Carpets market in China: The consumption pattern towards Nepali carpets has changed

The significant economic potential of the Nepali carpet industry became noticeable towards the end of the last decade. The statistics show that in 2014 the carpet industry consisted of around 250-300 thousand employees and the exported products were worth 64,743,570 dollars, with 95% of the carpets are produced in Kathmandu, the capital of Nepal. China is considered one of the biggest importers of Nepali carpets. According to Lin Lu, project manager at Daxue Consulting ‘’Previously, carpets were mostly used in the hospitality and public sectors like hotels, planes, offices, trains, and hospitals. Nowadays, the consumption pattern has changed. Overseas high-end carpet market in China is increasing. Chinese customers can buy more expensive products. They are looking for exclusive designs and fabrics. High end handmade carpets from India, Iran, Turkey and also Nepal are more and more required by Chinese consumers.”

Why the sophisticated hand-made Nepali carpets are becoming a trend in China?

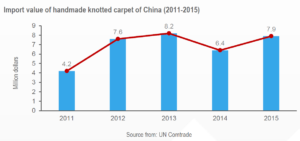

More Chinese customers are now interested in high-end carpets. Compared to Europe and America, the household carpet market in China is still small. Nevertheless, according to UN Comtrade, the import value of hand-made knotted carpets in China increased significantly from 4.2 million dollars in 2011 to 8.2 million dollars in 2013, while in 2015 it reached 7.9 million dollars.

Import value of hand-made knotted carpet of China from 2011-2015

There are two main reasons for the increase in demand of the Nepali hand-made carpets in China. The first one is the rise of commercial housing sales. Based on the data from National Statistics, commercial housing sales continued to maintain its impressive growth in 2016, increasing at an average rate of 43.2%. From January to May, the national commercial housing sales area has reached to 480 million square meters, producing and immense outcome of 3.68 trillion CNY. The second reason is the growth in per capita disposable income, which means that Chinese people have more money to decorate their houses, thus becoming potential clients of the carpet market. As presented by National Bureau of Statistics of China in the image below, the disposable income per capita in 2006 was 11759.5 CNY, and it continued to increase steadily till 2015 when it reached 31195 CNY in 2015.

China disposable income per capita from 2006-2015

The expensive labor force in Nepal and the inability to meet the demand make China import the high-end carpets from India, Turkey, and Afghanistan.

Kavindranath Thakur (Nepal Carpet Exporters Association President) underlined the fact that the high labor and production costs have made Nepali carpets lose their competitive advantage on the international market. Labor costs in Nepal are one of the highest in all of South Asia, with a total annual cost per worker of US$1,789, compared to other countries like Sri Lanka of $1,619, India $943, and Bangladesh $789. While, the rate of labor market efficiency, is among the lowest in Asia, based on the Global Competitiveness Report. As a result, Nepali carpet industry lacks productivity not being able to meet a full demand of Chinese market, being currently the fourth largest importer of carpets to China after India, Turkey, and Iran.

Daxue Consulting’s expertise

The International Trade Center (ITC, the joint agency of the World Trade Organisation and the United Nations, approached Daxue Consulting with the purpose of executing a training program on “how to export to China?” for the SMEs from six Asian countries (Afghanistan, Bangladesh, Cambodia, Laos, Myanmar and Nepal), each country was targeting a different products for export. For this project, Daxue Consulting developed a training program, which consisted of two modules. The first module presented general information on how to export to China, providing with details about how to collect market intelligence to design and implement the competitive export strategy in order to enter China market, especially work with Chinese enterprises. The second module focused on how to manage export transactions with Chinese enterprises, covering detailed information on the regulations and certificates required by the Chinese Government for the import business and the presentation of each selected product including the carpet industry for Nepal.

Stay Up-to-date, Follow Us on Facebook: