China’s consumer generated video (CGV) economy refers to economic activities- such as brand sales- fuelled by videos created by Chinese consumers. These videos can be in recorded form, or livestreams. According to McKinsey research, 11% of Chinese consumers’ time on social media is spent watching, sharing, and creating short videos. In 2018, the Chinese short video industry was worth 46.7 billion RMB in revenue. The coronavirus crisis has in fact further added to this booming industry, in light of how more consumers are staying at home with greater leisure time.

Source: Vjshi, a user scrolling through videos

The importance of China’s consumer generated video economy for brands

Videos provide an authentic means for consumers to show their connection with brands, aiding brands in widening their consumer base. This is because videos enable creators to express themselves holistically. In addition, videos promote enthusiastic engagement between video-creators and viewers. Overarchingly, China’s CGV economy is particularly important for brands as 92% of consumers trust user-generated content more than traditional advertising.

Platforms supporting China’s CGV economy

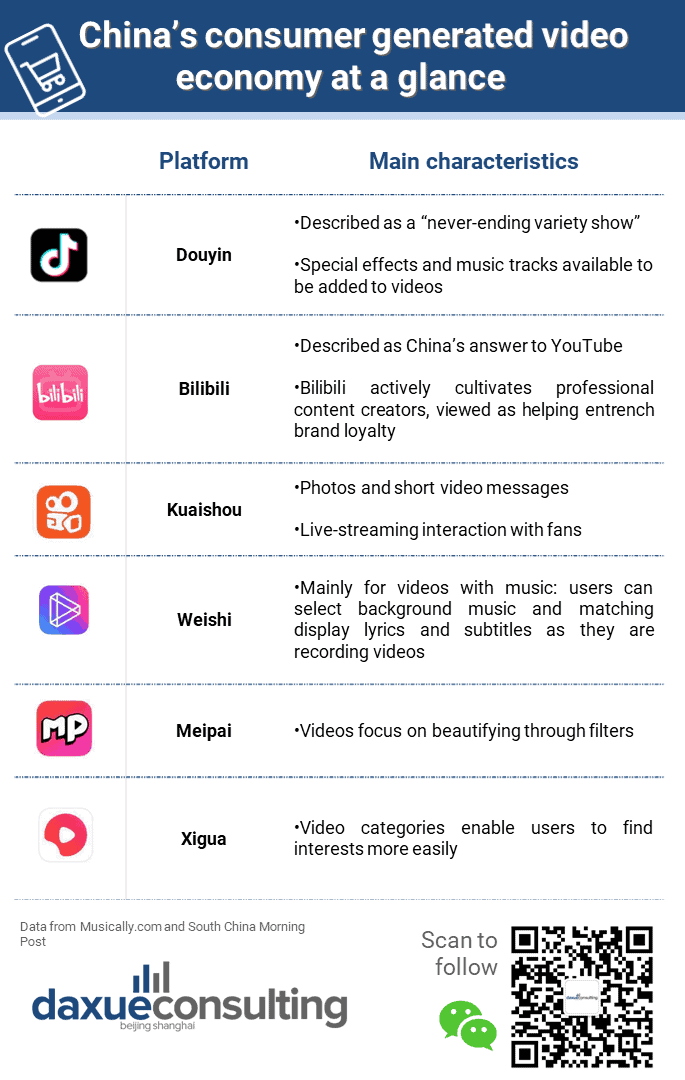

Douyin (抖音), Xigua (西瓜), Bilibili (哔哩哔哩), Kuaishou(快手), Weishi (微视)…the list of platforms boosting the video economy in China is seemingly endless. To help you make the right choice for your brand, the following table summarises the unique characteristics of the most popular platforms.

Infographic by daxue consulting, China’s CGV economy at a glance

Finding the right fit for your brand

Douyin is the most commonly used platform in China’s CGV economy, with 600 million active users just in China alone. This means that videos have an opportunity to reach a larger audience, yet also run the risk of being drowned in a sea of content. It is notable that Douyin is currently testing a function which allows in-app sales of products. This function would enable Douyin users to highlight an object within a video and perform a search for that item. This means that brands would do well to explore how they can make their products more eye-catching should this function be implemented.

Kuaishou is the second most utilised platform in the video economy in China. It targets Chinese grassroots society, with 64% of users living in lower-tier cities.

Bilibili actively cultivates professional content creators, viewed as helping entrench brand loyalty. What this means is that professional content creators are likely to be given priority in terms of reaching out to audience over smaller independent creators. Brands which have attracted the highest retention on this platform so far are from the tech and entertainment industry.

Weishi is mainly for video creators who integrate music heavily into their content. It enables users to select background music and matching display lyrics and subtitles as they are recording videos.

Meipai focuses heavily on beautifying through filters. This makes it more suitable for brands focused on beauty, skincare, or lifestyle.

Xigua has video categories which then enable users to find videos that they are interested in more easily. Notably, algorithms and user sharing favour high-quality videos longer than a minute. Brands starting to branch into China’s CGV economy could find this app easier to navigate and utilise.

How brands motivate consumers to add to the video economy in China

Challenges to enabling consumers to generate videos

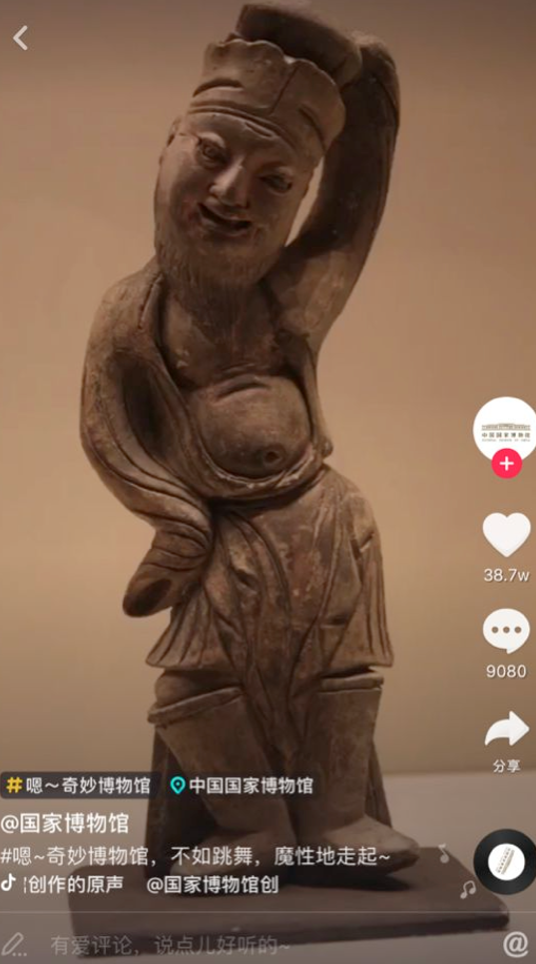

In May 2018, in celebration of National Museum Day in China, seven of China’s largest museums partnered with each other and Douyin. Targeted at Youth, they created a #WondrousMuseum (#嗯~奇妙博物馆) hashtag challenge. To participate in this challenge, visitors went around the museums involved to film videos of themselves with certain specific artefacts. The challenge highlighted the unexpectedly unique and fun poses that various artefacts had, dismantling the stereotype of museums being boring places. In just three days of launching, videos of museum artefacts had been played more than 118 million times. The eagerness of consumers to participate in the video economy in China is evident- showing their openness to new perspectives and discoveries.

Source: Zhihu, Example of artefact filmed during National Museum Day

Incentivizing consumers to be part of China’s CGV economy

In a bid to encourage consumers to create videos, Weibo stated that users who create four vlogs within 30 days would be certified by Weibo. As part of this initiative, Weibo also invited stars such as Jackson Yee (易烊千玺) and Yang Zi (杨紫) to participate in the ‘Star Producer Micro Project’ (明星制片人微计划) in order to gain further traction. Brands can also consider exploring how to work with KOLs to inspire consumers to generate videos.

Examples of brands which leveraged successfully China’s CGV economy

Haidilao (海底捞)

Haidilao is the largest hotpot chain in China with almost a thousand branches worldwide in end June 2020. Its widespread and still-growing popularity is due in part to how consumers on video platforms show innovative ways of eating hotpot at its restaurants.

For instance, there was a viral trend on Douyin showing how to make a certain kind of Haidilao porridge. Consumer generated videos enabled viewers to easily understand how this type of porridge is made step by step, encouraging them to go themselves to Haidilao outlets to try it out.

Coco Milk Tea (Coco 奶茶)

China’s CGV economy has also tremendously helped milk tea brand Coco Milk Tea to boost sales. A 15-second video on Douyin showing how to make a delicious ‘secret menu’ Milk Tea went viral. Coco Milk Tea’s success in the video economy in China has been credited as “reviving Coco Milk Tea from obscurity”.

Source: Bilibili, Coco Milk tea viral recipe video

Not all viral video trends are good for brands

However, brands should note that such viral consumer-generated videos are not always beneficial for brand image. Another type of viral video showed customers sneaking in their own ingredients into hotpot restaurants– with some customers even bringing in whole chickens and fishes. Brands should thus monitor and take action quickly against consumer-generated videos which do not fit into the overall brand image.

Source: AsiaOne, Hotpot customers bringing their own ingredients, shared on consumer generated video in China

Lessons from China’s consumer generated video economy

Analyzing trends in China’s CGV economy, it is evident that brands have much to benefit from consumers creating videos of their products. However, brands should be astute in choosing the ‘right fit’ video platform in order to maximize results. Brands should also note that not all viral video trends are beneficial to brand image.