China’s diamond market has been the world’s second-largest for over a decade. According to Statista, the Chinese diamond jewelry market was valued at approximately USD 8.8 billion in 2022. This article aims to explore the dynamic landscape of China’s jewelry market, specifically emphasizing the shifting trends within the diamond sector.

Download our China luxury market report

Driving forces, such as declining marriage rates, contribute to the downward trend in diamond prices, alongside the emergence of alternative investments like gold jewelry and the growing popularity of lab-grown gems. Our objective is to shed light on the factors influencing consumer behavior, market shifts, and emerging preferences, providing valuable insights for stakeholders in the diamond industry.

Diamonds are considered one of the top gifts by Chinese millennial women

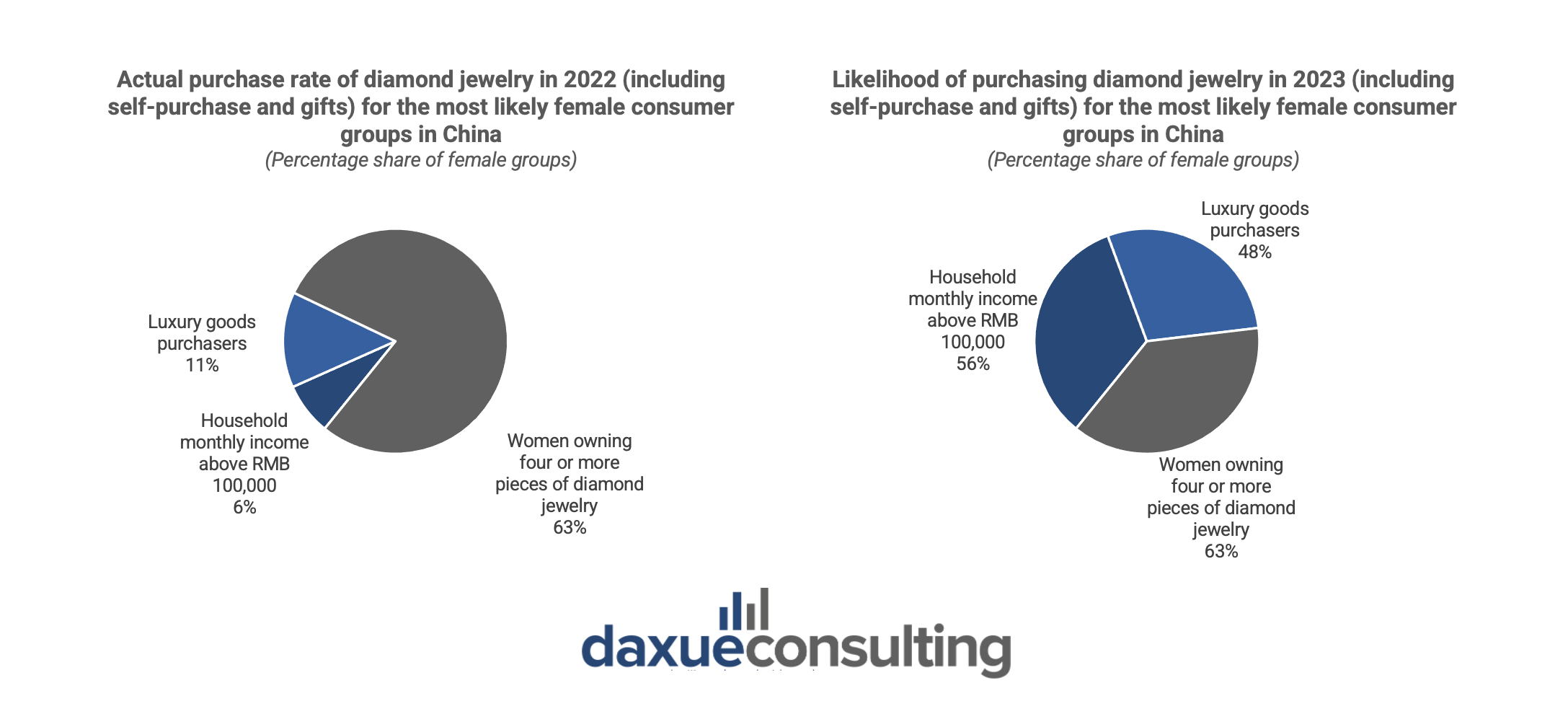

DeBeers Diamond Insight Report 2023 reveals that the allure of natural diamonds is continuously increasing, with more and more women considering them as the third most desired gift for 2023. Compared to other demographics, women from the millennial generation (aged 26 to 41) and affluent consumer groups with a household monthly income of over RMB 30,000 are more likely to express a desire to receive diamond jewelry gifts.

Women’s desire for diamond jewelry accounts for the vast majority of China’s total diamond demand, reaching as high as 97%. Even though Chinese consumers still exhibit strong demand for natural diamonds, there exists a gap between purchase intention and actual buying behaviour. This gap signifies an opportunity for the diamond industry to respond based on consumer analysis, thereby seizing the opportunity.

China’s diamond dilemma: Insights into declining demand amidst changing trends

The 2023 Global Rough Diamond Price Index reveals a 6.5% decline in diamond prices since the beginning of 2022. As early as March 2023, international polished diamond prices experienced a dramatic year-on-year decrease of 17.6%, representing the most severe downturn in the past four years, even surpassing the declines observed during the pandemic period.

Various factors contribute to this shift, including the lingering effects of COVID-19 lockdowns, sluggish income growth, and a weakening property sector. The end of pandemic restrictions saw consumers diverting their spending towards travel experiences rather than physical products, further impacting diamond sales.

Another significant factor is the declining marriage rate, which hit a record low in 2022 according to data from China’s Ministry of Civil Affairs. The rate drastically decreased from approximately 13.47 million couples in 2013 to 6.84 million in 2022. Younger generations prioritize personal development and financial stability over marriage, resulting in reduced demand for engagement and wedding rings.

The rise of gold jewelry as an investment

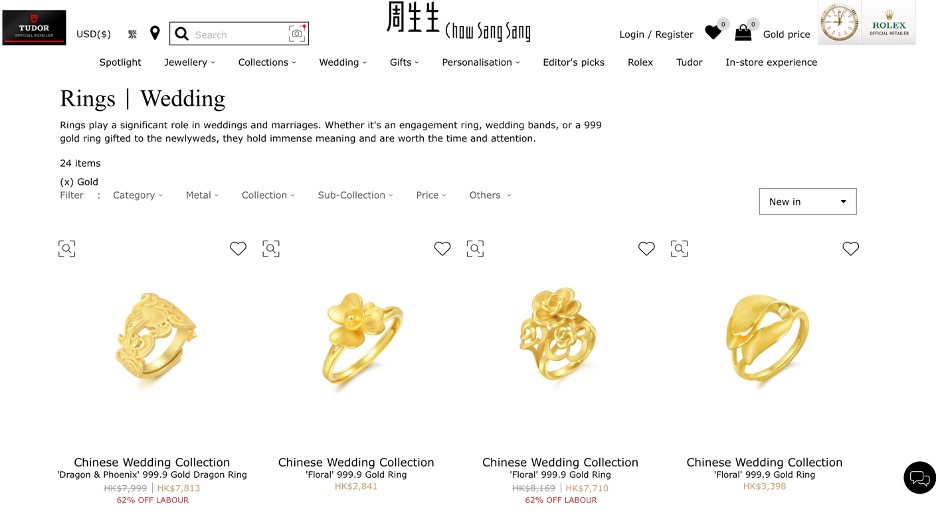

Moreover, Chinese newlyweds are increasingly turning to gold as an alternative investment, with rising gold prices driving a surge in consumption of gold jewelry. Unlike diamonds, which are primarily associated with Western traditions, gold jewelry has deep cultural roots in Chinese weddings. For centuries, gold has symbolized wealth, prosperity, and auspiciousness in Chinese culture.

A striking example of this cultural significance can be observed on the official website of Chow Sang Sang, a renowned Chinese brand, where multiple choices for 999.9 gold wedding rings are available. This not only underscores the enduring allure of gold but also highlights its integral role in Chinese matrimonial customs.

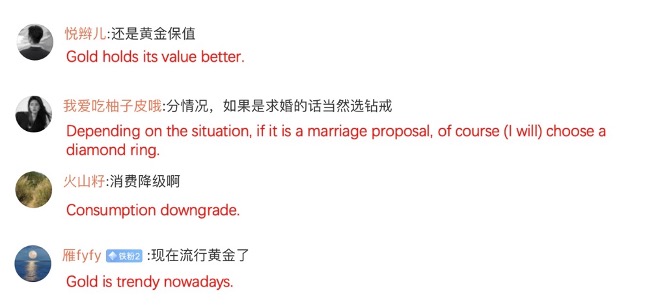

The price of gold has been on a steady increase in 2023, which is usually a sign of an economic slowdown with soaring demand. In contrast, the price of diamonds has plummeted to 18% compared to its highest point in February 2022. These market developments are further accelerating the shift in preferences from diamonds to gold when it comes to wedding gifts among young people in China. Based on social listening from Weibo among Chinese young consumers (Millennials and Gen Z), they are more interested in buying gold than diamonds, citing reasons such as the storage of value and rising gold prices.

In the first quarter of 2023, China’s consumption of gold jewelry increased by 12.29% compared to the previous year, reaching a total of 189.61 tons. The price of gold reached a 14% return in the face of geopolitical risks, the Chinese central bank purchased a large amount of gold and intensified expectations of central bank interest rate cuts. This makes gold a good investment option and the Chinese often consider gold as a haven for investment. China saw a 28% increase in investments in gold bars and coins compared to 2023, reaching a total of 280 tons last year.

Concurrently, the steady increase in gold prices amidst an economic slowdown contrasts sharply with the plummeting diamond prices, accelerating the preference shift towards gold for wedding gifts among Chinese youth. As the market dynamics continue to evolve, understanding these trends is essential for stakeholders in the diamond industry to navigate the changing landscape effectively.

Lab vs. Real diamonds in China

China’s diamond mines have been the largest industrial diamond producers globally. As of 2016, the mines began producing gemstone-quality diamonds using the HPHT (High Pressure High Temperature) method. These gemstones meet the 4C criteria: cut, colour, clarity and carat, thus can be used for jewelry.

Globally, 6-7 million carats of jewelry-grade rough diamonds are produced every year and 3 million of them are produced in China, of which 80% are produced in Henan province. On its Initial Public Offering (IPO), Henan Liliang Diamond’s (a manufacturer of synthetic diamonds) shares opened with an issue price of 20.62 RMB and closed at 229.38 RMB.

Are natural diamonds an ‘IQ tax’?

Chinese netizens often refer to diamond engagement rings as an ‘IQ tax’. This expression refers to the belief that paying a higher price for something is a result of being gullible or unintelligent. On Chinese social media platforms, many men share they would prefer synthetic diamonds but fear their girlfriend’s reaction to receiving one.

In a video on Xiaohongshu, a man asks a woman if she would accept an artificial diamond ring- she replies, “definitely not”. The man then shows her photos of a lab-grown diamond and a natural one and asks her to guess which is real. She guesses wrong, but later comments on how the imperfection of the natural diamond makes it real and valuable, while the artificial one looks too perfect, and too good to be true.

Positive reactions to lab-grown diamonds

Surprisingly, most posts about lab-grown diamonds on Xiaohongshu are very positive, praising their cheap price– on average one-third less than natural diamonds, and the fact that both chemically and physically, lab-grown diamonds are identical to natural diamonds. Many Xiaohongshu users like that they can afford a bigger, higher quality synthetic diamond than they would have been able to if they were to purchase a natural diamond.

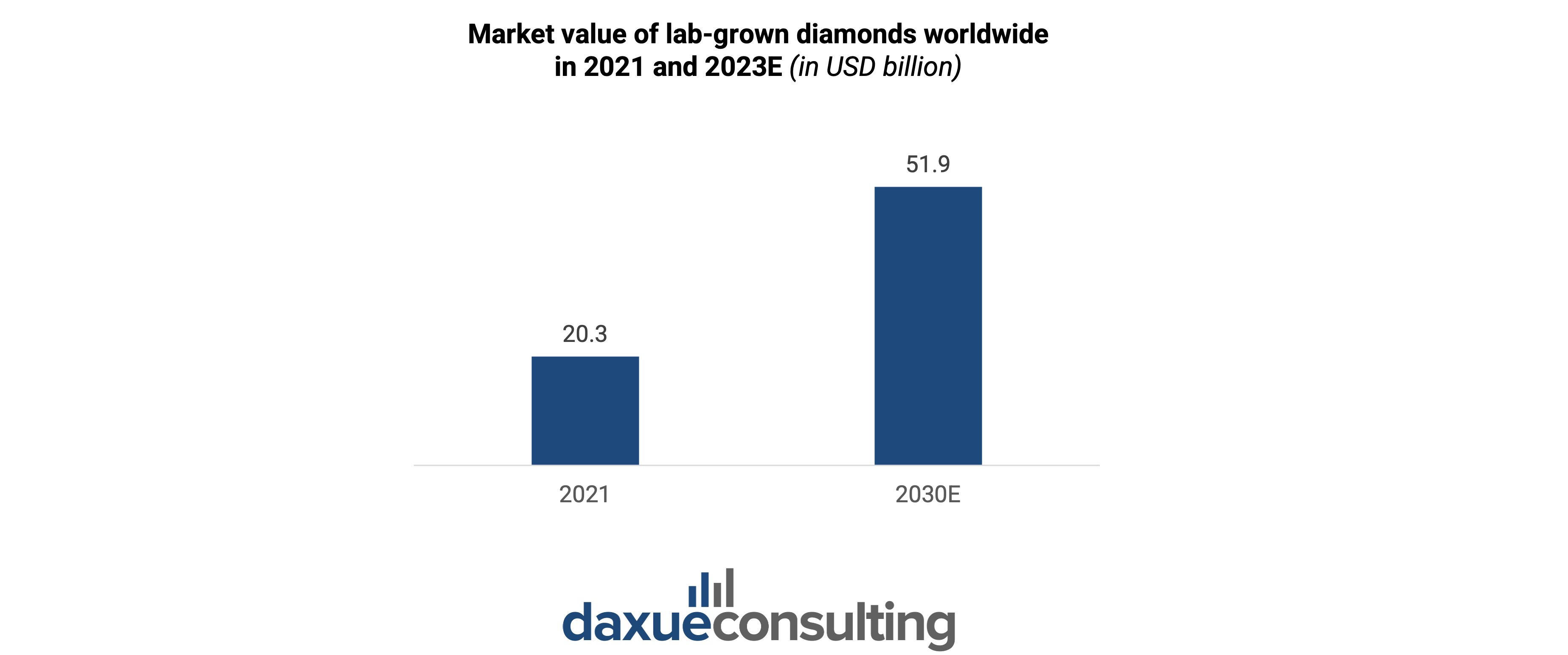

With the market value of lab-grown diamonds steadily increasing since 2018, and predictions expecting it to reach USD 51.9 billion in 2030, the trend of lab-grown diamonds is not one to ignore. Synthetic diamond’s affordability will play a big part in their increasing popularity, while for those strongly against synthetic diamonds on engagement rings, it could be an affordable option for pendants and earrings used as accessories.

Exploring the future of China’s diamond market

As the landscape of luxury commodities evolves, the future of diamonds seems poised for a transformation. The emergence of lab-grown diamonds presents a promising avenue for the resurgence of demand. Offering a more cost-effective alternative, lab-grown diamonds are gaining traction among Chinese consumers, particularly the younger demographic, who appreciate their affordability and value proposition. Social media platforms like Xiaohongshu echo this sentiment, with users lauding lab-grown diamonds for their ability to afford larger and higher-quality stones compared to natural diamonds.

Despite current challenges, the market for diamond sales and diamond jewelry is set for ongoing growth in the upcoming years, driven by rising demand for sustainable and inventive products, along with the extensive integration of technology. Projections indicate that by 2030, the global market size for diamond sales and diamond jewelry is anticipated to reach multimillion-dollar levels.

Brands like De Beers remain optimistic about the growth potential of diamond sales, particularly among millennials and the burgeoning Gen Z demographic. As diamonds are present in contemporary Chinese culture, both as symbols of love and investment, their future trajectory will be full of innovation and further expansion.

Trends in China’s diamond market

- The diamond market in China remains the world’s second-largest, with a valuation of approximately USD 8.8 billion in 2022, driven by increasing demand, particularly among women who consider diamonds as coveted gifts.

- Despite strong demand, a gap exists between purchase intention and actual buying behavior, signalling an opportunity for the industry to respond based on consumer analysis.

- The rise of lab-grown diamonds presents a cost-effective alternative, gaining popularity among Chinese consumers, especially the younger demographic, due to their affordability and value proposition, as evidenced by positive sentiments on platforms like Xiaohongshu.

We are a team of experts on the diamond market in China

Are you looking to tap into the lucrative Chinese diamond market? At Daxue Consulting we can assist you in navigating the difficulties of the Chinese diamond sector by providing customized market research and strategic insights.

Whether you’re an investor, jewelry maker, or retailer of diamonds, our team of professionals can offer you insightful, data-driven analysis and practical suggestions to advance your company. Our team will provide you with the necessary knowledge and methods to take advantage of new opportunities and maintain an advantage over competitors, ranging from competitor analysis to trends in consumer behavior.

Get in touch with us at dx@daxueconsulting.com to find out how our advisory services may help you accomplish your business goals and realize the full potential of the Chinese diamond industry.