In China’s dynamic e-commerce landscape, Dewu—also known as Poizon—has emerged as a leading platform among Gen-Z consumers. Launched in 2015 as a sneaker authentication service under the name “毒” (Poison), it has since developed into a social commerce platform that integrates shopping with community engagement and trend-driven content. Dewu in China has established itself as the fourth-largest e-commerce platform, with 88 million monthly active users (MAU) in March 2024, a year-on-year increase of 17.3%, trailing only the giants Taobao, Pinduoduo, and JD.com. Its unique “authenticate first, ship later” model, meaning items are first thoroughly verified for authenticity and quality by professional teams before being shipped to buyers to ensure genuine products, has not only built unprecedented trust in a market plagued by counterfeits but has also created an entire ecosystem where shopping, socializing, and status-signaling converge.

Download our report on the rise of Chinese luxury brands

The Dewu difference: A business model built on trust

At its core, Dewu operates on a C2B2C model that fundamentally differs from traditional e-commerce platforms. The product is first shipped to Dewu’s sprawling 12,000-square-meter Shanghai Quality Assurance Center. Teams of authenticators examine each item using a combination of AI-powered image recognition, blockchain verification, and human expertise.

- Physical Inspection: Checking for manufacturing flaws or signs of wear

- Authentication: Cross-referencing with databases of genuine products

- Documentation: High-resolution photography and detailed reports

- Packaging: Securing items with Dewu’s signature “anti-counterfeit four-piece set” (certificate, security tag, branded box, and sealing tape)

This meticulous approach has made Dewu the default platform for China’s gray market. In 2023, the number of merchants on Dewu with annual sales exceeding RMB 100 million increased by 70%, highlighting the platform’s growing commercial scale and appeal to high-performing sellers.

Origins in sneaker culture, rooted in authenticity

Dewu’s origin story is deeply rooted in China’s burgeoning sneaker culture. Founder Yang Bing, previously a co-founder of the sports community platform Hupu (虎扑), recognized the need for a trustworthy authentication service after observing rampant counterfeit sales in online sneaker communities. The platform’s early success came from addressing this pain point, with its “过毒” (passed Poison) verification becoming the gold standard for authentic sneakers.

Rebranding into a lifestyle empire

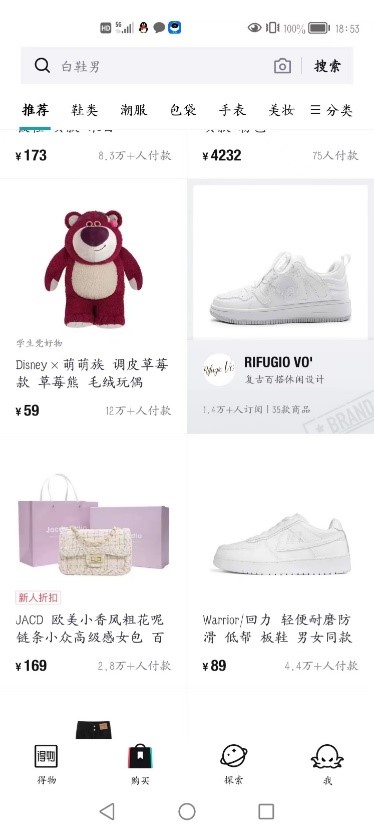

In 2020, the platform rebranded as “得物” (Dewu, meaning “obtain things”), signaling a strategic shift from a niche authentication service to a full-scale lifestyle shopping destination. Today, Dewu’s product categories read like a Gen-Z wish list: limited-edition sneakers, designer collaborations, anime merchandise, high-end skincare, and even astronaut-themed jewelry that sold out within hours of China’s space station milestones. This diversification has been crucial to maintaining growth as the initial sneaker resale frenzy has cooled. It also reflected Dewu’s effort to serve the broader lifestyle interests of young Chinese consumers, who have consistently shown demand for trend-driven products beyond sneakers—such as streetwear, luxury goods, beauty, and Guochao (国潮) domestic brands.

Dewu’s expansion underscores how consumer trust, especially in an environment plagued by Chinese counterfeit products, can be leveraged to grow beyond niche categories into a comprehensive shopping experience. While it broadens access and visibility among Gen-Z consumers, it also risks undermining official retail pricing and distribution strategies, forcing global luxury houses to rethink their approach to gray markets and parallel imports in China.

However, Dewu’s attempts to expand into everyday product categories have faced challenges. Without the authentication-driven appeal that underpins its sneaker and luxury segments, the platform struggles to compete with giants like Taobao and Pinduoduo on convenience or price in the commodity space, where those rivals hold tighter supply chain control. At the same time, Dewu’s popularity as a resale hub for luxury goods—often sourced abroad by Daigous (代购) and sold at lower prices—poses a complex challenge for luxury brands.

The Gen-Z playbook: How Dewu wins young consumers

Dewu’s mastery of youth marketing manifests in several key strategies: by deeply understanding the unique preferences and behaviors of Gen-Z, Dewu expertly combines other common features such as innovative product offerings, engaging social interactions, and targeted marketing campaigns. These approaches not only capture the attention of young consumers but also build strong brand loyalty, positioning Dewu as a go-to platform for the next generation of shoppers.

Community-driven commerce

The platform leverages user-generated content (UGC), with shoppers posting detailed reviews, outfit inspiration photos, and unboxing videos. These authentic peer recommendations are creating a virtuous cycle, where popular items gain social proof and become even more desirable, and the increased popularity in turn encourages more users to contribute UGC, continuously fueling the growth of both the products and the platform.

Challenges in the authentication paradise

Authentication controversies

The platform’s reputation suffered after a high-profile 2021 incident where it disputed the authenticity of a Gucci belt purchased from rival platform Vipshop. After a consumer who bought the belt on Vipshop obtained a Dewu authentication result deeming it counterfeit, a public dispute erupted, with Vipshop steadfastly maintaining the item’s genuineness and providing supply chain certification and third-party inspection reports. However, subsequent legal rulings in related consumer lawsuits favored Vipshop, as courts questioned the validity of Dewu’s authentication qualifications and procedures. This outcome not only fueled widespread public skepticism about Dewu’s verification standards and reliability but also cast a lasting shadow over the platform’s credibility in the market.

Return policy backlash

Strict return policies have drawn ire. Multiple users report rejected returns for “unopened” items, with some alleging platform staff caused damage during inspections. The requirement to pay 10 to 30% “depreciation fees” on refused returns has sparked social media outrage.

Beyond China: Dewu’s push for global market share

The international expansion, currently testing in South Korea, Japan, and the United States, aims to replicate the authentication model abroad. Early challenges include building credibility with global brands and competing with established players like StockX in ways like focusing on curating hype products tailored to regional tastes while maintaining its multi-step authentication process. The company held a seller summit and business briefing in Seoul, launching large-scale merchant recruitment. POIZON has established a Korea division and opened a logistics center in Incheon, forming part of its global network that includes hubs in New York, Milan, Tokyo, and Hong Kong. In Korea, POIZON offers a hybrid model combining self-operated and marketplace features, allowing sellers to list products without running a storefront or customer service, with flexible settlement options and no pre-purchase requirements, lowering the barrier for local brands to join the platform.

The blueprint for Gen-Z commerce

- Dewu’s authentication model underscores that Gen-Z consumers in China value authenticity and transparency. Their shopping behavior is shaped not only by trends and status but also by a desire for safe and social shopping experiences.

- UGC and KOL seeding drive Dewu’s most successful launches. Traditional marketing takes a backseat to organic peer recommendations.

- Limited editions and platform-first releases generate disproportionate buzz, with exclusive inventory drops contributing to engagement and sales momentum.