In the fashion industry in South Korea, staying in tune with trends is crucial. South Korea consumer trends evolve rapidly, requiring businesses to adapt swiftly to changing preferences. The 20s to 30s age group, in particular, shows remarkable sensitivity to fashion trends compared to other age groups. Specifically, the trend awareness scores for women in their 20s reached 62.2 points, and men in their 20s scored 56.5 points. This marks the highest within their respective genders.

Read our Korea’s consumer trends report

The young generation’s strong interest in fashion trends is reflected on social media as well. Kkang Stylelist, a YouTuber exclusively dedicated to men’s fashion trends, boasts a subscriber base exceeding 1.24 million as of November 2023. Similarly, Next-Door Sister Manager and Alice Punk, both focusing on women’s fashion, have amassed 821 thousand and 689 thousand subscribers, respectively.

Domestic Brand: Leading MZ Generation’s fashion trend

In South Korea’s fashion industry, Domestic Brands represent clothing brands founded by domestic designers. Unlike other type of brands like licensed brands or No Brands, Domestic Brands oversee the entire process, from designing clothes to production and direct selling. Once considered a low-profit sector in the Korean fashion industry, they were often only distributed through online channels rather than offline stores like department stores and major shopping malls. However, they are now considered trend leaders, leading the fashion preferences of the MZ Generation. Many have transitioned from online platforms to offline stores as they are generating enough sales to maintain offline stores.

One domestic brand, Matin Kim, achieved remarkable sales by generating KRW 98 million in online sales and establishing a physical store at The Hyundai Seoul in Yeouido. With a monthly revenue of KRW 1.2 million, Matin Kim has claimed the top spot in the fashion segment’s sales. This illustrates that Domestic Brands are no longer confined to online realms. They have become formidable competitors even among other renowned brands.

No Brands leading Korean fashion trends with cheap prices

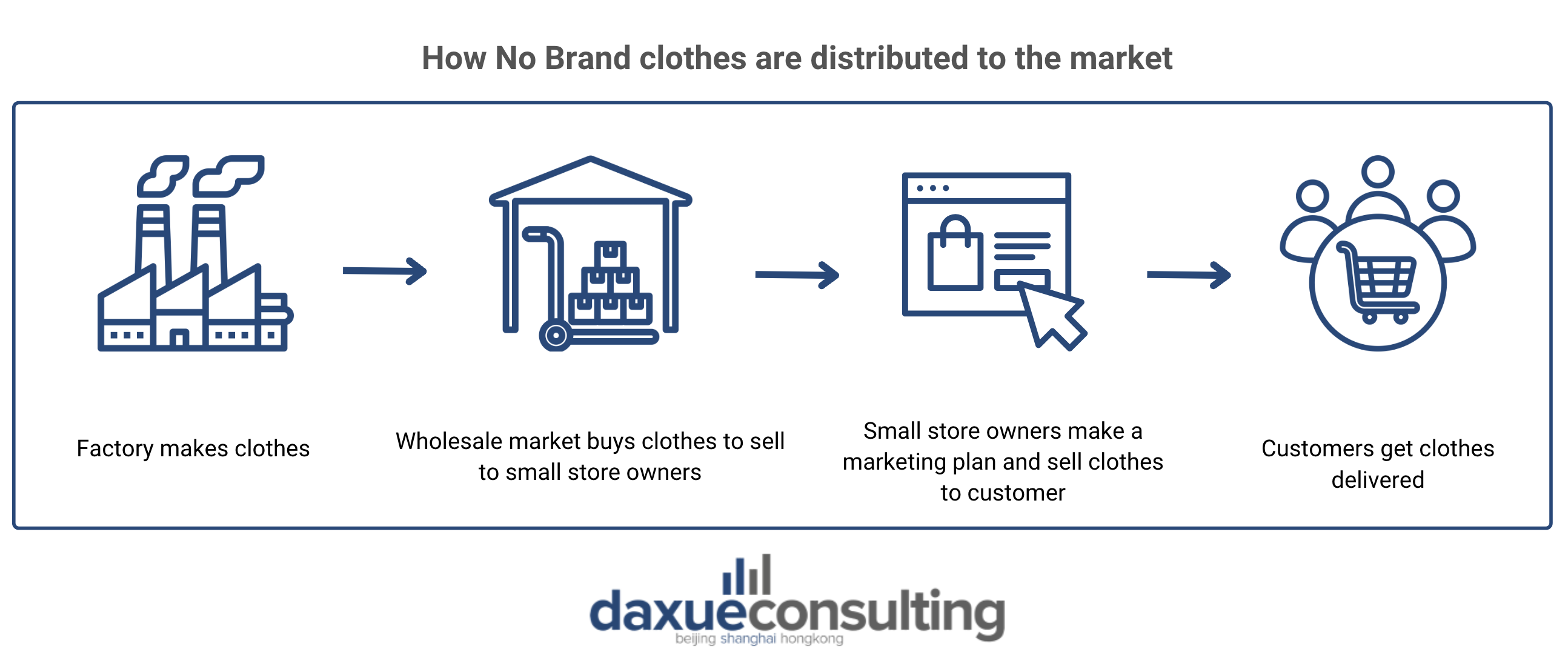

No Brands clothes, often referred to as “Bo-sae” clothes (보세옷), represent garments sold at a low price without offline stores or designers. They are typically manufactured based on the brand concepts of other labels and sold accordingly. Originating in the 1970s when Korea’s clothing trade was booming, No Brands clothes were initially sold to fulfill overseas orders and were made from leftover fabrics to create unbranded garments sold in markets. Today, No Brands clothes are produced through pre-purchases or orders from wholesale markets like Dongdaemun, which buy clothes that align with their store concept and then sell them through retail channels.

No Brands use different channels to target people of different ages. They target the younger generation on online retail websites and the elderly population in traditional markets. Young people are attracted to their trendy yet affordable clothes, despite the risk of not trying them on before purchase. This shows that consumers in the Korean fashion scene prioritize cost-effectiveness and staying on-trend. Approximately 28% of total clothing sales come from No Brands – about 20% for men’s sale and 28% for women.

Apps are not optional but a must have

Having an online channel is crucial to sell clothes in Korea. 66.8% of the MZ Generation prefer online over offline when purchasing clothes. Moreover, in 2022, the total amount spent on clothing through online purchases in South Korea amounted to KRW 40 billion, with KRW 31 billion of that transacted through mobile platforms. Reasons for the preference for online shopping include factors, such as reasonable prices and various promotions.

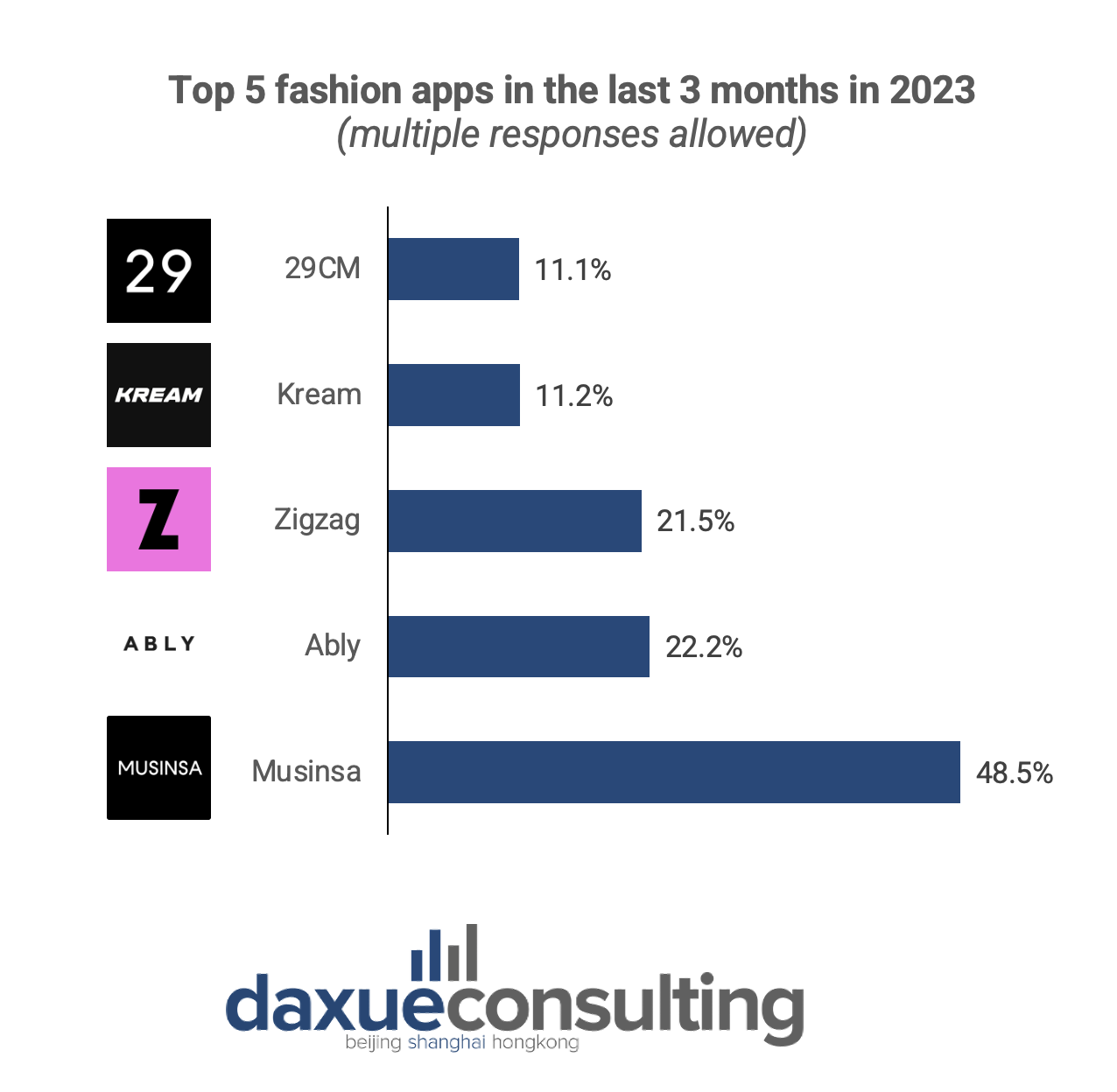

Domestic Brands targeting the younger demographic and many No Brands predominantly sell their products online. Particularly, fashion apps like Musinsa and W Concept specializing in Domestic Brands, as well as apps like Zigzag and Ably focusing on No Brands, are popular platforms for selling clothing. The appeal lies in the ability of these apps to introduce users to a variety of brands and provide real-time reviews, making them highly popular among the MZ Generation. In 2022, Musinsa, one of the biggest domestic fashion brand apps reached one million MAU (Monthly Active Users).

Online-only is not sufficient for online platforms and Domestic Brands: the young generation want in-person experiences

As the online shopping market becomes more competitive, some online shopping platforms have started losing money for their aggressive marketing despite the huge revenue. Zigzag’s sales revenue for 2022, for example, reached KRW 101.8 million, showing an increase of 56.1% compared to the previous year. However, at the same time, their operating loss recorded KRW 51.8 million, representing about 37% increase compared to last year. Most big online shopping platforms are targeting the same audiences, MZ generation, resulting in intensified competition among and increased spending on marketing.

Moreover, domestic brands that were previously primarily or exclusively online are transitioning to offline platforms. They aim to attract more customers by providing an offline shopping experience. Consumers are increasingly responding positively to this shift as they can now explore both online and offline options for products they had previously only encountered online. Through collaborations such as W Concept and Shinsegae Department Store, some brands that were once exclusively online have opened offline stores. The brands that expanded offline reported a sales increase of over 40%. Rest&Recreation, which simultaneously launched online and offline stores in collaboration with W Concept, exhibited the highest growth rate compared to other new brands joining the platform.

Store location shows the hierarchy of brands

Opening offline stores is crucial, and the choice of the location for these stores is equally important. In areas known for their unique atmosphere and popular among young people, there are often branded stores labeled with specific styles, such as “Hongdae style” or “Seongsu-dong style.” This leads brands to select locations based on the direction they are pursuing. Nike in Korea, for instance, named its concept store “Nike Store Hongdae” for this reason. It aimed to appeal to the 10s to 20s age group as Hongdae has a reputation as a fashion hub for the young generation.

These famous areas include Hongdae, Seongsu, and Hannam. Musinsa has strategically opened two locations: Musinsa Terrace Hongdae and Musinsa Terrace Seongsu. These stores aim to provide an experience-oriented shopping experience, where customers can simultaneously indulge in both clothing and coffee. Shoppers have the freedom to “browse or spend time” and “touch or try on clothes,” immersing themselves directly in the brand and the store ambiance. Even if customers don’t make a purchase offline, Musinsa provides a valuable opportunity for them to enjoy their time and encourages them to continue their purchases online.

Korean brands and celebrities together setting fashion trends

Fashion trends are evident both online and offline, with the fastest changes observed in the style choices of K-pop stars. Gentle Monster, one of the most successful fashion brands in Korea, experienced a huge boost in sales after recruiting BLACKPINK’s Jennie as their brand ambassador. The unique design of their sunglasses, coupled with Jennie’s fame, created a powerful synergy effect. In fact, products created in collaboration with Jennie achieved record-breaking sales, attaining tremendous popularity among the younger generation.

One of the other collaborations is the partnership between Musinsa and New Jeans. Musinsa, primarily known for its focus on men’s apparel, had relatively lower sales in women’s fashion compared to men’s. However, following the collaboration with New Jeans, women’s sales growth more than doubled. The continuous exposure of new fashion to female customers through collaborations like New Jeans, suggesting “outfits for the office”, contributed to the increased sales in women’s fashion. Such collaborations between the fashion and entertainment industries appeal to many younger fashionistas.

Key points: Sensitive Korean fashion trend moving fast with different brand leaders

- Korean fashion trends are highly sensitive and crucial in Korean fashion industry.

- Domestic brands traditionally considered low profit, now lead the fashion preferences of the MZ generation.

- No Brands play a crucial role in Korean fashion, targeting both the young and elderly populations.

- Fashion apps like Musinsa, W Concept, Zigzag, and Ably are popular among the MZ generation.

- After the pandemic, people are seeking more in-person experiences, posing a threat to online malls.

- The choice of location for offline stores is crucial, especially among the MZ generation.