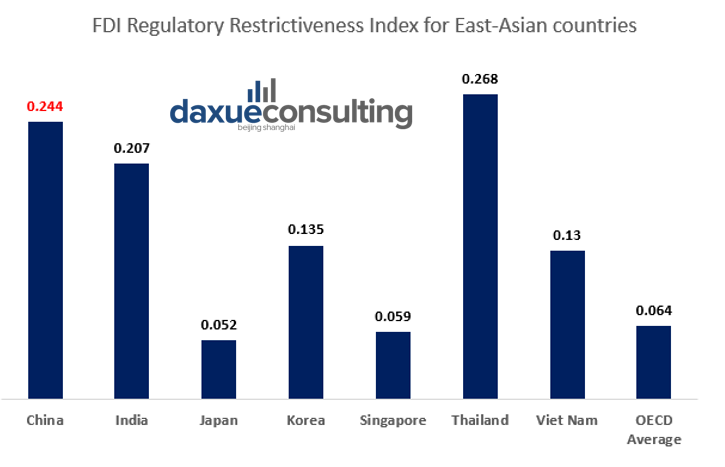

Market entry strategies and investing in China can often prove to be a difficult endeavor due to the harsh Chinese regulations on foreign direct investments (FDIs) in the mainland. With FDI restrictions almost four times higher than the OECD average according to the FDI Regulatory Restrictiveness Index, the Chinese market is hard to penetrate for foreign companies whether it be for market entry or simply for investing in Chinese equity. However, these restrictions might ease soon for European businesses and investors. Six years after starting negotiations in 2014, , in December 2020 China and the EU concluded with the first EU-China investment deal.

The Comprehensive Agreement on Investment plans on lifting regulations for Chinese investments in the EU in exchange of easing Chinese regulations for European investors. From the lifting of joint venture requirements and equity caps, to the removal of forced transfer of technology in key sectors, this new EU-China investment deal represents a golden opportunity for EU-based businesses willing to invest in China. Also including corporate social responsibility commitments and reaffirming both countries’ commitments to the Paris Agreement, the deal is now being finalized before being submitted for approval by the EU Council and the European Parliament. It is expected to be signed later this year.

Source: OECD.Stat. China is one of the most restrictive East-Asian countries on foreign direct investments (FDIs), far above the OECD average.

The lifting of joint venture requirements in key industries would ease market entry for EU businesses

Joint ventures in China are a great way to start a business expansion in China, granting more flexibility than a simple sales office. However, they are also way more costly, take a long time to set up and are highly reliant on the company’s local partner. Thus, setting up a joint venture in China is a complex, high risk, high reward endeavor and China imposes even stricter requirements for joint ventures in some sectors it wishes to protect from aggressive FDIs.

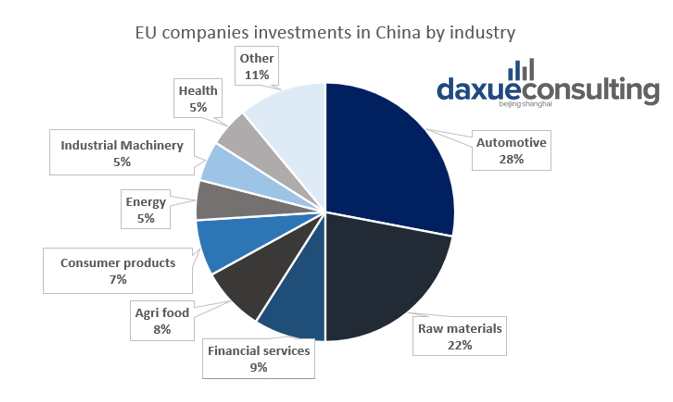

Fortunately for European investors, the EU-China investment deal plans on lifting the joint venture requirements for a number of key industries. These include the automotive sector, financial services, private hospitals, real estate services, consulting and environmental services. The opening of the private health sector, although contained to a few key Chinese cities including Beijing, Shanghai, Tianjin, Guangzhou, and Shenzhen, has particularly incited interest. Among the improvements implied by this ease of joint venture regulations are a better access to litigation for foreign parties and the removal of forced transfer of technology.

Source: European Commission. Lifting of joint ventures requirements covered by the CAI will open new opportunities for EU investors in the automotive and health industries, among others.

The EU-China investment deal plans on protecting EU businesses’ intellectual property

Forced Transfer of Technology (FTT) has been, for a long time, a source of concerns for people wanting to invest in China. As one of the main arguments from the US side in the trade war, FTT represents a disadvantage deemed unfair for foreign companies competing in China. Imposed by Chinese regulations in key sectors, FTT is especially a problem in manufactured goods and tech industries as it forces companies to hand out trade secrets.

The EU-China investment deal will lift FTT requirements for European businesses in order to protect their Chinese investments. This would be particularly beneficial in the automotive sector, one of the biggest sources of investment from the EU. The Comprehensive Agreement on Investment also gives more legal reach to EU companies in that area. The agreement would notably allow more freedom in technology licensing as well as protection for confidential business data from local administrative bodies. Overall, the Comprehensive Agreement on Investment should give more protection to EU businesses’ intellectual property in China while streamlining legal processes.

China plans to further open its economy to EU foreign investment

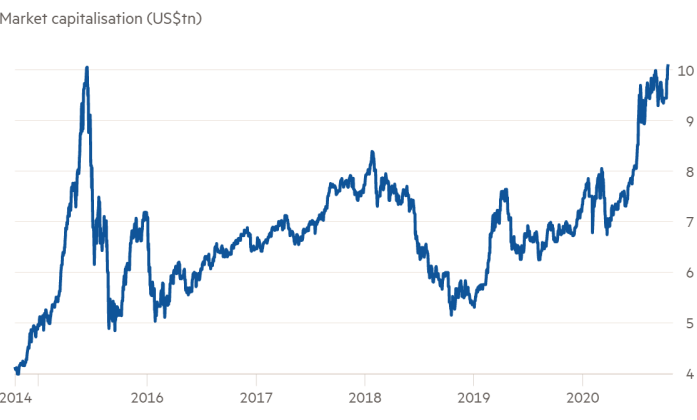

As the world’s economy is in turmoil, reeling from the global pandemic, China’s stock market is at its highest since its 2015 boom. Investing in China’s finance seems to be a great opportunity now more than ever; however, the Communist Party keeps a tight control on Chinese investments, whether they are domestic or foreign.

This cap on equity combined with several investment bans, especially for listed companies, allows better control from the government on the economy and reduces the volatility of the market as well as investment potential. While China has already gradually started to liberalize its finance sector, the EU-China investment deal further opens banking, securities and insurance trading as well as the asset management sector.

More interestingly, the deal plans to lift the investment ban for cloud services: China will now be open to EU investors subject to a 50% equity cap for that industry. China will also allow EU companies to invest without restriction in cargo-handling, container depots and stations. This will allow EU companies to organize a full range of multi-modal door-to-door transport, including the domestic leg of international maritime transport.

Source: Bloomberg. China’s stock market is at an all-time high since 2015, a great opportunity for investing in China.

China agrees to level the playing field between EU businesses and Chinese state-owned enterprises

Although China’s economy has largely been liberalized since the the time of Deng Xiaoping, Chinese regulations have always privileged state-owned enterprises (SOE). Whether through subsidies, bank loans, or a lack of transparency in their purchases and sales, SOEs have benefited from a competitive advantage for years. While the Comprehensive Agreement on Investment will not strip these privileges from Chinese SOEs, rather, it will allow for more transparency in their process as well as the establishment of legal channels to resolve disputes with EU firms.

Transparency seems to be the watchword of the agreement with a general streamlining of Chinese investments and legal disputes. Corporate social responsibility is also a major point of the investment deal with renewed commitments from China to abide to the Paris Agreements and not to lower work standards to seek competitiveness.

What does the Comprehensive Agreement on Investment mean for EU businesses?

If the EU-China investment deal implications could be summarized in two words, it would be streamlining and transparency. Let it be clear that investing in China will still be a difficult endeavor for EU companies after the agreement is ratified by the EU Commission. However, with more investment openings, less restrictions for market entry and the streamlining of legal disputes, the opportunities to successfully invest in China for EU investors have never been better. Despite American criticism, the Comprehensive Agreement on Investment is set to allow deeper ties between the PRC and the EU which provides a great environment for future and current investments. To learn more about investing in China, email dx@daxueconsulting.com to contact our project team.

Author: Camille Gaujacq

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Our report on M&A opportunities in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast