Chinese companies seek to buy IPO in Hong Kong

Hong Kong stock market, which is prosperous because of Hong Kong’s position as the most significant financial center in Asia, is increasingly listing Chinese companies. Only on July 12th, 2018, eight Chinese companies in Hong Kong simultaneously made the listing, the announcement stage was so crowded the procedure for each company’s listing announcement was shortened.

Chinese society also pays much attention to Hong Kong stock market news and Chinese companies listed in Hong Kong, and the number of this crowd is going up year-by-year. With the stock trading regulations that allow Chinese investors to purchase stocks in Hong Kong stock market, more attention comes from Chinese investors..

Chinese investors willing to learn more about Hong Kong stock market

Relevant data of Chinese web searches shows how Chinese are interested in the information and news of Chinese companies listed in Hong Kong.

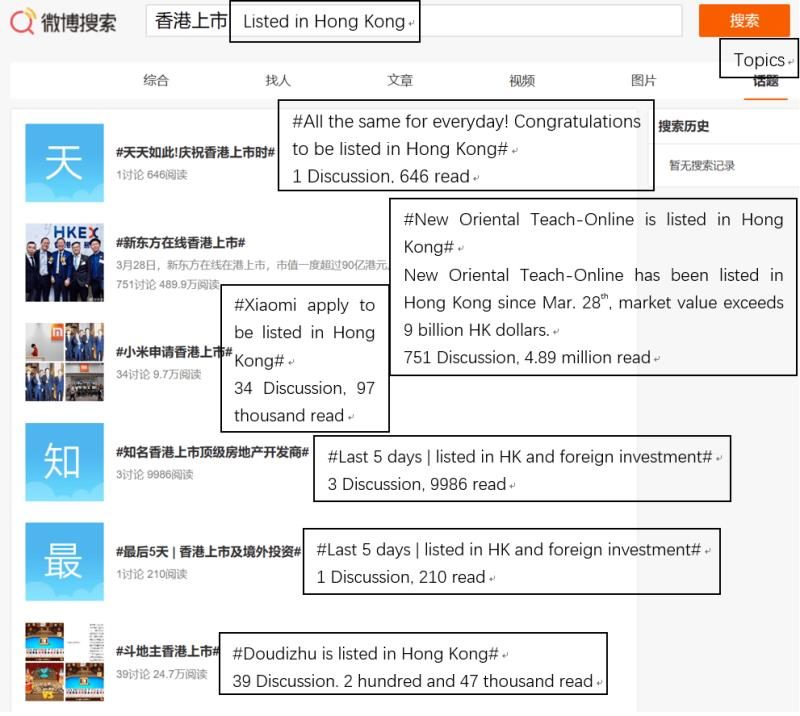

The searching record of “being listed in Hong Kong” on Sina Weibo is shown above, and there are many relevant discussions. The most popular debate, which is about the listing of Chinese online educational company New Oriental Teach-Online (新东方在线) in Hong Kong, has been read about 4.9 million times. In addition, the discussions about the listings of Doudizhu (斗地主), a Chinese online poker company, and Xiaomi (小米), a Chinese high-tech company, also has been viewed around two-hundred thousand and ninety thousand times respectively.

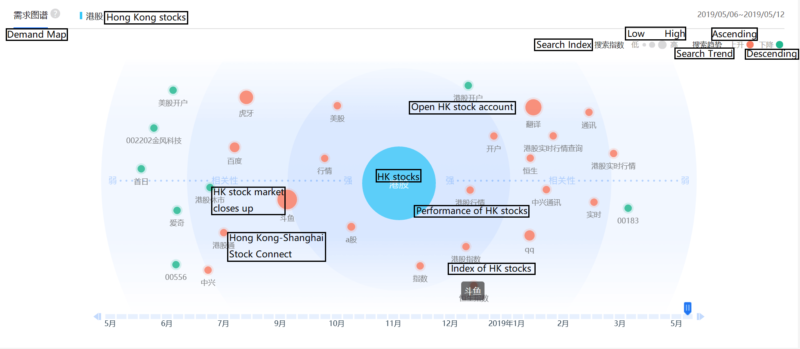

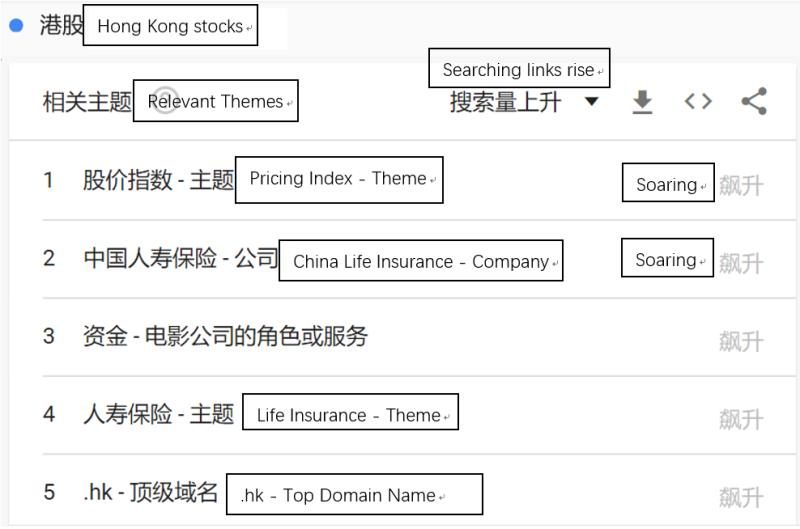

Data from Baidu and Google also show that Chinese not only focus on comprehensive information of the Hong Kong stock market but also give certain attention to individual stock’s performance. The graph provided by Baidu Index shows that there are more clicks for performance and specific indexes (HSCEI, HSI, etc.) of the Hong Kong stock market. The graph provided by Google Trend shows that the theme of China Life Insurance, which is a Chinese state-owned insurance company listed in Hong Kong, has ranked second in the ranking of increase of Hong Kong stocks relevant themes, because the stock price of China Life Insurancehas continuously dropped for several days. Thismeans that unlike their predecessors who just noticed general HK stock market news or information, now the Chinese are paying more attention to the performance of individual Chinese Stock in the Hong Kong stock market.

Current situation and future trend of Chinese companies listed in Hong Kong stock market

The stock market in HK has performed well in recent years. By the end of the first half of 2018, there are 108 IPO in the Hong Kong stock market, which is a better performance than that of both the Chinese stock market and the American stock market, which only have 63 and 69 IPO respectively.

With the prosperity of the Hong Kong stock market, more Chinese companies flood the stock market in HK and expected to have more considerable influence. According to the data released, although the number of Chinese companies that have IPO in Hong Kong is not noticeable by the end of the first half of 2018 – there are only 37 Chinese companies listed in the Hong Kong stock market – the percentage of Chinese companies listed in the Hong Kong stock market has been increased to 50.83%. In addition, the fundraising percentage of Chinese companies IPO in Hong Kong is higher than that of others by the end of the first half of 2018: approximately 80% of the funds raised in the Hong Kong stock market is done by the 37 Chinese companies.

The total market value of Chinese companies listed in Hong Kong stock market also increases year-on-year from 30% of the total exchange in 2005, to above 40% in 2017, and is expected to reach 60% in 2017 if the market value of Chinese private companies is included.

Based on the data above, the number and proportion of Chinese companies listed in Hong Kong stock market are expected to increase.

Reasons behind buying IPO in Hong Kong instead of buying IPO in China

Plenty of reasons have been put forward to explain why IPO in Hong Kong is more attractive than IPO in China for Chinese companies, among them are differences between Hong Kong and Chinese listing regulations, a larger number of investors in Hong Kong and brand awareness improvement.

Listing regulations: Differences between China and Hong Kong

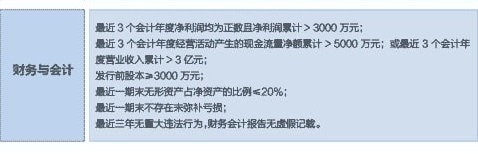

One of the differences between Hong Kong and Chinese listing regulations is that China has stricter financial requirements of performance for pre-listed companies…

Companies that want to be listed on the main board in the Shanghai Stock Exchange, one of the Chinese stock exchanges, have to meet these financial requirements:

- Profits must be positive and higher than 30 million RMB in the past three years;

- The net cash flow derived from operational activities must be higher than 50 million RMB or the operating revenue must be higher than 300 million RMB in the past three years in total.

Basically, every stock board in China has similar financial requirements, and it seems that stock exchange in China will not make revisions for such requirements in a short time.

On the contrary, stock exchange in HK has enacted several new regulations to embrace more promising companies, especially in the high-tech industry. On April 30th, 2018, the Hong Kong stock exchange announced a new revision of Hong Kong listing regulations, A Listing Regime for Companies from Emerging and Innovative Sectors, would be effective on May 1st, 2018. The new revision mainly introduces two innovations that are not effective in the Chinese stock market: on one hand, biotech companies that do not have to make operating revenue can be listed in the stock market in HK. Additionally, weighted voting rights (WVR), which “refers to governance structures in which certain persons are given voting power, or other related rights disproportionate to their shareholdings”, is accepted for certain listed companies in Hong Kong stock market.

“Whatever views we may have with respect to WVR, the competitive reality is Hong Kong can’t afford to rule out these companies solely on the basis of their use of WVR.” Charles Li, who directs Hong Kong stock exchange now, said on the media center of Hong Kong stock exchange.

Regulatory innovations of Hong Kong stock exchange grant Hong Kong stock market an advantage to attract many high-tech companies, especially biotech companies, and companies with high-growth value to be listed in Hong Kong. Xiaomi, one of the high-tech company in China, is one of the beneficiaries by Hong Kong new regulation and its IPO was announced in August 2018.

There are more diversified investors in the Hong Kong stock market

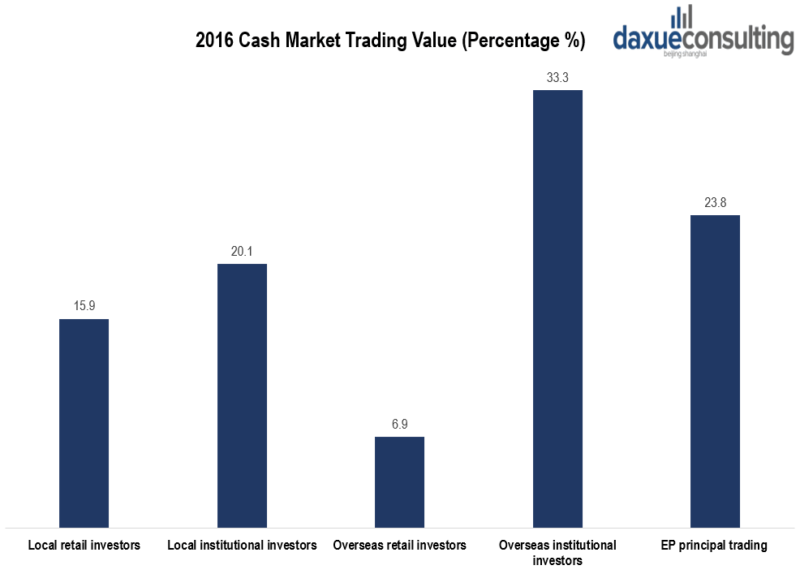

According to the statistics released by the Hong Kong stock exchange, in 2016 the overseas investors accounted for about 40% of all the investors in the Hong Kong stock market.

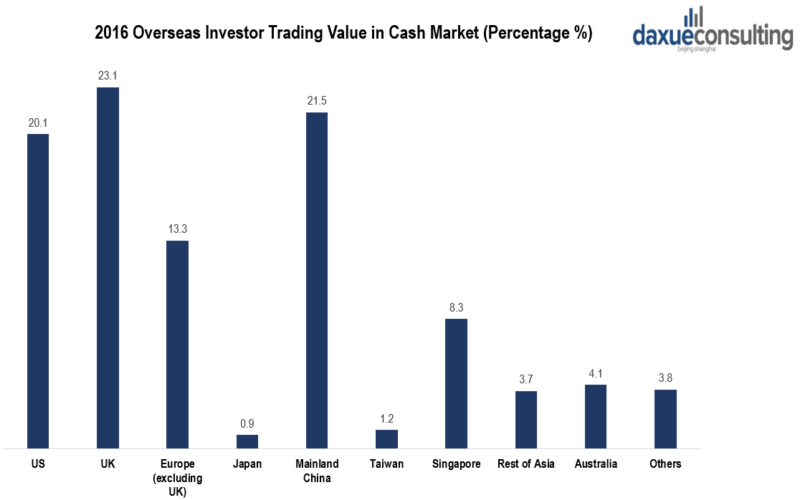

Diverse overseas investors trading in Hong Kong mainly came from Mainland China, UK, and US. Apart from that, Asia was the area that contributed the most overseas investors to Hong Kong compared to other continents. (the UK is excluded from Europe in statistics released).

This phenomenon is attractive for Chinese companies to be listed in Hong Kong because Hong Kong has investors worldwide who bring more capital inflows to companies’ IPO and secondary market, which is beneficial to the shareholders and the performance of the companies.

Opportunities for Chinese companies listed on the Hong Kong stock market

As it mentions above, the Hong Kong stock market has diverse investors who come from all over the world, including US, UK, Mainland China, etc., and Chinese companies listed in Hong Kong stock market have more opportunities to expose themselves to potential customers both domestically and abroad. In 2018, Tongcheng-eLong (同城艺龙) , which is backed by the giant tech company Tencent, got listed in Hong Kong and announced its IPO was a way to build up the company’s brand awareness.

Difficulties for Chinese companies to have IPO in Hong Kong

The Hong Kong stock market has advantages motivating Chinese companies to be listed, but the shortcomings are also eye-catching. For one, shareholding regulations of companies in China are quite strict according to the Foreign Investment Law of China; and it forbids foreign investment in companies from specific industries included in the negative list (issued by the Ministry of Commerce of China), while foreign investment is inevitable when companies are listed in Hong Kong.

Secondly, as the Hong Kong stock exchange requires, all pre-listed companies:

- Disclose all information that is relevant to its business operation including domestic and foreign business

- Professional parties such as sponsors and law firms must conduct due diligence and give comments on whether companies’ information is authentic and legitimate according to laws and regulations of Hong Kong and where business operates. This requires professional parties to have a vast network to get access to different areas if the companies have business around the world.

Chinese and Hong Kong stock markets today: Solution for shareholding regulation

To avoid the shareholding regulation and be listed in Hong Kong stock market, most Chinese companies set up another company registered overseas as the listing entity in Hong Kong stock market, and this overseas company will control and obtain all commercial operation and gains of the Chinese companies by contracts. This method bypasses the restriction of shareholding because there is no actual share transfer in records, and the Hong Kong stock exchange acknowledges this method by approving the listing of Xiaomi.

IPO in Hong Kong requires professional parties to provide as much information of pre-listed companies as possible for the Hong Kong stock exchange’s reference. This information may be obtained both in Hong Kong and Mainland China, even sometimes in other areas of the world. As a result, professional parties that have offices in Hong Kong and Mainland China would have advantages to conduct IPO business for Chinese companies to be listed in Hong Kong. Additionally, international professional parties are also welcomed in IPO in Hong Kong business because more and more Chinese companies expand their business and operation to other countries, and international professional parties are more resourceful to provide industry data, market reports and companies’ situations based on their strong network and databases.

Author: Dennis Deng

Make the new economic China Paradigm positive leverage for your business

Daxue Consulting helps you get the best of the Chinese market.

You have a question on how to benefit from IPO business in Hong Kong, do not hesitate to contact us at dx@daxue-consulting.comto find fresh ideas and solutions.