E-sports are rapidly growing and are becoming a very lucrative sector as it is expected to generate 1.38 billion USD in revenues by the end of 2022. With China accounting for nearly a third of worldwide eSport revenues, it has attracted a lot of interest from the business world.

In this article, we will analyze the eSport business model and how it differentiates from traditional sports. Then, we will deep-dive into the eSports industry in China.

What is the eSports business model?

Just like traditional sports, it involves the attention and the massive audience generated by game competitions that represent the main source of eSport revenues. Several actors benefit from that, such as eSport players and teams, video game companies, media, streaming, sponsors, platforms, tournament organizer, etc.

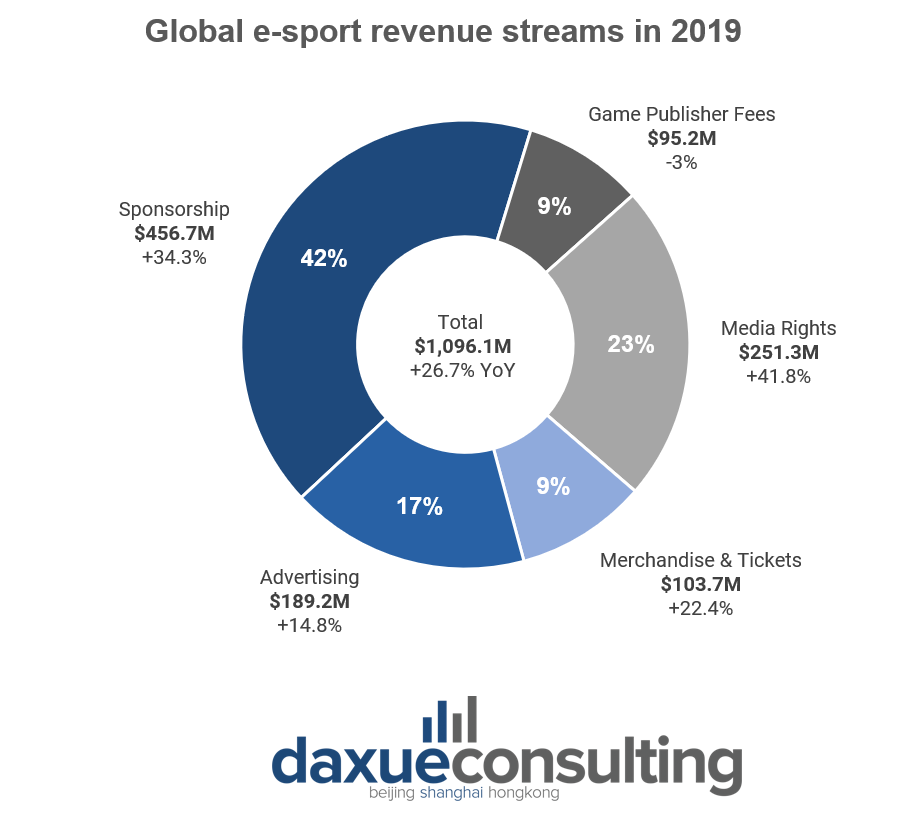

Sponsorship, advertising, and media rights account for the major eSport revenue streams.

Sponsorship and advertisement

In the eSport business model, sponsorship and advertisements are the most common way to make money and represent roughly 60% of the overall eSport revenues.

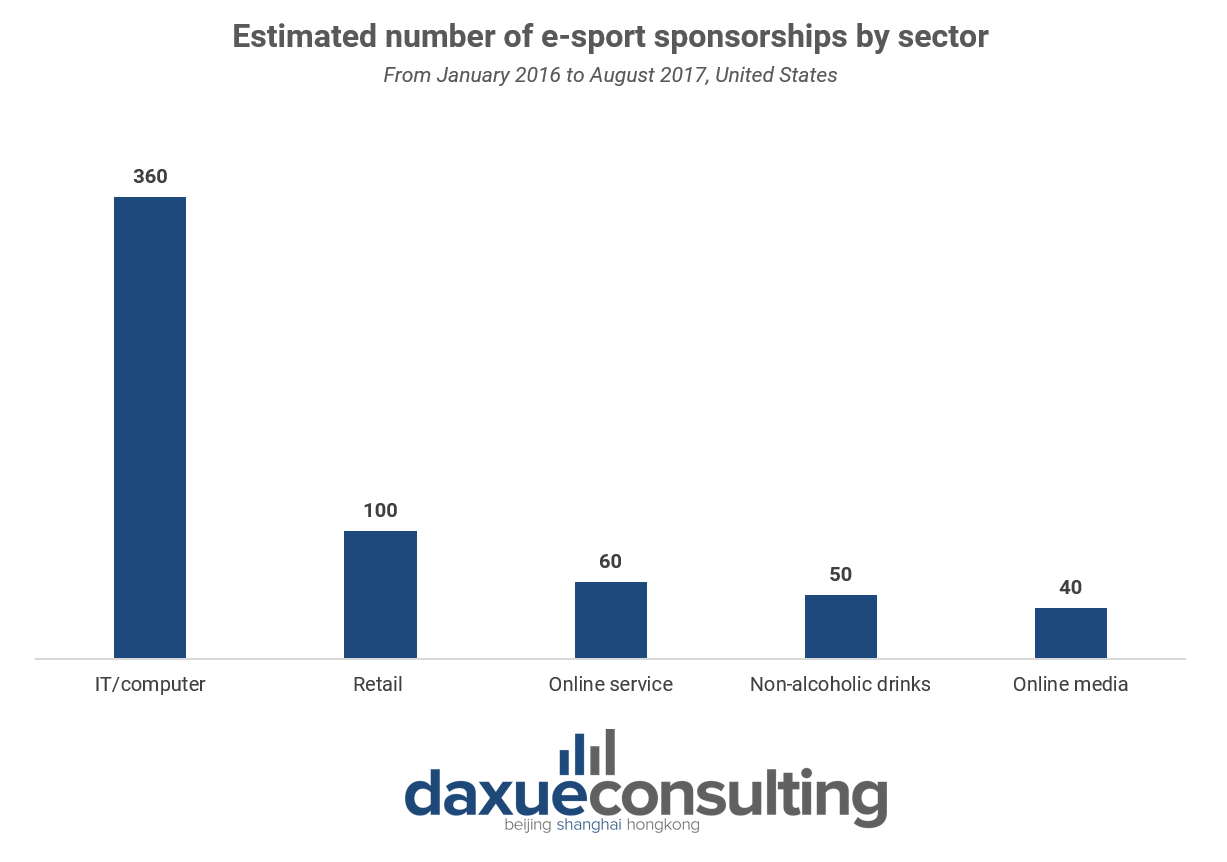

This most often concerns IT/computers brands, which will offer players to use their equipment or their platform in exchange for visibility. Logitech G is the perfect example as it is famous for sponsoring the equipment of several eSport teams. But non-IT-related companies, such as retail or beverage brands can also sponsor eSports. They can do it the same way they sponsor traditional sports: product placements, direct sponsorship of teams or events, rights to use IP in marketing, etc.

Other sources of revenue in the eSport business model

- Game publisher fees (9%), which represent payments made from tournament organizers to game publishers to have the rights to use their IP (the game) for an event;

- Media rights (23%) which have considerably grown in the last few years as media are more and more aware of the potentiality of the eSports market;

- Merchandise and tickets sales (9%) is also a growing source of revenue. In 2017, the League of Legends World Championships final took place in the famous Bird’s Nest Stadium in Beijing and the 40,000 available seats, ranging from 240 RMB to 11,800 RMB, were snapped up in just a few minutes;

- Lastly, eSport teams can also make money by winning tournaments/leagues. In 2021, the International (the annual Dota 2 championship tournament) which is known to have the biggest prize pool of all games, offered a 40 million USD prize to the winning team, making it the largest amount of money won in an eSport tournament so far.

Cost

Since eSport teams get most of their revenue from sponsorship, they need to perform well at tournaments and events so as to be highly visible to consumers. Typical expenses in the eSport business include player salaries, personnel salaries (eSport trainers, nutritionists, physical trainers), player housing expenses, training facility rent and equipment expense.

How eSports differentiate from traditional sports

E-sports are similar to real sports in many ways: they are basically videogames competitions that oppose several teams or players. Like what happens for traditional sports competitions, e-sport tournaments can attract a big group of audience, each team has its own supporters, and both e-sport players and athletes have to go through intense physical and mental training.

Thus, e-sports are already recognized as an actual sport in many countries such as the US, South Korea, China and it may even become an Olympic discipline in the future.

So, what makes virtual competitions different from traditional sports?

These are the elements to take into consideration:

1. They are virtual

The major difference is that e-sports can be played online, whereas real sports must be played in person.

This allows e-sports to be very universal, as they can gather people from all over the world, and do not differentiate by gender or by age. It is also widely accessible since anyone can watch it for free and can play to the very same video game as e-sport players.

2. Constant changes

There are always new updates and new video games released for e-sports, unlike traditional sports that stay traditional and unique. Therefore, e-sport players have to adapt quickly to changes within the game (new rules, weapons, etc.) and across games, as it can be highly popular for a moment, but public interest could fade within a year. However, most players specialize themselves in one single video game.

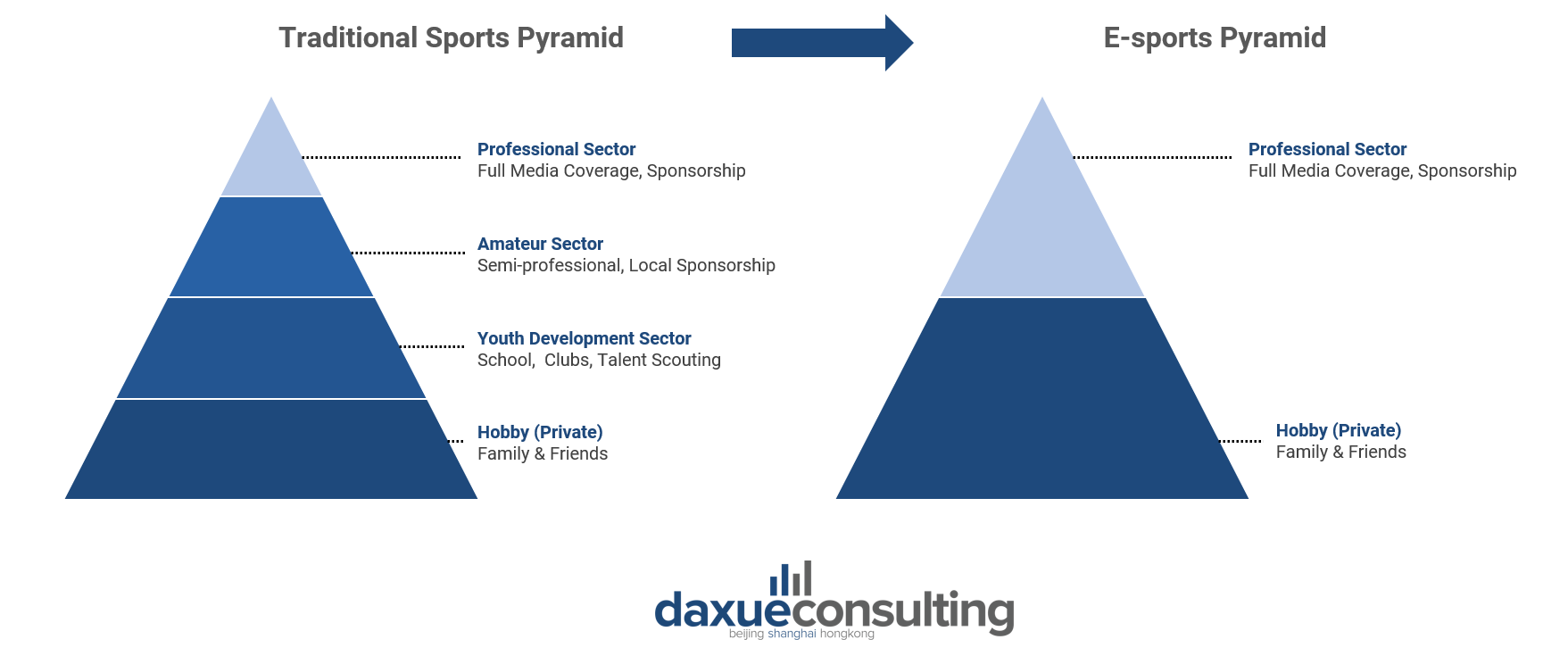

3. Less developed structure

In traditional sports, the path from a casual to a professional player can be planned, and the structure of the system makes it easier to project. Whereas in the e-sport universe, there is a big gap between amateur and professional level, even if e-sport schools are developing fast in China.

Also, one of the key differences between e-sports and traditional sports is the fact that a company owns the intellectual property of the game. The NFL doesn’t own football, but Activision Blizzard does own the game Overwatch. And the companies that own the IP behind the games like to take an active role in developing the competitive scene, by organizing big tournaments or funding the prize reward. Thus, video game companies have huge control over e-sports.

4. Bigger audience but lower purchasing power

Despite the tremendous growth, e-sports fan spending is lower than in traditional sports. According to Newzoo, e-sports enthusiasts spent an average of 3.64 USD per person compared to basketball fans who spent an average of 15 USD per person. The primary factor for this gap is that e-sports content is largely available for free, the audience is younger with lower income and spending on merchandise remains relatively small.

Why brands should take advantage of esports in China

E-sports are very trendy these days in China: new dedicated facilities such as e-sport hotels are mushrooming across the country and virtual sports are even at the center of some of the most recent C-dramas, such as The King’s Avatar and Falling Into Your Smile.

Most of eSport fans in China consist of young men under 30 years old. But the proportion of Chinese eSport female fans is non-negligible. They account for 30% of total eSport supporters in China (whereas in the US, they just represent 17% of the audience). Moreover, according to several surveys, women are more willing to spend money to attend overseas eSports events and buy merchandise. The number of female gamers is rising as well. By winning the 2019 Hearthstone Grandmasters championship, Chinese player Li Xiao Meng also known as “Liooon” encouraged a lot of Chinese women to go pro.

But one of the most important features in esports in China is the level of emotional engagement. According to McKinsey & Co, Chinese fans are more likely to play and watch Ssports, follow a favorite player, or follow an eSport team than their US counterpart. They would also spend more time engaging with eSport than with traditional sport.

eSports in China can untap many opportunities for brands

eSports in China can help brands communicate differently. Like its audience, eSports are strongly connected. Few people from the new generation consume television or radio, but eSports are on every digital platform (Huya, Douyu Live, Bilibili). Brands can also communicate through eSports on a wide range of channels: KOLs, eSport icons, events, teams, clubs, or communities. And the virtual nature of eSports also allows them to have online and offline campaigns. For example, a sponsor can do branding on a player’s jersey and on the player’s avatar’s skins (custom in-game outfits). In 2019, Samsung partnered with Fortnite to offer the exclusive Samsung Galaxy Fortnite skin, which was originally only made available to gamers who pre-ordered the Samsung Galaxy Note 9.

Brands from all industries are diving into eSports in China

A lot of brands from a wide range of sectors have already decided to enter the Chinese e-sport market.

For example, the furniture giant IKEA has released a home furnishing collection for e-sport gamers in China, including tables, chairs, storage boxes, and other accessories. IKEA’s main aspiration was to create a more comfortable and healthy gaming experience.

The US activewear giant Nike also has tapped into the e-sport world partnering with Tencent’s TJ Sports to sponsor China’s League of Legends Pro League (LPL). All LPL players, coaches, referees, and team managers had to wear Nike clothes and shoes during the tournament days. Nike has also released 16 LPL team uniforms and LPL co-branded T-shirts. In line with its LPL marketing campaign, the sportswear company released a short video called “Camp Next Level”, which aimed to highlight the importance of the relationship between exercise and good e-sport performances. The humoristic video that depicts several Chinese e-sports players gathering to join a special e-sports training camp attracted millions of views on Weibo.

The link between food and beverages and gaming has always been very tight. Red Bull, Coca-Cola, and PepsiCo have all been active global e-sports sponsors for years. The US tortilla chips brand Doritos has often sponsored e-sports events as well, and they selected the South Korean e-sport icon Faker for an ad in 2017.

Luxury brands want to have their piece of the e-sports cake

Luxury brands have also been more and more active in the e-sports industry. E-sports and luxury cars have always been very close, such as FAW-Audi becoming Weibo Gaming’s first sponsor, but retail and male-beauty luxury brands are also stepping into gaming. Burberry signed a partnership with Tencent Games to integrate its products into the Chinese online mobile game Honor of Kings. Lab Series, the high-end male skincare line from Estée Lauder collaborated with League of Legends Chinese professional e-sport team Invictus Gaming. Furthermore, n 2019, Louis Vuitton started a partnership with Riot Games for the League of Legends World Championship. They designed the trophy case, which was a luxurious and high-tech monogrammed trunk, but they also collaborated on exclusive game skins and real-life collection bags, footwear, apparel, and accessories. Depending on their budget, fans could buy limited-edition LVxLoL sneakers for 1,140 USD or purchase a skin for points earned in the game.

What to know about eSports in China:

- China is the world’s largest e-sport market, and gaming competitions are becoming more and more mainstream in the country.

- Sponsorship and advertisement account for roughly 60% of e-sport market revenues.

- Investing in e-sports can be very different from investing in traditional sports, as things can change very fast, the business model is still at its infancy and the audience is larger than in traditional sports, but younger and with a lower purchasing power.

- E-sports can untap a lot of new opportunities: sponsorship can be done in real life (IRL) but also virtually (on avatar or during a live stream), thereby effectively targeting tech-savvy Chinese Gen-Z.

- Chinese esport fans are mainly men under 30 years old, but there is a growing number of female gamers and e-sport fans.

- Chinese esport supporters show a higher level of engagement than US ones.

- A wide range of brands have already successfully collaborated with e-sport teams and video game companies.