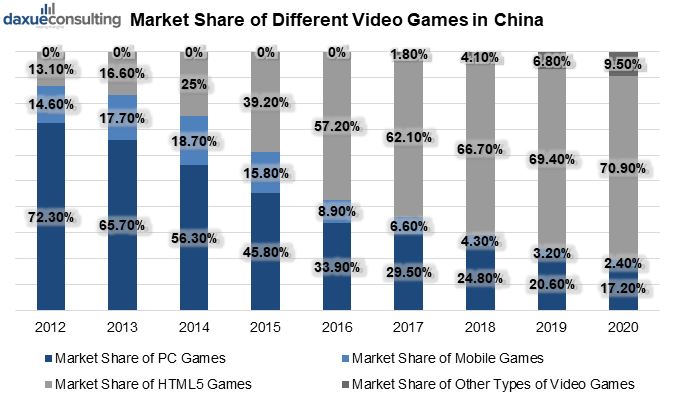

The Chinese e-sports market is about to unleash huge potential. PC games dominated the first 15 years of the 21st Century in China. However, the huge mobile user population changed the industry scene. Mobile gaming has already replaced PC gaming, taking the biggest share of the Chinese gaming market. However, though PC gaming is witnessing its decreasing influence in mainland China, the professional e-sports market of PC games is not. PC game-based esports market is still the best-performing segmented market in China compared with other types of e-sports market. This does not mean that PC games will still hold the dominant place in the e-sports scene in China, especially when the domestic mobile gaming giants start to push for more recognition of mobile e-sports among the Chinese gaming population.

A huge gaming population gives a solid foundation for the rapid growth in the Chinese e-sports market. Consumers of e-sports products and services (including games, in-game purchases, e-sports merchandises, and other related products and services) contributed the largest single country spending in the world in 2017. In the same year, China (US$32.5B) and the United States (US$25.4B) account for half of the world’s total consumption on games.

E-sports is still considered to be a controversial topic in China. Public attitudes towards gaming has largely affected the promotion of e-sports as a type of competition. Fortunately, the Chinese government and Chinese social media recognized the legitimacy of e-sports and a neutral view is now taking the advantage against the traditional negative views on e-sports in China.

Now is the best time for the Chinese e-sports market

China has an enormous domestic gaming and e-sports market

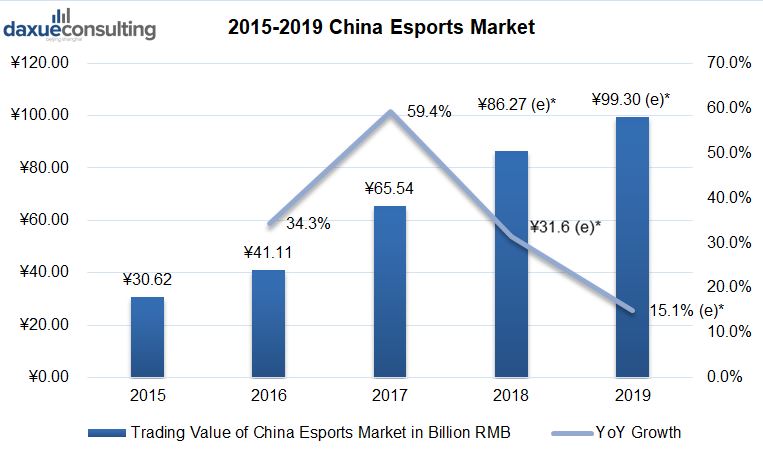

The Chinese e-sports market size doubled in only two years, growing from 30 billion RMB to more than 60 billion RMB from 2015 to 2017, and is expected to hit 100 RMB in 2019. The year-over-year growth rate kept growing from 2015 to 2017 and reached its highest level of 59.4% in 2017. This figure showed a slightly decreasing trend as the expansion of the e-sports market in China slew down recently. However, the 31.6% annual growth rate from 2017 to 2018 still represents around 21 billion RMB in net growth. This amount is only 3 billion less than the amount grew between the year 2016 and 2017, when this market was on the full growth acceleration.

China now consumes the most e-sports goods and services in the world

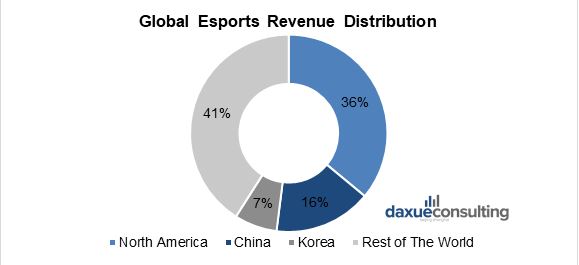

China is now the second largest e-sports economy in the world, only after North America consisted of Canada, the United States, and Mexico. In 2018, the Chinese e-sports economy contributed 16% of the worlds’ total e-sports industry revenue. As a country, China and Chinese e-sports consumers show a huge desire for e-sports goods and services. Data shows that China has the largest consumer spending on e-sports related goods and services. In 2017, Chinese consumers spent 32.5 billion USD on goods and services. In the same year, the once leading e-sports consumer, the United States, only generated 25.4 billion USD, considerably less than China. Together, China and the United States generated half of the world’s total e-sports related consumption and hold dominant places on market size and market spending.

China has a huge e-sports-ready gaming population with an unrealized potential to consume

The e-sports market’s growth is mainly driven by the large gaming population in China.

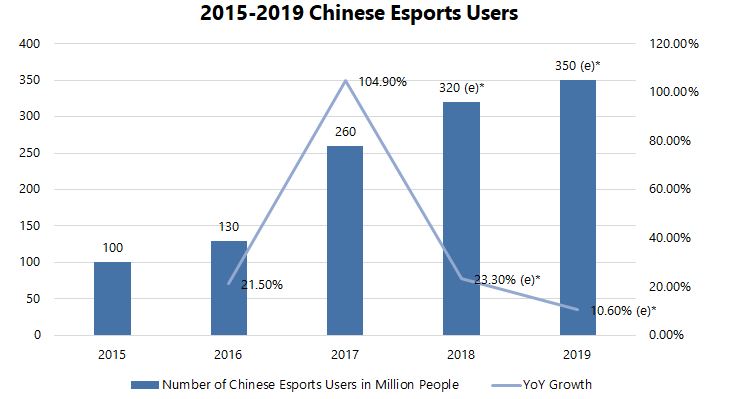

According to Daxue Consulting’s research, the population of e-sports users (defined as those who play e-sports games, consuming e-sports related goods and services) grew from 100 million to 260 million in only 3 years from 2015-2017. The yearly growth rate between 2016 and 2017 has even reached 104.9% per annum. The total gaming and e-sports users population doubled between 2016 and 2017 and will reach 350 million in 2019 by expected estimation. The similar growth pattern is observed in e-sports consumers population like that in the e-sports market. The expected annual growth rate in e-sports users population is expected to slow down in 2018 and 2019 as the e-sports economy starts to mature in 2018.

Mobile gaming is the future of the Chinese e-sports market

Mobile gaming was not a threat to PC before 2015. The largest leap on market share of mobile games happened between 2015 and 2016, which resulted in an 18 percentage point growth on market share and enabled mobile games to exceed PC games to share the most of the Chinese games market at 57.2% in 2016. Researchers on Chinese e-sports and gaming industry set high expectations for mobile games in the next three years. In 2020, mobile games are suggested to consist of more than 2/3 of all types of games in the Chinese market.

Social attitudes starting to favour e-sports in China

2018 witnessed several major breakthroughs in Chinese e-sports history. In the presence of ubiquitous internet connectivity, every social event can be viral in a second. Chinese social media and search engines significantly contribute towards the promotion of a neutral view on e-sports as a type of competition. Meanwhile, the Chinese government is trying to build a stable and healthy environment for digital production by issuing new guidelines and regulations on contents, publication and distribution. These efforts now see the returns in terms of more objective public attitudes on gaming and e-sports.

Major breakthroughs on e-sports promote the awareness of the Chinese public

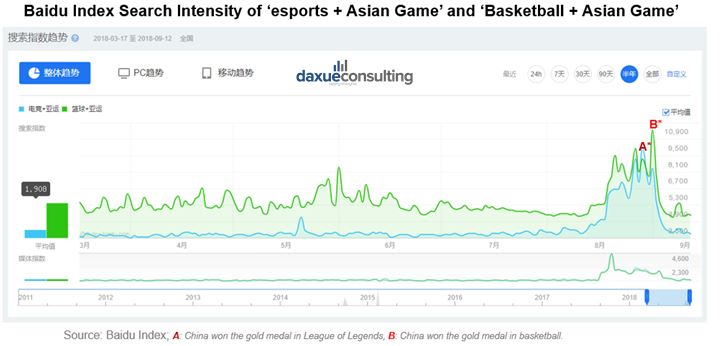

Besides professional leagues events such as League of Legends Professional League in China, Mid-Season Invitational and Rift Rival, the major international game for the first time took e-sports as part of its competition system in 2018. The 2018 Jakarta Asian Game held an e-sports demonstration game in four games. Among those games, League of Legends got the most attention, and the Chinese team finally won the gold medal. This news generated intensive Internet search and heated up the biggest microblog social media platform Weibo. According to the data from Baidu Index, the search intensity of ‘league of legends’+ ‘Asian Game’ almost caught up with the search intensity of ‘basketball’+ ‘Asian Game’ when China won the first place in LoL demonstration competition on the same day.

The public holds mixed views on e-sports in China

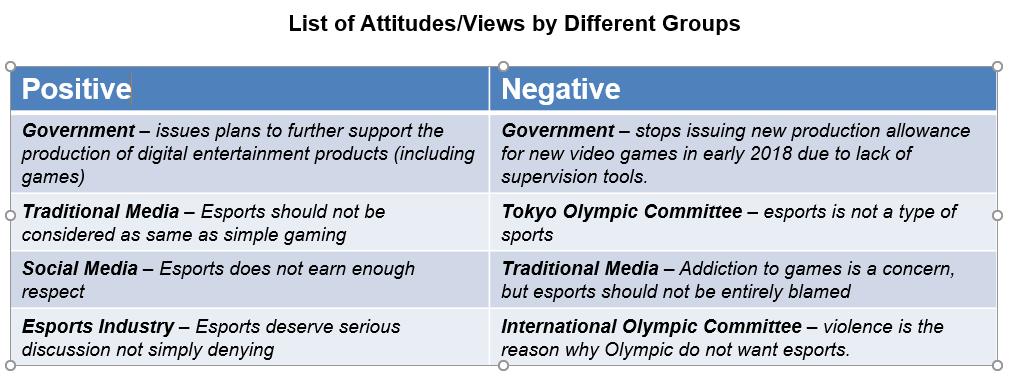

Though e-sports activities and events are gaining more and more attention among the Chinese public, the overall trend is still unclear.

The public attitudes are all at their infancy with both positive and negative comments on Chinese e-sports. The government has made self-contradictory moves by making new regulation and plans in pursuit for more quality digital publications including new games while stopped issuing new publication allowances for a new video game in early 2018. Social media and traditional media both call for fair views on e-sports and the separation of e-sports from simply gaming. However, the international professional sports games organizations such as the International Olympics Committee still regards e-sports as violent and inappropriate to be involved in Olympics.

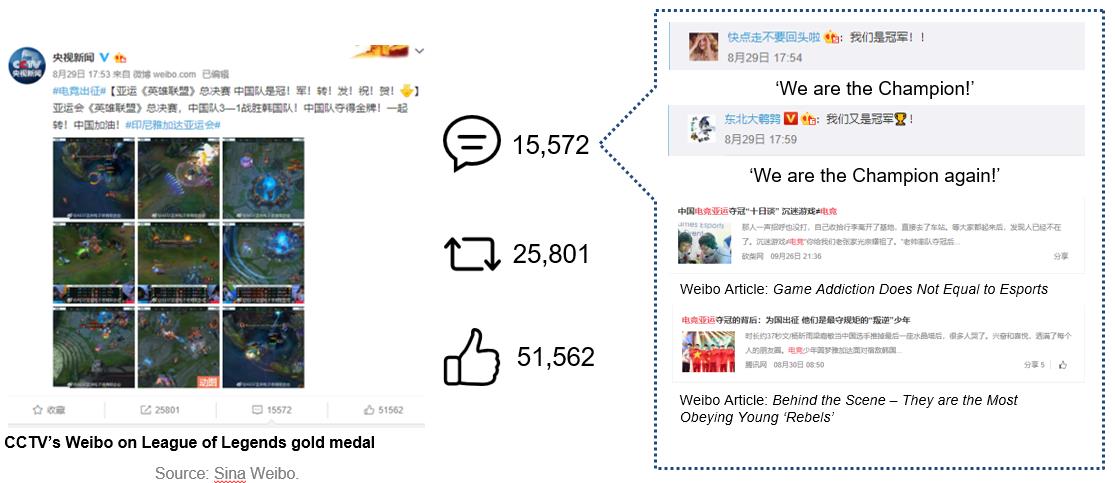

The government’s official view boosts the confidence of Chinese e-sports

When the Chinese team won the gold medal in the League of Legends demonstration game, the Chinese government official media Weibo account CCTV News has immediately announced this news. This microblog post gained 15,572 comments, 25,801 reposts and 51,562 likes in the first several hours after posting and most of the comments are congratulating and praising Chinese e-sports teams on their outstanding performances. In the following days after the gold medal, topics of social media posts and articles started to diversify with different focuses on e-sports industry, player’s characteristics, the distinction between e-sports and gaming and so on. In short, the public focus turns gradually from the negative side of gaming towards a more diversified spectrum of views on e-sports and estimated as overall neutral.

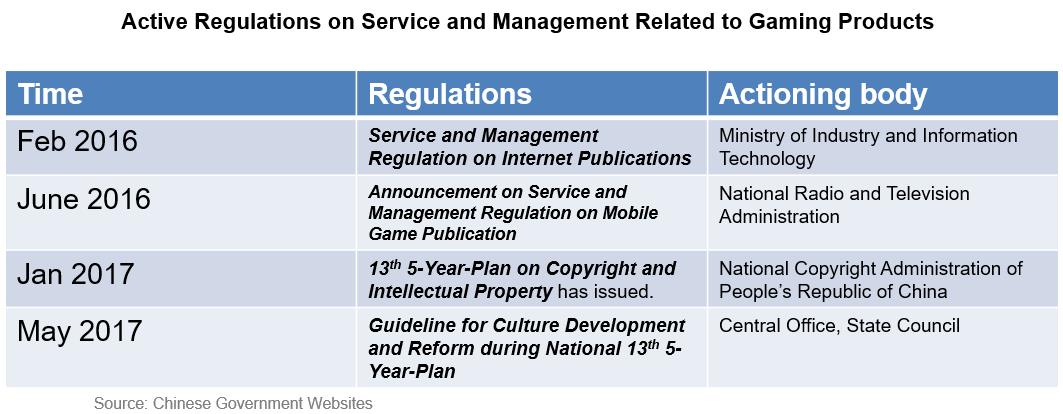

Games as cultural and entertainment products gain more attention from the government than before

Managing regulations on digital products including video games have been refined during recent years. These refinements did not only add more detailed classification and corresponding rules of operations but also diversified the related punishments for different offences within the practices during the process of production, distribution, and management of various video games. The aim for these actions of frequent updates on regulations potentially means the Chinese government is now seeking more qualified gaming products. Meanwhile, the Chinese government is trying to create a healthy and lively environment for quality game production, distribution, and management.

Business potential is evident: an LPL example

Among all major professional e-sports leagues in China, the League of Legends Pro League is the most recognized one and leads the development of the entire professional e-sports industry.

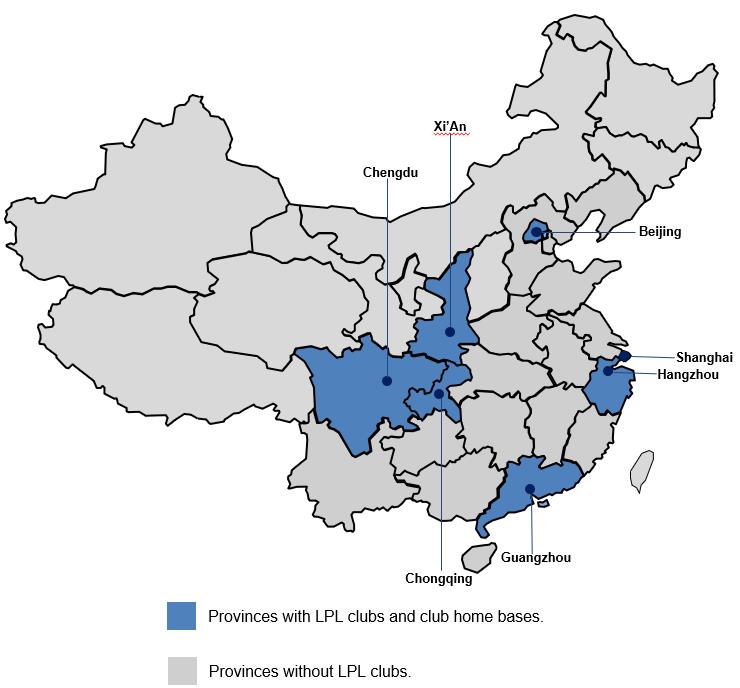

In 2017, LPL announced that they will promote a ‘home-away’ competition system with current LPL participating clubs. In 2018, there are already 6 clubs announced their League of Legends team home city. These clubs are most prominent clubs in Chinese e-sports histories such as LaoGanDie (LGD – Hangzhou), Edward Gaming (EDG – Shanghai), OH MY GOD (OMG – Chengdu), Royal Never Give Up (RNG – Beijing), SNAKE (Snake – Chongqing) and Team WE (WE – Xi’An). The purpose is to attract local audiences and promote the localization process for LPL competitions. This creates a great opportunity for cross-industrial investments as the localized ‘e-sports +’ model will generate more opportunity than ever before.

Mobile gaming: a China-unique phenomenon

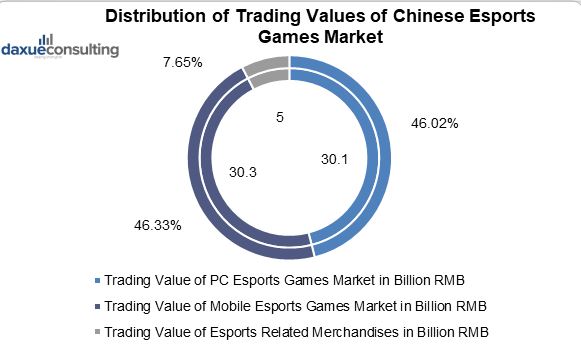

In 2017, the total trading value of Chinese mobile e-sports market in first time exceeded PC e-sports to become the largest in China. Chinese mobile e-sports market now shares more than 46.33% of the total e-sports market trading value in China, contributed 30.3 billion RMB in 2017.

Mobile MOBA games delivered the best performance

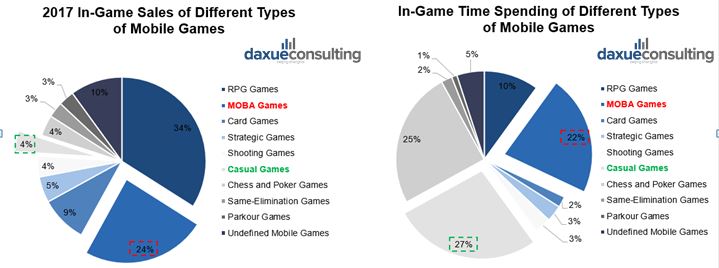

Among all mobile game types, mobile MOBA games perform the best. Mobile MOBA games deliver nearly 25% in both in-game sales and in-game time spending. Compared with other types of games (such as leisure games, which share 27% of in-game time spending and only 4% of in-game sales), MOBA games deliver the best outcome and continue to be the most welcomed game type by producers and consumers.

Honour of kings: a successful mobile MOBA example

Honour of Kings by Tencent Games is the most successful mobile MOBA game in China. In 2017, this mobile game, and its professional league King Pro League (KPL) ranked in the first place among all mobile e-sports professional competitions with 10.3 billion full-year content viewers in 2017. Among those, its official broadcasting and videos on various platforms had 9.1 billion full-year content viewers, means nearly 90% of their views are either watching their live professional games broadcasting or videos from the KPL official operator Tencent Games.

In early 2018, Tencent teamed up with VSPN to promote a home-away system like LPL, and established two home stadiums in Chengdu and Shanghai for the Western and Eastern Conferences.

The unexpected surge of tactical-FPS mobile games

After the success of PC-based tactical first personal shooting (FPS) game PLAYER UNKNOWN’S BATTLEGROUND (PUBG) in early 2017, many mobile game producers managed to imitate this new game type and produced various similar mobile versions.

In December 2017, FPS (including tactical FPS games) users increased by 178.6% compared with the previous month, making it the biggest surprise in the mobile game market in late 2017. Tencent Games, the biggest mobile game producer in China, has gained authorization from Bluehole Studio, the original publisher of PC game PUBG, and launched the official mobile version in both domestic and international app stores. NetEase Gams and other domestic producers all produced own similar versions to compete in the domestic market.

Market trends and opportunities for future development

Games are getting more entertaining with lower barriers of entry

Currently, dominant PC and mobile e-sports games are showing a trend of being more entertaining with diversified playing mechanism, while the requirement for entering game playing is becoming much easier. For example, PUBG, the game combined FPS and team tactics into one, has created an entirely new concept of competitiveness with 100 players competing for one last surviving title in one game. The Honour of Kings, on the other hand, has lowered the barriers of entry on skills, gaming gears, and team paring mechanisms. Based on large Chinese mobile population with a web connection, everyone can quickly pair up with other people and play a game which only consumes 10-20 minutes. Less gaming techniques are needed as Tencent Games updates the game frequently with new features providing more conveniences.

Lifted purchasing power means e-sports consumers are willing to pay more

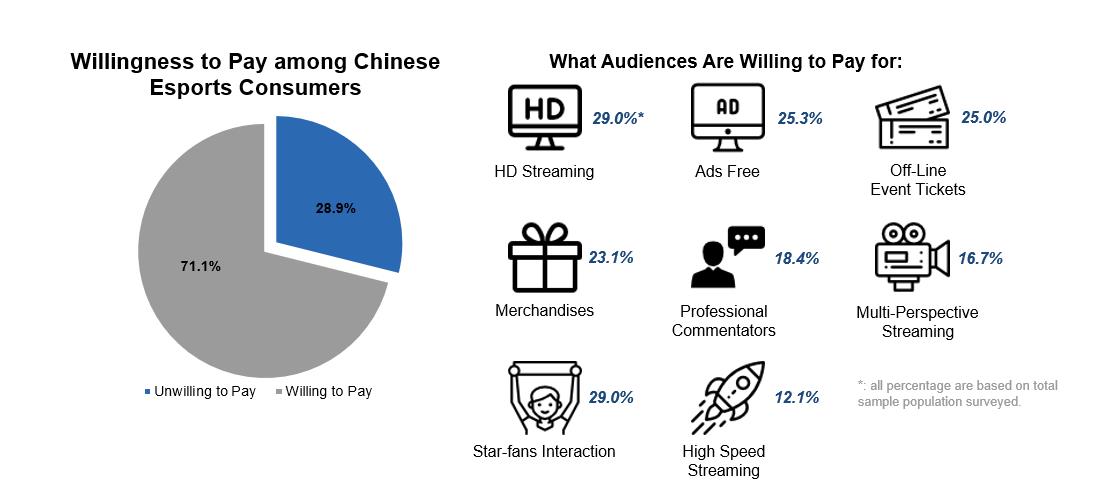

More than 70% of the Chinese e-sports consumers are willing to pay for one or several types of e-sports goods and services. The major consumption will come from online live and content streaming. Among all online e-sports consumption types, consumers mainly focus on the quality of their online experiences including high definition (HD) streaming (29.0%), ads-free services (25.3%), professional commentators (18.4%), Multi-perspective streaming (16.7%) and high-speed video streaming (12.1%). The off-line e-sports market is being realized gradually in recent years. Now about a quarter of the e-sports consumer population is willing to pay for off-line events tickets and also more than 1/5 of the same population is willing to buy merchandises related to e-sports games, events and professional e-sports clubs.

The new ‘E-sports +’ business model can attract cross-industry interests

The off-line potential of professional e-sports leagues, tournament, and participating clubs and players can be realized by integrating online and offline operations. To realize the offline potential of online events, a business can team up with traditional industries such as manufacturing, retailing, food and other goods and services which have abundant offline promotion experiences and resources. Meanwhile, traditional industries can also be benefited from the online promotion by e-sports industry operators to reach a wider audience for their promotional activities. One example of an online-offline cooperation is Giant Networks’ Battle of Balls professional league and Tongyi Ice Black Tea.

This cooperation combined two unrelated brands into one entity and Tongyi has reached its promotional purpose via a full spectrum of advertising activities including the specially-designed in-game skin, theme song, special product design of Tongyi Ice Black Tea, in-game special tools and other online and offline activities. Battle of Balls, on the other hand, has reached Tongyi’s large consumer population that could be potentially turned into their gaming consumer in the nearly future. In 2017, more than 60% of the Chinese e-sports users agree that the advertisement showed during e-sports events is related to e-sports spirits and themes.

Industry needs will drive social changes

The growing demand for entertaining gaming experience and easier access to playing will drive the expansion of the market. And the expansion of the market will reciprocally boost the demand for an understanding of gaming and e-sports activities. Governmental attitudes are now changing, and e-sports now need objective justification to reach a harmonious social understanding. This requires more talents in the industry, also needs a comprehensive regulation and supervision system to maintain the healthy development of the market. Overall, preliminary findings suggest that there are already tendencies of development in this direction, and the continuing expansion of the industry will further accelerate such tendencies.

Author: Jiameng Hu

https://www.slideshare.net/AllisonMalmsten/esports-market-in-china

Daxue Consulting can help with the analysis of any market in China, including the e-sport market

Daxue Consulting, as a market research company, provides the adapted data in one of the most challenging markets in the world, China. We have a wide range of services to deliver a competitive market research. To know more about the personal data market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.