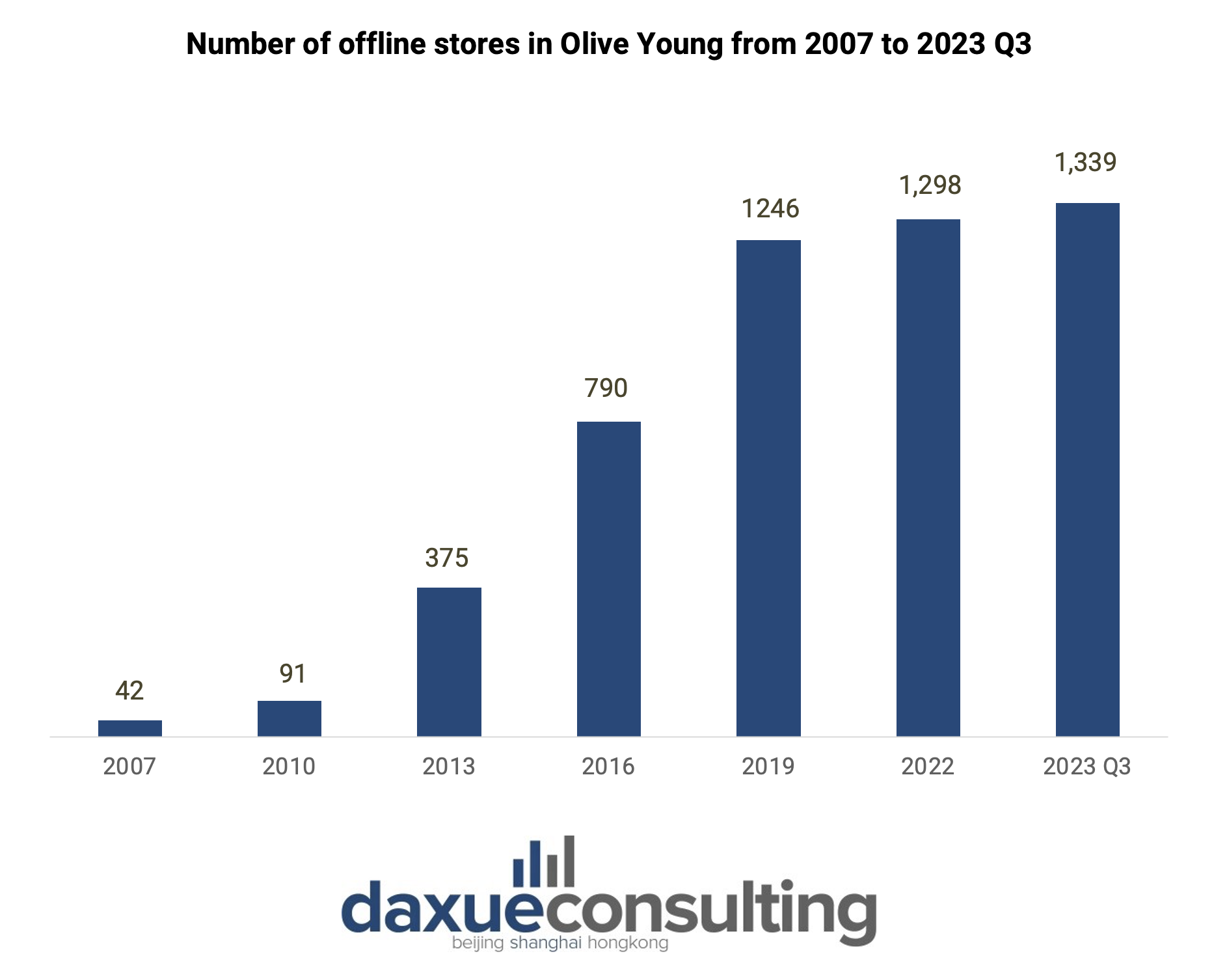

Similar to the global cosmetic store Sephora, Olive Young stands as the foremost health and beauty retailer in South Korea, boasting 1,339 offline stores in 2023. In contrast to Sephora’s focus on cosmetics and beauty accessories, Olive Young sets itself apart by not only prioritizing cosmetics but also offering a wide range of health and wellness products.

Read our Korea’s MZ Generation report

Benefiting from a diverse product range and an expansive store network, Olive Young in South Korea has witnessed a substantial boost in revenue. Within just three quarters of 2023, it surpassed its total revenue of USD 1.6 billion in 2022, underscoring its robust performance and market prominence.

Olive Young’s dominance in South Korea

Olive Young, a leader in the domestic health and beauty store industry, made its debut in 1999 as a drug store. Faced with South Korea’s strict regulations on medicine, it shifted its focus to cosmetics and added health and wellness products. This pioneering move, offering both beauty and health and wellness products under one roof, played a pivotal role in shaping the health and beauty store industry in South Korea. Rapidly expanding its offline stores and launching various online services, Olive Young quickly established dominance in the industry.

Olive Young’s competitors like Lalavla of GS retail and LOHB’s of Lotte withdrew from the industry in 2022. This left only noteworthy competitors, Chicor of SSG and Sephora of LVMH. This shift in the competitive landscape has had a significant impact on Olive Young’s market share in the health and beauty market. Its market share surged from 50.5% in 2020 to 71.3% in the first half of 2022. The widening gap between Olive Young and its competitors signals a transformation from market dominance to potential monopoly in the industry.

Reasons for Olive Young’s popularity

Olive Young’s success is mainly due to its first-mover advantage and strategic expansion. Pioneering the industry, Olive Young strategically expanded by placing its offline stores in densely populated areas, targeting young female students as their main consumers. However, the brand’s success is not solely reliant on its first-mover advantage and strategic expansion. The brand’s wide product variety, omnichannel experience, and foreigner-friendly strategies have also contributed to its success.

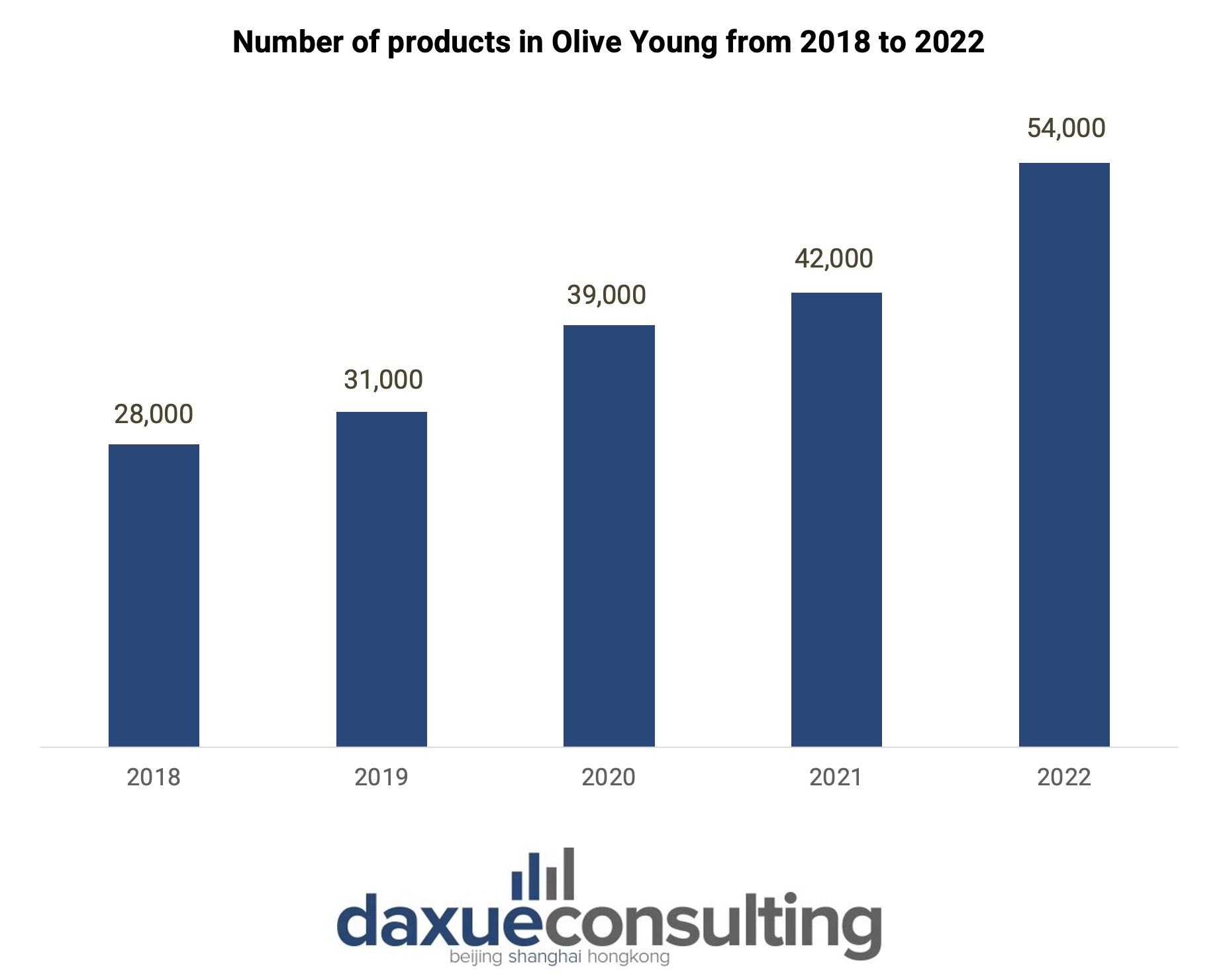

Olive Young in South Korea provides wide product variety to the consumers

Olive Young is renowned for its product variety, providing a variety of choices not only in cosmetics and skincare but also wellness. This allows consumers to compare products from different brands conveniently and make holistic beauty purchases in one place. To maximize the strength of its product variety, Olive Young has continued to expand its offerings, increasing from 28,000 products in 2018 to 54,000 products in 2022. In addition, Olive Young actively seeks out lesser-known brands that offer quality products, and provide the products with affordable price to the consumers.

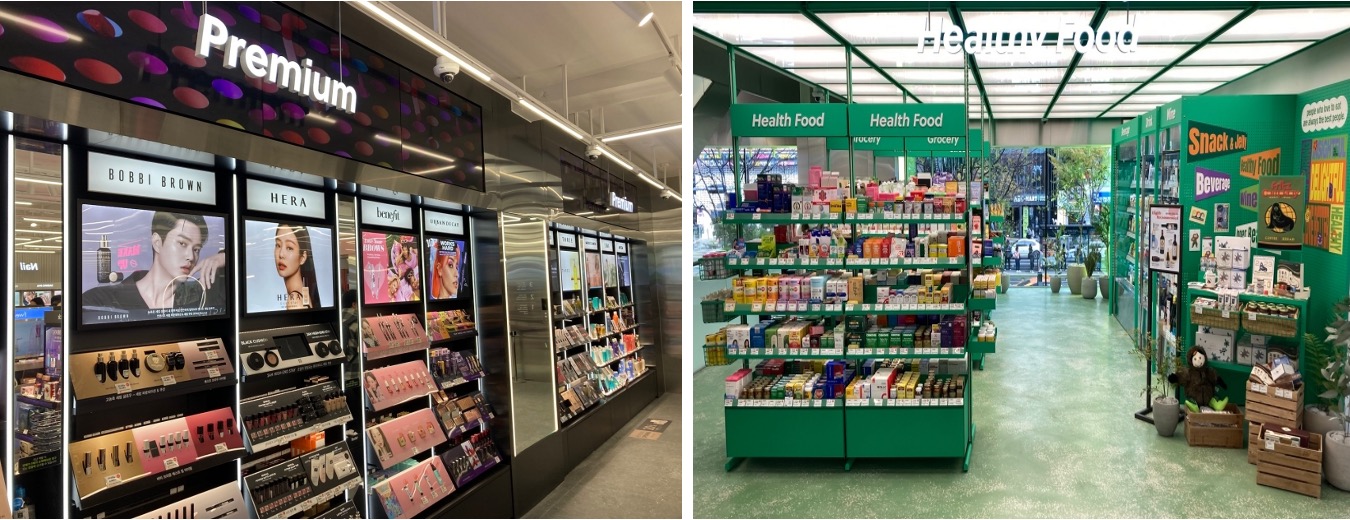

Beyond catering to a broad market, Olive Young also sells luxury products. Olive Young’s premium cosmetics sales have increased by 36% from 2021 to 2022. Moreover, followed by MZ Generations’ increasing demand for luxury cosmetic products, Olive Young opened its online premium cosmetic shopping mall “Luxe Edit (럭스에디트)” in 2023, with a focus on selling small luxuries.

Olive Young’s effort in strengthening omnichannel experience

As the pioneer of domestic health and beauty stores, Olive Young secured industry dominance through rapid offline store expansions, complemented by a robust online presence. This dual approach significantly enhanced its omnichannel experience.

Leveraging its extensive offline network, Olive Young launched the “same day delivery (오늘드림)” service in 2018, allowing consumers to receive their orders on the same day. This initiative not only showcased the brand’s commitment to convenience but also marked a significant step in enhancing the overall customer experience.

Furthermore, Olive Young developed a comprehensive online shopping platform and application. These platforms enable consumers to access diverse services, such as daily discounted products and best-selling items for each offline store online. These efforts aim to enhance consumer convenience and bridge the gap between the online and offline shopping experiences.

To further strengthen consumers’ omnichannel experience, Olive Young has renovated its offline stores for better in-store experience. 88 offline stores have been renovated in the first half of 2022, and more stores are expected to be updated in the future. Notable among these is its remodeled store in Gangnam. This store features specialized sections for the healthy food market and strategically categorizes sectors that align with trending cosmetics categories like clean beauty, vegan products, and premium sectors.

Capitalizing on spread of K-beauty

With the global spread of Hallyu, Korean style of makeup and skincare gained popularity among international audiences. Catching the trend, Olive Young started to focus more on targeting foreign customers. Its flagship store in Myeongdong, a popular tourist destination, was remodeled into a foreigner-friendly store. Given that 90% of Myeongdong flagship store’s consumers are foreigners, the store provides tax refund services for foreign consumers. It also introduces products in English, Chinese, and Japanese.

Moreover, Olive Young Global, Olive Young’s online shopping platform for global customers, provides delivery services to consumers in over 150 countries. The revenue on the global platform continues to increase, increasing by 80% from January to October 2022 to the same period in 2023. Products that gained popularity on the global platform also have the chance to be sold in Korean online stores. Brands like “Skin1004 (스킨 1004)” and “Beauty of Choson (조선미녀)” gained popularity among foreigners through Olive Young Global first before being launched in Korean online and offline stores.

Key takeaways on Olive Young in South Korea

- Olive Young, boasting 1,339 stores in 2023, dominates South Korea’s health and beauty store market.

- With competitors withdrawing, Olive Young faces little competition.

- Olive Young’s success hinges on a strategic first-mover advantage, an omni-channel experience seamlessly supported by both online and offline stores, and diverse array of product offerings.

- Olive Young is renowned for offering a wide variety of products, including those from lesser-known brands. The brand has also expanded its luxury portfolio with the introduction of Luxe Edit in 2023.

- Responding to the increasing popularity of K-beauty, Olive Young launched global mall and a foreigner-friendly store in Myeongdong to target global consumers.