In 1995, approximately one in twenty (5.3%) Chinese children were overweight. In 2014, one in five (20.5%) Chinese children were overweight. This makes China’s 2014 childhood overweight prevalence rate about the same as the USA in 1990. On top of this, the growth rate of the childhood overweight prevalence rate in China from 1995 to 2014 was around 2.5 times higher as that of the USA from 1970 to 1990. If the USA’s battle with obesity can provide any foreshadowing for what’s to come, the increase of childhood obesity in China will lead to increased rates of diabetes and metabolic abnormalities that the markets will have to address. This will raise the consumer demand in a wide range of industries including pharmaceutical, medical, health food and fitness.

How is China’s childhood obesity epidemic different from other countries?

Due to different culture of eating, exersize, and treating illnesses, we cannot assume that China’s childhood obesity epidemic will mirror those of the United States and United Kingdom.

In China, obesity is correlated with a higher income, whereas in western developed countries, obesity is correlated with a lower income.

Chinese children in suburban or rural regions tend to be less active than those in urban regions. Whereas in the United States, there is no significant difference in physical activity levels between rural and urban areas. Additionally, according to a 2016 study, China’s rural children are less likely to pass the nations standardized fitness exams compared to urban areas.

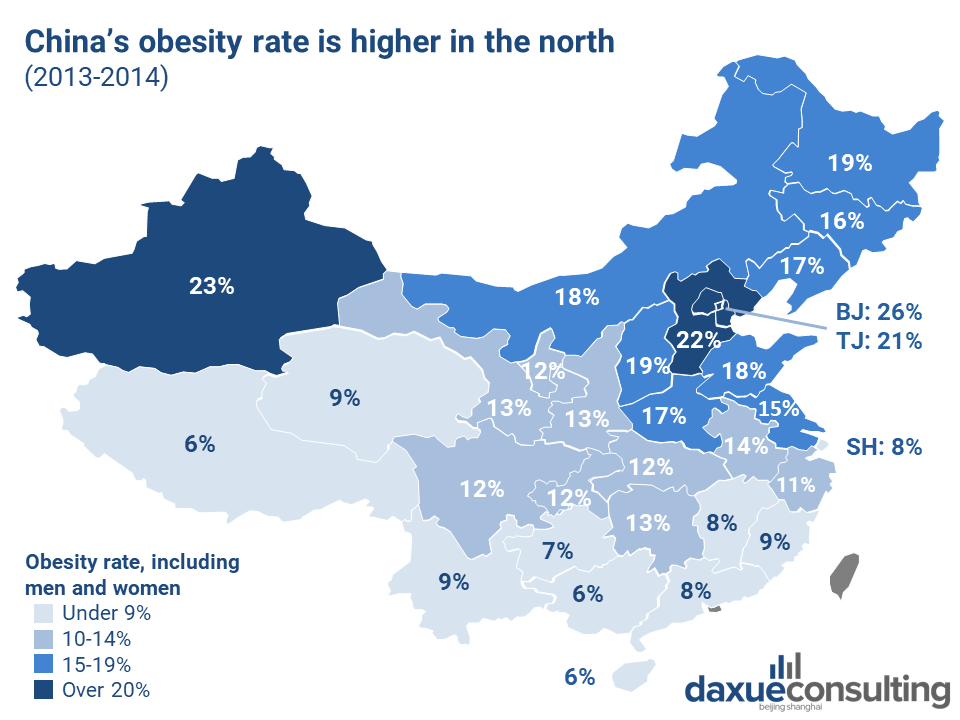

Lastly, like many other societal trends, there are distinct regional differences in China’s obesity patterns. The north, and especially the Beijing, Tianjin, Hebei area where there is a cluster in obesity. On the other hand, the south is, on average, much thinner, as well as Shanghai, which has less obesity than it’s surrounding provinces.

Data source: American College of Physicians; Chronic Disease and Risk Factor Surveillance, The Economist, analysis by daxue consulting. Obesity rates are higher in the north.

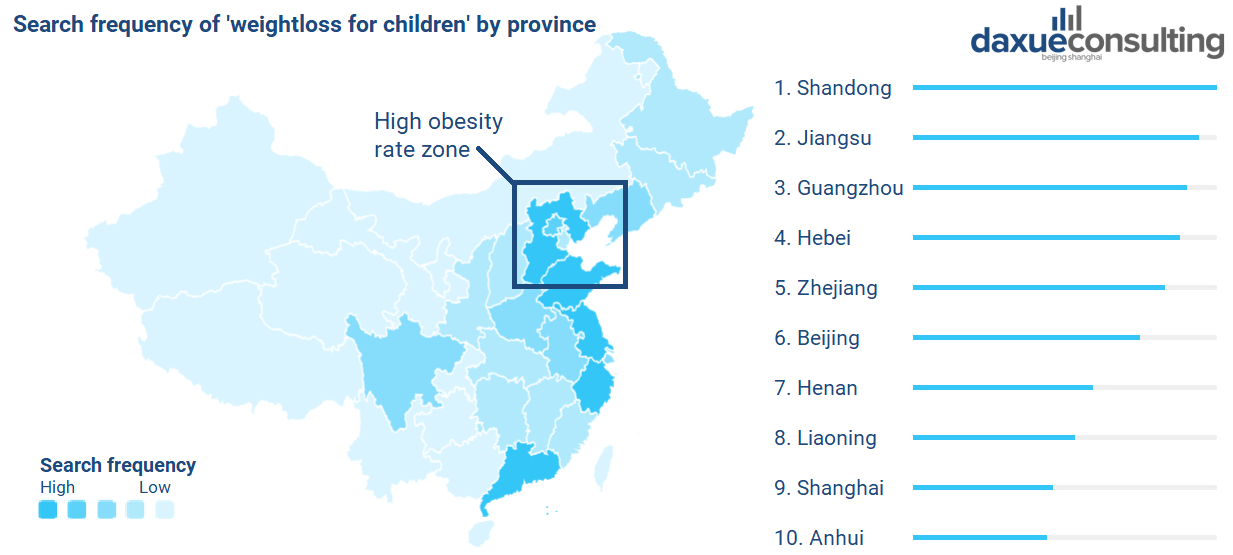

Data source: Baidu index, daxue consulting analysis, search frequency of ‘weight-loss for children’ in China by province. Date range: September 2019 – August 2020.

The drivers of Childhood obesity in China

The sudden increase in Childhood obesity rates is due to many factors. A changing lifestyle and shift from farming to technology creates less demand for hard labor. While at the same time, the generational differences presents parents and grand-parents who have not

Chinese children have an increasingly sedentary lifestyle

Chinese children are spending more time indoors and are less active. 56% percent of Chinese students walk or bike to school, however in urban areas where public transportation is booming, the number of children using active transportation is dropping. In addition to less active transportation, Chinese children are less active in organized sports and athletic activities. Around 20% of school aged children in Shanghai participate in organized sports, compared to 72% across the United States. Also contributing to the increasing sedentary lifestyle of Chinese youth is the massive homework load and popularity of sedentary entertainment like video games and surfing the internet.

The “Grandparent Effect” – grandparent’s affectionate overfeeding contributes to childhood obesity in China

Grandparents play a large role in childcare. Grandparents’ co-residence affects a grandchild’s weight outcome through changes in dietary patterns and physical activity. The current generation of Chinese grandparents grew up around starvation and poverty. This led them to see extra fat as a sign of health rather than seeing it as a danger to their grandchild. As a result, grandparents tend to over-feed their grandchildren, especially boys; this has been called the “grandparent effect”.

“My parents feed lots of meat to my daughter who is already overweight. They say the “3 highs” (high blood sugar, high blood pressure and high cholesterol) do not affect children, as they are the burden of adults…children can eat freely”. – Quote from Chinese parent

Increase in processed foods

China’s snack market size grew by 422% from 2006 to 2016, accorindg to a report from the Circulation Industry Promotion Center, an affiliate of the Ministry of Commerce. However, much of this growth is also from China’s healthy snack market.

Source: Reuters, via the Atlantic. Soft drinks which are the epitome of a bad diet in the west are making their way into Chinese households

What markets will be affected by Childhood obesity in China?

The direct economic impact of childhood obesity in China are medical costs. Because of the current trend of childhood obesity, unless if there is a major shift towards healthier childhoods, we can expect major implications in the Chinese healthcare market.

An overweight childhood affects an entire lifetime

Children who have obesity are more likely to have the following diseases as they grow up:

- Cardiovascular diseases

- Impaired glucose tolerance, insulin resistance and type two diabetes

- Breathing problems such as asthma and sleep apnea

- Joint problems and musculoskeletal discomfort

- Fatty liver disease

- Gallstones

- Gastro-esophageal reflux (also known as heartburn)

Diabetes is becoming a public health crisis in China

The instances for type 2 diabetes in China has been rising over the past few decades. An estimated 11% of the Chinese population suffers from diabetes. China alone accounts for around one-fourth of the global diabetes cases. And around 95% of the diabetes cases in China are type 2.

What is unusual is that Chinese tend to get diabetes at an average lower BMI rate than their western counterparts. It is unclear whether this is due to genetic or cultural reasons.

The rapidly increasing diabetes rate is boosting the diabetes treatment market in China. However supply is not yet meeting demand, only 5.6% of Chinese diabetes patient are hitting the optimal levels of blood pressure, lipid targets and blood glucose.

Cardiovascular disease treatment market in China

As of 2018, there were 290 million patients with cardiovascular diseases in China, 245 million of which are hypertension. The same research shows that a shocking 45% of deaths in China are due to cardiovascular diseases, which is higher than the global average of 33%. Since 2009, the rate of deaths from cardiovascular diseases was higher in rural areas than urban areas for the first time. This is consistent with the overall trend of obesity growing faster in rural than urban areas.

China’s cadiovascular devices market is expected to maintain a growth rate of nearly 8% until 2024. The cardiovascular dvices market in China was a 2.8 billion USD market in 2018, and is expected to reach 4.5 billion USD in size in 2024.

Can China’s rising health awareness defeat the growing obesity rates?

Two concurrent forces, conflicting symptoms of a growing economy: the growing obesity rate and the increasing health awareness in China. In 2019, only 4.9% of the Chinese population hit the gym. Though it is a seemingly small part of the population, the trend is growing quickly. Millions more have been logging into fitness APPs like KEEP for at-home workouts.

At the same time, Euromonitor China’s statistics show that China’s vegan product market has maintained a growth rate of 17.2% from 2015 to 2020. Chinese have a growing awareness of nutrition and wellness, especially in large cities.

However, the trend of health awareness vs. obesity is still split by the urban-rural divide. Urbanites are diving into the health-scene, while rural Chinese, who are more likely to be raised by grandparents who tend to overfeed them, have an increasingly less active lifestyle.

The COVID-19 pandemic gave momentum to China’s growing health awareness trend. This may impact consumer psychology towards wellness in more ways than expected. Baidu searches for ‘weight-loss for children skyrocketed in the months following the COVID-19 outbreak. Reasons could be that parents were locked indoors with their family members and wanted to ensure everyone was getting activity, and keeping their immune systems in shape.

Data source: Baidu index, daxue consulting analysis, search frequency of ‘Overweight child’ and ‘weight-loss for children’ between 2012 and 2020.

What does China’s childhood obesity epidemic mean for the economy?

Ten years from now, the 20% of overweight children will be entering adulthood, and will be fighting an uphill battle to maintain a healthy weight into adulthood.

- Supply does not meet demand when it comes to medical necessities. To keep up with the obesity rate, China has a high demand for healthcare. This is especially urgent for diabetes and cardiovascular diseases in rural areas.

- Increase knowledge about nutrition and increasing obesity are happening concurrently. Though it is not a causation relationship, we can expect more diverse diet-oriented consumption in the future.

- ‘Healthy’ could become a focal point in marketing messages. In current times, parents and grandparents are dedicated to keeping their children healthy, but may have different ideas of what healthy looks like. Given the easy access to nutrient dense foods in the modern world, the importance of eating less calories, will become evident in the younger generations. Which is in contrast to the elderly generation who may be inclined to overfeed. Hence, it is worth keeping an eye on Chinese perceptions towards health and nutrition.

Learn more about the health industry in China, from our vitamin market report

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast