Crowdfunding in China started to develop relatively late compared to the global market: the market size peaked in 2016 with 48,467 successful campaigns in that year. Chinese crowdfunding models include investment-based, non-investment based and integrated crowdfunding. The investment-based crowdfunding model includes equity-based and property-based crowdfunding. Non-investment-based crowdfunding model includes reward-based and donation-based crowdfunding.

How crowdfunding in China differs from the West

China has different classifications for crowdfunding

Property-based crowdfunding has 3 different types: real estate, vehicle, and 3C products, while in Western countries, it usually only includes real estate crowdfunding. Moreover, Peer-to-Peer (P2P) lending is illegal in China whereas it a popular crowdfunding type in other developed countries.

Differences between equity-based crowdfunding and venture capital

Equity-based crowdfunding in China has have more limitations in terms of distribution channels compared to the US, but the entry barrier for crowdfunding investors is much smaller than the entry barrier for venture capital investors.

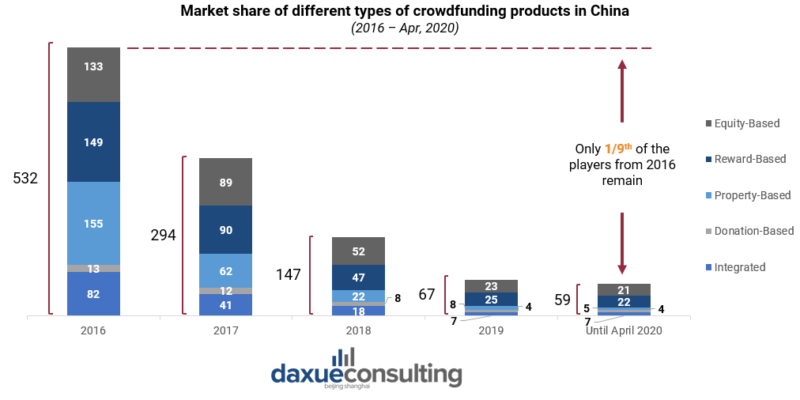

The number of platforms greatly declined over the last four years

Because of tighter regulations as well as the instability and high risk of investing in properties such as vehicles, a large portion of property-based crowdfunding platforms closed down in China. Thus, its market share plummeted significantly over the last five years. By April 2020, there were 59 crowdfunding platforms in China, an 88.9% decrease from 532 platforms in 2016.

Crowdfunding in China: key trends

Three main factors influence crowdfunding in China: new regulations, adjustment with monetary policies and the scale of leading crowdfunding campaigns. China Treasury yields dropped from 3.6% in 2015 to 2.6% in the first half year of 2016, causing large amount of capital seeking for alternative investment methods in the later half of 2016, including crowdfunding. Due to that, total crowdfunding value in China in H2 2017 increased significantly.

Characteristics of the Chinese crowdfunding market

Since China’s government increased screening requirements for investors and crowdfunding platforms, internet giants such as JD and Xiaomi closed their investment-based crowdfunding business in 2017 and shifted the focus of their business to non-investment based and integrated categories.

IP + products are the new hot crowdfunding items

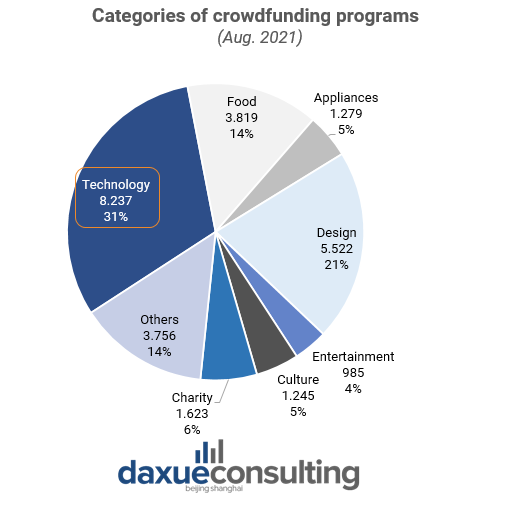

Crowdfunding platforms are focusing more on reward-based crowdfunding due to the strict supervisionand high risksinherent to investment-based crowdfunding. As the main users of online shopping and investment are Gen-Y and Gen-Z who like to follow trends, the timeliness of crowdfunding matches the short burst nature of movies and contemporary trends. Thus, IP products are very popular in reward-based crowdfunding.

The topics about films’ and museums’ periphery, and literatureare the most welcomed by consumers in China. In terms of products, blind boxes, handcraft modelsand cultural creationscater to consumers the best.

Regulations and policies

Crowdfunding platforms’ activities are under the supervision of China’s Securities Regulatory Commission. They have to register under a certain threshold of capital. Besides, public activities are also strictly prohibited on the platforms.

Other requirements include that an equity-based crowdfunding platform must have at least 5 million CNYregistered capital in China and two or more senior managers with 3 or more yearsof working experience in finance or information technology. Number of total investors for each program should be less than 200 and any type of public advertisement is not allowed.

However, there are no specific laws for reward-based crowdfunding, which falls under the application range of Contract Lawand Administrative Measures for Online Trading.

Leading local players and failure cases

JD includes crowdfunding as one of the nine sectors of JD Finance

JD Crowdfunding is an integrated crowdfunding platform established in July 2014 with 21,182 campaigns in total. Investment policies are strict, therefore most crowdfunding campaigns are based on rewards and donations while JD regards it as one of its channels for selling products. Among all projects, the technology category takes the largest share of crowdfunding campaigns.

There are some obvious advantages of JD platform:

- As a crowdfunding platform owned by one of the biggest Internet giants in China, JD crowdfunding has JD Group’s capital and credit endorsement.

- JD Group has its own delivery business, and logistics costs are much cheaper.

- The crowdfunding platform can expend the amount of cash flow of JD’s financial services.

- JD crowdfunding lacks reliable verification and nearly all kinds of vendors can launch a crowdfunding campaign. Thus, it’s difficult to garner consumer trust.

- Many products on JD crowdfunding have already existed on various Chinese e-commerce platforms and JD crowdfunding is often just used as a group buying distribution channelfor cheaper prices.

Crowdfunding in China: Musikid’s failure case

Musikid is a platform that offered a complete service chain of fundamental music agent for musicians. Since Musikid was an independent platform without the backing of big capital and one of its main businesses was offline concerts, it did not survive through the pandemic.

In the beginning of 2020, all outdoor activities stopped suddenly because of COVID-19 lockdowns. Musikid, as an independent vertical field crowdfunding platform, couldn’t bear the losses over months. Therefore, after the scandal of musicians claiming that Musikid failed to pay for their concert revenue, Musikid lost its credibility and left the market.

Chinese business on global platforms

According to President Xi’s speech in August 2021, China will vigorously develop its manufacturing industry. Indiegogo is one of the leading global crowdfunding platforms devoted to bring China’s manufacturing products to consumers on the global market. Compared to traditional B2B exports, manufacturers can receive more active feedbacks on their products from both consumers and the market via crowdfunding services. It opened its China branch in Shenzhen in 2016. China is now the company’s fastest-growing market accounted for over 40% of the campaigns that raised 560 million CNY in 2020. From 2016 to now, Indiegogo China has raised over 2 billion CNY. Indiegogo is committed to help Chinese companies debut new products through crowdfunding, and over 350 Chinese companies have succeeded with Indiegogo. Consequently, products from China have raised close to 20 million CNY over the past four years.

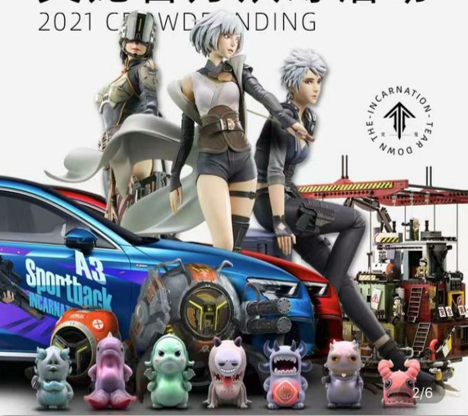

Best practices and implications of crowdfunding in China: Incarnation case

Incarnation is a domestic 3D animation of a Chinese traditional story. Along with the final episode of the first season released a range of IP derivatives. Incarnation‘s crowdfunding campaign reached 16.7 million CNYin just one month, which was 16%of the original planned fundraising goal, creating a new record for a crowdfunding campaign around a domestic project.

Incarnation is co-produced by Bilibili and YHKT Entertainment. Since its launched on Bilibili, Incarnation’s rating has been as high as 9.6, and the number of views has exceeded 400 million over two years. The majority of Incarnation’s audience is male. Therefore, Bilibili and YHKT Entertainment designed a garage kit as a reward for their crowdfunding campaign.

Targeting Gen-Z in China

Bilibili launched as a video platform catering to Chinese Gen-Z. It adopted anime, gaming, and dancing related videos as its main categories. Due to the high retention and loyalty of Bilibili’s users, the e-commerce section for selling IP-related products and reward-based crowdfunding campaigns was subsequently released.

With China’s economic and technological development, young Chinese people are beginning to feel the rising status of their country around the world, which brings them great pride and a willingness to give their country’s culture and brands more opportunities and a higher desire to buy them.

Gen-Z was the first generation to grow up making purchases online. Therefore, they have a stronger ability to recognize the authenticity of e-commerce products and stronger willingness to purchase online.

Key takeaways from our crowdfunding in China report

- China’s crowdfunding market started ten years later than those of developed countries. Crowdfunding is separated into three categories in China: investment-based crowdfunding, non-investment-based crowdfunding, and integrated crowdfunding. In between, investment-based crowdfunding platforms have different classifications when compared with other countries.

- Most investment crowdfunding platforms have transformed into non-investment crowdfunding because of strict recent regulatory measures. The primarily targeted consumers in China are the post-90s, and the characteristics include group buying and IP products. Many leading non-investment and integrated crowdfunding platforms are generated by domestic Internet giants.

- Yet because of the wild growth, the market declined at a fast pace. As of 2020, only 1 out of 9 players remained in the market. The Chinese government introduced regulations after the regular occurrence of financial fraud. Consequently, market share switched from property and equity-based crowdfunding to reward and donation-based platforms.

- The top 5 local players have successfully raised 16 million CNY in one month, including Xiaomiyoupin, Suningzhongzhou, Zaodianxinhuo, Modian, and JD Finance. Most of their crowdfunding projects are based on rewards or donations.

- Indiegogo and Kickstarter, both being global leading crowdfunding platforms, have designed their China offices with the ambition of introducing domestic manufacturers to the overseas market.

- As an anime video platform, Bilibili found the business opportunities to have an in-app e-commerce platform targeting fans to sell IP derivatives and raise IP crowdfunding projects. Alibaba-funded Zaodianxinhuo is a reward-based crowdfunding platform that launched rural revitalization projects.