Facing the increasing elderly population and risks of eye diseases for office workers, eye supplements market in China is growing.

Statistics show, China’s elderly population will increase to 418 million in 2035, accounting for 1/4 of the total population. Cataract and glaucoma are often the most common problems of eye health in the elderly. Age-related macular degeneration (AMD) is another big eyes-related issue. In China, 4 million people suffered from age-related macular degeneration in 2017. It has become one of the important reasons affecting the eye health of the elderly. The incidence of age-related macular degeneration increases with age. Timely taking of eye supplements can help to treat AMD at an early stage. Otherwise, it is highly likely that the lesion will cause severe visual impairment or even blindness.

Besides the silver generation in China, white-collar workers in China are the ones who experience various high-energy blue lights such as mobile phones and computers. This blue light radiation for a long time leads to various problems such as eye fatigue, itching and soreness. At present, the prevention of visual damage caused by blue light is the main directions of the eye healthcare market in China.

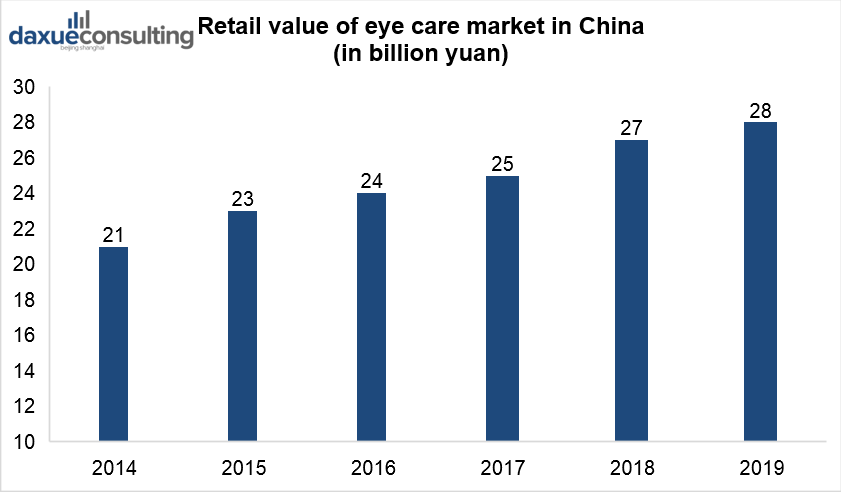

The retail value of eye care market in China is increasing

In 2014 retail value of eye care market in China accounted for 24 billion yuan. In 2019 it reached 28 billion yuan.

[Data Source: Euromonitor, ‘Retail value of eye care market in China’]

The eye care market includes eye disease medicine (cataract medicine, glaucoma medicine) industry, eyewear industry, eye protection industry. Eye supplements include Chinese medicine eye patch, eye drops, blueberry nutrition capsules, etc.

The concentration ratio of the eye supplements market in China is 36.4%. The compound annual growth rate (CAGR) of this market was higher from 2005-2012 and accounted for 9%. From 2012-2019 it was 5.1%.

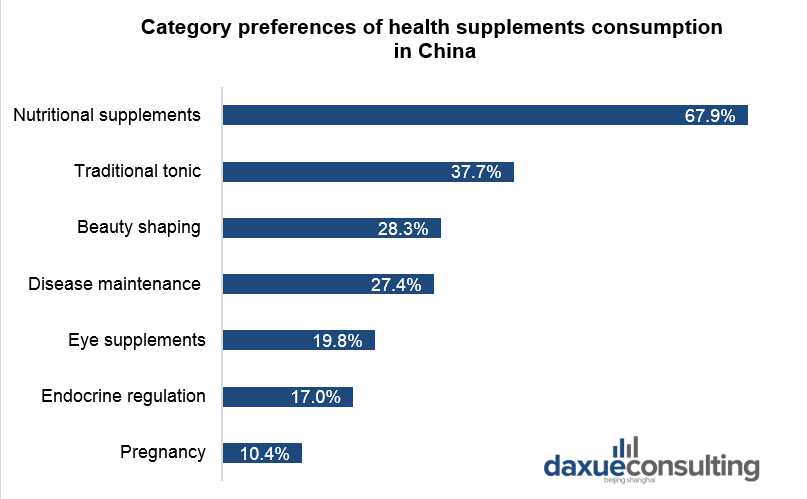

Different reasons for purchasing eye health supplements

According to iimedia research, in 2019 19.8% of the respondents preferred health supplements related to eye care and pressure reduction.

[Data Source: iimedia, ‘Category preferences of health supplements consumption in China’]

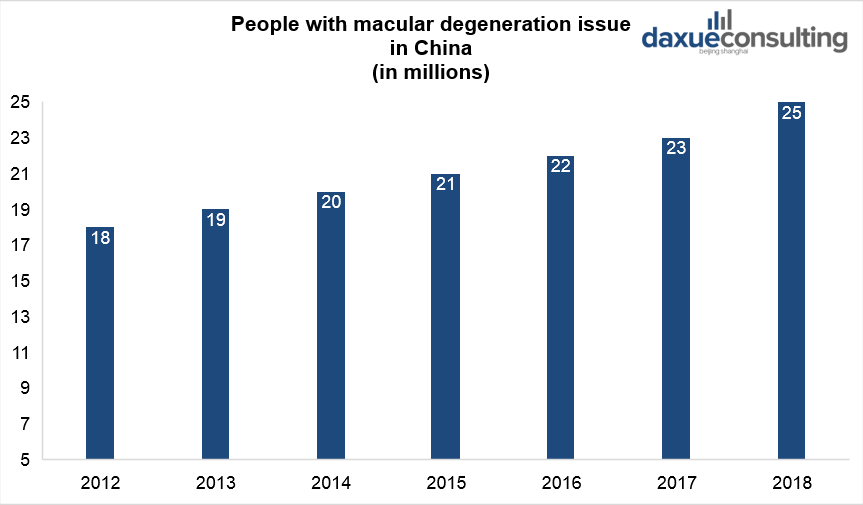

High rate of eye-related diseases in China

Data shows the prevalence rate of cataract in China among those aged between 60 – 89 years old is around 80%. It is above 90% for those older than 90 years old. Besides, around 25 million elderly people in China in year 2018 had the macular degeneration issue. The age-standardized prevalence rates of glaucoma have increased over the past 20 years, reaching 2.6% in rural China.

[Data Source: Age Club, ‘People with macular degeneration in China’]

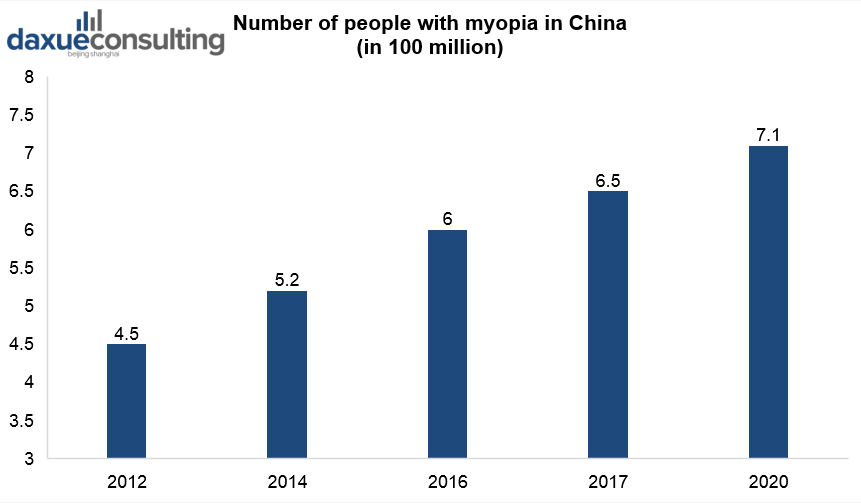

Big number of people with myopia creates opportunities for eye supplements market in China

In 2016, the number of myopic patients in China has reached 600 million. By 2020, the total number will reach 700 million, accounting for about 49% of the total population.

[Data Source: BigData, ‘Number of people with myopia in China’]

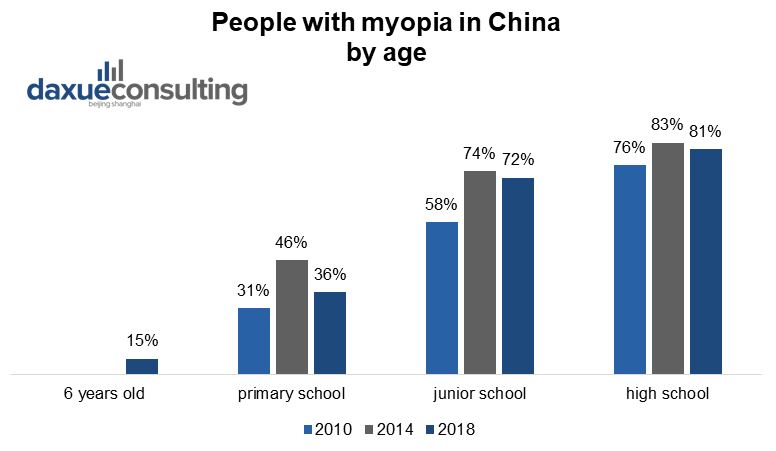

According to the “Results of Chinese Children and Adolescents Myopia Survey 2018”, the overall myopia rate of children was 53.6%. Among them, 14.5% of 6-year-old children, 36% of primary school students, 71.6% of junior high school students. 81% of high school students had myopia. The myopia problem of children and adolescents becomes more and more serious as their academic performance increases. Myopia is also a driver of the eyeglasses market in China.

[Data Source: BigData, ‘People with myopia in China by age’]

China’s myopic population is already huge. At the same time the situation is getting worse with the popularity of different electronic devices in China.

Lutein and zeaxanthin products grow in the eye supplements market in China

The combination of zeaxanthin and lutein can filter harmful blue light, protect eyes from oxidative stress and radical damage. Besides, it reduces macular damage, playing a role in maintaining normal vision of the retina. Such supplements also prevent age-related macular degeneration. In addition, lutein protects eyesight, delaying the progression of myopia, and alleviating visual fatigue. However, the human body cannot synthesize lutein itself. That is the reason of growing demand for lutein-based eye supplements. In 2008, the National Health Commission approved Lutein Ester from Marigold Flower as a new resource for food efficacy.

Lutein and zeaxanthin production in China

In the pharmaceutical industry in China, lutein and zeaxanthin is used in the development of eye care products.From 2012 to 2016, the compound annual growth rate of products based on lutein and zeaxanthin were 25% and 18%. Between 2017 and 2020, the lutein price compound annual growth rate will reach 6.3%. The market size will exceed 350 million US dollars in 2020.

Chinese enterprises have officially produced lutein since 2000. There are two types of products, natural and synthetic. The latter has the largest output (a company in Lanxi City, Zhejiang Province). The domestic annual production capacity of lutein has been 10-20 tons.

Blueberries eye supplements production

Companies also widely use blueberry to produce eye supplements. Blueberries contain an antioxidant called anthocyanin that may provide eye protection and even improve vision. China’s northeast Daxing’anling region has established a domestic blueberry production and processing base. At present, Chinese companies export blueberry dry powder that meets international standards to Japan and Europe. The estimated annual export volume is about 10 tons.

COVID-19 impact on eye supplements market in China

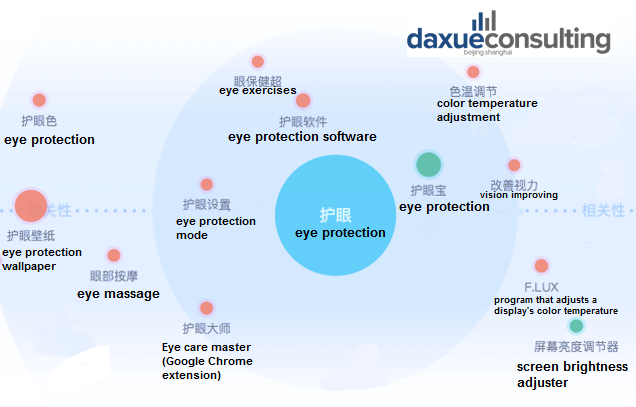

According to Baidu index, the search for ‘eye care’ grew after the lockdown. But none of these researches are related to eye supplements. Instead, they are related to anti-blue light electronic devices, eye-protection exercises and eye-care instruments.

Baidu index: eye care related search terms

Prospects of eye supplements market in China

Eye supplements targeting the old people have great market potential. Especially for those have macular-degeneration issue. A Chinese company called BY-HEALTH (汤臣倍健) launched a product called ‘EASEYE’ (健视佳) in 2018 targeting at this group. It earned 47 million yuan in terms of revenue and this company is expanding its domestic market. This product contains triple nutrients of β-carotene, lutein ester and anthocyanin, which has the effect of alleviating visual fatigue. Moreover, elderly people’s health awareness becomes higher due to the coronavirus outbreak in China.

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast