The increasing global presence of Chinese businesses seeking growth opportunities highlights the crucial role of overseas advertising for Chinese brands. In 2022, China ranked second in worldwide advertising spending, amounting to USD 17.9K. In China’s advertising industry, digital advertising dominates, accounting for the majority share. In 2023, TV & video advertising are the biggest players, with a market value of USD 72.32 billion.

Download our US consumer segmentation report

Advertising approaches in overseas markets

Online Channels:

- Video Advertising –TikTok primarily attracts a younger audience (37.3% aged 18-24) as of July 2023, while YouTube’s audience is older (15% aged 18-24 and 46.4% aged 35+) as of January 2023. Leveraging YouTube’s strong brand recognition in the US (94%) and the UK ( 95%) offers significant advertising advantages while TikTok has a large user base, with 122 million in the US, 99.8 million in Indonesia. YouTube achieves an average ad conversion rate of 12%, with 70% of viewers making purchases from discovered brands. TikTok’s average ad conversion rate is 1.1%, with 92% of users taking action after viewing a post, and 25% actively researching or making purchases of featured products.

- Social Media Advertising – Instagram targets global internet users aged 18 to 24, with a preference rate of 30.8% as of January 2023. Meanwhile, India boasted the world’s largest Instagram audience with 229.55 million users, followed by the United States (143.35 million users) and Brazil (113.5 million users). In India, the cost of Instagram ads proves to be a worthwhile investment, driven by an impressive average conversion rate of 1.08%. In contrast, alternative platforms like Twitter yield a lower conversion rate of only 0.77%, while Pinterest ads lag even further behind at 0.54%.

Offline Channels:

- Billboard advertising – Great Wall Motor (GWM) introduced its luxury and high-end SUV brand, WEY in New York’s Times Square. This location draws more than 10,000 tourists daily, making the NASDAQ Tower’s digital screen one of the premier spots to capture global attention. China Southern Airlines is enhancing its brand visibility in the UK through strategic advertising in London Underground, part of a broader campaign that includes taxi ads and online initiatives to engage the UK audience effectively.

- Brochures – Confucius Institutes and Chinese language schools operate in various countries, including Trinidad and Tobago, Hungary, Eastern European countries and others. To attract students interested in Mandarin language learning and exploring Chinese culture, they utilize offline advertising materials like brochures, showcasing their educational services, cultural activities, and HSK tests.

Chinese brands’ overseas advertising showdown in different industries

Beauty and skincare industry

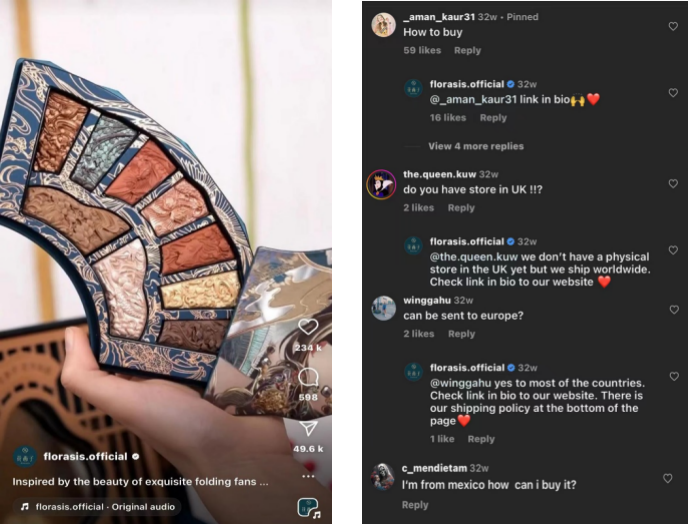

Florasis effectively advertises products through Instagram, boasting an account 460,000 followers. An unboxing video of a makeup palette posted on Florasis’ official Instagram account received a remarkable 234,205 likes, indicating strong online engagement. Customer inquiries about product purchases and overseas shipping, including to Europe and Mexico, are prevalent. In the Asia-Pacific region, 83% of beauty consumers will engage with Instagram monthly, with 52% using social media platforms to discover new products and trends. Particularly noteworthy is the influence on younger consumers, as 73% of Gen Z and Millennial beauty buyers in Asia-Pacific actively utilize Instagram to explore and connect with brands, underscoring its pivotal role in shaping the beauty industry landscape.

Fashion Industry

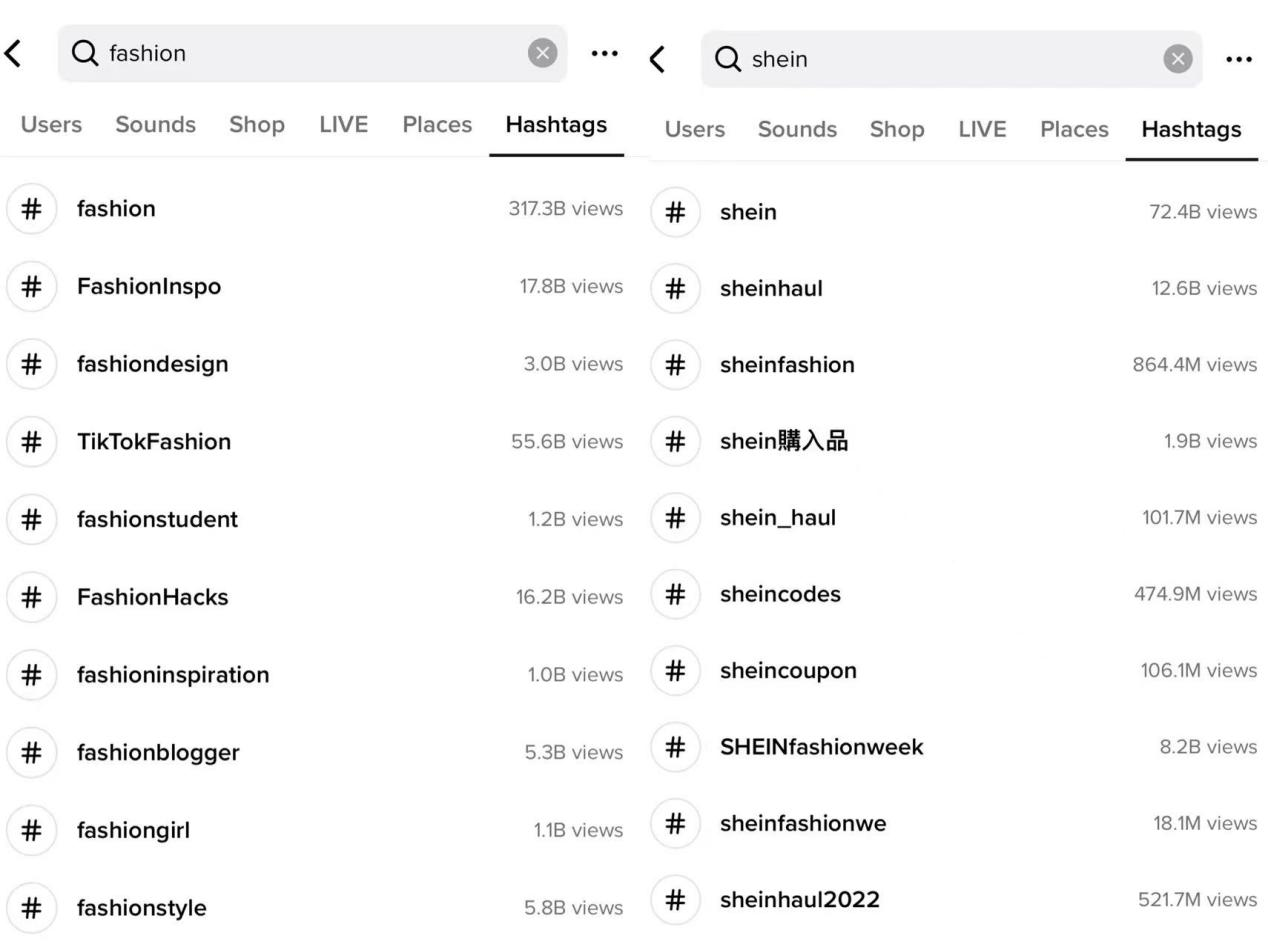

Shein effectively utilizes TikTok for Chinese brands’ overseas advertising, capitalizing on its shared Chinese ownership to enhance global visibility. Shein has emerged as the favored brand among TikTok influencers, with influential TikTok creators endorsing Shein products, thereby inspiring Gen-Z shoppers to explore the clothing offerings. Fashion enthusiasts on TikTok actively seek and engage with content that piques their interest, with hashtags like #fashion, #sheinfashion and other fashion-related hashtags, amassing billions of views. TikTok users are 15% more likely to support and make purchases from small, independent businesses compared to other social media platforms.

Event sponsorship advertisement: elevating Chinese brands to new heights

Chinese sportswear brand Li-Ning gained attention in the U.S. through endorsement deals with American basketball players, notably NBA player Dwyane Wade, leading to the “Way of Wade” sneaker line. By strategically featuring Wade in advertising campaigns, Li-Ning successfully appealed to basketball fans and garnered brand recognition in the U.S.

During the FIFA World Cup Qatar 2022, Chinese sponsorship surged to USD 1.4 billion, establishing China as the world’s top sponsor. This involved deals with national soccer teams by companies like Yili Group, GAC Mitsubishi Motors, Wanda Sports, and Xiaohongshu. Companies like Mengniu signed lucrative contracts with renowned soccer players such as Lionel Messi and Kylian Mbappe as brand ambassadors, resulting in a remarkable overseas revenue surge of over 74%.

Advertising on Amazon: leveraging specific interests and categories

The number of active Chinese advertiser accounts on Amazon surged by over 13 times between early 2017 and June 2023, highlighting the significance of advertising. Amazon Ads enables Chinese brands to reach global consumers through diverse video streaming and media platforms, including Prime Video, Twitch, and Freevee. The Chinese intelligent pet brand, Homerunpet, has successfully expanded into overseas markets, including the United States, Europe, and Japan, utilizing Amazon Ads to distribute creative video advertisements.

In online shopping, Amazon outpaces Google in product searches, with 74% of online shoppers starting their product search on Amazon, compared to 65% using search engines like Google in 2021. Amazon excels in specialized product-focused searches and precise audience targeting through Amazon Ads compared to Google Ads which offers a broader range of targeting options, including location, age and gender.

From followers to customers: the power of Key Opinion Leaders (KOLs) in Chinese brands’ overseas advertising

In Southeast Asia, Perfect Diary rapidly gained prominence by collaborating with TikTok and Facebook KOLs. This rise to prominence was facilitated by strategic collaborations, including a co-branded series with Sanrio and partnerships with local celebrities like AMEE in Vietnam. Within just one year in the region, by May 2021, Perfect Diary achieved the top position in several cosmetics categories: first in lip products in Malaysia, first in color cosmetics in Singapore and Vietnam, and first in loose powder sales in the Philippines.

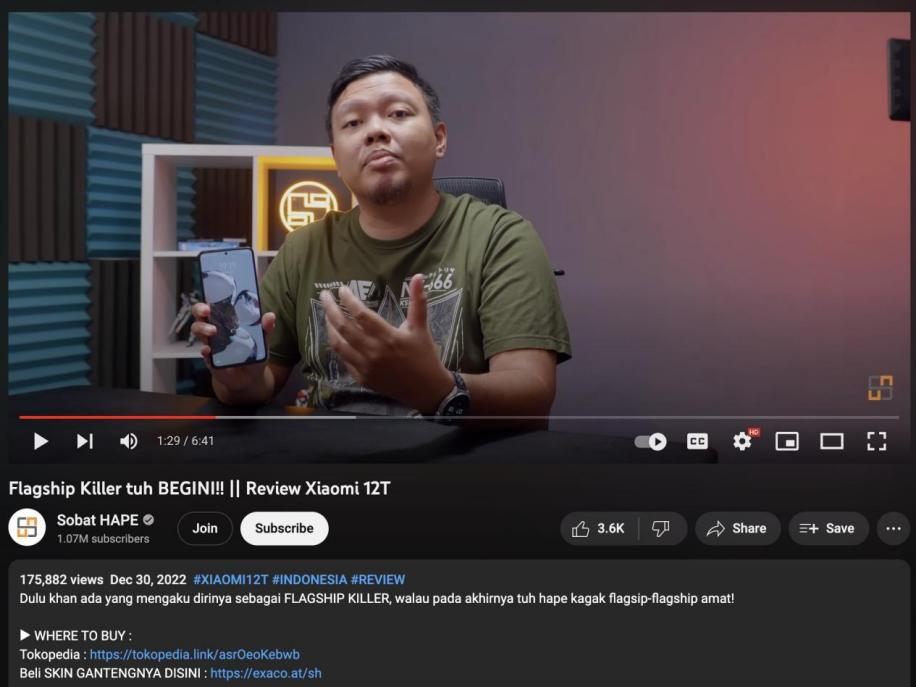

Indonesian tech influencers prefer YouTube’s extended video format for in-depth gadget explanations, visual demos, and tutorials. For instance, “Sobat HAPE,” with 1.07 million subscribers, effectively engages its audience, particularly with a creative review of the Chinese brand products like Xiaomi Redmibook 12T. KOLs also provide direct purchase links on video pages for viewer convenience.

Unlocking the untapped market: leveraging virtual influencer for Chinese brands’ overseas advertising

Many Chinese and overseas product brands have embraced collaborations with virtual influencer to position their brand as forward-thinking and tech-savvy, appealing to young consumers and investors. For instance, Laneige appointed China’s first virtual male icon, 川Chuan as its official spokesperson. M.A.C. launched the “Lightful C3” product line through an ambassador deal with Ayayi. while Angie advertises for the Chinese automotive brand Chery. However, many of these advertisements are mainly promoted within China on platforms like Xiaohongshu and Weibo and are less common in overseas markets like YouTube.

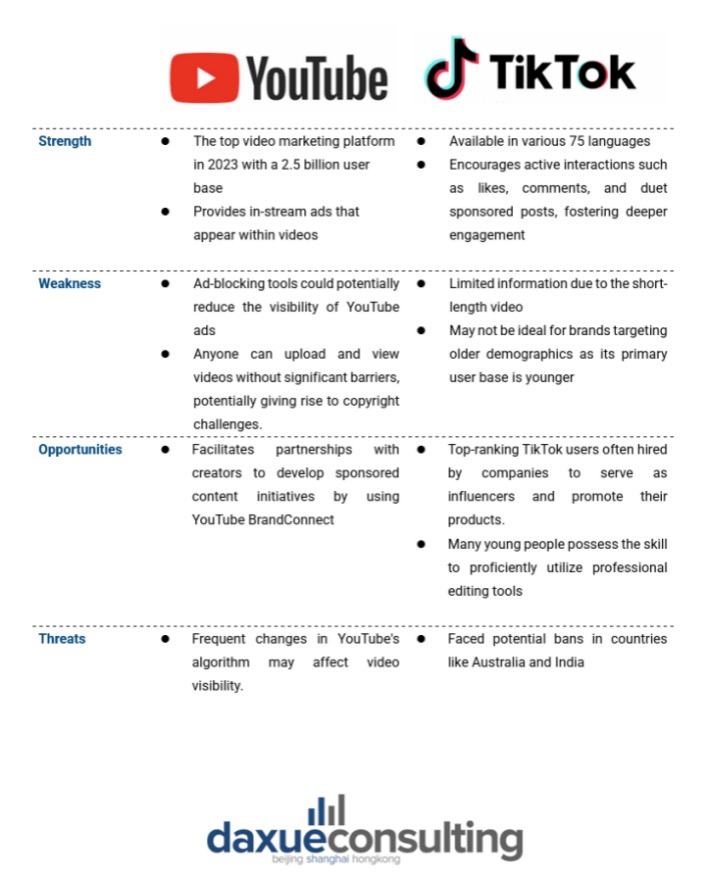

Youtube vs Tiktok: which advertising channel is better for Chinese brands?

YouTube

YouTube, with a 2.5 billion user base worldwide, remains the top video marketing platform in 2023, offering ample opportunities for branddiscovery and providing non-skippable in-stream ads that appear within videos. Ad-blocking tools on YouTube may reduce ad visibility, and it primarily offers passive viewing without active interactions with consumers. The platform’s open accessibility can pose copyright challenges.

YouTube BrandConnect facilitates partnerships with creators to develop influencer marketing and sponsored content initiatives. Frequent changes in YouTube’s algorithm, including engagement, watch time, viewer behavior and channel authority, may affect video visibility.

TikTok

TikTok is available in various 75 languages across 150 countries, encouraging active interactions such as likes, comments, and duet-sponsored posts, fostering deeper engagement.

TikTok’s short video format may limit the amount of product information that can be effectively conveyed to viewers, and it may not provide sufficient information for brands targetting older demographics due to its predominantly youthful user base.

Top-ranking TikTok users are often hired by companies to serve as influencers and promote their products, while numerous young individuals possess the adeptness to skillfully employ professional editing tools

Tiktok has faced potential bans in countries like Australia and India, posing a potential disruption to marketing strategies.

Key takeaways for Chinese brands to advertise in overseas markets

- In China’s advertising industry, digital advertising dominates, accounting for the majority share, and it is projected that a staggering 92% of the total advertising expenditure will come from digital sources by the year 2027.

- Chinese brands have achieved substantial international success through collaborations with a diverse range of overseas KOLs, utilizing social media advertising like Instagram and TikTok.

- Advertising through sponsorships of international events involving renowned athletes has been adopted by brands such as Yili, Mengniu, and Li-Ning.

- Amazon’s strength lies in specialized product-focused search and precise audience targeting, allowing advertisers to tailor ads for specific interests and product categories.

- Selecting the most suitable advertising channels for Chinese brands in overseas markets requires a comprehensive understanding of the target audience, market dynamics, and available resources.