“Buy Now Pay Later” (BNPL) services, as the name suggests, allow consumers to make instant purchases but pay later in several small instalments. Its flexibility, the omnichannel application, and the wide adoption of online shopping attract the young generation and fuel the explosive growth worldwide.

The global BNPL market records an explosive CAGR rise of more than 85% from 2019, reaching US$ 120 billion in 2021. The Chinese market witnesses a similar trend. According to BNPL Survey, the Chinese BNPL market is forecast to grow by 52.7% annually, reaching US$ 83,5 billion in 2022.

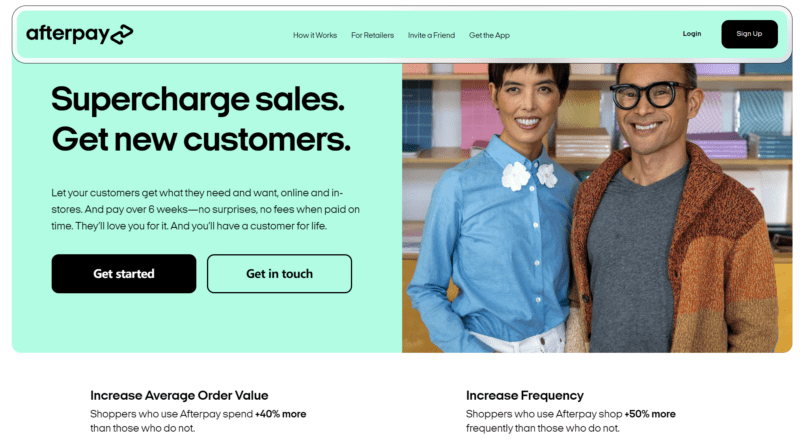

BNPL companies adopt the classic two-sided market business model where they subsidize the consumers with zero interest rate instalments while charging merchants commissions. The financial report from Afterpay reveals that the merchant commission (typically 4-6% per transaction) accounts for more than 60% of their total revenue.

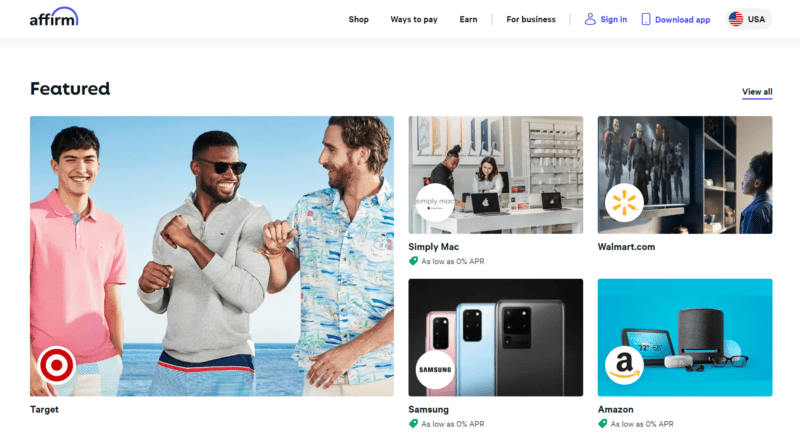

By using the BNPL payment, consumers avoid the lengthy process of credit card application and smooth out their expenses over an extended period without additional interest. By partnering with BNPL companies, the merchants increase product exposure, improve customer acquisition, enjoy higher average order value, and get paid upfront. According to Max Levchin, co-founder of BNPL giant Affirm, the goals of BNPL are mainly “bringing new customers, increasing their cart size, increasing their conversion at the point of sale.”

Why BNPL? From both consumers’ and merchants’ perspectives

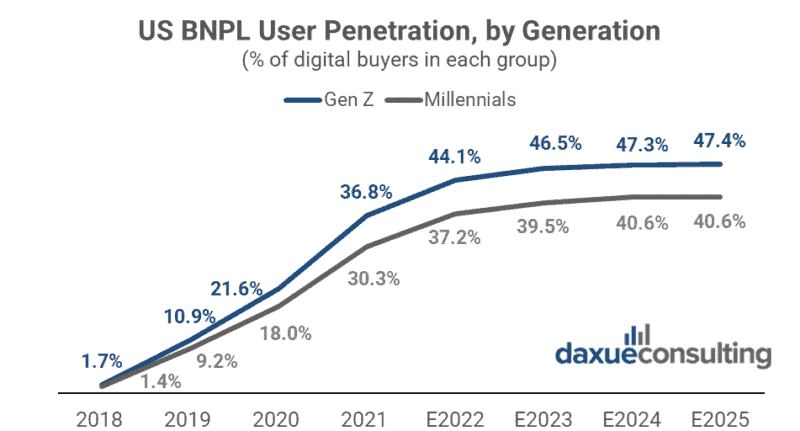

One of the major driving forces of the BNPL growth is that they successfully target the young generation, especially the Millennials and Generation Z. The report from eMarketer shows that almost 75% of BNPL US consumers are Gen Z or Millennials. It predicts that 44.1% of Generation Z aged 14 and older will have purchased with BNPL at least once by the end of 2022.

The young generation prefers online shopping with convenient payment. The BNPL service processes the payment in just a few seconds and allows the borrower to repay the amount later. In addition, the integration of merchant and BNPL platforms also facilitates shopping convenience. On many BNPL websites, consumers could directly find the links to partner merchants’ products.

Young shoppers also value the flexibility provided by BNPL. Most traditional financial institutions are cautious about lending money to young people with low or no credit scores. As a result, the young generation may not have easy access to credit cards. Instead, the BNPL companies use alternative data and artificial intelligence to study consumers’ profiles and decide the credit accordingly. Therefore, the BNPL provides an accessible alternative and grants spending power to the youth. Additionally, the BNPL companies typically charge zero or low interest compared to traditional credit card companies. Given the long-lasting impact of Covid-19 worldwide, BNPL provides an economical way to spread their expenses over a more extended period.

Merchants can benefit from Chinese BNPL services

Besides attracting consumers with low or no interest rates, the BNPL companies also create values for the merchants by attracting new consumers, increasing average order values, and getting paid upfront with lower risk.

The BNPL companies open merchants’ businesses to new consumer bases that may not afford the products before. Since the consumers can now spend more than they have in hand, the merchants’ sales will increase. The customized and enhanced checkout experience also contributes to the merchants’ sales. John Strain, CTO of Afterpay, claimed, “We’re able to provide a more customized shopping experience, give our customers additional convenience and control and reach a younger demographic who may not have been able to shop with us before.” According to 2022 Commerce and Payment Trends Report, BNPL can translate into 20-30% higher conversion rates for merchants and 30-50% higher average ticket sales.

The merchants partnering with BNPL companies may relieved from collecting payments from consumers. The merchants receive the full amount (with commissions deducted) upfront from the BNPL companies. They do not have to shoulder the responsibility of charging consumer instalments. It is the BNPL companies to accept the liability of fraud of the purchases.

How BNPL works in China?

Although BNPL is still at its infancy in China, it is commonly agreed that future growth will be solid and promising. China Buy Now Pay Later Markets Report 2022 predicts a strong medium to long-term growth of the Chinese BNPL industry, reaching a CAGR of 26.3% from 2022 to 2028. Unlike what happens in Western countries, the Chinese market is familiar with the cashless society, online shopping, and e-commerce. There is a massive demand for the BNPL payment. The trend is strengthened by the strict Covid-19 policy, which urges consumers to smooth out spending and avoid offline interaction.

The large technology firms, like Ant Group, Pinduoduo, and JD.com, dominate the current Chinese BNPL market. However, the Chinese government has lately taken strict measures to crack down on monopoly internet giants. There may be newly emerging BNPL companies to fill the market vacuum. Besides, it may be potential opportunities for the BNPL late comers to enter the new consumption scenes that are not covered before. One of the examples may be the mobile gaming industry.

Foreign investors have also started entering the Chinese BNPL market. For instance, Afterpay invests in Chinese local BNPL firm Happay (Xigua maidan), Klarna establishes a subsidiary in China, and Singapore-based BNPL firm Atome has expanded to cover Tier I and Tier II cities partnering with 1,500 brands. It is expected that more BNPL giants will flood into the Chinese market.

Risk and challenge in the Chinese market

For BNPL, reward and risk are two sides to the same coin. A higher speed of growth often comes with higher risk. There are two main challenges for the BNPL to continue to thrive in the Chinese market: the default risk and government intervention.

Of that typical 4% commission, Redburn estimates BNPL companies to earn a 1.5 % net profit after deducting the average funding cost and fees to other payment chains. The gross profit will only be 0.3% (before operating cost) if an average 1.2% credit loss is incurred. Once the scale of lending fails to cover the cost of bad debts, it will be easy to cause a capital chain rupture.

It may also be worth considering why some young generations do not get credit cards except for being tired of the tedious application procedures. Chances are that some of them may lack credit or have low repayment ability. Additionally, it has been criticized that the BNPL may foster overspending habits. It can be easy to fall into the trap of default risk.

Never far from the collapse of China’s P2P lending industry in 2018, which saw more than US$100 billion in losses with millions of victims. Since then, the Chinese government have been sensitive to systematic risk in the financial market and tried its best to ensure the financial system’s stability, even at the expense of its development. In the context of BNPL, the regulatory framework and guidelines are yet to be mature. In the future, it is foreseeable that the regulation will kick in to develop the system and restrict the market referencing credit businesses with licenses. Foreign investors, no matter BNPL companies or partner merchants, should not underestimate the Chinese government’s determination and ability to take courageous actions.

Apart from that, the information disclosure problem is also worth noting in the Chinese BNPL market. With the implementation of Cybersecurity Law, Data Security Law, and Personal Information Protection Law in China, the access to user data will be narrower. The limited access to user data posts higher requirements for risk control.

Better understanding Chinese BNPL services

- The BNPL is set to grow both internationally and in China.

- The BNPL companies attract consumers with low or zero interest loans and allow them to pay in several instalments.

- The merchants also benefit from expanding consumer bases and getting paid upfront with lower risk at the cost of commission fees.

- Large technology firms dominate the current Chinese BNPL market with e-commerce platforms. There are still potential market opportunities for the late comers with the new market.

- There are two main challenges for the BNPL to continue to thrive in the Chinese market: the default risk and government intervention.

Author: Liang ZHAO