In recent years group buying in China has gradually changed the consumer behavior of many Chinese people. Group buying refers to a way of buying in which consumers unite to increase their bargaining power. Making the sacrifice of small profits for more frequent turnover, merchants can offer discounts for group purchases below retail prices. As an emerging e-commerce model, community group buying in China improves the bargaining power of consumers through the forms of consumer self-organization and professional group buying websites.

Based on its characteristics and recent observations, our team at Daxue Consulting speculates that community group buying in China will continue to rise in the long run even when the pandemic is over, and here’s why.

What are the advantages of group buying in China?

Since the development of community group buying is based on social networks, the cost of acquiring customers is very low. The community group buying model has high conversion and retention capabilities. Additionally, the channels for acquiring traffic are more diversified.

Community group buying integrates small orders from households in the community into a larger order. Merchants can deliver the goods in a unified manner, and then the consumers pick them up. By replacing express last-mile delivery, it greatly reduces the logistics cost. At the same time, it saves the cost of home delivery by couriers through group leader delivery or consumer pick-up mode.

The next advantage is that supply chain in the community group buying market in China is simple: as there is no middleman, the price is more affordable. The group leader serves as an intermediate bridge between the community group buying platform and consumers. Compared with traditional channels, community group purchases have low logistics costs, less inventory pressure and higher sales efficiency.

Who were the main consumers before the 2022 lockdowns?

Based on the user statistics from the group-buying platform Niwonin, 44% of users used to age between of 30 and 39, while 85% of daily active users were women. Citizens of Chinese low-tier cities where people have sufficient purchasing power and have a close community made most of the community group purchases, whereas users in tier-1 cities tended to choose more traditional Chinese e-commerce platforms like Taobao and JD. People in high-income cities often do not know their neighbors, which also makes it difficult to create groups.

How the COVID-19 pandemic boosted the group buying market in China

The pandemic in early 2020 was also an accelerator promoting group buying to a larger audience. Throughout the pandemic, at least 27 cities in China have experienced lockdown restrictions, affecting at least 180 million people. When the cities paused the operation and people were stuck at home, satisfying daily necessities became an issue.

On top of that, online delivery almost ceased when lockdowns happened due to the fact that deliverymen were also restricted from going outside. Some communities started distributing free food packages and daily necessities, but this varied from district to district and not all communities were guaranteed with sufficient food supplies. As a result, group buying turned into an optimal choice, especially during the lockdowns when labor force was extremely limited. People gathered on online group buying platforms and purchased items in bulks, then these platforms distributed items to communities. Consumers could either collect their products in the community or wait for volunteers to deliver them at their door.

The 2022 lockdowns drive community group buying to big cities

We speculate the 2022 lockdowns is likely to bring group buying to a larger audience, as more consumers from upper-tier markets may participate. Indeed, the uncertainties around further lockdowns will also push people to stock up.

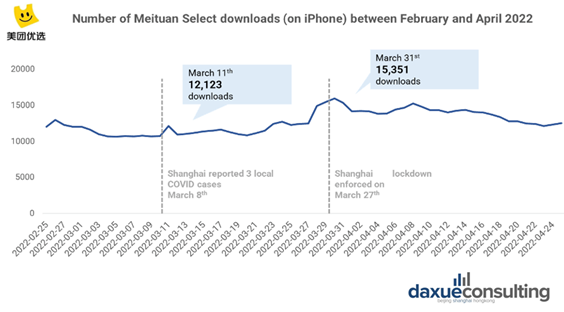

Both Meituan Select and Pinduoduo, China’s top-two online community group buying platforms, experienced a notable increase in downloads when Shanghai reported three local covid cases on March 8th, twenty days before the lockdown was enforced.

The decrease in consumer confidence also pushed people to buy less and save more. China’s Consumer Confidence Index recorded a decline of 26.5 from March to April 2022, revealing a slight downward in consumer optimism. Furthermore, 54.7% of respondents in Bank of China 2022 Q1 survey declared planning to save more this year. As a result, people may seek platforms offering cheaper alternatives for grocery, and group buying is one of the possible options.

Group buying in China creates a closer community

In high-income cities in China, most people are not familiar with their next-door neighbors. However, the 2022 Shanghai lockdown has brought people closer together by group buying. For example, group buying organizers invited residents who live in the same community into group chats and published products that consumers would like to buy together. Residents interacted frequently through the chat to discuss about the quality and price of the products, thereby building up a stronger sense of a closer community. Moreover, the enhanced bargaining power allowed people have better prices.

Apart from price, quality is also an essential factor for consumers when purchasing groceries. How could the community determine whether a product is worth buying? Group chats effectively increased information-sharing among community buyers through word-of-mouth. As a result, products with inferior quality and unacceptable prices do not last long in a community buying situation. In the long run, brands who want to profit from the community buying situation must consider how they can maintain a high reputation and pay closer attention to consumers’ needs and preferences. Perhaps, these group chats are the most authentic platforms in catching the evolving preferences of Chinese consumers.

The future of China’s community buying market

As community group buying consumers are likely to continue rising in the following years, the group buying industry may experience adjustments. Different platforms are likely to reposition and enter the market. Other platforms may exit their current market and rebrand to focus on upper-tier markets, while some platforms may remain where they are and continue serving the lower-tier market. Indeed, it is difficult for a single platform or brand to cover the whole group buying market in China as consumers’ preferences are constantly changing and varied significantly by market tier.

The evolution of China’s group buying market:

- After the 2022 Shanghai lockdown, community group buying has been pushed to the spotlight, and our team speculates that community group buying in China will continue to rise in the long run, even when the pandemic is over.

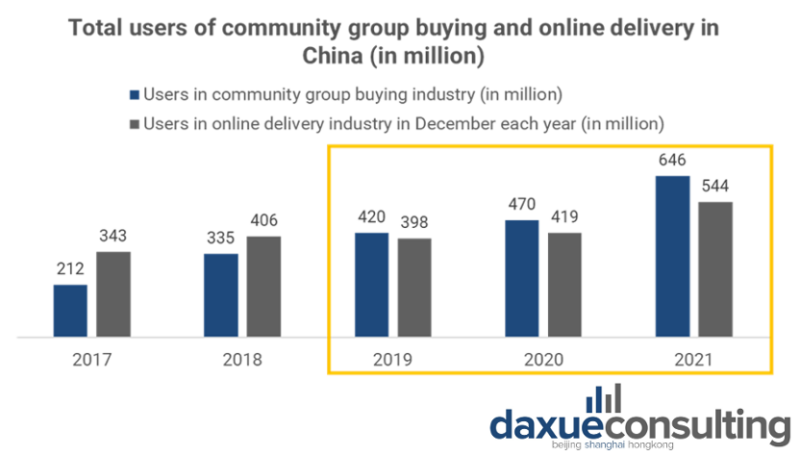

- Group buying users surpassed online delivery in terms of total users in 2019 while huge investments were injected into the market.

- The pandemic in early 2020 was also an accelerator promoting group buying to a larger audience.

- The risk of further lockdowns will push people to stock up, and the decreased consumer confidence also pushed people to buy less and save more, while group buying is one option that satisfies the needs.

- The 2022 Shanghai lockdown has brought people closer together through group buying, which results in enhanced bargaining power allowing people have better prices when participating in group buying.

- Group chats effectively increased information-sharing among community buyers through word-of-mouth, so only high-quality products may survive in group buying.

- The group buying industry may experience adjustments soon when it gains a larger audience.

Learn more about the long-term Zero-COVID impact on Chinese Consumption

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast