In October 2020, residents of Shenzhen Luohu district received unique red pockets (Hong Bao), not from their relatives or via WeChat, but from their local government. Inside these digital red pockets was China’s digital yuan. Fifty thousand lucky residents received a total of 10 million worth of digital yuan, which can be spent in over 3,300 merchants ranging from Walmart to local meat shops. The news caught international attention.

The lucky draw among others is a part of the authority’s ambitious move to adopt digital currency in China in its new Central Bank Digital Currency (CBDC) project. Shenzhen’s critical role in developing the Guangdong-Hong Kong-Macao Greater Bay Area made it an ideal candidate for the newest digital currency pilot trial location, alongside Xiongan New Area, Suzhou, and Chengdu.

According to Yicai’s report of the trial in Luohu, some residents found available merchants are still limited while some others experienced minor technical issues when using the digital currency. Although most of the lucky residents didn’t find the system substantially different from their current payment methods, certain groups, such as the authorities, exporters, banks, show their excitement of the potential benefits of the initiative.

The concept of digital currency has been explored by the Central bank, the People’s Bank of China, in collaboration with commercial banks since 2014. The initiative has become a priority to assist China’s digitalization and propel the yuan to the international reserve status; the authorities plans to extend the trials to other developed regions soon, notably the 2022 Winter Olympics Games venues.

Source: Yicai, Screenshot of the tested app

Concept of DCEP in China: digitalizing the yuan

After years of popularization of mobile devices, China has become a mobile-first nation and a global pioneer in mobile payments with 776 million users as of March 2020. A survey shows that 92% of the population in the largest cities in China regularly use platforms like WeChat Pay or AliPay as their means of payment. The number comes to 47% for the rural population. Market of mobile payments in China jumped from 3.5% in 2011 to 83.0% in 2018.

Thanks to the existing infrastructure and popular acceptance, China logically became the second country to test sovereign digital currency in the real world and highly possible to officially adopt digital currency in the near future in the global race of digitalization of currency.

The current pilot trials experiment the implementation of Digital Currency Electronic Payment (DCEP) within China’s larger CBDC initiative. DCEP project’s main objective is to replace the physical cash (M0). DCEP in China is issued and distributed by the central bank, using a centralized ledger technology different from cryptocurrencies’ decentralized blockchain framework. According to the current framework, the commercial banks will convert a portion of the physical cash into DCEP, subsequently, circulate the digital yuan in the economy.

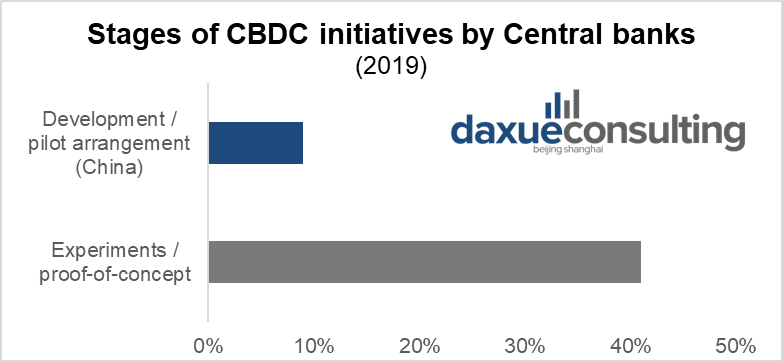

Source: BIS, designed by Daxue Consulting, Stages of CBDC initiatives by Central banks

For an average consumer, its main difference from current mobile payment platforms is that physical banknotes will not be part of the transaction. Steve Hopkins, co-founder of The China Guys and former strategy director for a cryptocurrency investment bank, told us “by and large, the average consumer is unlikely to feel too much disruption to ordinary life during the transition to a digital CNY”, but the real changes are in Beijing’s access to financial data. “A digital currency with native ties to China’s central bank, the PBOC, will unlock certain capabilities. For example, the ability for Beijing to access mass financial data from top to bottom will allow policymakers to airdrop targeted social welfare support and stimulus direct to individuals” says Hopkins.

While the appearance of cash has become less frequent in China’s highly “cashless” society, the foundation of the system is, in fact, still traditional cash, even if it only appears in the background of transactions between digital payment platforms and banks. The digital currency will further simplify the process, as the transactions will only happen digitally without the presence of cash at any level. The users will not need to have paper banknotes in the system; digital currency will be directly deposited into one’s electronic bank wallet.

China’s CBDC vs. traditional cryptocurrencies: legal and secure

China’s CBDC is fundamentally different from traditional decentralized cryptocurrencies such as Bitcoin, Ethereum or Facebook’s Diem. While the latter uses blockchain technology to verify transactions with computer networks, the former is the digital form of sovereign currency issued and governed by the Central bank.

Currently, most cryptocurrencies are traded as investments with high fluctuation levels, usually making up the more risky side of an investment portfolio. In contrast, the value of China’s CBDC is precisely the same as the yuan. It is technically just the sovereign currency in digital form, and it is pegged 1:1 with yuan.

Consequently, the usage of CBDC is very different from cryptocurrencies. It can be used in all scenarios just as the traditional banknotes, while the digital feature gives it edges to the paper banknotes in many scenarios. While the jewelry shop in Dubai or the café in South Korea accepting cryptocurrencies as a payment method made news after years of blockchain hype, the DCEP’s usability as a daily payment method has already been proven right after the launch of the pilot trials. Its usage is expected to become widely available in the future, just like WeChat Pay and AliPay nowadays.

For cryptocurrencies, one of the prominent features is the anonymity of the currency. By using blockchain technology, cryptocurrencies are decentralized, and it is nearly impossible to track the transactions. As a result, cryptocurrencies are often used for illegal activities’ transactions. However, the international community hasn’t reached a consensus regarding the status of cryptocurrencies, and the regulations differ.

In China, cryptocurrencies such as Bitcoin are not considered virtual property, meaning the possession will not be protected by law. In contrast, CBDC will enjoy the legal status, which cryptocurrencies lack.

DCEP in China vs. WeChat Pay and Alipay: even more convenient

The use of DCEP is not mutually exclusive from the current mobile payment platforms like WeChat Pay and Alipay. Still, their dominance of the market is likely to be challenged. The introduction of DCEP can supplement some scenarios that mobile payment platforms are not capable of or suitable for, while DCEP can be better regulated and will provide more information to commercial banks.

For average consumers, DCEP wallet’s capability of offline payment and offline transfer can be the most visible improvement of usability from WeChat Pay and Alipay. The authority stated that the transaction of DCEP could happen directly from wallets to wallets independent of banks or any other intermediaries via the internet. A user will be able to directly transmit money in person by just “tapping” two phones, even without an internet connection.

Although the goal is ambitious, the project is currently at an early stage. The Central bank still needs to undergo substantial development of the security and privacy of the system.

Making CBDC popular: government, banks and businesses

Even though it is only in the early testing stage, the authority has already been actively promoting digital currencies, and many businesses have demonstrated an interest in transforming their payment system. Other than the lucky draw in Luohu district, it was reported that some civil servants in another pilot trial location, Suzhou, received digital yuan as salaries. The distribution channels will be widened in the future, as the authority directs the resources to encourage digitalization. Some experts suggest that using digital yuan for subsidiaries and tax refunds in the post-COVID-19 recovery period can simplify the process and increase the DCEP user base.

Answering the authority’s call, both the physical businesses in those pilot trial locations and some of the most well-known digital companies have already added digital yuan as a payment method. E-commerce giant JD and ride-sharing platform Didi are among the earliest to update their payment systems.

Although we don’t yet know the exact ways that the authority would implement after the official nation-wide circulation of DCEP in China, some moves can be expected. For example, the government might use it to pay government workers and subsidies or designate it as the sole payment method for certain administrative duties. Thus, although paper banknotes will not disappear, the life without DCEP in the future might be increasingly inconvenient, just like how it is without WeChat or Alipay today.

China’s CBDC aims to shape the future

Impact on businesses: empowering commercial banks

The use of digital currency in China will benefit businesses by providing a faster and more secure transaction method, alleviating some risks entail in the traditional methods. The transaction will be possible without banks as intermediates, thus, also potentially avoiding some transaction-related delays and costs. As the eco-system improved domestically and internationally, many companies will rely more on DCEP in the future.

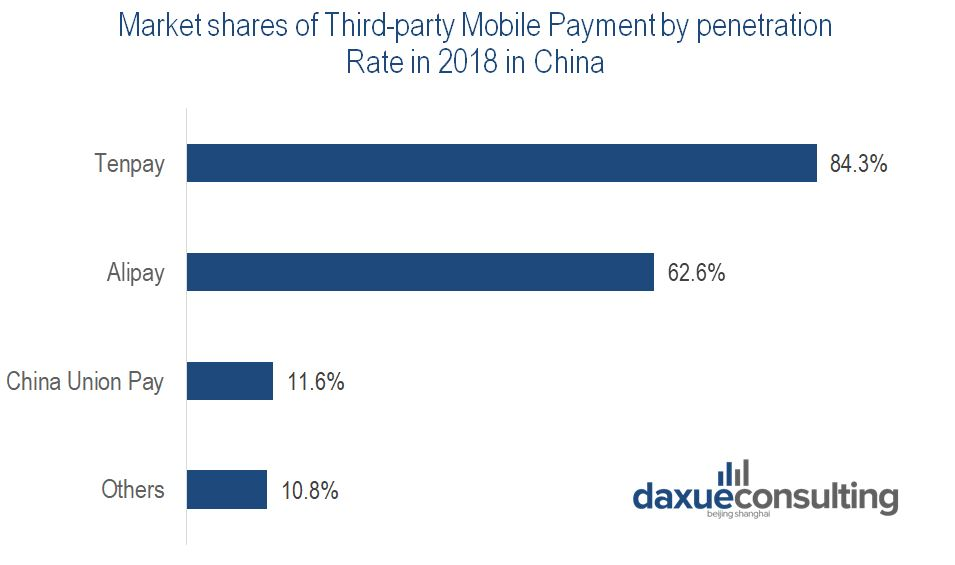

Commercial banks will be one of the primary beneficiaries of DCEP in China. Third-party mobile payment platforms, namely Tenpay (WeChat Pay and QQ Wallet) and Alipay, dominate China’s mobile payment market; commercial banks’ mobile payment development significantly lags behind.

Users often have to undertake an extra step of depositing savings from the bank account to WeChat Pay or Alipay in order to spend for daily payments like shopping for groceries. In a world with DCEP, third-party mobile payment platforms are likely to become dis-intermediated and obsolete. DCEP also benefits commercial banks’ ability to access data. They will be able to extract more data from DCEP payments to assess the credibility better and analyze users’ spending habits. These data related to mobile payment are currently possessed exclusively by mobile payment platforms and help them re-enforce their market dominance.

Source: eMarketer, designed by Daxue Consulting, Market shares of Third-party Payment in China

Impact on economy: bringing the unbanked population into the mainstream economy

A Chinese investment bank, Citic Securities, predicts that the total size of the DCEP in China could reach one trillion yuan within few years of circulation, roughly equivalent to one-eighth of China’s physical cash. The authority claimed that the DCEP would not completely replace physical cash in the foreseeable future since it tries to avoid the criticism of state surveillance; nonetheless, the usage of physical currency will gradually decline when the project becomes more popular.

Thus, the feature will not be completely cashless, at least in the near future. Still, the convenience and the advantages of the digital currency in China will drive at least a large portion of the population to abandon the physical banknotes.

DCEP’s capability of data feedback will benefit not only the banks but also the government. With data feedback, the government will be able to plan the economy accordingly. This will allow the government to track the money, especially concerning illicit activities. And it will enable the authorities to regulate the transactions better, alleviating the risks of counterfeiting, money laundry and other illegal financial activities.

Additionally, with the largest unbanked population of 225 million adults without an account as of 2017, China has been somewhat restricted from achieving its goal to eradicate poverty due to their absence in the mainstream economy. While it results in inconvenience for the unbanked population in accessing services, their absence in the banking system brings difficulties for the authority in obtaining relevant data and information.

With the help of DCEP, the government expects to bring unbanked population into the mainstream economy. The simple and streamlined procedure of entering the system will encourage China’s unbanked population to adopt digital currencies. The government, banks, and merchants can all benefits from their data, which has been absent due to their unbanked status.

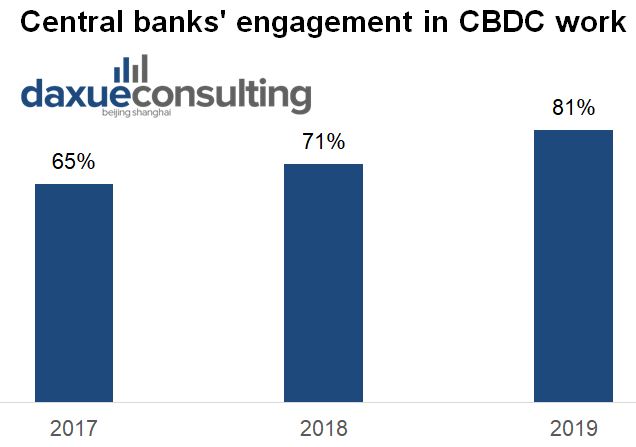

Impact on the world: challenging US Dollar’s dominance

Examining the rapid development of crypto currencies, central bank digital currencies are probably the future of governments’ priorities in China and around the world. According to a report by BIS in collaboration with biggest Central banks, including the European Central Bank and the Federal Reserve, more than 80 percent of responded Central banks engaged in various CBDC projects as of 2019. As a pioneer, China will showcase the possibility of such a project and shape the direction of its future development.

Source: BIS, designed by Daxue Consulting, Central banks’ engagement in CBDC work

One thing that can be certain is that as long as the authority advances the project and the population adopts it as its daily payment method, foreign merchants will soon accept DCEP due to Chinese consumers’ strong purchasing power abroad. Just as how the sign of AliPay and WeChat can be seen from Bangkok to Toronto, foreign merchants are expected to accept DCEP as a payment method in the future.

However, DCEP will not only be seen in shopping malls but also on the government’s negotiation table. Chinese authority seeks to propel the yuan to international reserve status with the help of digital yuan.

Currently, the US Dollar, accounting for more than 88% of international settlement transactions, is still the international trade standard. The authority hopes CBDC’s ability of fast-tracking transactions and data feedback will make it a more popular option in trade, potentially replacing US Dollar in the long term to achieve its global dominance.

Illustrating the ambition, the authorities are expected to push for the use of digital yuan in foreign projects, most notably the infrastructure projects of the BRI initiative. The ability to persuade the implementation of the system abroad will enable its development and acceptance domestically and internationally.

Author: Guosheng Cai

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Check out our report on M&A in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast