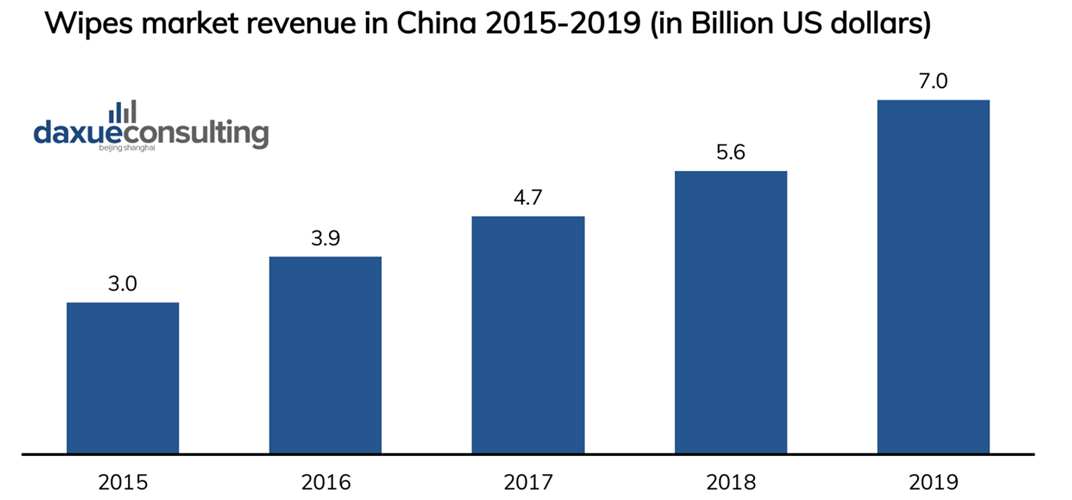

The Chinese wipes market has grown dramatically, from three to seven billion US dollars from 2014 to 2019. In 2019, the growth rate reached 21.5%. China’s baby wipes market is the top segment of the Chinese wipes market, which is segmented into baby wipes, regular sanitary wipes, make-up removal wipes and sanitary wipes for women. Baby wipes account for 56.4% market share in 2017. Moreover, the booming E-commerce industry in China has also helped China’s baby wipes market expand its channels from offline to online. According to the Maternal and Child Research Institute, in 2018, the online market size of baby wipes reached 3.31 billion yuan, with a 36.3% growth rate.

Source: ChinIRN.COM, design by daxue consulting, wipes market in China, revenue 2015-2019

Five trends in China’s baby wipes market

High-end goods become more popular due to the consumption upgrade

The proportion of high-end products to mass products are increasing in China’s baby wipes market, there are two main reasons for this trend. First, China’s GDP is increasing continuously, with the improvement of consumption levels, quality and brand have become the primary keywords for China’s baby care market. When parents choose baby wipes products, their focus has gradually shifted from price to the product itself, paying more attention to product quality and professionalism. Second, safety has become the primary selection criterion for Chinese parents. If baby wipes failed to meet the quality standard, they will threaten the health of infants. As high-quality and high-end products are usually related to safety, these two elements are more important when consumers purchase baby wipes products.

The two-child policy opens a new door for baby wipes

In October 2015, the two-child policy was launched by the Chinese government and the birth rate increased slightly from 2016 to 2017. The group of the second child even accounts for 51% of the newborn babies in 2017. The peak of new-born babies was encouraged by the two-child policy, bringing new opportunities and customers to China’s baby wipes market.

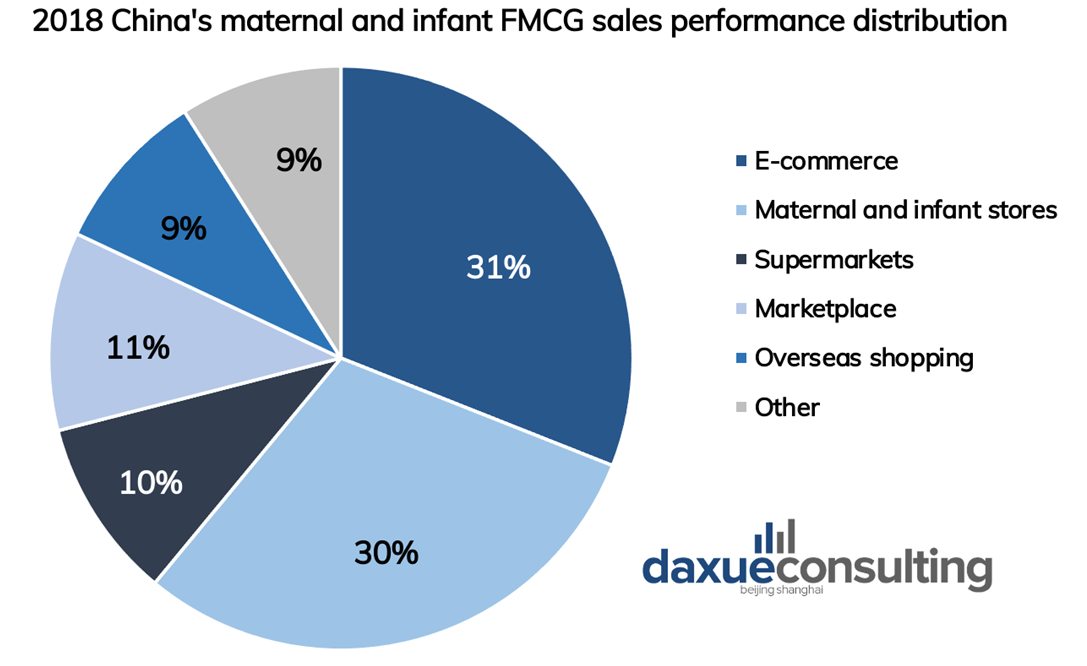

In distribution, e-commerce is becoming more important

The online scale of the baby wipes’ market is growing rapidly, e-commerce and speciality stores have become the main channels for customers in China’s baby care market. According to the Kantar report, in 2018, 31% sales of maternal fast-moving consumer goods came from the online channel while 30% came from maternal and infant stores. Additionally, some leading maternal and infant stores expanded to online business to increase sales by integrating both offline and online channels. As for the e-commerce platforms, Tmall is the top platform for maternal and infant products, achieving a 52.9% market share of online sales in 2018. Baby wipes as one of the typical maternal goods also show a similar trend. Ecommerce sales of China’s baby wipes reached to 19% and the penetration rate of e-commerce platforms a have increased by 24.5% in 2018.

Source: Kantar, design by daxue consulting, maternal and infant FMCG distribution, 2018

Increased consumer awareness of hygiene, especially after COVID-19

Chinese customers’ hygiene habits have changed after the pandemic. The awareness for disinfection is increasing and people are more used to masks, wipes and gels in public places to prevent COVID-19. Because babies are one of the groups who are vulnerable, parents realized the importance to keep their health by using baby wipes which will not harm babies’ sensitive skin. Among the baby wipes, the category of “hand and mouth wipes” has grown rapidly even before the pandemic, with an annual sales growth rate of 12.1% from 2017 to 2019. The demand for baby wipes is expected to develop in 2020.

“Sinking market” provides new opportunities for China’s baby care market

“Sinking market” refers to lower-tier cities in Chinese. In 2020, about 4.5 million children aged from 0 to 3 were in first-tier cities, 5.4 million were in second-tier cities, and 38 million were in lower-tier cities. Additionally, it is predicted that by 2022, the Chinese middle class and the affluent class will account for 81% of urban households in China. Among them, most new middle class are from third- and fourth-tier cities. Strong demand for baby care products will be generated by the increase in the new population and the consumption upgrade in these lower-tier cities.

Brand competition landscape in China’s baby-wipes market

The market is mainly dominated by Chinese brands. Overall, leading brands in China’s baby wipes market are Babycare, Purcotton (全棉时代), Huggies, Goodbaby, Anmous, Matern’ella.

The brand Babycare’s wipes focus on safety and adds a variety of nutrients to nourish babies’ skin. In 2019, the sales of Babycare exceeded 400 million, ranked as the first in China’s baby wipe market. High-quality cotton is the competitive advantage of Purcotton (全棉时代). Most brands in China’s baby care market are played in several sub-categories of the baby care industry, such as Good boy, Matern Ela and Frog Prince. When brands are successful in other related categories, it will be easier for them to gain consumers’ trust when they enter the market. The following table gives a brief introduction to the main international brands in China’s baby wipes market.

Huggies

On top of offline channels including maternal stores and supermarkets, Huggies opened its official flagship stores on three Chinese e-commerce platforms: Tmall, JD and Xiaohongshu. It provides different sizes of packages to better meet customers’ needs. To stimulate sales, it provides promotion activities and coupons on all e-commerce channels, as another way of heavy discount. Moreover, Huggies cooperated with the top live streaming KOL in China (WEIYA薇娅) to promote their baby wipes. On its social media platforms, Huggies has launched several campaigns for all products, including baby wipes, to interact with its customers. “Night Talk” and “Cute baby competition” are regular activities and Huggies sends products to active participants. One innovative activity is the “Gold medal mom” on Arbor Day. Huggies encourages parents to accelerate germination by using Huggies’ baby wipes.

Pigeon

Pigeon’s Tmall official store is its main e-commerce because it distributed 10 SKUs on Tmall, 2SKUs on JD and 4SKUs on Xiaohongshu. Offline distribution is also important for Pigeon and it expands to more than 600 offline maternal stores in 2020. In 2019, Pigeon cooperates with Hipac (海拍客), a Chinese maternal B2B2C platform connecting brands with offline stores and suppliers, to target lower-tier cities’ customers. This cooperation has helped Pigeon to expand through the offline channel.

NUK

NUK distributed two baby wipes products on Tmall, JD and Xiaohongshu. It provides discounts on e-commerce platforms and did live streaming with celebrity Feng Wang (汪峰) on JD’s new dad festival. NUK showed COVID-19 crisis response by donating baby wipes to Wuhan during the lockdown.

Johnson’s baby

Johnson’s baby opened official stores on two e-commerce platforms: 6 SKUs on Tmall and 2 SKUs on JD. In 2014, it launched “baby SPA centre” and helped hospitals to build more than 600 standard touch rooms to build their caring and professional branding image. In 2018, it collaborated with Alibaba and RT-market to create Johnson’s maternal intelligence city in Shanghai, which is a new retailing solution to digitalize their brand.

Merries

Merries places 10 products on Tmall and 1 product on JD. On its WeChat official channel, Merreis published articles for baby wipes when the seasons change and give suggestions about how to use baby wipes.

Combi

Combi has 4 products on Tmall and 2 on JD. Despite the online distribution, Combi provided clear instructions for its offline counters. The babycare brand has an official Chinese website: it distributed in 58 offline stores, including maternal stores and shopping mall. Mainly in top-tier cities, such as Shanghai and Guangdong. Combi provides coupons and discounts to encourages sales. On its social media platforms, Combi strengthens the safety characteristic for the baby wipes and invite customers to share experience on Weibo.

Soondoongi

Different from companies above, Soondoongi only sells baby wipes and distributed on all e-commerce platforms: Tmall, JD and Xiaohongshu. It launches a special package in “Chinese red” for the Chinese customers. Soondoongi cooperates with KOLs in China, such as Cherie (雪梨), to promote the brand through live streaming.

What brands should know about China’s baby wipes market

The Chinese baby wipes market has a promising trend in these aspects. First, the market size is increasing continuously, and the consumption habits are upgrading in China. Young parents are more willing to pay for high-end products and take interest in high-quality baby wipes. Safety and health are becoming keywords after the pandemic, which may be the key attraction points for customers when they choose baby care products. International brands can leverage China’s omni-channel environment and increase customer stickiness by launching campaigns on social media. Also, expanding distribution to maternal stores in lower-tier cities are the trend in China’s baby wipes market.

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast