Durex China accounts for a large market share of the promising condom market

When choosing a product once called “an armor against pleasure, and a cobweb against infection,” people tend to go for trusted brands. That is why well-known condoms such as Durex and Okamoto have such huge market shares. Ever since it dntered the Chinese market in 1998, Durex China has become the top condom company. It occupies over 40% market share in the Chinese condom market now. On the other hand, the condom market and the adult toys market in China still have plenty of room for growth. According to the “2017-2022 China Sex Toys Industry Development Prospect Survey and Investment and Financing Strategy Research Report” released by the China Business Research Institute, China’s condom sales will increase from $ 1.9 billion in 2015 to $ 5.2 billion in 2024.

Durex and its products

Durex is the trademarked name for a range of condoms that used to be made by British company SSL International. This company was sold to Reckitt Benckiser in July 2010. The name, which the London Rubber Company trademarked in 1929, is a portmanteau of “Durability, Reliability, and Excellence”, though some people mistake it as being “Durable Latex”. Durex condoms represent around one-quarter of the global market for prophylactic sheaths, manufacturing around one billion units per year in 17 factories worldwide. Durex condoms are sold in more than 150 countries and are the most popular brand of condoms in over 40 countries. Durex’s range includes condoms, sex toys and lubricants, and focuses on reaching new consumers in innovative ways.

Digital marketing strategies of Durex in China

Durex succeeds in the Chinese condom market by leveraging Chinese social media. Relying on the awareness gained on social media, Durex in China has become the top 1 brand in the Chinese condom market since 2011. What can other brands learn from Durex China’s successful e-marketing strategies?

Durex’s legendary Weibo marketing

Online buzz marketing

[Source: Durex Weibo, “Durex’s creative posts”]

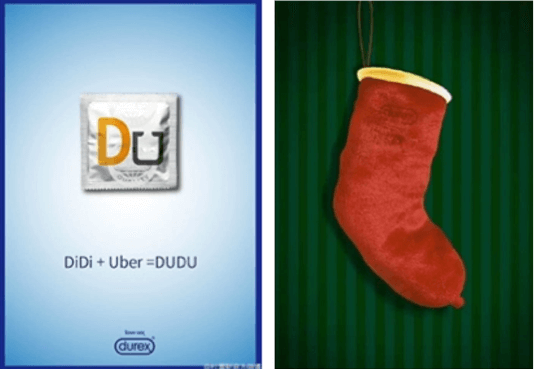

Since Durex opened its official Weibo account in 2010, there has been a lot of successful Weibo marketing cases from Durex China. . Durex marketing team is good at creating unique images and copywriting, which combines Durex product and trending topics. For example, at the time of DIDI-Uber merger (DIDI, the Chinese ride-hailing giant, merged its rival Uber China after a bitter fight in 2018), Durex split and reorganized the English names of the two brands to create a new word “DUDU”. “DUDU” is an acronym for Didi and Uber and can also be regarded as the abbreviation of “DO YOU”, which is related to the hot topic and connected to the character of Durex’s products.

Durex often posts creative posts on Weibo for various festivals. For instance, Durex leveraged the shape of its condom product and that of Christmas stockings to design an impressive Christmas Eve poster. These creative, humorous and unusual posts of Durex in China often cause a sensation and attract millions of retweets on Weibo, which helps Durex reach its target customers, those youthful, open and modern Chinese demographic.

Interactive online marketing

[Source: Durex Weibo, “an interactive fan topic on Durex’s Weibo”]

One of the secrets of Durex’s successful Weibo marketing is the high level of fan interaction. For example, topic #杜绝胡说# is an interactive fan topic released by Durex China Weibo account at around 10 o’clock every night. It has a relatively fixed push time, a fixed label, and a description “Do you know Dudu? Do you want to know more about him/her? Come and talk to Dudu ~ ” to invite fans to share their opinions on some hot topics.

In addition, Durex always responds to the comments under its posts timely with its playful and entertaining tone of voice, which makes the brand get closer to its fans and encourage more their audience to engage. Also, Durex takes advantage of rewarded interaction to motivate the participation of their fans, like delivering its products as prizes to Weibo users who retweet Durex’s posts. This not only excites their fans and attracts more participators, but also promotes its products. Through high-quality interaction, Durex can connect with its users closely and gain more loyal followers.

Other digital marketing channels

[Source: Durex Weibo, “Durex version of Tetris”]

Apart from Weibo, Durex in China also leverages WeChat, a messaging and social media app with over 1 billion monthly users, and Tik Tok, a hot app for making and sharing short videos, to advertise and attract a larger customer base. On WeChat, Durex launched an HTML5 games from time to time to attract users. For example, Durex designed a “Durex version of Tetris”, making the connection with the game and the brand by creating a graphs and game guide with sexual undertones. Some innovative H5 games created by Durex in China attract millions of WeChat users. On Tik Tok, Durex China creates several creative short videos, attracting 299.2 thousand followers and receiving 1.7 million likes within only ten months.

Durex is known in China for creating innovative, humorous and innuendoes advertising by leveraging social media platforms. From the above examples, we know that all marketing campaigns of Durex in China are customers-centered, and this marketing strategy can be recognized as reverse marketing, which emphasizes servicing customers instead of just promoting and advertising the brand’s products. Durex China puts customers first, reversely creating the content that users like. It creatively links trending topics or hot issues and the Durex brand to produce specific content for target customers. This reverse marketing strategy enables Durex to generate awareness across various media platforms and reach a board customer base.

Under the spread of coronavirus: The development of local brands poses a threat to Durex China

The global spread of the coronavirus leads to the shortage of condoms because of the shutdown of large producers. On the other hand, people are emptying shelves to stock up condoms during the outbreak of coronavirus. The gap between demand and supply brings both challenges and opportunities for condom brands. For example, the domestic condom brand Jissbon outperforms in 2020, sharing a similar market share with Durex on the Tianmao platform, one of the biggest Chinese online shopping platforms. Currently, the sales of the top three domestic brands occupy 80% of the Chinese condom market in total, and the penetration rate is also close to that of developed countries.

As Chinese factories have resumed working since late February, domestic condom brands have seized the market opportunities and squeezed the market share of Durex China, posing a threat to Durex. The epidemic could have an impact on global production in the short term, thereby triggering changes in the Chinese condom market structure.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast