As coffee and milk tea brands saturate China’s first- and second-tier cities, beverage players are finding their next growth frontier in emerging-tier markets. Emerging-tier cities (tiers 3–5), home to over 70% of China’s population, are now driving new consumption patterns shaped by affordability, social media influence, and shifting lifestyle aspirations

Competitive landscape

While the top-tier market leans toward premiumization, consumers in emerging cities are fueling a wave of “accessible indulgence,” blending affordability with emotional satisfaction. Local champions like Mixue, Good Me, and Luckin Coffee are capturing these markets through innovative pricing, localized branding, and digital promotions that resonate with youth culture and small-town leisure.

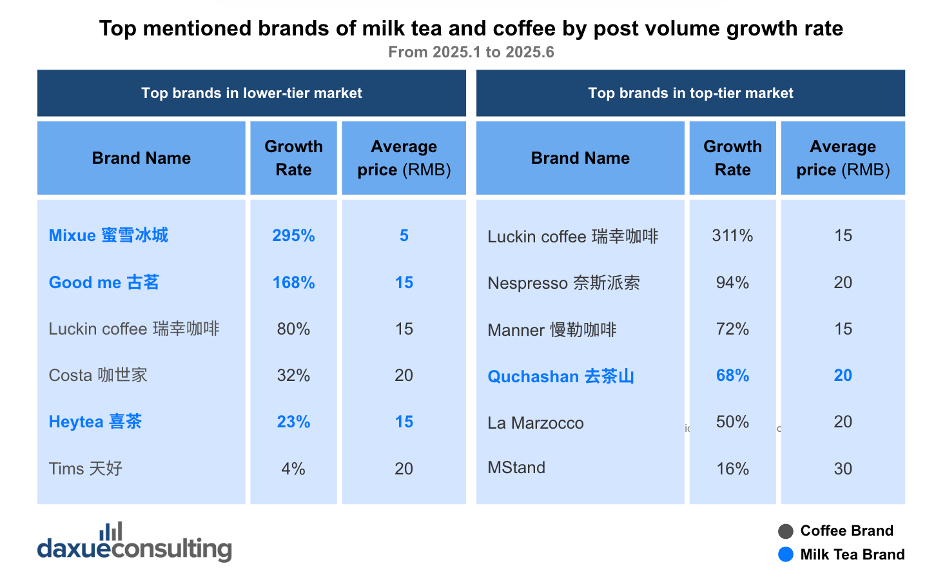

Social listening data from January to June 2025 shows that Mixue, Good Me, and Luckin Coffee dominate beverage discussions in emerging-tier markets, with respective growth rates of 295%, 168%, and 80%. Their products, priced between RMB 5 and 15, fit the affordability sweet spot.

In contrast, Costa, Heytea, and Tims, positioned at RMB 20 and above, struggle to gain similar traction. The same trend reverses in top-tier markets, where Luckin, Manner, and Nespresso outperform due to their premium positioning and association with coffee culture.

Coffee vs. milk tea dynamics

Milk tea dominates, coffee gains ground

In emerging-tier cities, milk tea remains the undisputed leader, driven by affordable pricing (RMB 5–10) and sweet, high-value formulations. Popular brands like Mixue and Good Me cater to younger consumers with high-sugar, flavored drinks that deliver both taste and emotional comfort.

At the same time, coffee is in its early adoption phase, supported by rising aspirations toward modern and “sophisticated” lifestyles. Chains like Luckin Coffee are introducing entry-level coffee products (RMB 8–15) to bridge the affordability gap. These include reformulated low-calorie options and latte variants that strike a balance between indulgence and perceived health benefits.

Top-tier contrast: coffee as a lifestyle symbol

In contrast, consumers in first- and second-tier cities (with a price range of RMB 15–30) exhibit a dual preference for both coffee and milk tea, with an emphasis on premium coffee beans, specialty brewing, and social identity. Consumers in these markets are willing to pay a “social capital premium” for brands like Manner and MStand, which align with identity expression, aesthetics, and culture.

Evolving consumer psychology in emerging-tier cities

Affordable indulgence as emotional reward

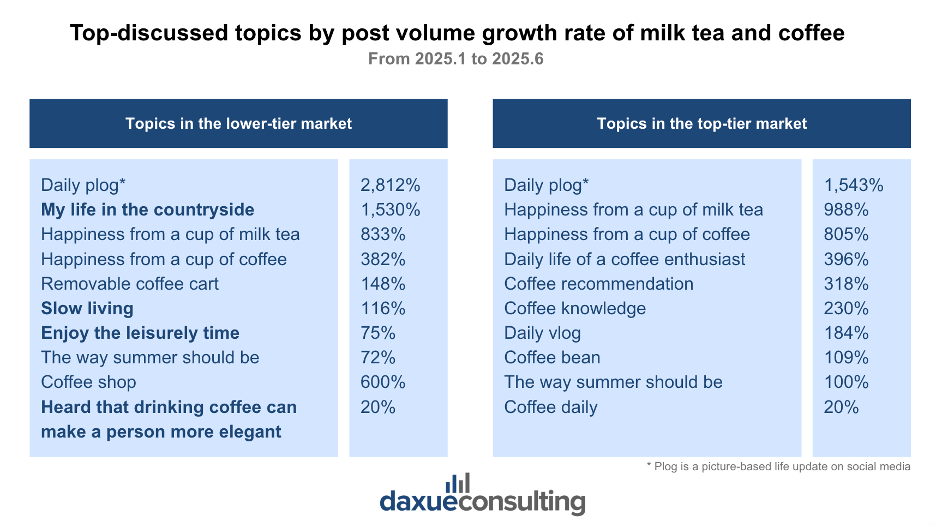

Emerging-tier consumers view beverage purchases not just as consumption, but as an affordable form of self-care. A cup of milk tea or coffee becomes a daily mood enhancer — a tangible expression of relaxation and optimism. On social media, terms like “enjoy the moment” and “slow living” dominate user narratives.

As shown in Daxue Consulting’s analysis, the topic “Happiness from a cup of milk tea” recorded an 833% growth rate, reflecting the association between drinks and joy, as well as lifestyle escapism. Similarly, “My life in the countryside” saw over 1,500% growth, signaling pride and contentment in small-town living, where beverages are part of leisurely self-expression rather than a display of status.

Trend-driven, less brand loyalty

Chinese consumers in emerging-tier cities tend to prioritize novelty, such as new flavors, packaging, and celebrity endorsements, over brand consistency. This “trend-driven loyalty” rewards brands that refresh campaigns frequently and maintain visibility on fast-cycle social platforms.

How Good Me captures emerging-tier consumers

Conqueror of both milk tea to coffee

Known for its milk tea, Good Me (古茗) has strategically entered the coffee market to expand its audience. Instead of launching a risky, innovative formula, the brand replicated Luckin Coffee’s best-selling coconut latte, repositioning it as the “Good Light Coconut Latte” priced at RMB 8.9. The product’s success lies in its accessibility: free coffee bean upgrades, low calories, and popular flavors that resonate with cost-conscious young consumers.

Marketing with a relatable aspirational edge

To elevate brand perception without alienating its price-sensitive base, Good Me collaborated with actor Daniel Wu, whose international image and bilingual appeal framed coffee as both trendy and attainable. The humorous TV spot “Daniel Wu Names Good Me Coffee” achieved over 55k likes, reinforcing the brand’s message of “common yet high-quality coffee” for everyday consumers.

Promotional campaigns that drive viral engagement

Good Me’s promo code campaign, which offered limited-time discounts and daily phrase challenges, generated massive participation online. The campaign’s design gamified savings, tapping into the discount sensitivity of emerging consumers while amplifying engagement across social platforms.

Decoding success in China’s emerging-tier beverage boom

- Price is non-negotiable. The sweet spot lies between RMB 5–15, where emotional satisfaction meets affordability.

- Campaigns using relatable humor or regional culture resonate more than globalized aesthetics.

- Emotional storytelling drives conversion. Brands that turn drinks into moments of happiness win both attention and repeat purchases.

- Agility is the new brand equity. Frequent flavor launches, influencer tie-ins, and interactive campaigns are crucial to maintaining relevance.