The frequently mentioned Nord Stream is an offshore natural gas pipeline network in Europe that spans from Russia to Germany under the Baltic Sea. The said pipeline is utilized to deliver billions of cubic meters of gas from Russia to Europe each year, making it a critical component in ensuring energy security in Europe. However, following the Russia-Ukraine conflict, Nord Stream 1 was closed indefinitely due to a number of leaks, while Nord Stream 2, which was recently completed, was never operational. With winter soon descending in the Northern Hemisphere, Europe is plunged into an energy crisis. Consequently, energy prices in Europe skyrocketed and there has been a surge in the export of Chinese heating appliances into the region.

Why the EU is mired in an energy crisis

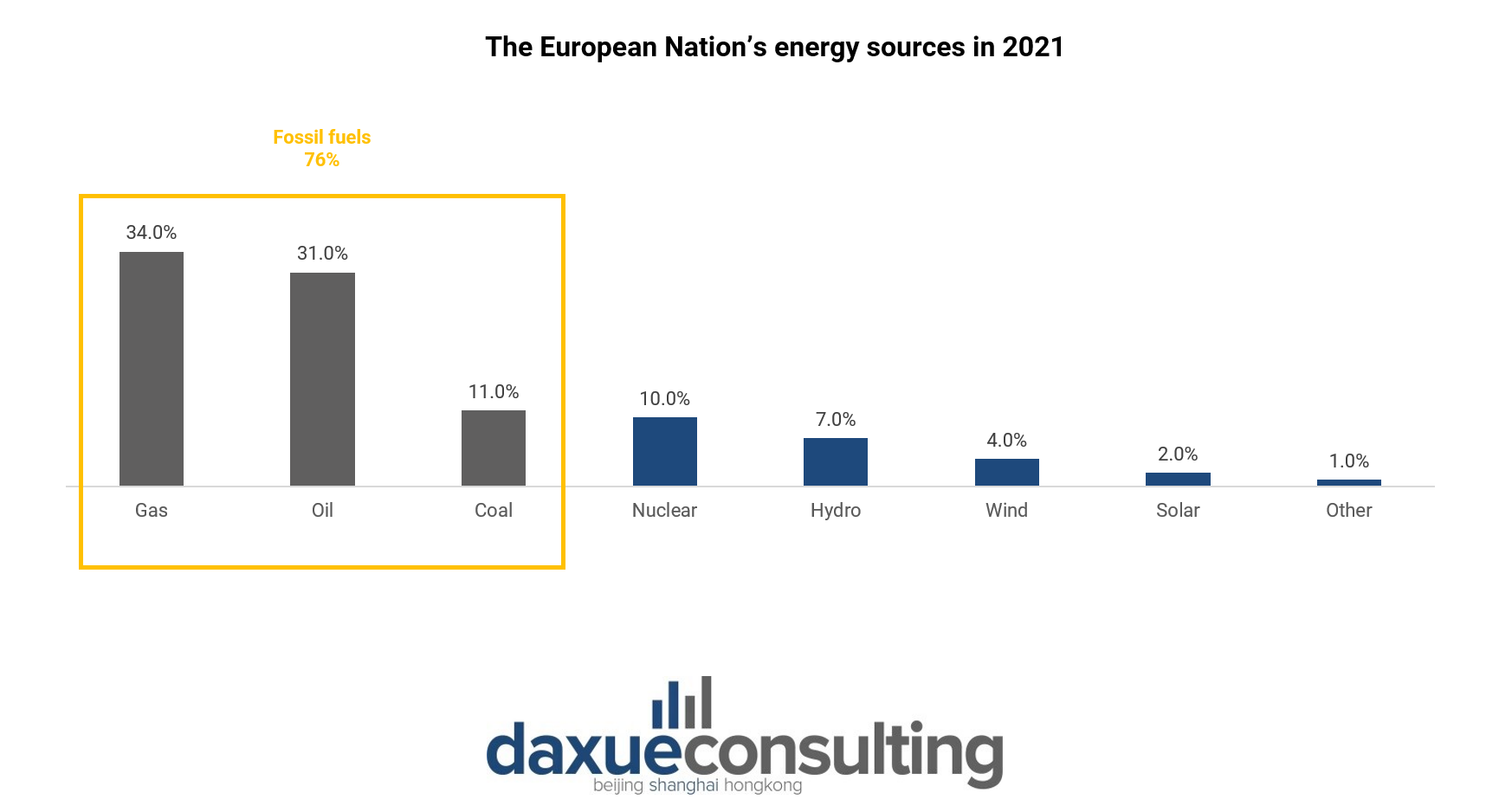

Discussing European countries as a whole, an overwhelming majority of their energy, 76%, is produced by burning fossil fuels, with gas taking the first place, producing 34% of the energy in Europe in 2021.

Examining the European Union specifically, the region is a net energy importer having imported 58% of its energy needs in 2020 while only producing 42% domestically. According to the European Council, more than 40% of the domestically produced energy in the EU originated from renewable sources, with nuclear power plants accounting for about a third.

The effects of the Russia-Ukraine war

The EU used to supply around the same amount of natural gas it consumed in the 1960s and 1970s. However, after its North Sea reserves were depleted, the EU became the world’s largest importer of natural gas. In 2020, 43% of European Union natural gas imports originated from Russia, making Russia the largest natural gas exporter to the EU region.

Reacting to the decision of Russia to invade Ukraine, the European Union member states joined to impose sanctions on Russia. Moscow then blamed the sanctions imposed by the West for hindering Nord Stream 1 gas pipeline maintenance. As of September 2022, Russia’s gas exports to the EU have dropped by 80% compared to recent years. Consequently, natural gas prices also increased.

Energy prices are soaring in Europe

The rise in natural gas and coal prices, along with the increased demand brought on by the “post-pandemic” economic recovery, led energy prices in Europe to skyrocket.

Examining the EU in particular, the wholesale electricity prices in the region tripled, far exceeding the 40% increase in underlying average electricity generation costs in the first half of 2022. In late August, gas prices in Europe hit a new high of more than 343 euros (about RMB 2,359) per megawatt-hour in late August. It is now more expensive to generate electricity from gas compared to coal.

As a response, the governments of the EU countries are now agreeing to cut down gas demand by 15% and set electricity savings targets to prevent shortages. The Russia-Ukraine conflict also clearly showed the need for the EU to diversify its energy sources. Thus, nuclear power is back into spotlight once again. Notably, Germany, one of the most skeptical countries towards nuclear power, displayed a slight shift in its stance when the economic minister, Robert Habeck, confirmed the plans to postpone the nation’s full nuclear phase-out.

The landscape of heating appliances in Europe

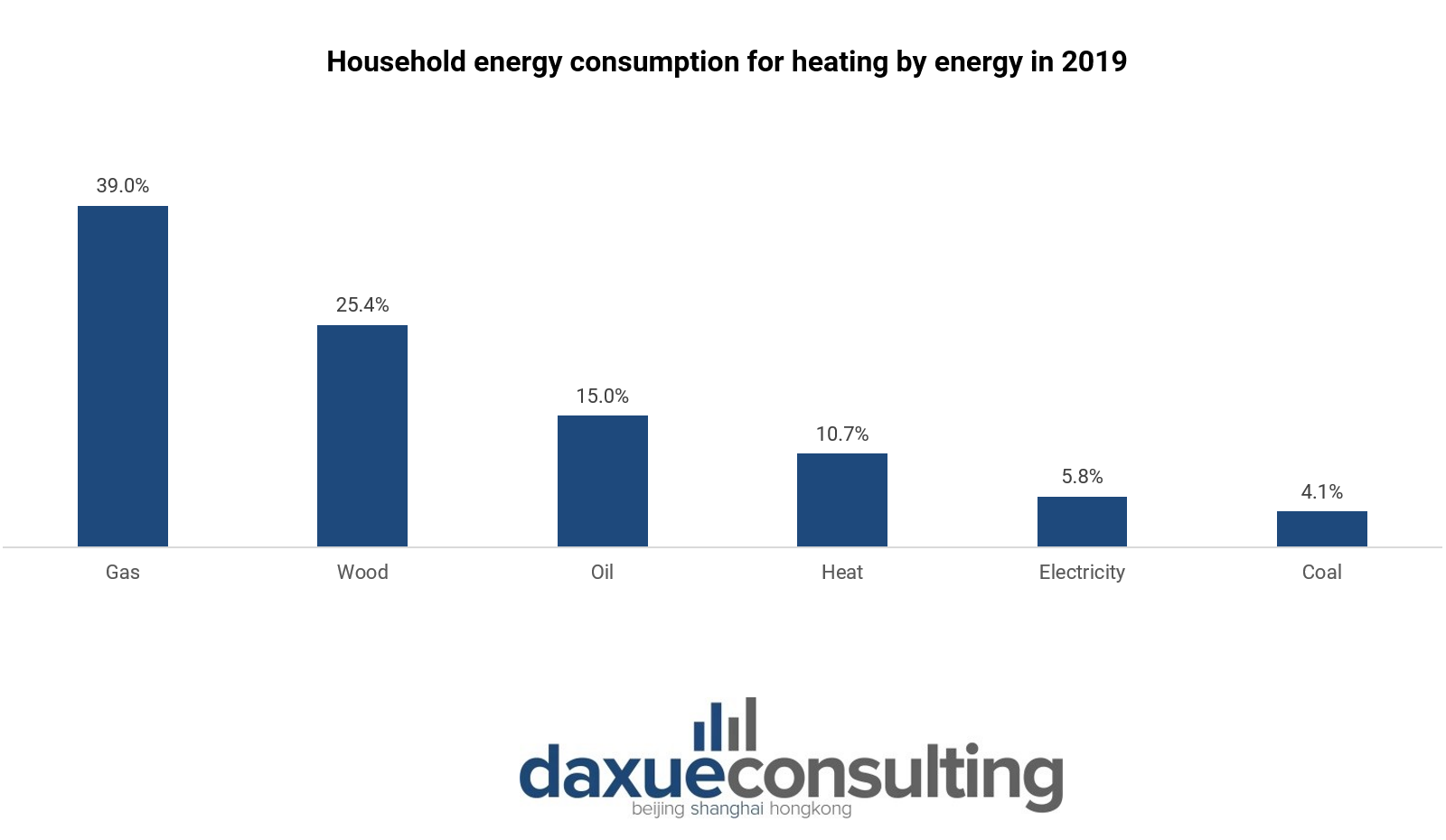

Fossil fuels produce more than 80% of Europe’s heat supply with gas boilers being the most common method of heating in the EU. Natural gas was also the leading energy source for household heating in the EU in 2019.

Even though gas boilers tend to be less efficient than heat pumps and dissipate the heat, they are are usually cheaper to install and are thought to be more cost-effective to operate. Hence, boilers have become more widespread compared to heat pumps in Europe. However, considering the increasing energy prices in Europe, especially when it comes to natural gas, many Europeans are now starting to move to heat pumps and other heating devices as a less-costly alternative.

The demand for Chinese heating appliances in Europe

According to Xu Songlie, a general manager of Cixi Fuyun Electric, Chinese heating appliances in particular became widely popular in Europe as, despite their low price, they are able to meet safety standards to avoid fires.

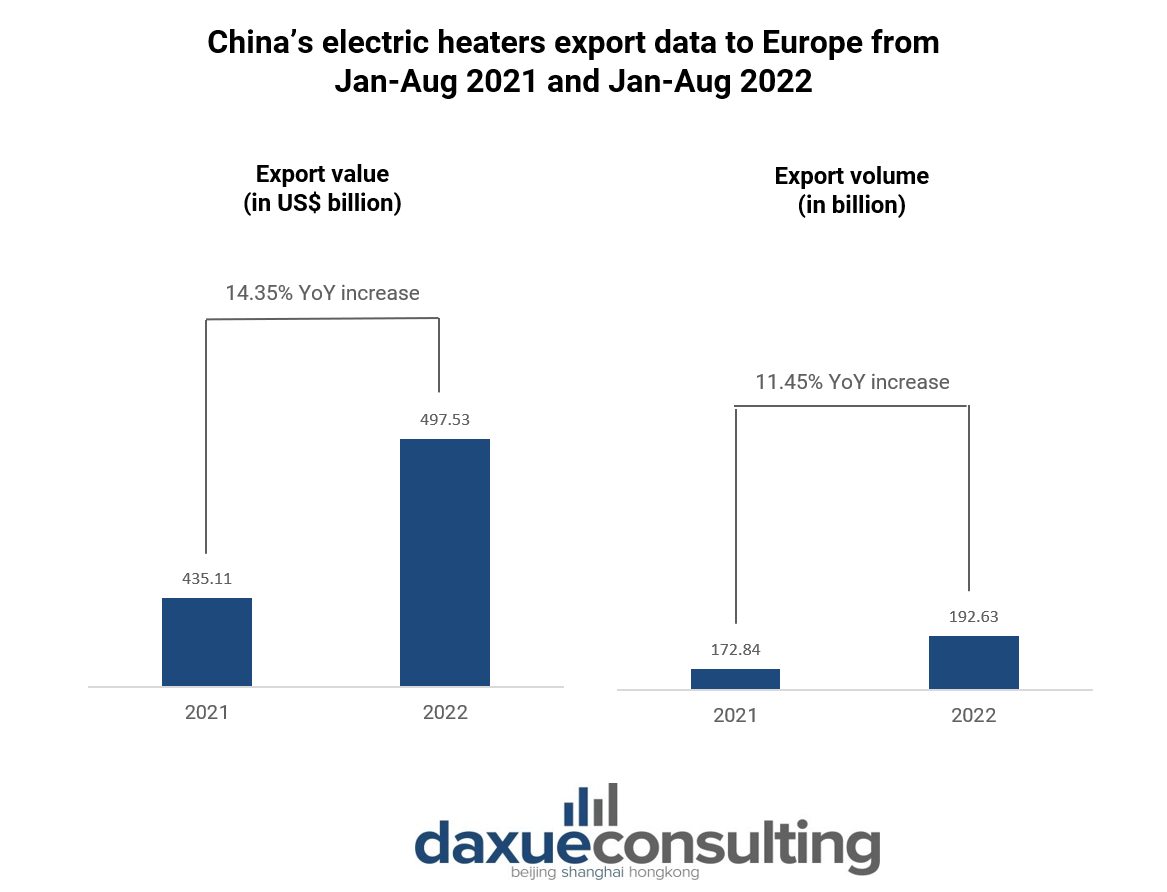

As stated by the China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME), China’s heating appliances export to Europe experienced a year-on-year increase of 14.35%, totaling US$497.53 billion (RMB 3.6 trillion) from January to August. Deliveries of comparable goods amounting to 22.54 billion units, or about U$70 billion (RMB 507.45 billion), were made to the European market just in August alone.

Electric blankets

Electric blankets are the most popular products as they require less energy to run compared to heaters. From data released by China Household Electrical Appliances Association, in the first six months of 2022, China’s electric blankets exports to the EU underwent a year-on-year increase of 97%, totaling US$33.4 million (RMB 242.13 million). Just in July, the EU as a whole ordered 1.29 million units of electric blankets from China, a month-on-month increase of nearly 150%.

Heat pumps

China is the world’s largest producer of heat pumps, responsible for around 60% of global production. In 2021, its heat pump export generated US$678.87 million (RMB4.86 billion), recording an astonishing 93.6% increase.

Exports of heat pumps from the Chinese home appliance manufacturer, Midea, increased by 215% in the first seven months compared to the same period last year. Exports of air-type heat pumps from Haier to Europe increased by more than 200% year-over-year, with France, Italy, and Germany accounting for the three biggest markets –an increase of 36%, 64%, and 26%, respectively. Other top Chinese heating appliances exporters to Europe, specifically heat pumps, are Gree, PHNIX, and Zhejiang Dayuan Pumps.

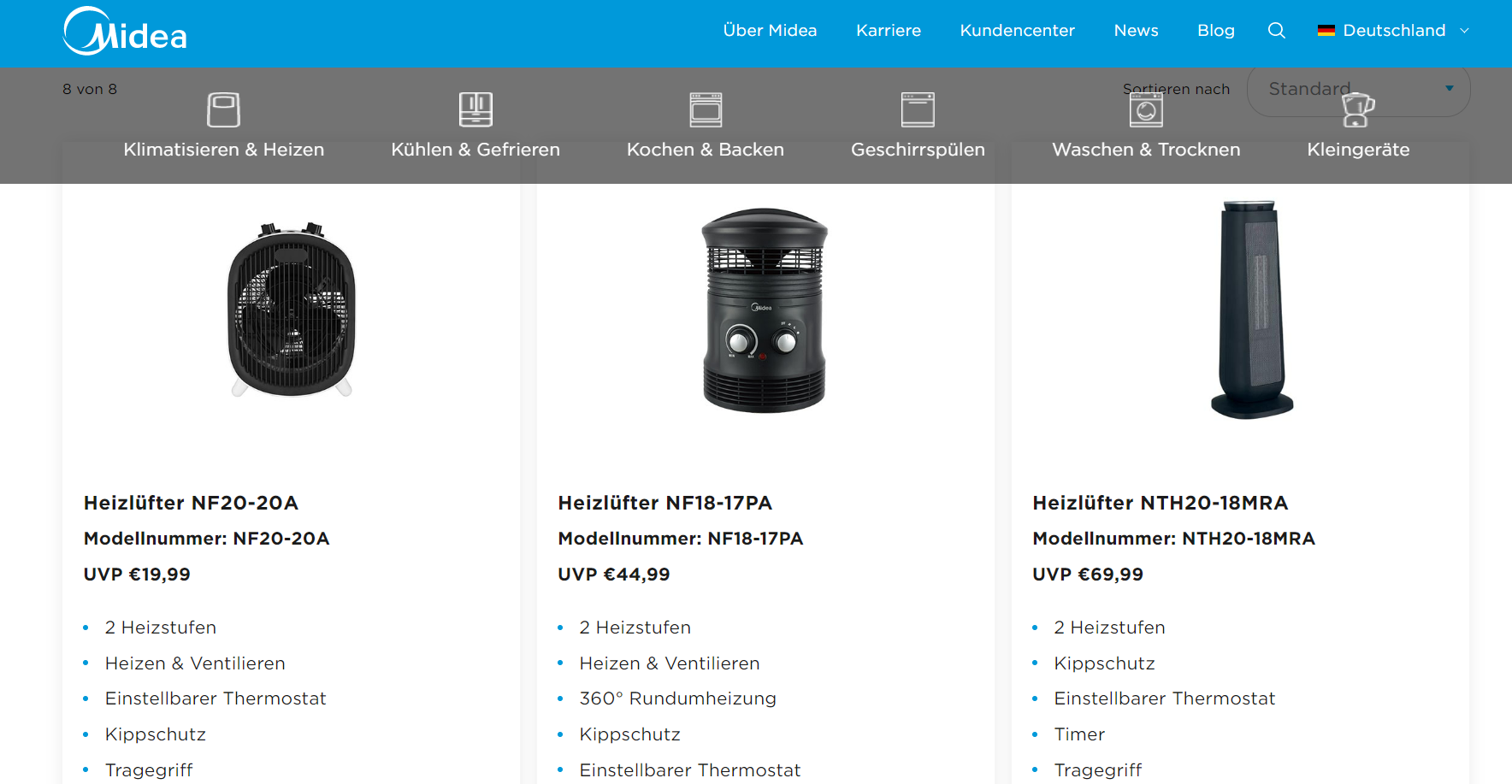

Heaters

Cixi, one of China’s heater production bases, exported heaters worth US$467.95 million (RMB3.35 billion). Of which, 45.67%, or US$213.72 million (RMB1.53 billion), is exported to the EU. This number represented a year-on-year increase of 55.2%.

Discussing a country in specific, approximately 600,000 electric heaters were sold in Germany in the first half of this year, a nearly 35% increase, according to a survey by the German-based GfK research group.

Due to the unusually large demand, China’s heating appliances companies have been “24 hours a day, seven days a week with three working shifts” to catch up with the demand from European customers. It is also anticipated that the sales season for heaters exported to the EU will be extended by about a month.

The future of Chinese heating appliances in Europe

Currently, the heat source shift from fossil energy to electricity in the EU region is motivated by the soaring energy prices in Europe. However, this trend will not suddenly stop even when the Russia-Ukraine conflict ends and the natural gas supply go back to normal as the EU aims to create an economy with net-zero greenhouse gas emissions by 2050. Heating and cooling are one of the sectors that have the most potential for impact as they account for 50% of the yearly energy consumption in the EU.

Taking a closer look at the EU’s biggest energy consumer, just over a million of the many millions of heating systems in German buildings are heat pumps. In contrast, there are more than 19 million gas and oil systems. To achieve the climate goals set for 2045, Germany will have to install around 6 million heat pumps by 2030. This means that the yearly uptake of heat pumps must increase, rising from 154,000 installations in 2021 to 500,000 each year by 2023. Thus, although heat pumps have been picking up lately in Europe due to the energy crisis, the average number is still quite low. Therefore, China’s heating appliances still boast great potential for growth in the European market in the near future.

What to know about the European energy crisis and Chinese heating appliances in Europe:

- Natural gas is the biggest source of energy for the European Union members.

- Russia is the largest exporter of natural gas to the EU region. However, due to the recent conflict with Ukraine, Russia decided to cut off its Nord Stream pipelines which causes energy prices in Europe to spike.

- Gas boilers are the most common heating method in Europe. However, Europeans are now switching to other heating devices such as electric blankets and heat pumps due to the increasing cost of gas.

- There has been an increase in imports of Chinese heating appliances in Europe because of the affordable prices and great quality products. Electric blankets, heat pumps, and heaters are some of the most popular goods.

- The unusually high demand made various China’s heating appliances firms work overtime to fulfil the request.

- The EU has a plan to reach carbon neutrality in 2050 and heating is one of the key sectors in the roadmap. There have been plans to switch gas boilers to heat pumps in the EU. Therefore, there is a good potential that Chinese heating appliances are here to stay in Europe.

Author: Regina Sukwanto