has become a strategic location for industry professional in their strategy to penetrate the Chinese market. After a great success at the Vinexpo exhibition in Shanghai in October 2019 dedicated to wine and spirits market, the economic capital is preparing to host Vinexpo again in October 2020, which attracted more than 5,000 visitors last year. Vinexpo and the e-commerce giant Alibaba joined forces to bring together market and online sales players to consolidate the market.

Will the wine market in China put trading partners in the shade?

Nonetheless, China’s entry into viticultural production worries the largest producing-countries which depend on its market. The Middle Kingdom has the second largest vineyard in the world, capable of meeting both domestic and foreign demand. With the acquisition of the foreign know-how, China has succeeded in producing very-good-quality wines that the consumer could favor China’s cheaper quality wines to the detriment of European producers.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes