China’s luxury market seeks steady recovery amidst challenges in 2022, which rebounded in 2023, as the market is driven by core luxury consumers who are less financially impacted by a slowing GDP. With the vigorous development of domestic luxury e-commerce, omnichannel luxury retail is making progress in China.

Luxury brands are not merely adapting to the digitally savvy preferences of Gen Z consumers but are also reshaping the very essence of consumer touchpoints. Through a fusion of online and offline strategies, brands are crafting personalized journeys that transcend physical and digital boundaries, creating immersive shopping experiences that cater to individual preferences.

Download our China luxury market report

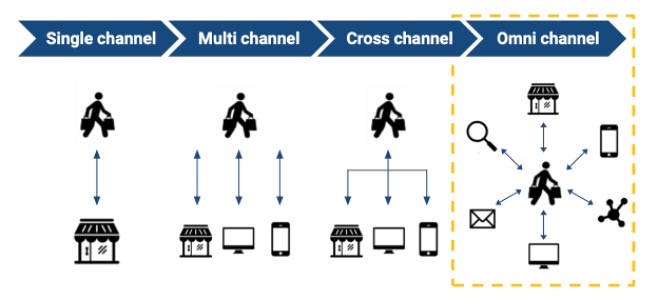

Omni-channel for providing equal customer experience across platforms

Omni-channel is a comprehensive strategy encompassing sales, marketing, and customer support, aimed at delivering a unified brand experience to customers across various channels. This approach ensures that regardless of the channel customers choose, whether it’s online through desktop or mobile apps, via telephone, or in a physical store, they encounter a seamless and consistent experience. The objective of business is to focus on the integration of all channels and touchpoints of the brand to build a global, frictionless, personalized and customer-centric customer experience.

Source: Daxue Consulting & VO2 Asia Pacific luxury report, Omni-channel: seamless integration of all channels

What does the omnichannel approach entail within the luxury sector?

Omnichannel strategies in China, in the realm of luxury, are aimed at providing a seamless and personalized experience for Chinese shoppers. Central to this strategy is the development of holistic customer profiles, where brands amalgamate customer data from various channels to gain comprehensive insights into customer journey and behavior. Leveraging advanced artificial intelligence technology and analytics, brands analyze this data to discern patterns and preferences, enabling them to tailor their offerings to individual tastes.

From personalized product recommendations to curated content and immersive in-store experiences, luxury brands craft personalized shopping journeys that resonate with customers at every touchpoint. This extends to the digital realm as well, known as Servicescape 2.0, where brands strive to replicate the high level of service synonymous with physical stores through personalized interactions online.

This convergence of online and offline experiences represents the evolution of luxury retail in the omni-channel era, where the focus is on delivering exceptional service and tailored experiences to every customer, regardless of the e-commerce platform or offline commerce channel they choose to engage with.

The evolution of luxury shopping in the digital age

Luxury brands are increasingly embracing hybrid commerce and phygital experiences, where the lines between digital and physical realms are becoming less distinct. This shift is reshaping traditional retail practices, with omnichannel strategies in China revolutionizing e-commerce platforms to emulate the immersive and personalized nature of in-store experiences.

In this dynamic landscape, traditional methods of product discovery, such as editorials and videos, are being complemented by cutting-edge technologies. For instance, 3D visualization enables customers to virtually try on items in multiple dimensions without the need for special glasses or additional apps. Platforms like Bottega Veneta’s Tmall store allow consumers to zoom in for detailed views of products from every angle, enhancing the online shopping experience with digital technologies.

Moreover, luxury brands are also innovating personalized services through digital technologies. Tmall Luxury Pavilion, for example, offers one-on-one video customer consultations, allowing sales associates to engage with customers in private sessions. This personalized approach extends to brands like Vacheron Constantin, which leverages Tmall Luxury Pavilion to create exclusive VIP experiences reminiscent of salon consultations.

Source: Tmall WeChat mini-program, 3D visualization of the bag in Bottega Veneta’s Tmall store (left), Tmall Luxury Pavilion’s one-on-one video consultation for Vacheron Constantin (right)

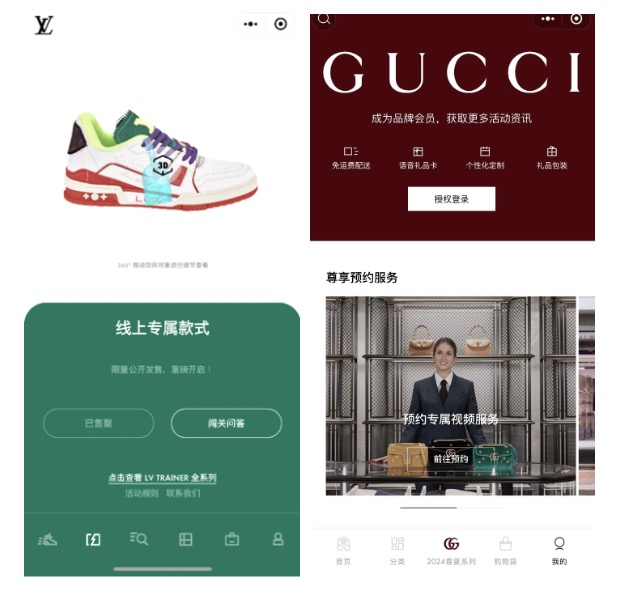

Additionally, Louis Vuitton’s online mini program also includes online exclusive styles of sneakers, which can be browsed in 3D on the mini program. Customers have the opportunity to engage further by answering questions and interacting with the content provided, enhancing their overall online shopping journey and fostering a deeper connection with the brand.

Moreover, GUCCI’s mini-program provides exclusive video consultation service. In the past, most of the consultations were online manual consultations with typing communication, while video consultations are more life-like and authentic. Through video communication on online commerce platforms, customers can more intuitively see the effects of trying on dynamic bags and other luxury items.

Source: LV’s online mini-program, Online exclusive style (Left); Gucci’s online mini-program, Exclusive video service (Right)

As luxury brands continue to embrace digital innovations, they are redefining the boundaries of retail and offering customers unparalleled shopping experiences that seamlessly blend the digital and physical worlds.

“Retailtainment” is transforming luxury shopping

In the context of omnichannel strategies in China, the emergence of “retailtainment” plays a pivotal role in transforming shapes the luxury shopping experiences. Luxury brands in China are leveraging experiential marketing to create immersive retail environments that go beyond traditional transactions. The sophisticated “retailtainment” offerings feature interactive displays, voice-activated and AR-enabled mirrors, and smart dressing rooms, meticulously crafted to deliver unparalleled experiences.

These experiences are not only visually stimulating but also engage multiple senses through smart technologies, creating a multisensory shopping journey that leaves a lasting impression. Recently, in celebration of Tmall Pavilion’s 5th anniversary, Alibaba introduced a series of metaverse upgrades, including an AR fashion show and a Meta Pass granting priority digital access to a variety of luxury brands. Additionally, an immersive extended reality (XR) exhibition offered a glimpse into the future of retail.

Source: Daxue Consulting & VO2 Asia Pacific luxury report, an immersive extended reality (XR) exhibition for Tmall Pavilion’s 5th anniversary

Luxury stores are evolving into creative and experimental hubs, where immersive retail experiences forge strong emotional connections with customers. For instance, Dior’s Zhangjia Garden in Shanghai operates as a dynamic pop-up store with evolving themes, while beauty label Sisley’s Asia-Pacific Maison Sisley in Shanghai Zhang Yuan integrates in-store coffee shops and beauty salons, enhancing the overall shopping experience.

Source: Daxue Consulting & VO2 Asia Pacific luxury report, Dior’s Zhangjia Garden in Shanghai as a pop-up store(Left); the first Asia-Pacific Maison Sisley in Shanghai(Right).

The art of personalized shopping experiences in China’s luxury market

In China’s evolving market, it is critical for businesses to adopt a customer-centric approach to adapt to changing preferences and cultivate lasting loyalty, ensuring continued relevance. A diverse range of personalized product options, from mobile payments, the convenience of booking to easily locating items in-store, as well as electronic booking and flexible delivery services, enable customers to tailor their buying journey to their unique preferences and needs.

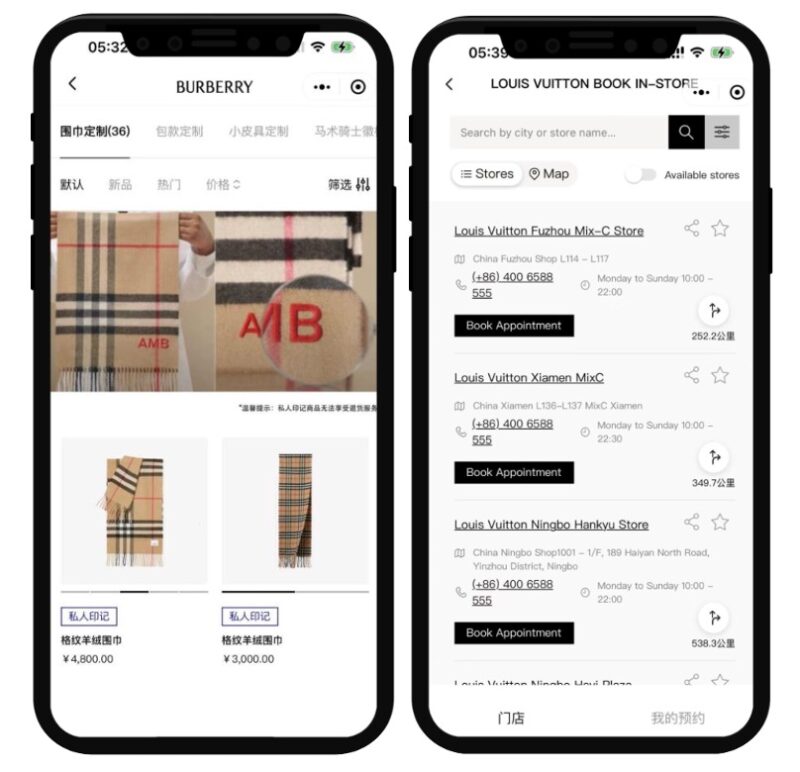

For instance, Burberry offers a bespoke product customization service, allowing consumers to add a personal touch by embroidering their initials onto items such as scarves, bags, and leather goods. Burberry not only enhances the perceived value of its products but also strengthens the emotional connection between the brand and its customers. This customization option caters to the growing demand for individuality and exclusivity among luxury consumers, allowing them to create unique pieces that reflect their personal style and preferences.

Meanwhile, Louis Vuitton’s WeChat mini-program streamlines the process by enabling customers to seamlessly schedule appointments with nearby stores using location pins, enhancing the overall shopping experience.

Source: Daxue Consulting & VO2 Asia Pacific luxury report, Burberry and Louis Vuitton’s WeChat mini-program

Brands leverage online and offline channels to streamline post-purchase services

The convenience of digital navigation has influenced traditionally in-person services, reshaping the scope of luxury offerings and transforming how consumers interact with luxury brands in an omnichannel digital landscape. This evolution has ushered in a “one-stop shop” luxury experience, where brands now provide post-purchase services that extend beyond the initial transaction.

In alignment with omnichannel strategies in China, luxury brands offer a comprehensive suite of services, ranging from item cleaning and maintenance to product exchanges, adjustments, and replacements. This approach empowers customers to seamlessly schedule and access assistance whenever needed, ensuring a seamless and convenient post-purchase experience.

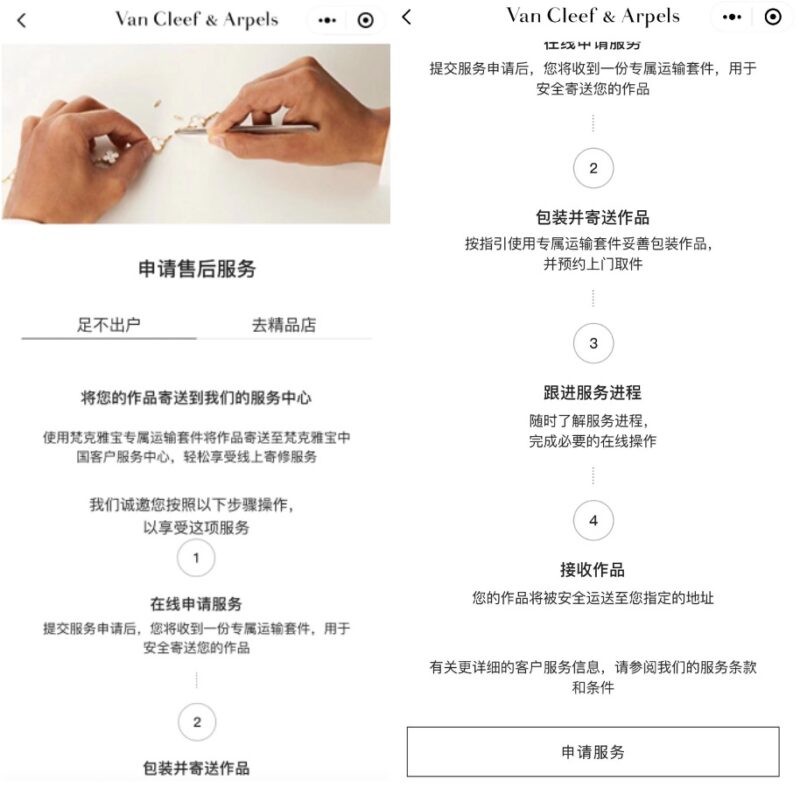

To be more specific, Van Cleef & Arpels has embraced the trend of digital navigation by introducing after-sales services for consumers, known as “足不出户,” which enables customers to effortlessly access online repair services from the comfort of their homes. This innovative service allows customers to conveniently submit their items for repair via the internet, eliminating the need for physical visits to a store or service center. It epitomizes the brand’s commitment to providing a seamless and hassle-free post-purchase experience, ensuring that customers can easily maintain and repair their Van Cleef & Arpels products with convenience and ease.

Source: Van Cleef & Arpels’s Wechat mini-program, post-purchase care services

This seamless integration of post-purchase services not only enhances convenience but also reinforces the brand’s commitment to delivering exceptional customer experiences across all touchpoints. Luxury brands, like Chopard Watches, Burberry, and Carven, have exemplified a commitment to exceptional customer service by integrating post-purchase care services onto the Tmall Luxury Pavilion platform.

This strategic ensures that customers receive the same high-quality service online as they would at physical stores. By providing these services through Tmall Luxury Pavilion, the brands have effectively bridged the gap between digital and physical retail experiences, offering customers a seamless and convenient way to access after-sales support.

Source: Daxue Consulting & VO2 Asia Pacific luxury report, Chopard Watches (Left), Burberry (Middle) & Carven (Right) integrated post-purchase care services on WeChat mini-program

The rise of omnichannel strategies and personalized journeys

- Omni-channel strategies in luxury retail multiply consumer touchpoints, reshaping the essence of consumer interactions.

- Luxury brands pioneer personalized journeys through a fusion of online and offline strategies, delivering tailored experiences, especially in the luxury market.

- Hybrid commerce and phygital experiences blur digital and physical boundaries, offering seamless and personalized service across channels.

- ‘Retailtainment’ captivates affluent consumers with immersive experiences, forging strong emotional connections with brands.

- The adoption of omnichannel strategies by luxury brands in China not only facilitates the seamless integration of post-purchase services, but also underscores their commitment to delivering exceptional customer experiences.

Elevate your luxury brand with Daxue Consulting’s market insights

Specializing in market research, consulting, branding, and consumer insights, Daxue Consulting is your partner in mastering China’s luxury retail landscape. Our expertise in omni-channel strategies empowers luxury brands to navigate the evolving market with confidence. We deliver in-depth analysis and strategic solutions that ensure a cohesive brand experience across all platforms, catering to the sophisticated needs of luxury consumers.

Partner with us for professional insights that will position your brand at the pinnacle of China’s luxury sector. Reach out to leverage our expertise for your brand’s success.