The Chinese airline industry has shown impressive growth in recent years. The number of air passengers in China has increased from 229 million in 2009 to more than 659 million in 2019.

China’s busiest three airports are located in Beijing, Shanghai and Guangzhou, those three airports are also ranked in the top 15 of the busiest airports worldwide.

Beijing Capital International Airport, Shanghai Pudong International Airport and Guangzhou Baiyun International Airport have shown a steady growth in air passengers over the past years. On average the passenger traffic at those airports grew 3.78% (Beijing), 8.18% (Shanghai) and 7.07% (Guangzhou) every year from 2010 to 2017.

What are the largest Chinese airlines in the market?

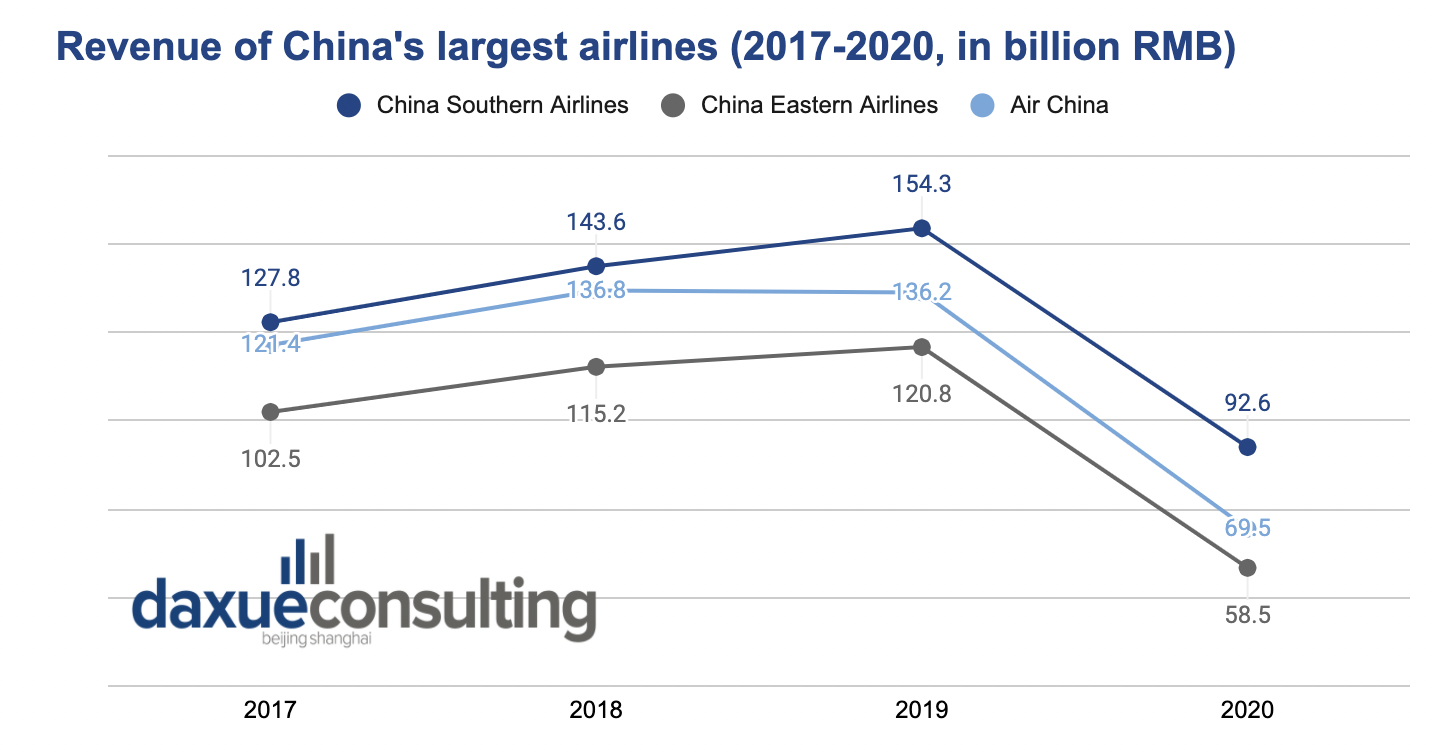

There are three major Chinese airlines currently operating in China, China Southern Airlines, China Eastern Airlines and Air China. With an annual revenue of roughly RMB 154 million, RMB 120 million and RMB 136 million respectively, the largest players in the Chinese airline industry showed an average annual growth of 9.91% (China Southern Airlines), 8.64% (China Eastern Airlines) and 6.13% Air China between 2017 to 2019. With the start of the COVID-19 pandemic the big three airlines experienced a drop in revenue of roughly 40%-52% from 2019 to 2020.

China Southern Airlines

China Southern Airlines is currently China’s largest airline in terms of aircraft fleet, routes, and passenger turnover. It operates mainly out of two international airport hubs: Guangzhou and Beijing. China Southern Airlines loyalty program called Sky Pearl Club, includes corporations such as American Airlines and KLM as partners on an international level and Chinese airlines such as Xiamen Airlines and Sichuan Airlines. China Southern Airlines network includes more than 1,000 routes to 224 locations in 40 countries. By the end of 2020, China Southern Airlines held a fleet of 851 passenger aircrafts, with the most common models from the Airbus 320 and the Boeing 737 series. Under China Southern Airlines also fall eight public subsidiaries, such as Xiamen Air and Henan Airlines.

China Eastern Airlines

China Eastern Airlines has its headquarters located in Shanghai and operates out of the hub of Shanghai Pudong International Airport and the Shanghai Hongqiao International Airport. The airline is part of the SkyTeam Alliance, which enables cooperation on flights with partners, such as China Airlines or Delta. In collaboration with SkyTeam Alliance member airlines, China Eastern Airlines offers flights to 1,036 locations in 170 countries. With a total of 725 passenger aircrafts by the end of 2020, China Eastern Airlines mostly operates the Airbus 320 and the Boeing 737 series.

Air China

Air China has a headquarter located in Beijing and operates from the airport hub of Beijing Capital International Airport. It works in cooperation with the StarAlliance, which gives it access to a network with partners such as Lufthansa and Singapore Airlines. In cooperation, the Chinese airline can therefore offer a route network to 1,300 locations in 195 countries to its customers. By the end of 2020, Air China held 702 passenger aircrafts, a majority of them being of the Airbus 320 and the Boeing 737 series.

Which sales channels do the Chinese airline industry deploy?

There are two main sales channels that customers can use to purchase flight tickets: Online travel agencies (OTA) and booking the flights directly through the airline. In addition to flights, these channels also offer extra services or products that can be added on, such as additional luggage or travel insurance. In particular, the Chinese travel insurance market is on the rise.

Ctrip is one of the largest OTAs in China

Ctrip, or Trip.com Group Limited, is a Chinese online platform that lets customers book flights, accommodations, rail tickets, bus tickets, tours, and other travel related products. The platform compares flight prices for a chosen date and lets the customer choose the cheapest or most convenient option. Moreover, customers can bundle several traveling products such as booking a flight and accommodation for a special price. In their annual shareholder letter in 2017, Trip.com states that the air travel offering on the platform includes almost 300 airlines and more that 3 million routes globally.

Overall, the platform accounted for roughly 10% of all travel related bookings in the RMB 5.4 trillion travel market. Trip.com core customers are Chinese; however, the platform has also expanded their offering to foreign consumers. A recent trend arising from those OTAs in China are travel blind box bookings. Platforms such as ly.com or Tongcheng Travel offered tickets with an unknown destination for sale, targeting younger generations.

Airlines in China use loyalty programs to capture customers in the long-run and increase direct sales

Chinese airlines sell their tickets through various direct sales channels, for example their official website, WeChat account or app.

According to Phocuswrite, in 2015 only 16% of the flight tickets sales in China were concluded directly on the airline’s website. To save costs, Chinese airlines are trying to cut out the middleman, the OTAs, and focus on increasing direct sales. Moreover, the Chinese government directed the state-owned airlines to reach a minimum of 50% in direct ticket sales by 2018.

Loyalty programs deployed by Chinese airlines are used as an incentive to guide customers to their direct sales channels. For example, Air China’s loyalty program, Phoenix Miles, offers VIP lounge access, ticket upgrades, additional luggage and priority when boarding or waiting in line. China Southern Airlines and China Eastern Airlines hold a comparable offering with their loyalty programs Sky Pearl Club and Eastern Miles.

How the Chinese airline industry is getting more high-tech

Airlines in China and airports across the country aim to implement more high-tech applications to improve efficiency and customer experience. However, can it compare to the overall high-tech landscape in China?

When the new Beijing Daxing International Airport opened in 2019, it included several high-tech features. The 5G smart travel system was created in collaboration with Huawei, China Eastern Airlines and China Unicom. It uses facial recognition technology to increase efficiency and convenience throughout the entire airport process. Customers can use facial identification when checking in bags, go through security and enter the plane. The technology verifies the customers identity in a database and makes using ID cards and flight tickets obsolete. Through this technology customers can complete all travel related transactions within 20 minutes.

Moreover, facial recognition together with Augmented reality (AR) glasses to improve customers’ experience. Airport and airline staff can quickly identify customers’ information and flight schedule without asking for their personal information. It can be used in the VIP lounges to remind customers privately that their flight is leaving soon instead of making a public announcement. This is just a small glimpse on how the Chinese airline industry will use high tech in the future, however, it is still a long way to implement this technology in all Chinese airports.

What challenges is the Chinese airline industry facing?

Chinese airlines struggled under the COVID-19 pandemic

The ongoing COVID-19 pandemic did not only drastically decrease the air travel passengers in China but also requires Chinese airlines to adopt new safety standards and sanitizing procedures. As part of the safety procedures, passengers have to fill out safety forms, undergo temperature checks and wear protective equipment. Airlines in China have reduced the food and beverage offerings and increased the sanitation of the planes. Moreover, there are novel filter systems on the aircrafts which are almost 100% effective against all germs and viruses.

The COVID-19 pandemic had a severe impact on the Chinese airlines. McKinsey estimated that between January and February 2020 the air travelers decreased by more than 80%.However, the Chinese Airline industry is on its recovery for domestic flights. According to McKinsey, domestic flights as well as hotel and railway booking reached 90% of 2019 levels at the end of August 2020. When it comes to international travelling, the Chinese Airline industry relies on governments allowing travel bubbles through quarantine free flights between countries. So far international flights from Chinese airlines have not yet recovered and are unlikely to increase unless the Chinese government establishes a travel agreement with another country.

The high-speed rail network imposes a considerable threat on the Chinese airline industry

The high-speed rail network offers an attractive alternative for many domestic travelers. High-speed train stations in China are mostly located in city centers whereas airports are usually based on cities’ outskirts. Moreover, the travel times of major high speed rail routes are competitive to air travel. In fact, travelling between Beijing and Shanghai takes around 4.5 hours by high speed train and 2.5 hours by plane, and comes with a simpler check-in process.

By the end of 2020 the high speed rail network accounted for 37,900km out of the regular 146,300km of rail routes. By 2035 the high speed railway is expected to increase to 70,000km of 200,000km railway network. According to the Chinese high speed rail network, the 80% of the Chinese domestic air travels will be covered by high-speed rails by 2025. The high-speed rail network has a negative impact on the demand of Chinese airlines, particularly on short and medium range flights. Experts predicted a decrease of 39% for 0-500km flights and a decrease of 31% for 501-1,000km flights. With the rail network extension, the Chinese airline industry faces a great threat of substitution domestically. On an international level however, Chinese airlines face little threat from railways as most countries do not have an extensive high-speed railway.

What are the takeaways for the Chinese airline industry?

- Online travel agencies have large power in China. Chinese airlines must create incentives to boost sales through their direct channels.

- In order to compete with the high-speed rail for domestic trips, airlines must leverage new technologies to increase efficiency and customer experiences.

- The Chinese airline industry was severely impacted by the Covid-19 pandemic but is already recovering