The baked goods market in China gained momentum in 1980 and experienced significant growth between 2000 and 2010. During this period, numerous foreign brands entered the Chinese market, establishing baked goods as a popular breakfast choice for many Chinese people.

In 2022, China’s baking industry surged to RMB 285.3 billion, continuing its post-pandemic recovery and benefitting from consumer upgrades and diverse consumption trends. Emphasizing health and nutrition in baked goods, the sector is poised for steady growth, with a projected scale of RMB 351.8 billion by 2025. Notably, 2022 saw a 6% year-on-year (yoy) increase in production, reaching 19.6 million tons. This data reflects the industry’s resilience and adaptability, capturing the essence of its dynamic evolution.

Download our guide to Chinese gifting habits

Gen Z are the main consumers of baked goods in China

The main consumer groups for baked goods in China consist of female individuals born in the 1990s and 2000s, students, and white-collar workers.

In response to the evolving preferences of Generation Z, prominent baking brands are proactively focusing on improving product aesthetics to align with contemporary trends. Furthermore, they are diversifying their product offerings and integrating wholesome ingredients to cater to the health-conscious preferences of this younger generation.

Health-awareness and Guochao reshaping the baked goods market in China

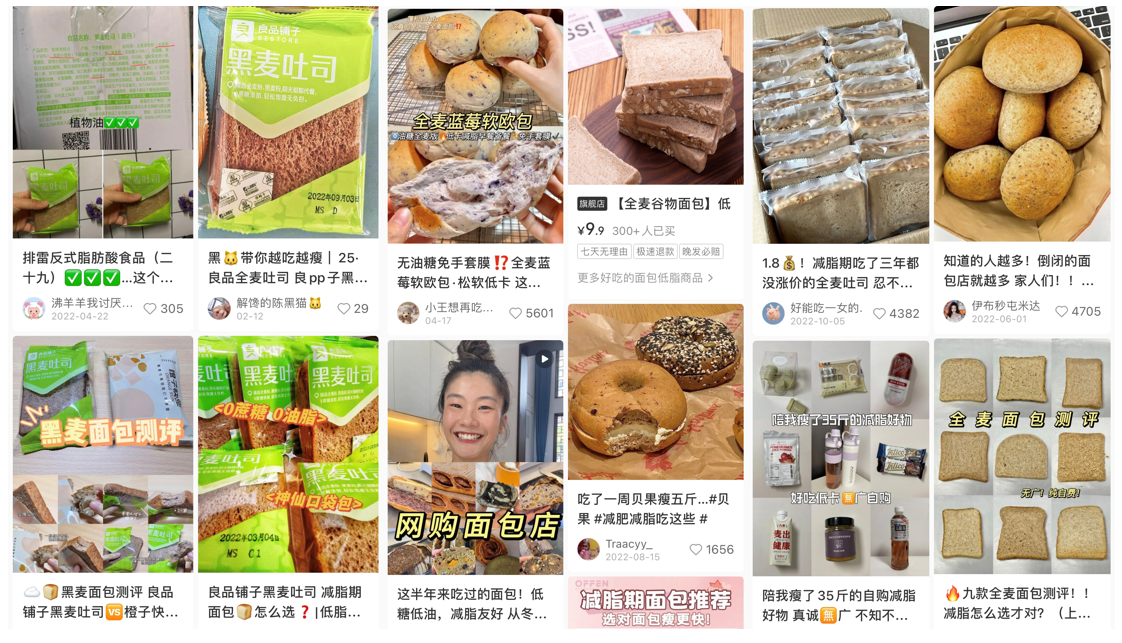

Chinese consumers are re-evaluating their diets, prioritizing nutritional components in baked products. For instance, artisan buns and bagels, introduced from outside of China, are now trendy and considered nutritionally light pastries on Xiaohongshu. Brands like Bestore (良品铺子) with their wholewheat bread and Qee Woo (七年五季)’s wholewheat artisan bread (欧包) exemplify this shift in consumer preferences. High fiber content, sugar-free, low-fat, and natural ingredients have become the prevailing criteria for consumers when choosing bakery products.

Moreover, ongoing product innovation, especially the introduction of new flavors, is crucial. Rising consumer expectations are compelling bakeries to enhance research and development efforts for diverse, visually appealing, and well-packaged offerings. Regarding packaging, the youth and office workers opt for smaller, portable packages, while seniors lean towards larger ones for snack sharing, often choosing softer baked goods with reduced sugar content.

Originating from the fashion industry, the Guochao trend is now influencing the bakery market as well, boosting the sales of modern Chinese pastries. In order to win young consumers’ hearts, local pastries shops are innovating their offerings, upgrading ingredients quality, as well as rejuvenating their packaging by incorporating insta-worthy China-chic patterns.

Chinese consumers are open to bakery products with foreign influence

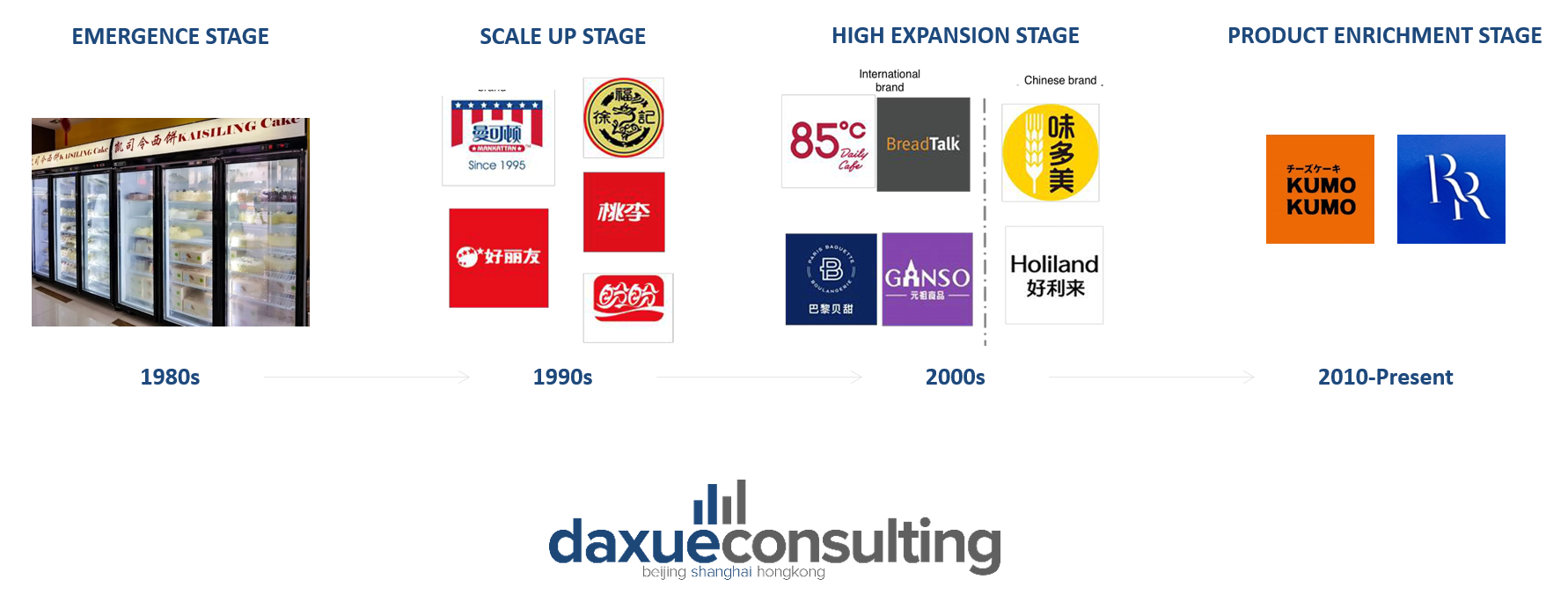

In the 1980s, individual bakeries emerged, introducing baked pastries from Hong Kong and Taiwan (China) to the mainland. These establishments featured shops at the front and bakery workshops at the back, focusing on Western-style bread.

Evolving into the 1990s, modern bakery enterprises, such as Orion (好丽友) and Xu Fuji (徐福记], adopted a mass production model characterized by centralized intensive factories, distributing pre-packaged products in supermarkets and retail stores. This strategic transition aligned with shifting consumer preferences, driven by a taste that resonated with Chinese tastes, effective marketing strategies, and increased convenience in both purchasing and storage.

Transitioning into the 2000s, there was a significant expansion phase marked by the rapid growth of offline branded bakery chains, such as BreadTalk and Holiland. The prevalent business model was characterized by a “central kitchen + frozen dough” approach, and the consumer preference shifted towards Japanese-style bread.

The dawn of a new era

Between 2010 and 2022, the bakery industry in China experienced a significant transformation. Online bakery brands gained prominence, and traditional brick-and-mortar establishments shifted their focus to align with evolving consumer preferences, combining drinks with premium European-style bread. This change resulted in a noticeable increase in bakery product prices.

Kumo Kumo, a Japanese-sounding Shanghai-based cheesecake chain, is a prime example of this shift. Renowned for its commitment to quality ingredients, the pastry chain sets itself apart by conducting the entire cake preparation process, from baking to packaging, right in front of customers. By offering both cheesecakes and cheese tea (milk tea with cheese), Kumo Kumo taps into the fusion of bakery and beverage trends. The Shanghai-based chain strategically creates a sense of scarcity and exclusivity by limiting product quantities and availability at specific times. Additionally, Kumo Kumo effectively utilizes social media, relying on Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) to generate buzz and attract a dedicated consumer base.

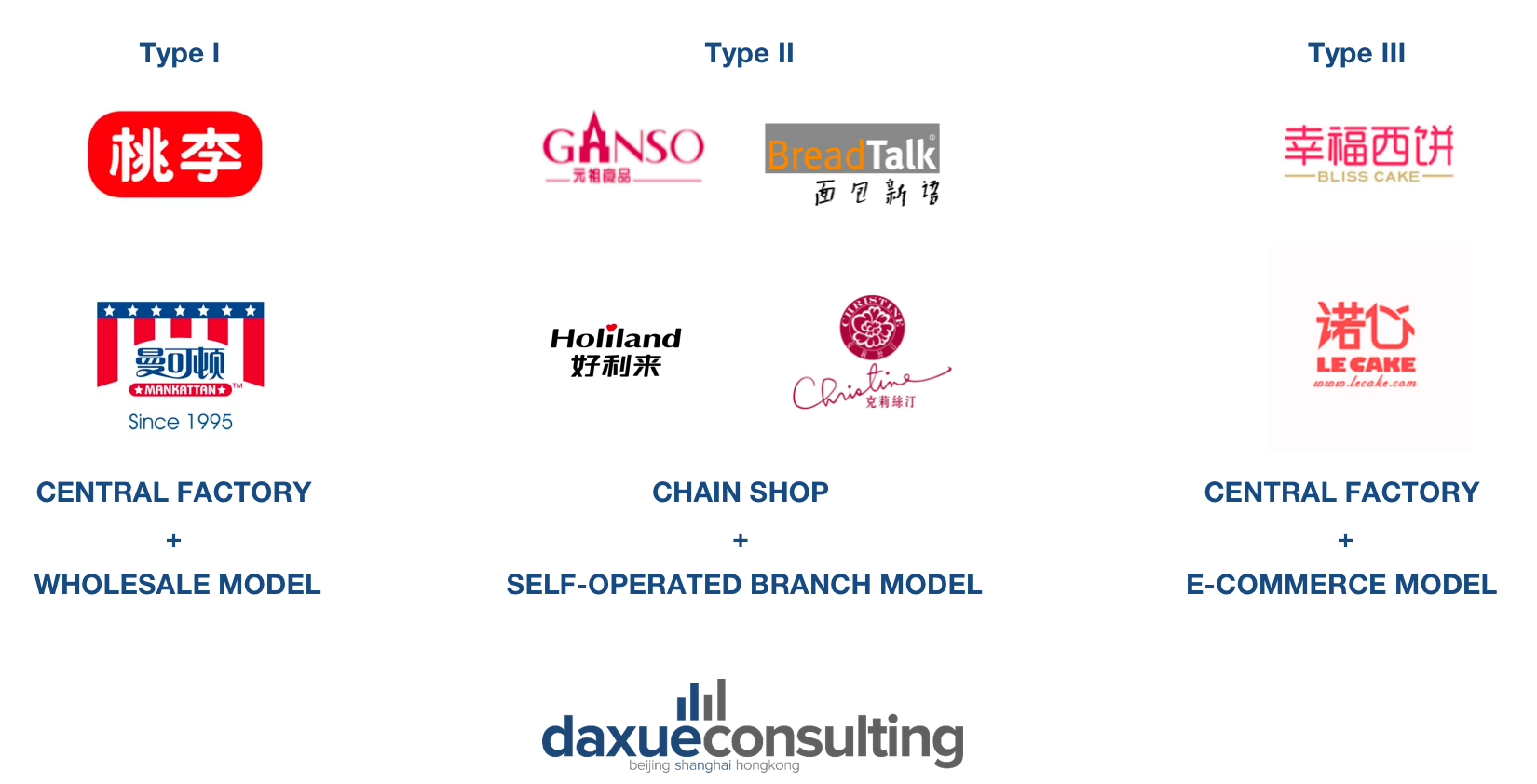

Three business models of bakery industry: daily convenience, better experience, and online competition

There are three distinct business models of bakery industry catering to different market segments. The first type is designed for daily consumption and is primarily available through mainstream sales channels such as supermarkets and convenience stores. Examples of this category include Toly Bread and Mankattan.

The second type, represented by brands like Holiland and BreadTalk, targets mid-to-high-end consumers. These brands operate through self-owned chains of shops strategically located in major cities, emphasizing a premium and refined customer experience.

The third type is positioned for the lower-end market, facing challenges due to intense competition from numerous small bakeries that operate through online sales channels. Brands like Bliss Cake and Le Cake operate in this category, navigating a competitive landscape where their bargaining power is influenced by the fierce presence of smaller bakeries vying for attention in the online marketplace.

Future trends in China’s baked goods market

E-commerce platforms are boosting the rise of the bakery market in China. Beyond providing a cost-effective alternative to physical stores, e-commerce facilitates brand visibility through strategic online activities. Additionally, it empowers these brands to test the market and make informed adjustments based on valuable customer feedback.

Notably, Western-style bakeries, such as BreadTalk and Le Pain Quotidien, actively utilize popular Chinese social media platforms like WeChat and Weibo. By their official accounts, they share product information, promotions, and events, engaging with followers and often collaborating with influential figures to broaden their audience.

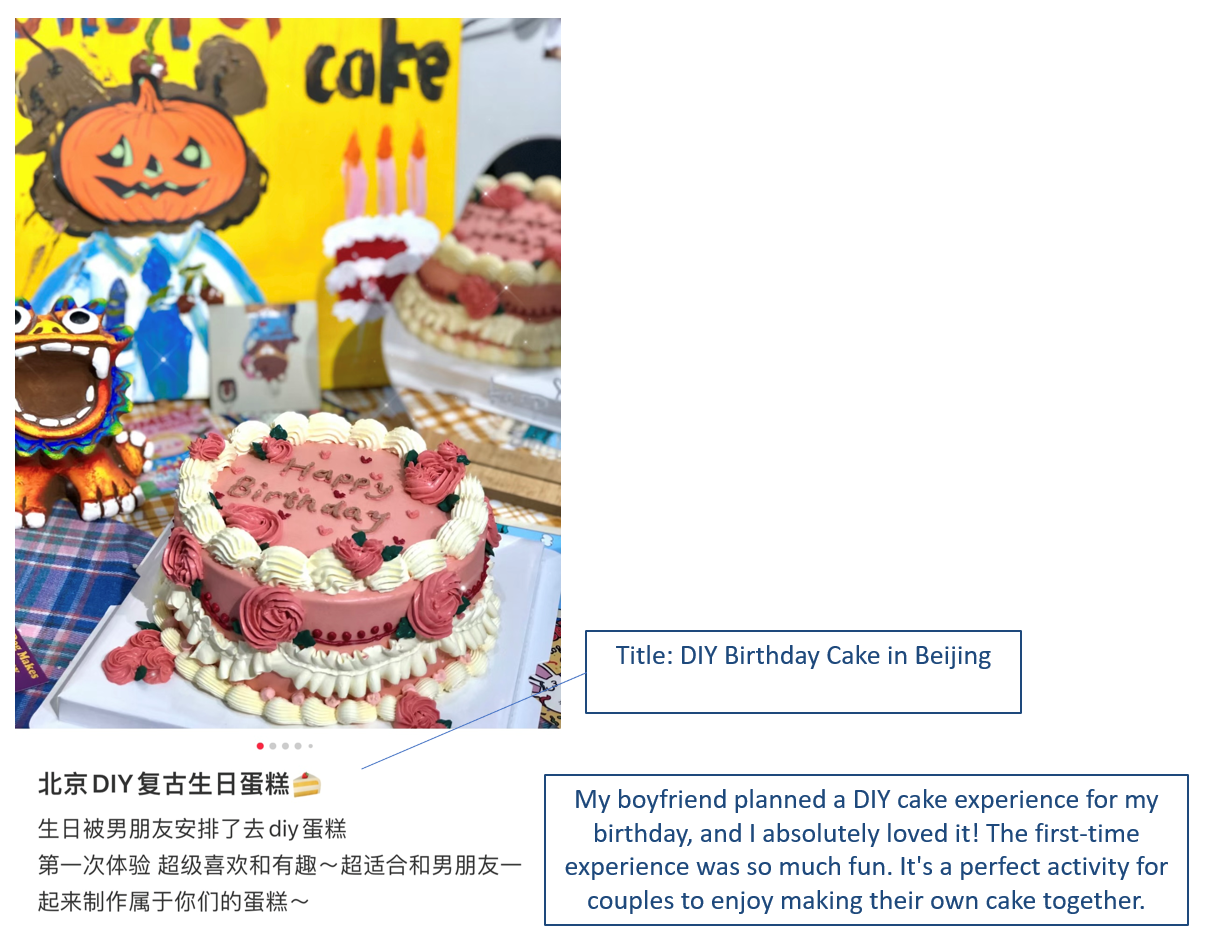

Moreover, some independent bakeries are starting to attract customers in a variety of ways, including providing the experience service of bakery classes for customers to Do it yourself (DIY) bakery products. Consumers are likely to recommend their experiences in the bakery stores to their friends and post their experience on the social media.

Exploring key trends reshaping China’s bakery industry in the digital age

- The baked goods market in China gained momentum in 1980, experiencing significant growth between 2000 and 2010, with the sector reaching RMB 285.3 billion in 2022, driven by post-pandemic recovery and diverse consumption trends.

- Gen Z emerges as the primary consumer group for baked goods in China, with a focus on health-conscious preferences, leading to a surge in demand for nutritious and light pastries.

- The Guochao trend, originating from the fashion industry, influences the bakery market, boosting sales of modern Chinese pastries and prompting local pastry shops to innovate in ingredients, quality, and packaging.

- Between 2010 and 2022, the industry transformed, witnessing the prominence of online bakery brands and traditional establishments shifting focus to combine drinks with premium European-style bread.

- Kumo Kumo, a Japanese-stlye Shanghai-based cheesecake and cheese tea chain, is a perfect example of this new trend. The brand is renowned for creating a sense of scarcity and exclusivity by limiting the daily amounts of products baked.