Even before the COVID-19 pandemic, Chinese businesses have been undergoing remarkable digital transformation. However, over the course of the pandemic, and in part due to the Zero-COVID policy, many industries began further digitalizing their business practices. This digitalization in China has been especially apparent over the course of the recent 2022 Shanghai lockdowns that took place from March to early June of 2022. Chinese consumers were forced to remain at home, leading to a drastic change in consumer habits.

During the lockdowns, Chinese consumers sought out sources of entertainment, well-being, and commerce that could be accessed from the comfort of their own homes. Our team at daxue consulting expects that certain key consumption trends will continue post-lockdowns, leading to a digital transformation in a few industries, including online entertainment, eCommerce, groceries/food delivery, and digital healthcare.

A surge in interest in video games due to recent lockdowns

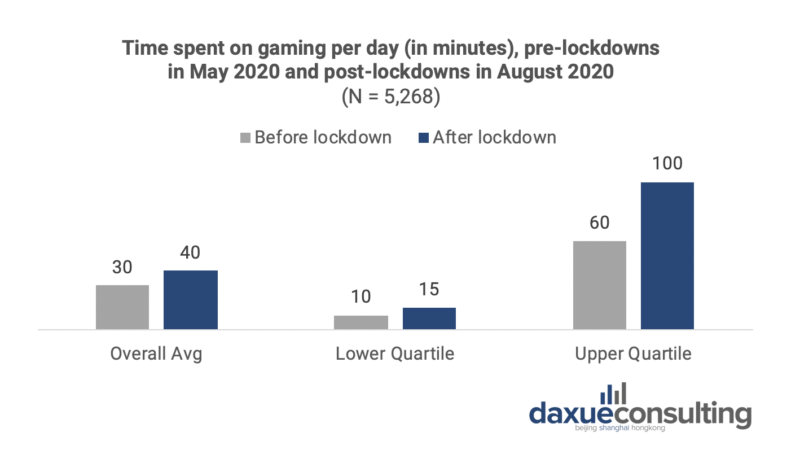

Being stuck inside their homes, Chinese consumers’ interest in video games saw a drastic increase over the course of the recent Q1 2022 lockdowns. Today, as the lockdowns in Shanghai have been lifted, Chinese consumers are spending significantly more time on playing video games and watching gaming content online.

According to a study published in 2022, the median age of video game players in China is around 27 years old, with 52.6% being male. However, female students in their 20s were actually the most likely to spend more time gaming post-lockdowns compared to pre-lockdowns. Overall, we expect that the recent March to May lockdowns in Shanghai will significantly increase the gaming time of Chinese consumers between the ages of 18-30.

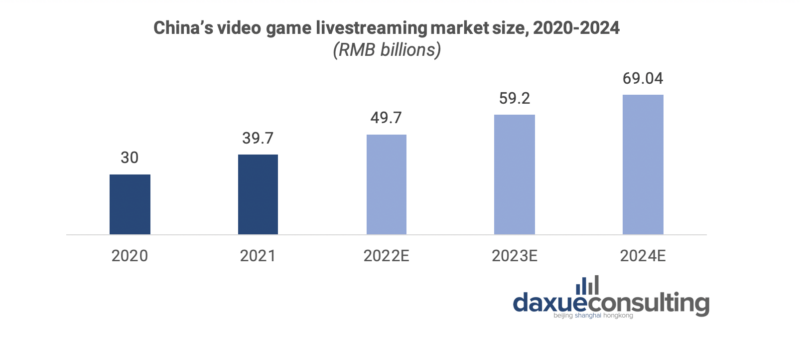

Increased monetization in video game livestreaming

Furthermore, Chinese consumers are increasingly willing to pay for additional services on livestreaming platforms, driving growth in the video game livestreaming market. As a result, China’s video game livestreaming market size is expected to reach close to 50 billion RMB (7.45 billion USD) in 2022.

This increased monetization of video game livestreaming has led to an increase in the Chinese video game livestream market size. These monetization businesses can include live commerce, cloud gaming, and paid livestreaming, which grew due to Chinese customers’ increased willingness to pay for such products and services. The leading video game livestreaming platforms in China by Monthly Active Users (MAU) include Huya Live, with 27 million MAU, and Douyu Live, with 22 million MAU.

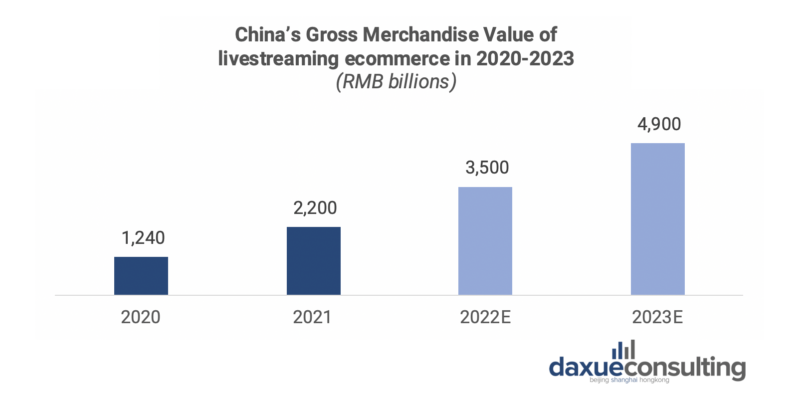

Changes in eCommerce livestreaming

Demand for eCommerce in China vastly outweighed the supply during the recent Shanghai lockdowns, due to strict anti-pandemic measures. We expect a surge in eCommerce spending in the near future as Chinese consumers seek to return to their pre-COVID consumption levels. Particularly in Shanghai, the severe slowdown of eCommerce consumption is expected to result in accumulated demand. Ultimately, China’s livestreaming eCommerce market is expected to grow substantially between 2021 and 2022.

Chinese consumers are highly engaged in interactive digital marketing campaigns

The “520” holiday in 2022 showcased a variety of highly digitalized and interactive marketing campaigns, such as IP collaborations, and the use of NFTs. This showcases the digitalization trends in digital marketing, and that Chinese consumers love engaging digitally with their favorite brands.

Digital IPs like King of Glory have substantial and dedicated fanbases that are very willing to spend on in-game content. In the Amiro X V&A museum collaboration, the V&A museum’s brand connotes sophistication, artistry, and design to consumers, elevating the Amiro brand through collaboration.

Another example, Balenciaga, Lancôme, and Lyfen, all sold NFTs for the “520” event. This suggests existing brands can design and sell their own NFTs to capture this growing market, as there is demand regardless of the brand’s industry.

The emergence of Key Opinion Consumers (KOCs)

Chinese consumers are also augmenting their eCommerce spending habits. During the 2022 lockdowns in Shanghai, Chinese consumers enjoyed livestreaming in the form of ”social commerce”, which refers to eCommerce where online interaction drives sales. As people were deprived of social interaction during the lockdowns, consumers have become more eager to directly interact with streamers and brand ambassadors.

The profiles of eCommerce ambassadors in China have also changed. While high-profile KOLs are a major aspect of consumers’ spending decisions, Chinese consumers increasingly look for opinions from fellow consumers when evaluating their next purchase. Livestreams with KOCs, or Key Opinion Consumers, became prevalent over the course of the 2022 Shanghai lockdowns. KOCs can range from someone’s close friends to their entire local community, but unlike sponsored KOLs and brand ambassadors, KOCs are not paid to promote products.

Return of online grocery shopping

Chinese consumers that struggled to fulfill basic needs under the lockdowns will become more conscious of their access to food. This was also highly apparent in the 2022 lockdowns in Shanghai, where many people expressed great difficulty in obtaining sufficient food, with the only way being through grocery deliveries.

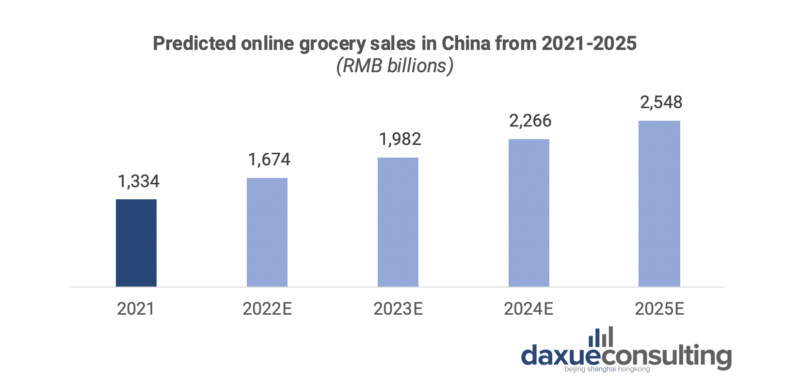

Therefore, we expect that Chinese consumers are now likely to purchase more groceries online. The zero-COVID policy means that strict anti-pandemic measures may be implemented again, leading to an ever-present risk of restricted movement and slowed supply chains. To consumers, purchasing groceries online is the safer and more reliable method of getting food.

Accumulated demand for takeaway services

In the same vein, the demand for takeaway services after lockdowns will be immense. This is once again due to Chinese consumers’ accumulated demand, as people seek out dishes and cuisines, they were not able to have under the lockdowns.

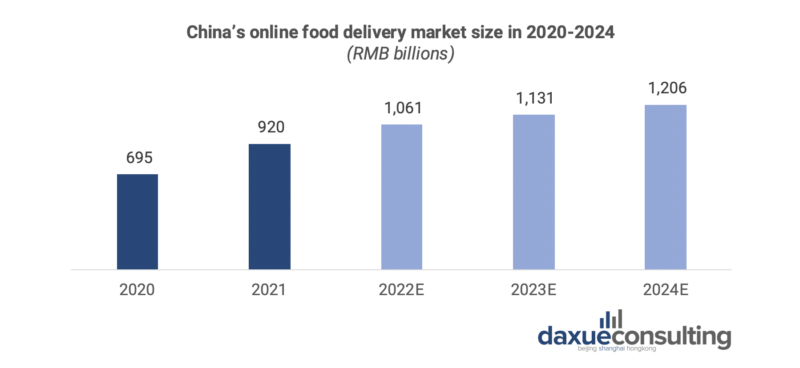

Now, China’s online food delivery industry is not only seeing a steady recovery, but also a digital transformation. For example, the food delivery industry in Shanghai is receiving government support in its digitalization efforts. The Shanghai District Government worked with Tencent to develop an online system on the company’s WeCom platform, helping restaurants connect with professional delivery businesses or arrange their own delivery riders. Therefore, the online food delivery market size in China is also expected to see a jump in 2022 with steady growth onwards.

Digital lifestyle content boomed during lockdowns

To alleviate the boredom and stresses of the comprehensive lockdowns in Shanghai, demand for lifestyle activities, such as fitness and home cooking, exploded during the lockdowns. However, the lifting of restrictions poses both threats and opportunities for these sectors.

Fitness livestreams

One form of lifestyle entertainment that rose to prominence during the Shanghai lockdowns was fitness livestreams. In early 2022, Taiwanese singer Liu Genghong went viral during lockdown with his workout livestream sessions on Douyin (Chinese Tiktok). His livestreams were viewed over 100 million times in total, breaking Douyin’s viewership record for 2022 so far. Liu’s popularity during the lockdowns revealed underlying demand for both fitness and livestreaming content as Chinese consumers are becoming increasingly conscious of their health and fitness.

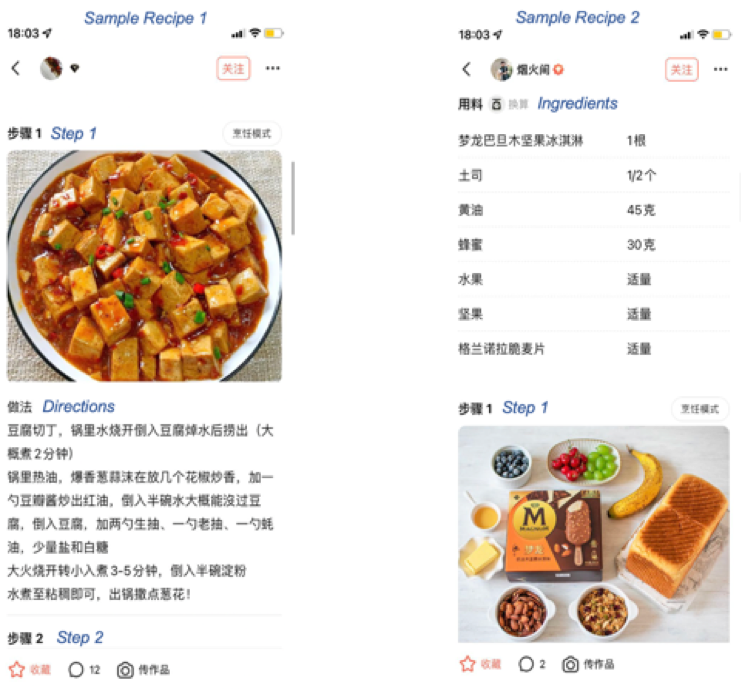

Recipe apps and home cooking

Because of the 2022 lockdowns forcing a stay-at-home lifestyle, Chinese consumers also became highly interested in cooking. Recipe apps were a major hit over the course of the pandemic with Chinese consumers, as cooking became a necessity for those under lockdown. It is also a way to learn a new skill, alleviate boredom, and give people an emotional outlet.

However, when lockdowns are lifted, consumers will begin eating out and buying delivery. This means that cooking-related apps will risk losing consumer engagement as many people will cook less.

However, the lifting of lockdowns will also provide opportunities. Supply chains will recover, and ingredients will be easier to access, making cooking easier and more enjoyable. People may no longer need to cook but may still want to cook. Cooking apps must attempt to convert users who cook out of necessity into hobbyists in order to succeed in the long term.

Some apps risk losing users after lockdowns are lifted

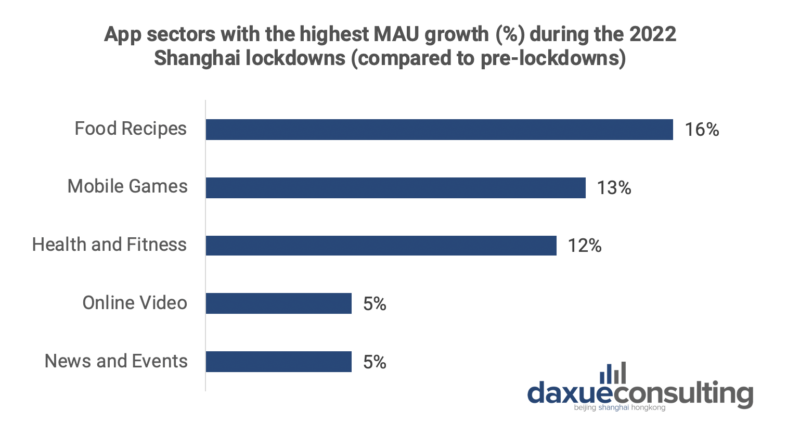

During the lockdowns in Shanghai, there was significant growth in MAU for food recipe apps, mobile games, and health and fitness apps – as these apps helped improve Chinese consumers’ lives or alleviated their boredom under the lockdowns. Their success can be attributed to being the only players in their respective industries during the lockdowns.

Although the number of active app users grew considerably under the 2022 lockdowns, app usage behavior is likely to normalize when the restrictions are lifted. Certain apps may be able to keep their user base, but many others are at risk of losing them. When consumption patterns return to normal, i.e. opportunities for in-person consumption increase, there will be more substitutes available to Chinese consumers.

First, mobile games are expected to be at low risk of losing many users. They are designed to be addicting, and scientific studies have demonstrated that Chinese consumers are spending more time playing video games. Video games are also a source of entertainment without many substitutes, whereas fitness centers are a key substitute for home fitness apps

On the other hand, the health and fitness app sector is expected to be at medium risk of losing user engagement. This category of apps encompasses a wide range of functions, and the risk of user engagement loss depends on the exact function of app.

We expect that home-workout apps, a more niche type of fitness app, are at a higher risk of losing user engagement when gyms and fitness centers resume operation. However, health, nutrition, and workout trackers like Keep and Boohee Health remain crucial to fitness enthusiasts. We believe these types of apps may even see increased usage, as Chinese consumers have become more interested in fitness after the lockdowns.

Finally, food recipe apps are at high risk of losing users. There is currently substantial built-up demand for dishes and cuisines that Chinese consumers were unable to enjoy under the lockdowns. Due to this, we expect that consumers will want to eat out or order delivery in the short term after the lockdowns are lifted and cook significantly less at home.

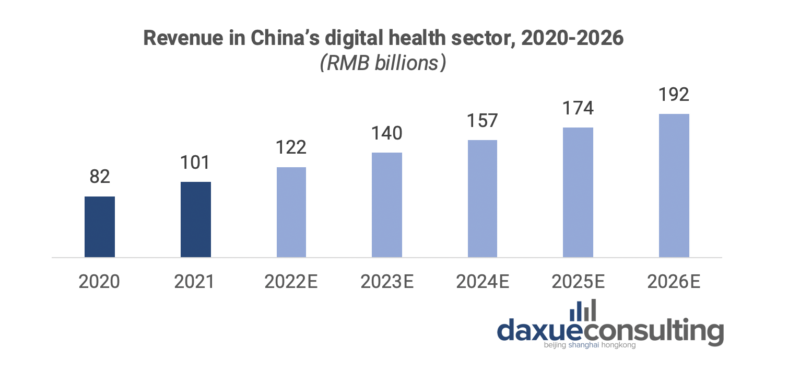

The dramatic rise in digital health and wellbeing solutions

Especially under the zero-COVID policy, digital health solutions became a major market in China. Daxue Consulting expects two areas to be significant in the digital health market. First, online primary care to alleviate overloaded hospitals, and second, AI-powered software that assists and complements healthcare professionals.

First, congestion in China’s large top-tier hospitals provides opportunities for digital primary medical care. For years, China’s largest and most advanced hospitals have experienced overcrowding, since people will visit a large hospital for basic medical issues better suited for primary care clinics. Online medical consultation, telemedicine, e-pharmacy, and OTC drug delivery services can provide unmatched convenience to consumers, solving the key pain point of hospital congestion.

Secondly, COVID accelerated the adoption of AI and data-assisted disease identification and treatment software. AI applications and automated systems were developed to support medical staff in the fight against COVID. This includes temperature-screening systems, health chatbots, and AI-equipped diagnostic assistants, which have significantly improved efficiency in identifying the coronavirus.

For example, Alibaba recently developed the “Medical Brain”, an AI software that helps physicians diagnose and propose treatment options.

Ultimately, AI-powered disease prevention, diagnosis, and monitoring software is expected to be in high demand, especially after the 2022 lockdowns, as China seeks to improve the quality and efficiency of the healthcare system.

Key takeaways from the digitalization in China trends post-2022 lockdowns

- Chinese consumers are expected to ‘revenge spend’ as restrictions ease in the following months of 2022

- Chinese consumers are playing more video games than ever and becoming more comfortable with monetization in video game livestreaming.

- Interactive digital events, brand collaboration events, NFTs/digital asset offerings, and KOCs are successful and emerging trends in the eCommerce business accelerated by the 2022 lockdowns in China.

- The possibility of further anti-pandemic restrictions in the future, given the zero-COVID policy, makes purchasing groceries online the most reliable method for Chinese consumers.

- Demand for takeaway food will grow significantly among Chinese consumers in the near future after lockdowns are lifted, especially in Shanghai.

- Chinese consumers are becoming more conscious of their physical health, making fitness and health trackers a lucrative area as lockdowns are lifted.

- However, recipe apps and online workout apps may struggle to maintain popularity in the long term.

- Digital health solutions will become a major market in China, following two broad directions: online primary care and AI-powered software to help medical staff.