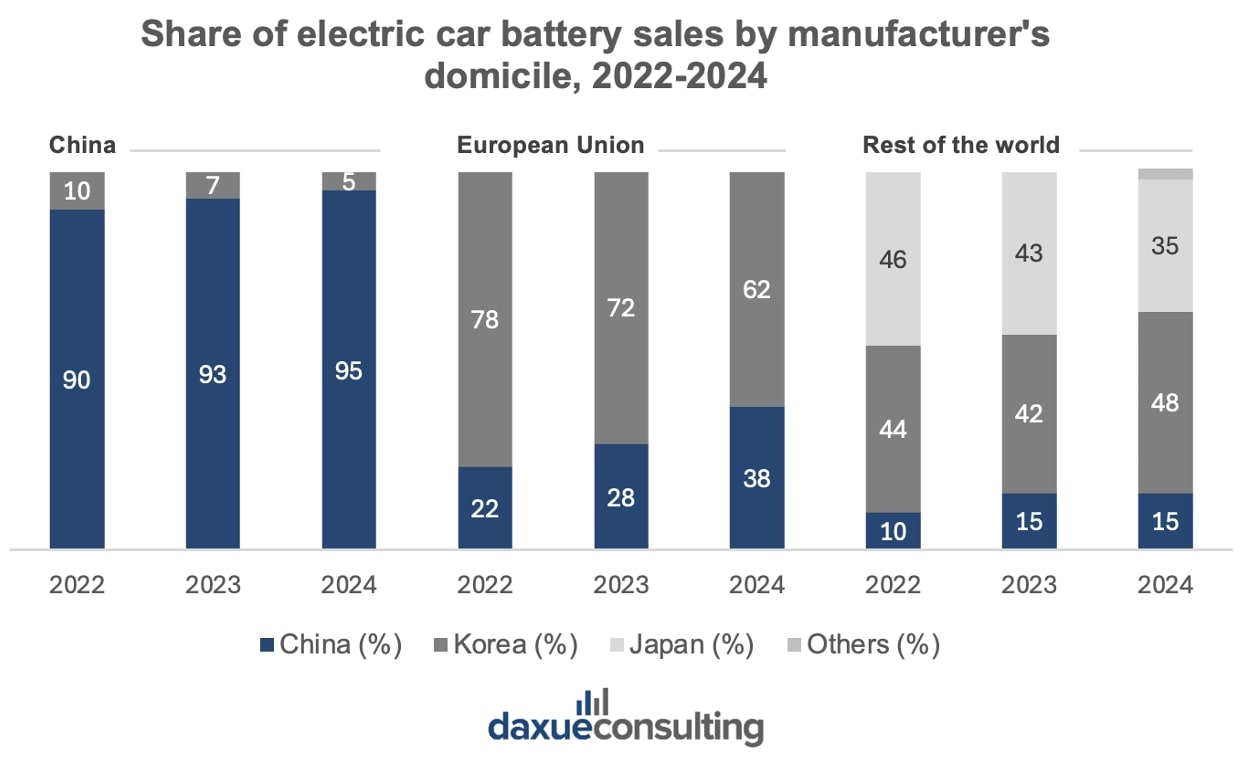

The country’s dominance is intensifying, not just in absolute production but in its share of global sales. In 2024, China produced over three-quarters of the batteries sold globally. In the EV industry, Chinese battery producers supplied 95% of EV batteries sold in China, 38% in the European Union, and 15% in the rest of the world. Chinese battery market dominance is not merely a function of volume; it reflects a tightly integrated value chain spanning raw material processing, cell manufacturing, and advanced pack assembly.

China’s advantage lies in its control over battery raw materials. In 2023, China processed over 60% of global lithium, 65% of cobalt, and more than 85% of graphite. These critical battery inputs give the country a near-monopoly over battery production. This control gives its manufacturers reliable access and lower costs compared to global competitors, allowing them to drive down battery production prices. Such vertical integration not only streamlines the supply chain but also gives China a strategic advantage in scaling production quickly and exporting aggressively.

For importing regions like the EU, the rising share of Chinese-made batteries (up from 22% in 2022 to 38% by 2024) raises questions about long-term strategic dependence and industrial resilience.

Domestic demand as a catalyst: The EV market driving scale

China’s battery leadership stems not only from its export strength but also from the rapidly surging demand for electric vehicles in its domestic automotive market. In 2024, China sold 11 million electric vehicles, more than 60% of global EV sales, making it the world’s largest and fastest-growing EV market. China’s EV market creates a virtuous cycle: high demand drives large-scale battery production, which lowers unit costs and spurs further adoption. Government policies, such as vehicle purchase subsidies, tax breaks, and non-monetary incentives like license plate access in major cities, have reinforced this momentum for over a decade.

Moreover, leading domestic automakers like BYD, NIO, and XPeng rely heavily on vertically integrated battery supply, allowing them to scale production rapidly and optimize battery performance. BYD, for example, now sells more EVs globally than Tesla and manufactures its own LFP batteries in-house.

CATL’s ascent: From national champion to global leader

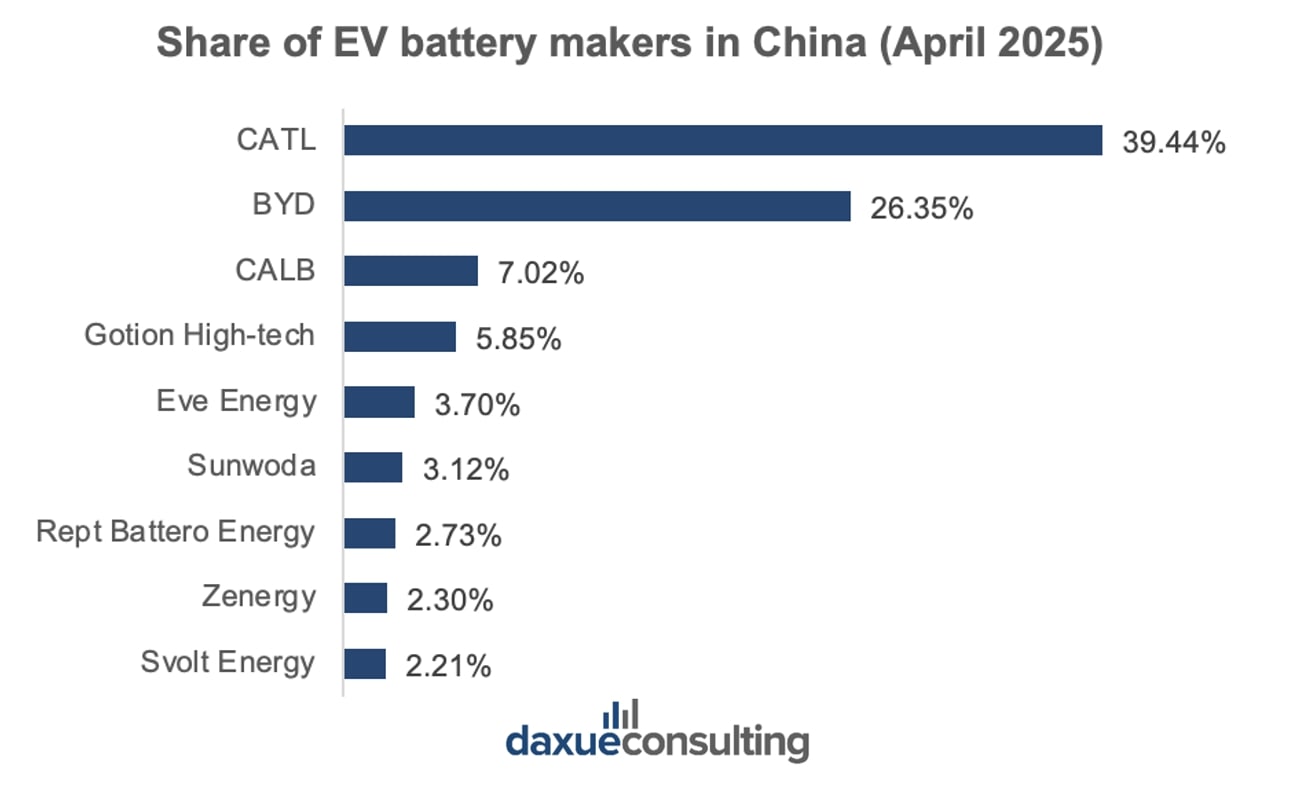

Among competitors, CATL is the undisputed domestic leader in EV battery manufacturing. With a 39.44% domestic market share in 2025, far ahead of competitors like BYD. In a sign of its growing international ambition, CATL completed a secondary listing on the Hong Kong Stock Exchange in July 2025. The listing raised over USD 4.6 billion, the largest global IPO of the year so far.

Much of CATL’s ascent is driven by its deep focus on innovation and rapid commercialization. In 2025, the company unveiled the second-generation Shenxing battery. It is capable of delivering 520 kilometers of range after just five minutes of charging, based on internal testing. This is 30% more than BYD’s Super-e platform, which offers about 400 kilometers in the same time frame. CATL’s early lead in technologies like cell-to-pack integration, sodium-ion chemistry, and extreme fast-charging has allowed it to shape the global standards of EV performance.

Beyond the Chinese battery market, CATL continues to expand aggressively with operational plants or planned facilities in Germany, Hungary, Indonesia, and Thailand, while navigating geopolitical barriers to enter North America.

Technological leadership: China’s shift to lithium iron phosphate (LFP) and sodium-ion

China’s battery industry is leading a global shift toward new chemistries, particularly lithium iron phosphate (LFP) and sodium-ion technologies. It was driven by the need for cost efficiency, supply security, and industrial scalability. As of 2024, LFP batteries accounted for over 75% of China’s domestic EV battery installations. This is thanks to their lower cost, higher thermal stability, and long cycle life. While traditionally considered lower in energy density than nickel-based chemistries, recent advancements by firms like CATL and BYD have closed the performance gap, making LFP a default option in many passenger and commercial EV segments. LFP battery pack prices in China have now fallen below USD 100 per kWh, a critical threshold for mass-market EV adoption.

Raw material volatility accelerates shift in Chinese battery market

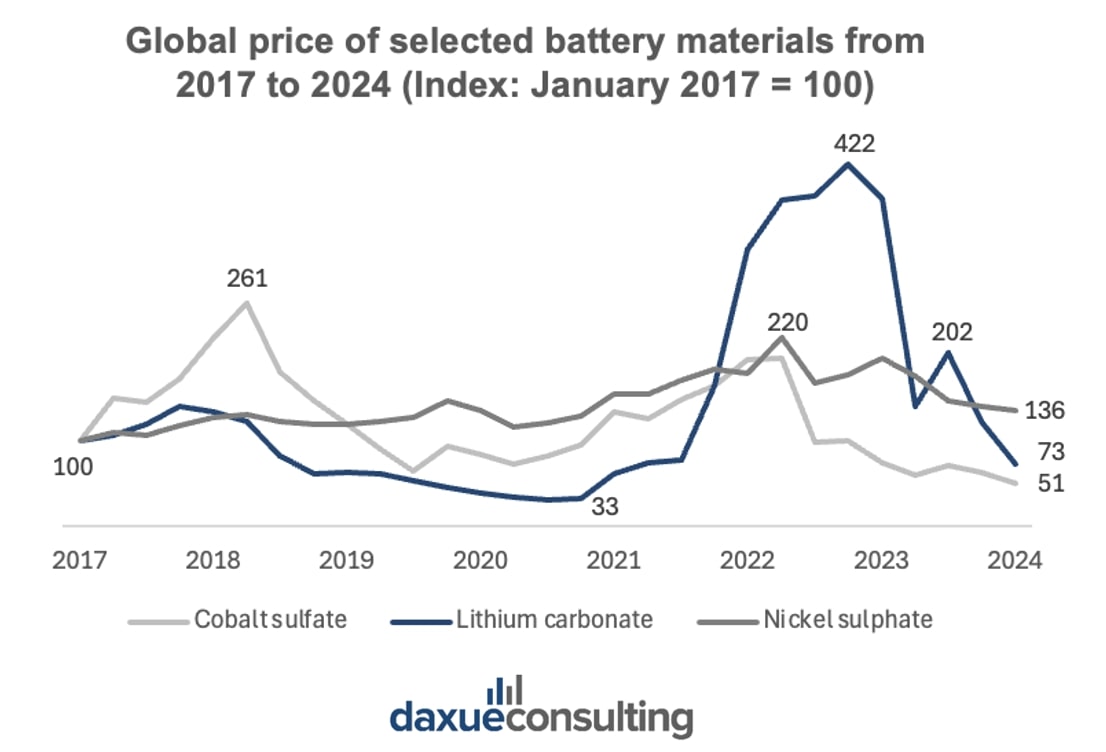

This shift to LFP and sodium-ion chemistries has become even more crucial in light of recent fluctuations in raw material prices. Between 2021 and 2023, the cost of lithium carbonate surged to more than 400% of its 2017 baseline due to fast growth in the EV industry, with producers unable to keep up, as mining and refining take 5 to 7 years on average. The surge has been aggravated by strong speculation and the Russia-Ukraine war, which caused global inflation across materials. Cobalt and nickel prices also experienced major spikes and fluctuations. Although prices have since declined, the volatility highlighted in global markets has accelerated China’s move away from dependence on these critical and geopolitically sensitive materials. By favoring chemistries that use abundant, low-cost inputs, Chinese manufacturers are effectively insulating themselves from future supply shocks and maintaining their cost advantage.

China is also pioneering the commercial deployment of sodium-ion batteries, which replace lithium with far more abundant and cheaper sodium. CATL and BYD both launched sodium-powered models in 2024-2025, targeting electric scooters, compact EVs, and grid storage applications. CATL’s first-generation sodium-ion packs already outperform older LFP models in cold-weather performance, and the company has committed to ramping up industrial production by 2026. These innovations reflect a larger trend: Chinese battery firms are not merely competing on scale; they are defining the global chemistry roadmap. As supply chain constraints and material prices fluctuate, China’s early pivot to diversified battery technologies gives it a long-term strategic edge in both mobility and stationary storage sectors.

Strategic implications of the Chinese battery market: Global competition and supply chain realignment

China’s dominance in battery production and materials processing has triggered a strategic response from other major economies. The United States and European Union are accelerating efforts to localize battery supply chains through subsidies, trade protections, and regulatory incentives, such as the U.S. Inflation Reduction Act and the EU Battery Regulation, signaling an urgent pivot to economic nationalism.

However, with China still controlling over 75% of global lithium-ion cell production and a majority share of key material refining, competitors face a steep challenge. This global realignment represents more than a reactionary economic policy; it signals the transformation of clean energy markets into arenas of geopolitical contest. As nations race to secure critical technologies and resources, tensions could escalate into trade disputes, protectionist standoffs, or even diplomatic rifts. One striking example is the recent EU-China escalation over rare earth export controls: in early July 2025, the European Parliament formally condemned China’s restrictions on rare earth shipments, materials critical for EVs, wind turbines, and defense technologies, and Beijing swiftly accused the EU of politicizing trade and applying “double standards”.

Developing countries in Africa, Southeast Asia, and Latin America with untapped mineral reserves may also become strategic battlegrounds, subject to competing influence from global powers. Resource-rich. African nations like Zimbabwe, Ghana, and Namibia are asserting greater control over their mineral wealth through export bans and local processing mandates, moves that reflect growing resource nationalism. These shifts have disrupted Western supply chains and opened the door to deeper Chinese engagement.

Challenges and opportunities of the Chinese battery market’s overseas expansion

- China has established itself as the global hub for EV battery manufacturing, controlling over 75% of global production and supported by the world’s largest domestic EV market, which saw over 11 million sales in 2024.

- Industry giants like CATL are accelerating this lead through major IPOs and cutting-edge battery technologies.

- By shifting toward LFP and sodium-ion chemistries, the Chinese battery market has secured long-term cost and supply chain advantages, reducing dependence on scarce minerals.

- In response, Western nations are racing to localize production and secure raw materials, turning this industrial gap into a contest over energy sovereignty.

- Tensions are already surfacing, from EU-China disputes over rare earth export controls to frictions with African nations asserting resource ownership, highlighting how the battery race is becoming a high-stakes front in global geopolitics.