China’s pork industry

China’s government has promoted the development of large-scale pig farms in response to disruptions in China’s pork industry caused by swine flu

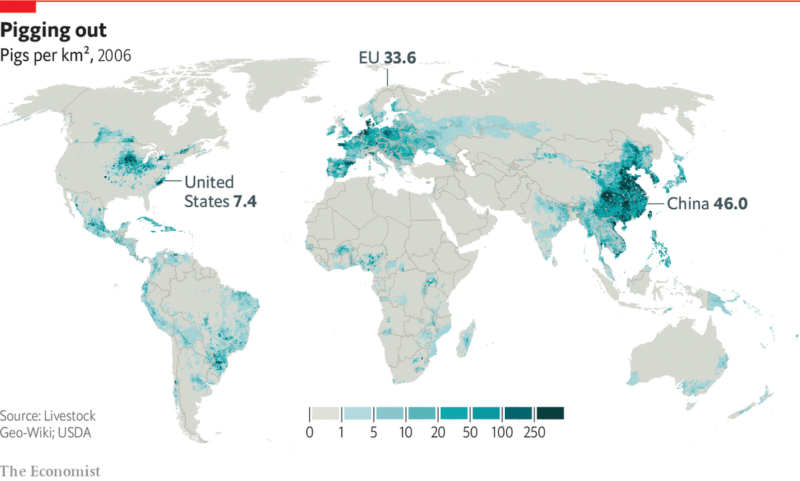

When people think of China, one of the first things that comes to mind is its huge population. For those in the food industry, China’s huge population also means huge demand, especially for pork which is a favorite meat in China. Worth about $128 billion in 2019, China’s pork industry is massive. Before the spread of swine flu across the country, there were over 400 million pigs in China, which is more than the population of people in the US.

In August of 2018, Chinese pig farmers in Liaoning, Jiangsu and Henan provinces first started noticing that something was wrong with their pigs. Less than one year later, every Chinese province had reported at least one case of swine flu. Since swine flu is fatal for pigs and since it can spread so rapidly between farms, millions of pigs had to be culled across China. By September 2019, the pig supply in the Chinese pork industry had decreased by nearly 38%.

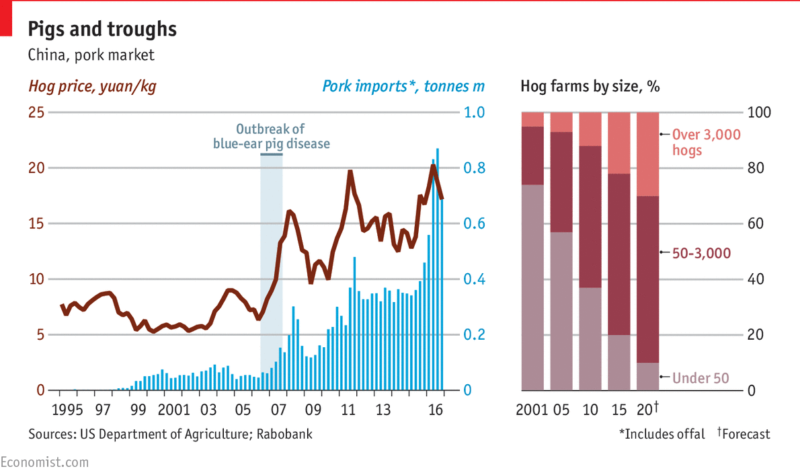

Since most Chinese pig farms are small scale farms, many farmers may only raise a few pigs at a time. As a result, when an epidemic such as swine flu races across the country, it is unlikely that small-scale farmers will report the incident or cull their pigs. Instead, small-scale farmers are incentivized to sell their contaminated meat and turn a blind eye to the problem. This is part of the reason why swine flu was able to spread so fast across the country and why it became so difficult to monitor.

The Chinese government promotes larger farms to stabilize China’s pork industry

With the spread of swine flu continuing to affect Chinese pig farms, prices for pork have begun climbing, with food inflation reaching 10%. This increase in prices has begun aggravating Chinese consumers, which is why the Chinese government has decided to intervene before the virus wreaks further havoc on the Chinese pork industry.

In order to incentivize companies to build larger pig farms, the Chinese government has begun offering financial support to those willing to increase their farm size. This financial support ranges from 500,000 RMB to 5 million RMB, a handsome sum of money for a company looking to enter the pork market in China. Between 2016 and early 2019, more than $10 billion worth of investment in large-scale pig farms in China had been reported.

Also on the government’s agenda is to increase standardization across the Chinese pork industry. The government is encouraging this through the incentive to build large-scale pig farms in China, as larger farms are more likely adhere to market, sanitation and environmental standards. These standards are useful in preventing a future epidemic of swine flu or other disease that could threaten the pork market in China.

Companies that are large in scale and that adhere to standard pork processing procedures stand to benefit from the current situation in the Chinese pork industry. But, what does this mean for foreign companies who are looking to enter the pork market in China?

Is this a once-in a lifetime opportunity for foreign companies to expand into the pork market in China?

China’s pork industry has historically been dominated by domestic companies and farms leaving little room for foreign entrants. However, Danish Crown had already entered the Chinese pork industry before the onset of the swine flu epidemic last year. After the disease swept across the country however, the company realized its golden opportunity had arrived. Last month, the Danish pork company opened a warehouse about 100 kilometers from Shanghai in Zhejiang province that will process and package imported pork from Denmark. On top of that, the Danish company made a deal this year with Alibaba to sell their high-end pork imports in Hema Xiansheng, a futuristic grocery store using new retail, that caters to China’s rising middle class and grocery delivery enthusiasts.

Also in the pipeline is an investment by Tonnies Group, a German outfit. Hoping to expand into the Chinese pork industry, the German company has announced a planned deal worth €500 million, of which €150 million will be invested in a large warehouse in Sichuan province. Once constructed, the warehouse will house one of the largest pork slaughtering centers, which will be used to process pork exports to China.

Due to its enormous size, there is a great deal of potential for other foreign companies looking to expand into the pork market in China. Not only has the demand for pork increase tremendously as a result of the swine flu epidemic, but it is also likely that demand will continue to grow steadily as more farms reveal their losses as a result of the epidemic. On top of all this, China’s ever-growing middle class has more and more appetite for pork.

What is the takeaway for companies eyeing up China’s pork industry?

Due to the current volatility that African swine flu has caused in China’s pork production, there is great potential for foreign companies to prosper in the pork market in China. On top of this, demand for meat from middle-class Chinese citizens is growing by the day, adding to the allure of the Chinese pork industry.

In addition to the epidemic and rising middle class, the Chinese government’s current attitude towards the pork industry helps foreign companies. Large pork companies looking to enter the pork market in China are eligible for subsidies. In addition, the government is encouraging companies that adhere to strict guidelines when it comes to processing and exporting pork to China. These both stand to benefit foreign companies.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes