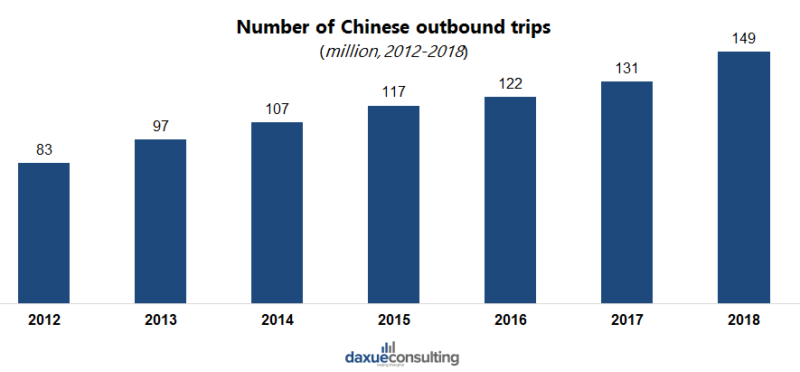

As a key part of the non-life insurance market, China is one of the largest tourism markets for both domestic and overseas tourists. In 2018, Chinese tourists made about 150 million trips overseas, and there were 55 billion trips within China. The drivers of the travel insurance market in China include higher disposable incomes, simplified passport and visa application procedures, policy support and the popularity of mobile Internet. In order to prepare for risks and escort the development of the tourism industry, travel insurance in China is increasingly popular.

[Source: Daxue consulting “Number of outbound trips from China”]

Most tourists travelling overseas buy travel insurance since they face a number of potential risks, especially when they are not familiar with the local culture and language. In the event of an accident, illness or unanticipated incidents, it can be difficult to find assistance or seek compensation. Tourists travelling within China face similar issues. However, many Chinese consumers have a sense of security about domestic tourism, they show less demand for travel insurance during domestic travel. Insurance companies need more publicity for travel insurance to enhance the safety awareness of Chinese tourists.

What does travel insurance in China include?

The main risks Chinese tourists face are personal injury, loss of property, flight delays, flight cancellations, lost baggage, hotel orders canceled, traffic accidents and disasters. Therefore, the travel insurance market in China has a large variety of products covering a variety of services including destinations, travel agencies, guides, tickets, transportation, hotels, etc. Among those risks, flight delays, disasters, lost baggage and property are the most frequent, the insurance target those risks are favored broadly by tourists. In the first half year of 2019, more than 40% of the claims of travel insurance in China were related to flight delays, since many airlines do not compensate for delays and cancellations if they are caused by external reasons like weather. Other than flight delays insurance, property loss (stolen or robbed) insurance is also necessary, especially for the Chinese tourists in Europe. In 2019, among all travel insurance claims related to the property loss (stolen or robbed) of Chinese tourists, about 20% happened in Europe.

What are the factors that influence sales of travel insurance in China?

The premiums and sales of travel insurance are highly affected by tourism season and holidays in China. Travel insurance usually enter the selling season during the New Year’s Day, the Spring Festival, May Day, National Holiday, winter and summer vacation. Secondly, the transportation tools used by travellers also have an impact on the sales of travel insurance. Tourists who travel by airplanes, bus and private cars are more willing to have travel insurance than people use other transportation methods. Policy and regulations about tourism are important factors. For example, every tourist must have insurance when they submitting application materials of short-term visa for the Schengen region. Travel insurance is also compulsory for traveling to Taiwan. Destination distance is also a key factor for consumers. Tourists who choose long-distance tourism often show stronger demands for travel insurance, and the security condition of destinations is significant factors as well. Most Chinese people are easily convinced of the need to purchase travel insurance after hearing of other tourists who had accidents while traveling in those regions.

Where do consumers buy travel insurance in China?

Travel agencies and insurance companies are traditional purchase channels for tourists, however, most consumers become habituated to use mobile apps and online tourism platforms (such as Ctrip 携程) to obtain information and buy travel insurance. On those platforms, travel insurance is treated as the value-added service of tourism and tickets, which largely simplified the purchase process of those insurance products.

[Source: vacations.ctrip.com “the travel insurance products for Chinese tourists”]

In addition, a considerable number of insurance companies have been trying to sell travel insurance through WeChat public accounts and mini-programs. However, some of Chinese tourists prefer to travel independently and they show less trust in travel insurance purchased online. Insurance companies need to develop more distribution channels for travel insurance in order to reach the diverse Chinese consumer base.

Leading players in the travel insurance market in China

PINGAN (中国平安) presence in China

[Source: baoxian.pingan.com “domestic and overseas travel insurance for the Chinese tourists”]

PINGAN is one of the largest domestic insurance companies in China. The travel insurance of PINGAN is divided into domestic and overseas tourism and includes both group travel and independent tourism. PINGAN’s domestic travel insurance mainly covers the risks of disasters, high-stakes sports, accidental injuries/death, medical treatment, property and luggage loss, the insurance also offers emergency rescue services and reasonable expenses for emergency situations (such as funeral and family visits). For the overseas travel insurance of PINGAN, it focuses on trip cancellation/delays, visa refusing and tickets loss other than personal injuries and property loss. PINGAN offers travel insurance targets on road trips, plateau areas and different regions, such as Europe, North America and Australia.

In order to offer better after-sales service, PINGAN developed online channels to provide quick claim settlement. The company encourages consumers to use simple three steps on PINGAN mobile app and WeChat account (scanning QR code) to get compensation in a very short time after they had accidents or disease.

Allianz (安联保险) presence in China

[Source: allianz360.com “global travel insurance for Chinese tourisms”]

As a globally famous financial service company, Allianz entered the China’s insurance market in 2003 and built partnership with JD (京东) to be a joint venture company in China. By working with JD, Allianz effectively expanded its online sales channels to benefit from China’s booming e-commerce market. The travel insurance products of Allianz cover different kinds of accidents, medical treatments, luggage, personal property, visa, flight delays and road rescue. Allianz launched the “digital first” strategy in China to make use of the huge mobile network, the company created a mobile app to digitalize the process of insurance purchasing and customize insurance products for consumers. Besides, consumers can implement self-service claims by using the WeChat account of Allianz. Through those strategies, Allianz provided superior quality service to the Chinese consumers and expended its market in China.

AIG (美亚保险) presence in China

[Source: aig.com.cn “domestic travel insurance for Chinese tourists”]

AIG insurance belongs to the American International Group and it is one of the largest wholly foreign-owned insurance companies in China. The company provides travel insurance to more than 1 million Chinese consumers every year. In 2017, the total premium of AIG insurance reached 1.6 billion RMB in China. The company localized in China by building seven branches in Shanghai, Beijing, Shenzhen, Guangdong, Jiangsu and Zhejiang. The travel insurance products of AIG target overseas tourism, domestic tourism, road trips and island tourism. In order to adapt the Chinese tourism market, AIG also launched distinctive insurance products, such as insurance products target on smartphones and outdoor activities like surfing, skiing, diving, etc.

The potential opportunities of the travel insurance market in China

Customized tourism is becoming more popular in China, along with independent tourism and niche destination tourism. Chinese tourists are also trying more dangerous activities while traveling, such as bungee jumping, paragliding, and surfing. These types of activities often require insurance packages to cover any risk of injury. As more travel that is adventurous becomes more popular among Chinese tourists, creating more opportunities to enter the travel insurance market in China.

Children and seniors have strong demands for travel insurance. Tourism is one of the most popular leisure activities for the Chinese senior citizens, in fact, seniors make up more than 20% of China’s tourists every year. However, there are not many travel insurance products targeting seniors, and single insurance products are unable to adapt to the diverse needs of consumers. As the number of travelers from and within China will very likely continue to increase, insurers should seize the opportunity to increase their market share by developing new products and identifying new customers groups, and making travel insurance more easily accessible.

Our report on Chinese travellers:

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes