Most Chinese dishes use more cooking oil than western ones. However, different regions of China have different cooking oil consumption habits. Currently, this market is controlled by big companies and WFOEs which build up enormous market share in previous years. The world’s second largest economic entity transferred from the largest producing country to the largest importing country just in just 6 years. The cooking oil market in China was worth 250 billion USD in 2019.

Overview of the cooking oil market in China

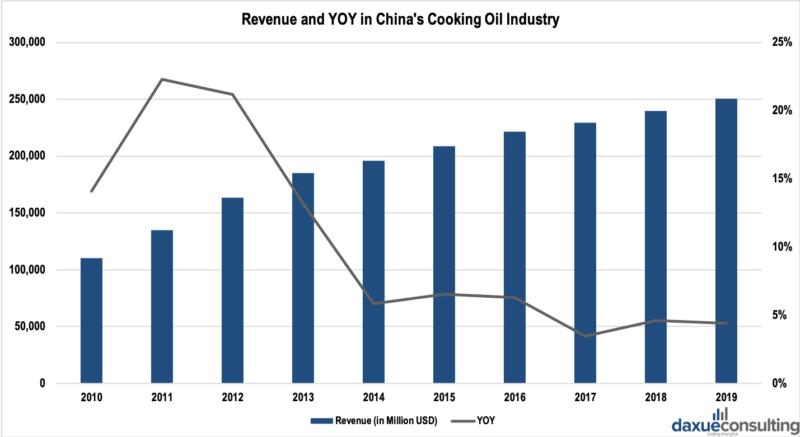

Revenue of the cooking oil market in China: Growth is slowing

According to IBISWorld, as the country has changed its economic focus from exports to domestic demand and increased living standards, consumption of cooking oil in China is expected to maintain a strong growth trend over the period. The revenue of the cooking oil market in China is growing 4.4% YOY. Over the past five years, revenue has risen at an annual 5.1%, meaning revenue will be over 260 billion USD in 2020.

In the upcoming 5 years until 2024, total industry revenue is expected to increase at an annual 3.8% and reach 301.9 billion USD. Due to the over-production of cooking oil in the previous five-year period, the revenue growth in the following years is forecasted to be slow. The main drivers of industry revenue growth over the five years through 2024 are expected to be the gradually growing demand from catering industries and the food sector. Further popularization of small-package cooking oil, rising global demand for biological diesel oil and competitive pricing levels are also projected to facilitate the industry revenue growth over the period.

[Data source: IBISWorld, ‘Revenue and YOY in China’s Cooking Oil Industry’]

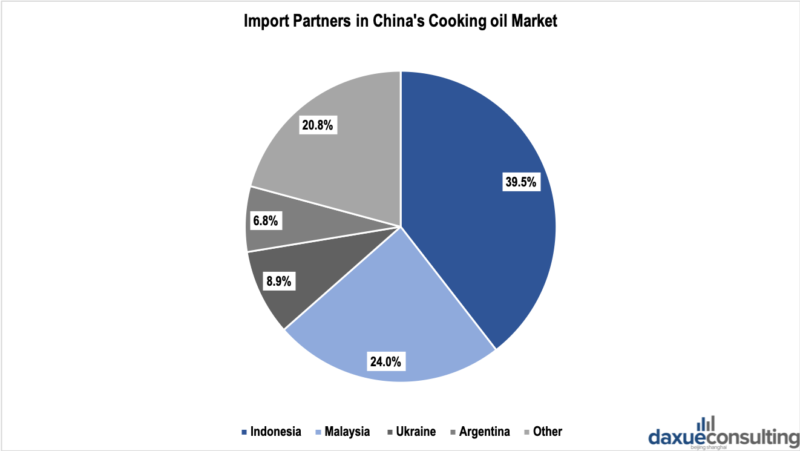

Import pattern in China’s cooking oil market: dominated by Indonesia and palm oil

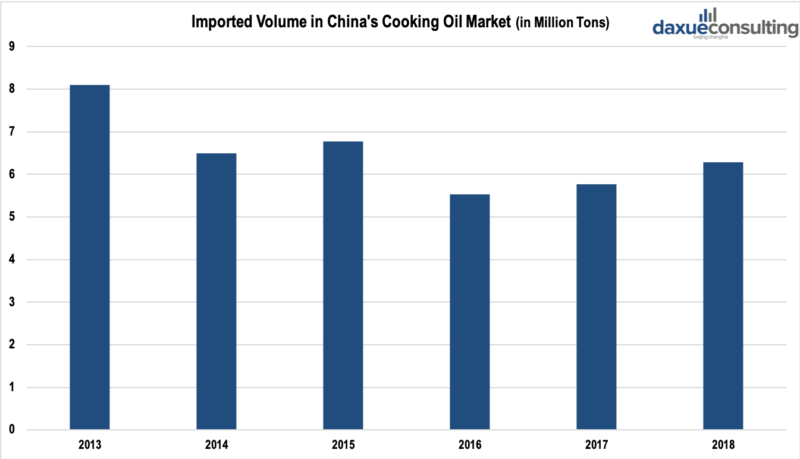

The imported volume has been fluctuating

According to IBISWorld, in 2018, the liquid palm oil was the main imported product in China’s cooking oil market. Followed by soybean oil and rapeseed oil. These are mainly imported from Southeast Asia and South America. Palm oil is an entirely imported product. In 2018, imports decreased by 1.6% to 8.3 billion USD in comparison with the previous year.

The major import partners in China’s cooking oil market were Indonesia, Malaysia and Ukraine, in total they accounted for 72.4% of total imports in 2018.

The Chinese government canceled import quotas of soybean oil, palm oil and rapeseed oil. Instead, it implemented a general tariff rate of 9% on January 1, 2006, which affected the import significantly.

[Data source: IBIS World, ‘Import Partners in China’s Cooking oil Market’]

The imported volume in China’s cooking oil market had experienced fluctuation from 2013-2018. In 2013, the imported volume was 8.1 million tons. Afterwards, it decreased gradually to 5.77 million tons in 2017. In 2018, there was a slight increase and the imported volume reached 6.29 million tons.

[Data source: iiMedia Research, ‘Imported Volume in China’s Cooking Oil Market (in Million Tons)’]

Chinese soy bean oil production is decreasing

Here comes the crucial time for Chinese cooking oil market as the production quantity of soybeans in Heilongjiang province is getting smaller and smaller, with a 90% decrease between 2006 and 2012. It is reported that over 7 tenths of soybeans are imported compared with high consumption. Statistics show that from January to September in 2005 China imported 1.953 million tons of beans and during the corresponding period in 2011 we did 3.771 million tons. Meanwhile the four big granary, AMD(Archer Daniels Midland), Bunge, Cargill and Louis Dreyfus known as ABCD have the say. However, soy bean oil is still the most consumed cooking oil in China.

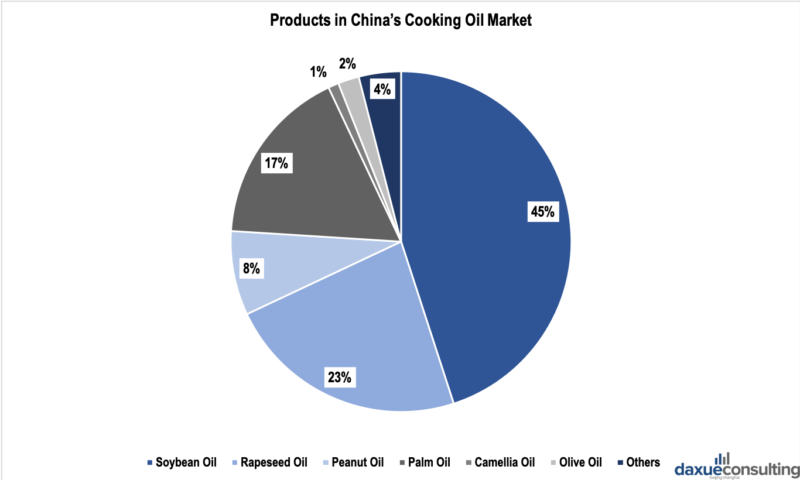

Products in China’s cooking oil market: dominated by soybean oil

[Data source: qianzhan, ‘Products and consumption in China’s Cooking Oil Market’]

Dishes baked or fried in cooking oil are welcomed guests on the tables of Chinese families for all meals in all regions. Chinese people are used to eating vegetable or animal fat and believe they make food more delicious. In the western world, people like eating with palm oil and olive oil, while in China most citizens prefer soybean oil and peanut oil for these raw materials are quite accessible in Mainland of China. Soybeans grow in the north eastern China. Shandong Province, in the North China Plain, is the most appropriate and economical field for peanuts.

What cooking oils do Chinese use?

The cooking oil market in China is comprised of animal oil and vegetable oil the latter one dominate the market.

Soybean oil

The largest industry segment is soybean oil, accounting for nearly half of total industry output. According to IBIS World, faster growth in the consumption of soybean oil in recent years has led to increasing production of soybean oil in the cooking oil market in China.

Rapeseed oil

Rapeseed oil makes up the second-largest segment with 23% of total industry output. According to IBIS World, production of Rapeseed oil in China mainly depend on domestic rapeseed supply, which has been relatively stable in recent years. Owing to a shortage in domestic supply caused by the ongoing low price of rapeseeds, rapeseed oil imports surged in 2007 by more than seven times.

Peanut oil

Peanut oil accounts for 8% of industry output in 2016. According to IBIS World, raw materials for peanut oil mainly depend on domestic peanut supplies. As the planting area of peanuts is limited in China, and the utilization proportion of peanuts for oil crushing is stable (between 60.0% and 65.0%), output of peanut oil is expected to remain stable in future years.

Palm oil

Despite the cheap price and wide application of palm oil, which created growing market demand, China does not produce palm oil.

Production and consumption of cooking oil market in China

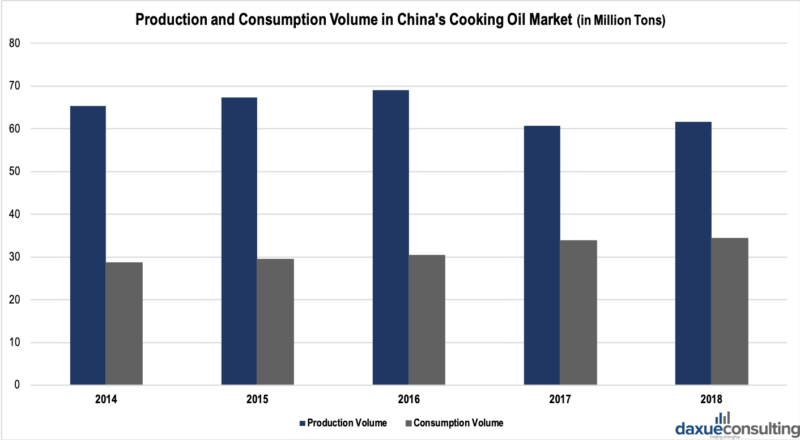

[Data source: qianzhan, ‘Production Volume and Consumption Volume in China’s Cooking Oil Market’]

Even though the revenue in the cooking oil market in China has been increasing at a decreasing rate, the production volume of cooking oil especially vegetable oil in China has been decreasing since 2017. In 2017, the total production volume was 60.718 million tons, which was about 8 million tons fewer than that in 2016. In 2018, the figure experienced a continuous decrease to 61.585 million tons.

On the other hand, the consumption volume of cooking oil especially vegetable oil had a stable increase with 4.54% of YOY on average during the period of 2012-2018. In 2018, cooking oil consumers in China consumed 34.4 million tons of vegetable oil.

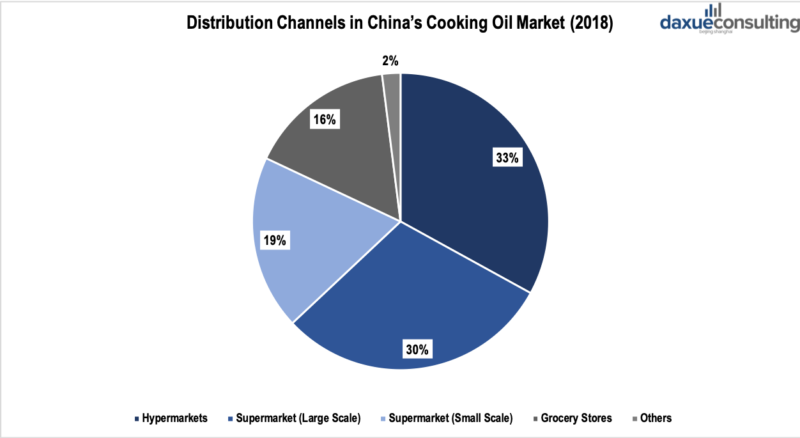

Distribution channels in China’s cooking oil market: dominated by hypermarkets and supermarkets

Hypermarkets and supermarkets (small or large scales) are the major distribution channels in China’s cooking oil market. In 2018, they accounted for more than 50% of the sales volume.

[Data source: Nielson and qianzhan, ‘Distribution Channels in China’s Cooking Oil Market (2018)’]

Future trend in China’s cooking oil market: product and quality matter

Due to diverse consumer preferences, product diversification and quality orientation are the trends in cooking oil industry in China. Well-known brands like Jin Long Yu, Lu Hua and Fu Lin Men, dedicate to develop novel products such as rice oil and camellia seed oil. Lu Hua has improved the quality of its current product, peanut oil by controlling its acid content. It is believed that quality and quantity of products in China’s cooking oil market will become the key drivers of success in this industry.

Secondly, millennial cooking oil consumers in China have facilitated the change in China’s cooking oil market. As more and more Chinese people who were born in the 1980s and 1990s have had their own families, some of them are likely to purchase niche cooking oil in China, such as olive oil, corn oil, and camellia oil. Niche cooking oil will be the profit driver in China’s cooking oil market. Satisfying millennial consumers in China’s cooking oil market will lead to brand success.

Brand analysis in China’s cooking oil market

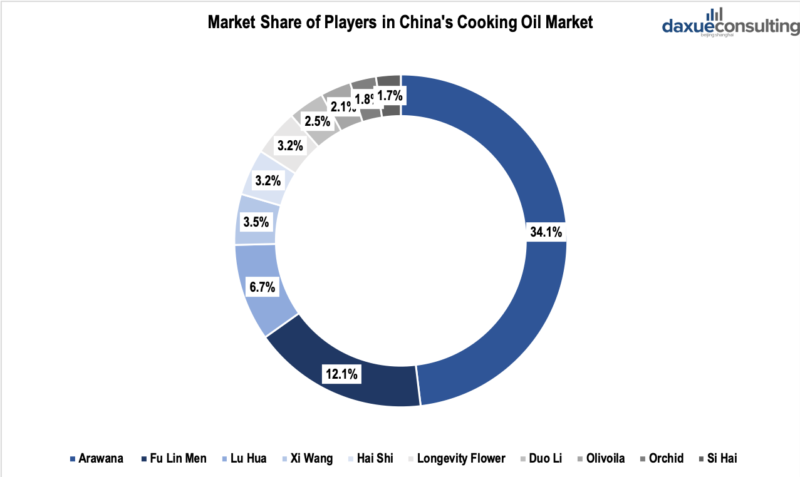

Key players in China’s cooking oil market: high CR4

After years of development, the concentration ratio in China’s cooking oil market has become high with the value of 63.8%. In other words, the top 4 companies, Wilmar International, COFCO, Shandong Luhua and Xiwang Food, are the key players.

Arawana and Fu Lin Men are 2 of the most famous cooking oil brands in China. The former was a brand of Wilmar International while the latter one is a branch brand of COFCO. Those top companies eventually monopolized the entire cooking oil industry. Followed by Lu Hua and Xiwang, the brands of Shandong Luhua and Xiwang Food respectively. In terms of western olive oil, Chinese indigenous brand Duo Li and Spanish brand Lamasia take the lead in the market.

[Data source: qianzhan, ‘Market Share of Players in China’s Cooking Oil Market’]

Wilmar International Limited

[Photo source: Sohu ‘Logo of Wilmar’]

According to IBISWorld, Wilmar International Limited is the largest agribusiness group in Asia. Its major business activities are oil palm cultivation, cooking oil refining, oilseed crushing, consumer-pack cooking oil processing and merchandising, specialty fats, oleo chemical and biodiesel manufacturing, and grain processing and merchandising.

Established in 2006, Yihai Kerry Investments is a subsidiary of Wilmar International and it is China’s largest producer of consumer-pack cooking oils and the largest oilseed crusher, cooking oil refiner and specialty fat and oleo chemical manufacturer. Currently, Yihai Kerry Investments has 48 oil refinery subsidiaries and 10 oil refinery associates in China, and an oil refining capacity of more than 18.3 million metric tons per year.

Its well-known brands are Arawana and Kou Fu. Arawana is a famous cooking oil brand in China and was also the official cooking oil of the 2008 Beijing Olympics.

[Photo source: Yihai Kerry, ‘Logo of Arawana’]

COFCO Group

[Photo source: COFCO, ‘Logo of COFCO’]

According to IBISWorld, founded in 1952, COFCO Group is a leading grain, oil and foodstuff import and export group, and is one of the largest food manufacturers in China. The company is also one of the world’s top 500 enterprises. Fu Lin Men is one of the brand of COFCO. In 1993, the first product was launched in Tianjin.

[Photo source: COFCO Group, ‘Logo of Fu Lin Men’]

Shandong Luhua Group Co., Ltd.

[Photo source: Shandong Luhua Group, ‘Logo of Luhua’]

According to IBISWorld, established in October 1993, Shandong Luhua Group is a private limited liability corporation. Annual peanut oil and sunflower oil productions are approximately 900,000 tons and 100,000 tons respectively. As a result of these, the company is the largest peanut oil extractor in China. Currently, SLG has 200 marketing branches, covering the domestic market. SLG has invested significantly in research and development of different crushing techniques to produce healthier edible peanut oil.

Luhua is the third most famous cooking oil brand in China after Arawana and Fu Lin Men and is the leading brand in peanut oil market, with more than 70% of market share.

Author: Amelia Han

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes