Driven by a tech-savvy population open to innovation, China’s luxury e-commerce market has rapidly become one of the world’s most dynamic. By 2023, the country accounted for an estimated 23% of global luxury online consumption, with projections showing it could reach 40% by 2030, overtaking Europe and the U.S. Additionally, in 2023, 53% of luxury buyers had already made online purchases. In this landscape, e-commerce platforms in China, is no longer just a sales channel for luxury brands. It is where brand value is built, trust is earned, and trends are born.

Download our China luxury market report

Platforms shape how luxury is discovered and sold

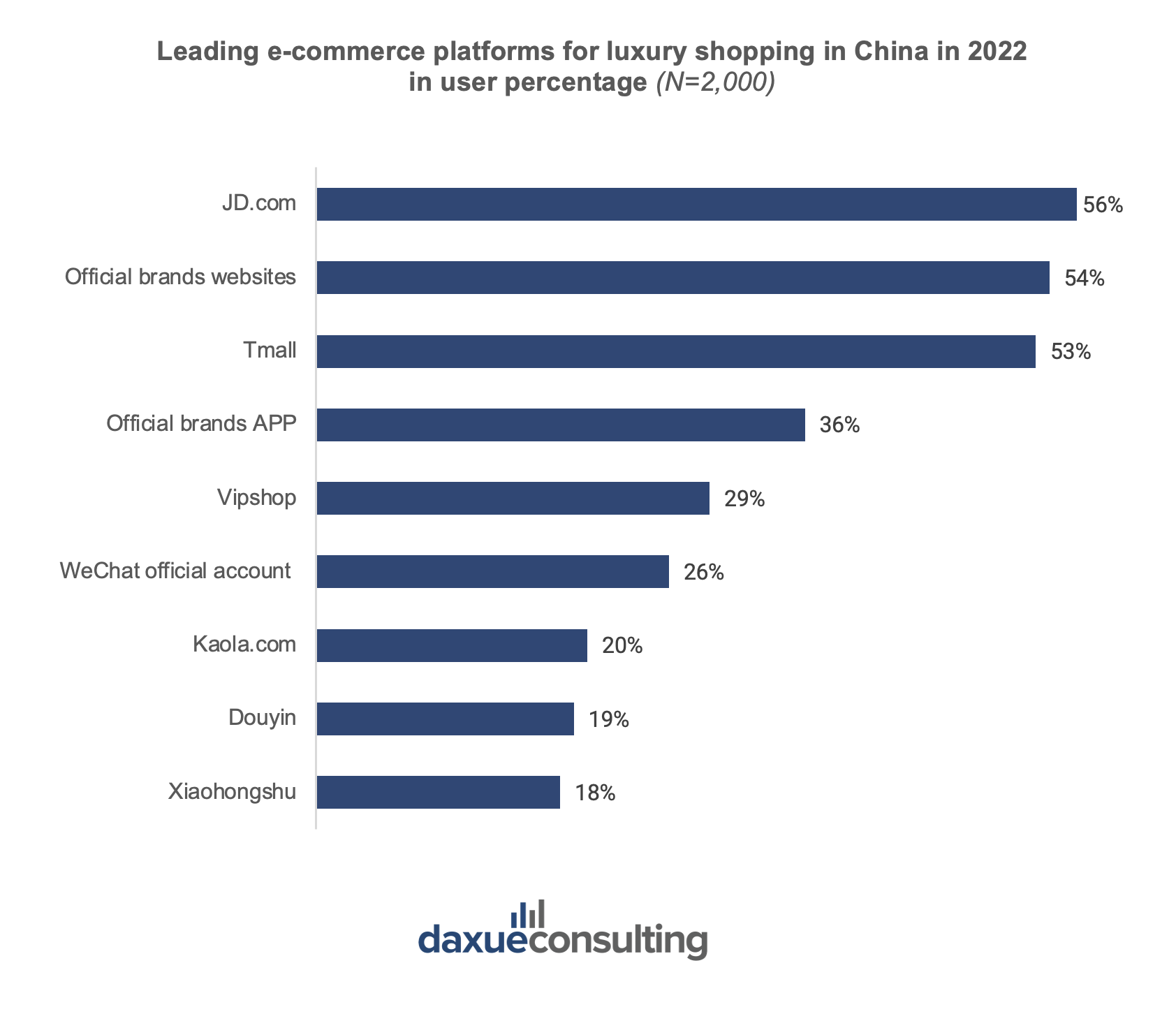

JD.com, official brand websites, and Tmall lead China’s luxury e-commerce, driven by their reliability and logistics strength. JD.com topping the list at 56% may seem surprising given its roots in electronics and high number of counterfeits, but its investments in official brand partnerships and fast delivery make it the default choice for luxury.

Brand websites and Tmall follow closely, reflecting continued consumer preference for direct, controlled shopping environments. The strong showing of official brand apps (36%) and even platforms like Vipshop (29%) shows that consumers are still gravitating toward platforms that ensure authenticity and convenience.

Meanwhile, Douyin and Xiaohongshu, with only 19% and 18%, respectively, are quickly becoming key channels for luxury discovery. Douyin, in particular, now reaches about one-third of JD.com’s luxury shopper base. This is a notable achievement for a short-video platform that only recently entered luxury e-commerce. As content-driven shopping gains ground, social commerce is expected to grow rapidly and reshape luxury consumption China.

WeChat mini-programs enhance immersion and redefine luxury storytelling

Luxury brands in China are using WeChat mini-programs to deliver more interactive shopping experiences. A standout feature is 3D visualization, allowing users to view and explore products in real time, rotating, zooming, and examining them from multiple angles without needing extra apps. Bottega Veneta’s Tmall store offers high-resolution product views, while Louis Vuitton’s mini-program includes 3D sneakers and interactive quizzes to boost engagement.

These innovations reflect the rise of “retailtainment,” a blend of shopping and entertainment. Brands are adding storytelling elements through AR tools, voice-activated mirrors, and extended reality experiences. For example, during Tmall Luxury Pavilion’s 5th anniversary, Alibaba launched a metaverse fashion show, AR activations, and a Meta Pass for exclusive digital access to top luxury brands, setting a new standard for virtual flagship stores.

Brands integrate luxury service, personalization, and after-sales

One-on-one video consultations are now common on platforms like Tmall Luxury Pavilion, allowing trained staff to guide customers in real time. Gucci and Vacheron Constantin enhance this with tailored, salon-style sessions for VIP clients and complex products like handbags.

Personalized services also extend to the pre- and post-purchase experience. Burberry offers product customization, Louis Vuitton supports in-store appointment booking, and Van Cleef & Arpels provides at-home repair services. Brands like Chopard, Burberry, and Carven offer full after-sales care online, turning digital platforms into fully integrated luxury ecosystems.

Live streaming evolves from sales tool to brand strategy

KOLs, short videos, and content labs now drive brand discovery in China’s luxury market. Influencer marketing, affiliate links, and algorithm-driven recommendations dominate, with Douyin and Xiaohongshu serving as essential platforms for luxury brand engagement.

Luxury live streaming is now central to brand engagement

In 2023, live streaming accounted for about 25% of China’s luxury e-commerce total online shopping GMV, confirming its central role in the digital retail ecosystem. Originally popularized by Alibaba in 2016 during Singles’ Day, live streaming quickly evolved into a RMB 4.9 trillion industry in 2023. With over 2.7 million active anchors and more than 10 million employees engaging in the industry, live streaming is no longer just a sales channel, it has become a key brand-building tool.

Quiet selling aligns with the rise of “quiet luxury”

With the rise of quiet luxury in China, the concept of quiet selling is gaining traction in China’s luxury e-commerce. Notable quiet-selling hosts like Teresa Cheung and Dong Jie are leading this trend. According to Xiaohongshu, Dong Jie’s April 2023 live stream achieved RMB 60 million in GMV, and her eight-hour-long live stream on May 25, 2023, attracted over 2.2 million views. These calm and elegant live streaming hosts attract high-end consumers. Brand storytelling now replaces aggressive sales tactics.

AI streamers are the next frontier in trusted brand representation

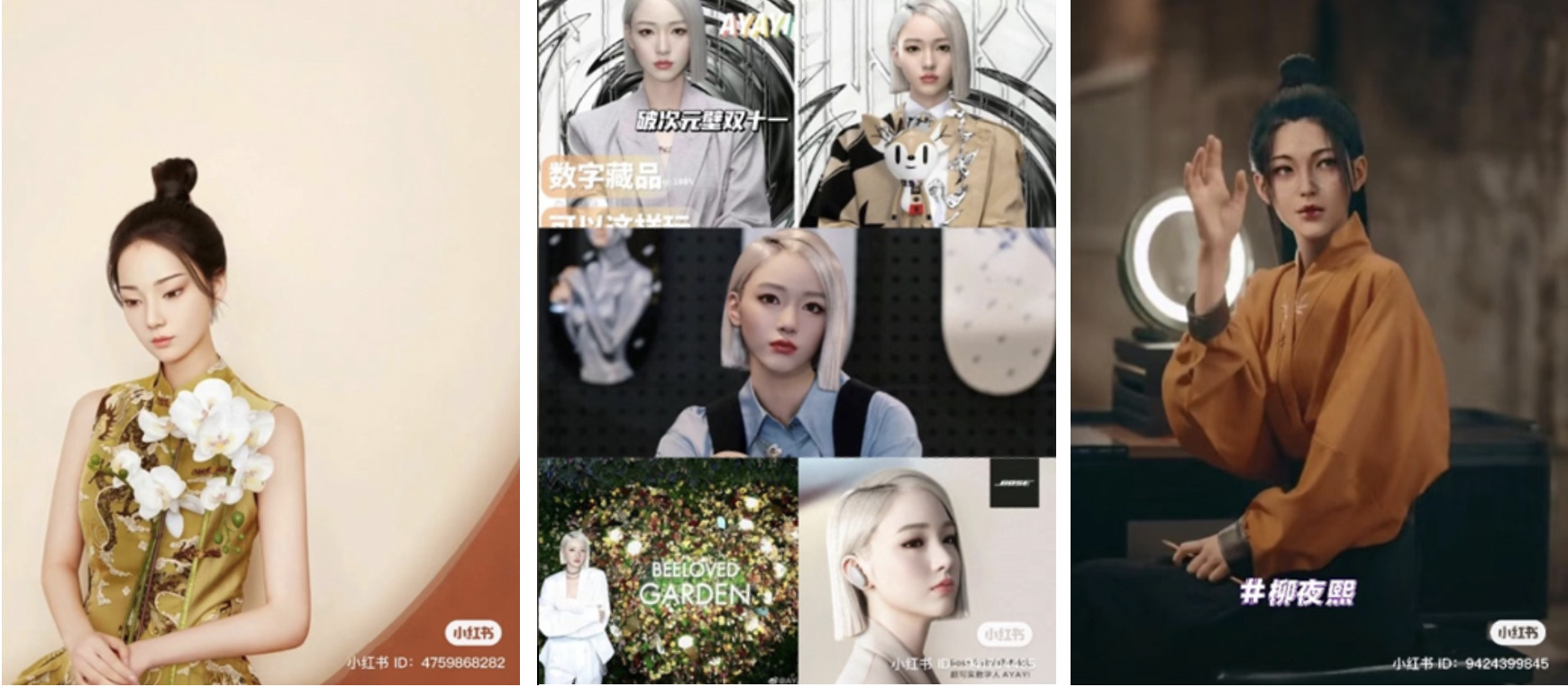

In the luxury sector, where image and brand integrity are critical, the rise of AI-generated live streamers offers a compelling solution to the frequent scandals involving human influencers. These virtual personalities help brands maintain consistent messaging, protect their image, and avoid reputational risks that can harm trust and sales. AI streamers also allow luxury houses to curate every detail of appearance, tone, and behavior, ensuring alignment with the brand aesthetics.

As younger consumers engage more through live streaming in China, AI-generated virtual humans are transforming how luxury brands connect with audiences. Virtual influencers like Liu Yexi, Ayayi, and Ling have already partnered with brands such as Prada and Tissot.

Unfair practices remain a big issue in China’s luxury market

As luxury brands expand their digital presence, certain online behaviors and platform dynamics are beginning to challenge brands’ image.

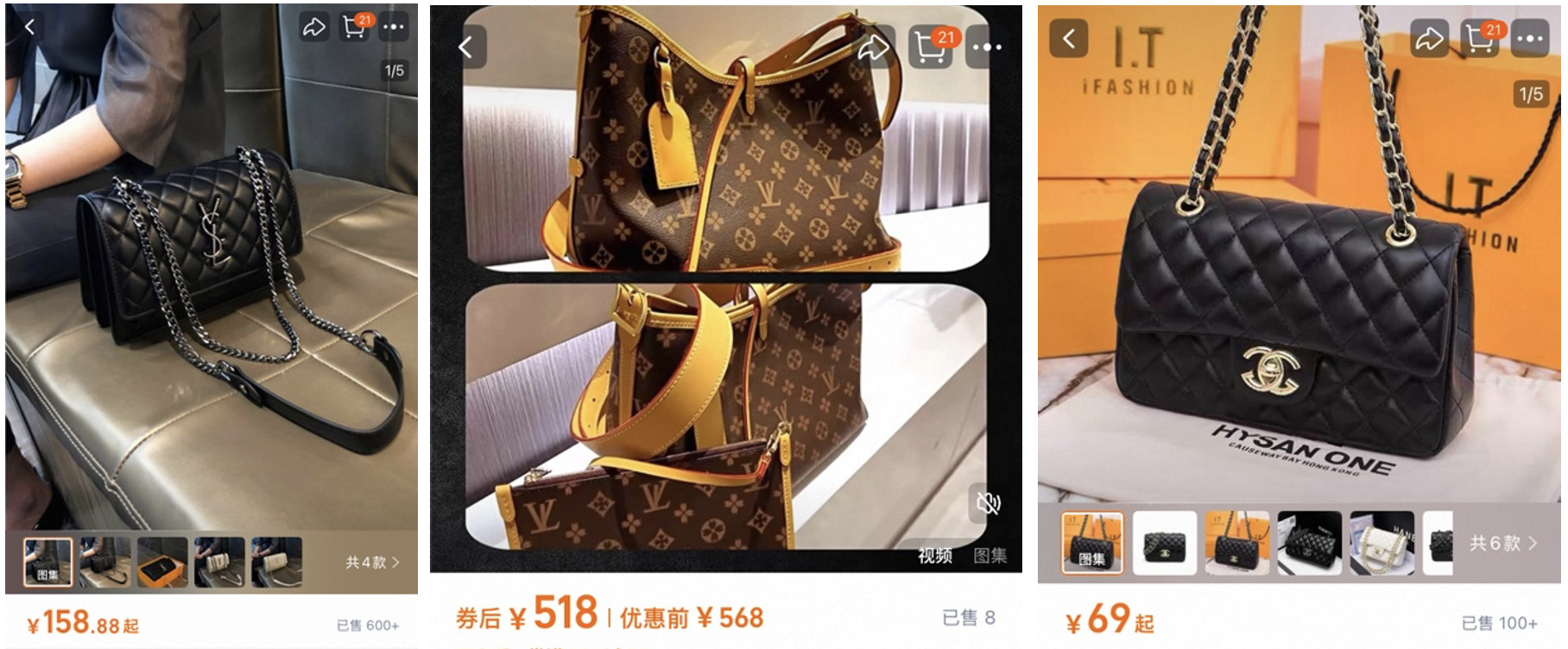

Counterfeits on mainstream platforms erode consumer trust

Counterfeit luxury goods remain a persistent issue on major platforms like Taobao and JD.com, undermining brand credibility and eroding consumer trust. Despite advancements in technology and platform regulation, enforcement is still inconsistent, making it difficult to fully protect brand value in the online marketplace.

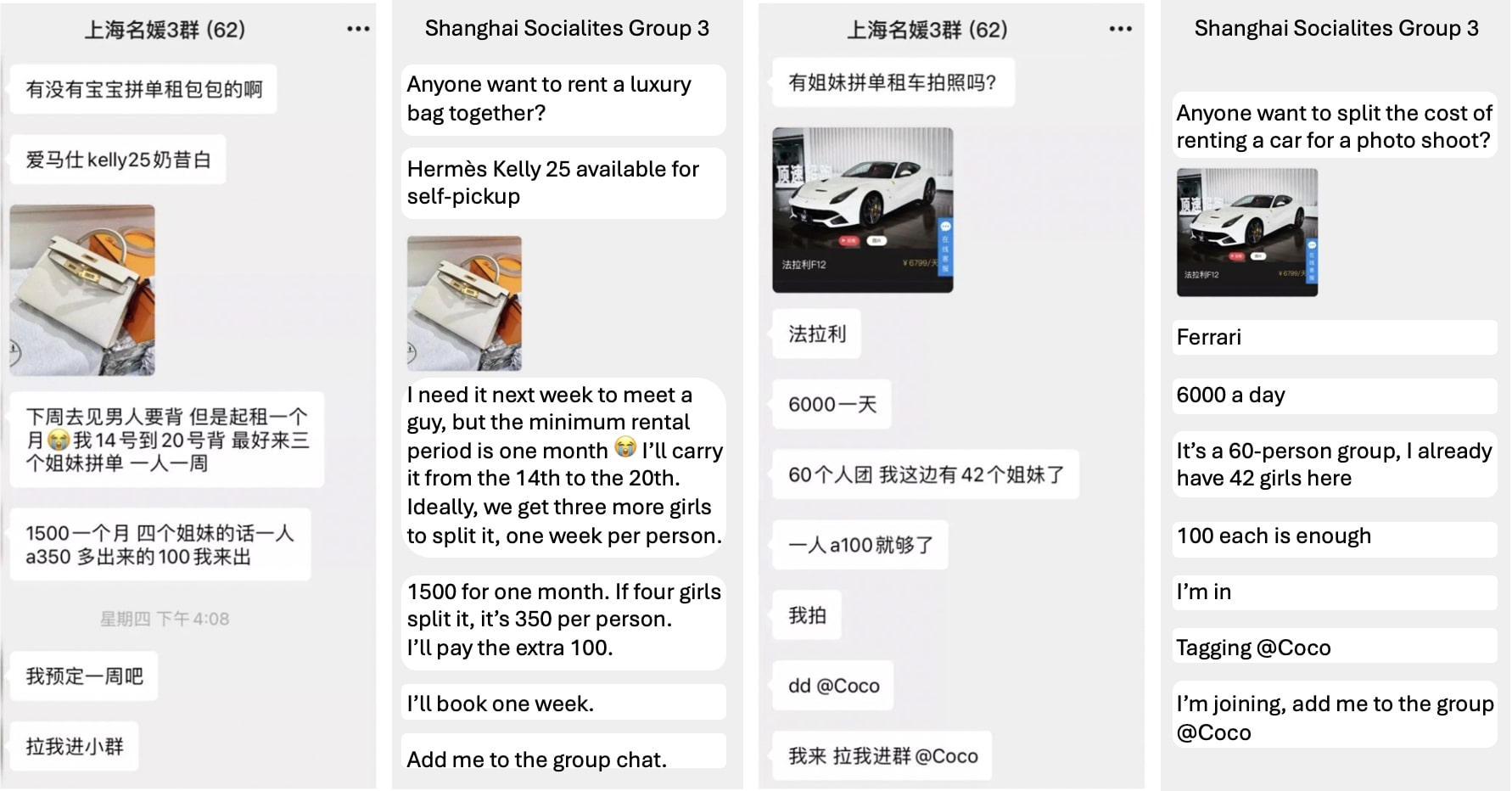

WeChat group-buying culture dilutes luxury exclusivity

A growing trend in China reveals how many so-called “socialites” flaunting luxury lifestyles online are staging their images through WeChat group buying schemes. In groups like “Shanghai Socialite,” members split the cost of renting Hermes bags, Ferrari cars, or hotel rooms at places like the Bulgari Hotel in Shanghai, just to take photos. Strict photo protocols are followed: towels can’t be wet, food shouldn’t be eaten, and everyone takes turns posing. Some even share second-hand Gucci stockings or a rented bag across several users. For many participants, the goal isn’t just vanity. It’s to attract social media followers, land brand sponsorships, or gain perceived status, including dating wealthier partners.

While this may increase brand visibility, it poses a credibility issue for luxury labels. Brand prestige risks dilution. If Dior bags or luxury hotel stays are constantly associated with staged, group-funded social media moments, the aura of exclusivity and authenticity that luxury brands rely on starts to erode.

Shopping festivals are high-stakes moments for luxury brands

The 618 Shopping Festival, launched by JD.com, and Double 11 (Singles’ Day), pioneered by Alibaba, are China’s two most influential annual shopping events. These festivals drive massive sales volume by combining deep discounts, exclusive product launches, and live stream-powered entertainment. For luxury brands, these events represent key moments to reach high-spending Chinese consumers, boost seasonal sales, and strengthen brand presence.

For the 2024 618 Festival, JD.com is removing pre-sale periods to simplify the shopping process. It is focusing instead on instant discounts, faster delivery, and enhanced after-sales service. Double 11 continues to innovate with multi-platform campaigns, celebrity-led live streams, and tailored VIP experiences to keep consumer engagement high.

How China is redefining luxury e-commerce

- China has emerged as the world’s most dynamic luxury e-commerce market, with digital platforms like JD.com, Tmall, and WeChat mini-programs reshaping how consumers discover, shop, and engage with brands.

- Live streaming, now central to brand building, combines entertainment and commerce through KOLs, short videos, and even AI-powered virtual influencers.

- Personalization is a key differentiator, with brands offering 3D product views, one-on-one video consultations, and full-service aftercare.

- However, challenges such as Chinese counterfeit products and staged “socialite” content on platforms like WeChat threaten brand authenticity and exclusivity.

- Major shopping festivals like 618 and Double 11 remain critical sales moments, offering luxury brands the chance to boost visibility and connect with high-spending consumers.

Mastering China’s Luxury Market Dynamics

As China’s luxury market witnesses a robust rebound, positioning your brand effectively in this evolving landscape is paramount. We specialize in strategic consulting for luxury brands aiming to penetrate or expand within the Chinese market, leveraging our deep understanding of local consumer preferences, cultural nuances, and digital trends.

Our Services Include:

- Market Insight: We provide comprehensive analyses of the latest trends and consumer behaviours in China’s luxury sector, ensuring your brand stays ahead of the curve.

- Brand Localization: Tailoring your brand’s narrative to resonate with Chinese cultural values and consumer expectations, enhancing relevance and appeal.

- Consulting Services: We offer strategy and management consulting every step of the way.

- Regulatory Navigation: Assisting with the legal and regulatory aspects of entering and operating in the Chinese market, ensuring smooth and compliant business practices.

Connect with our team of experts to refine your strategy and secure your brand’s position in China’s thriving luxury market.

Read our report on the rise of Chinese luxury brands