China’s baby formula market has faced several challenges over the past two decades, leading to a decline in consumer trust. One of the most significant incidents that shook the industry occurred in 2008. Melamine was found in contaminated baby formula products. The toxin was identified in a Chinese brand. However, it rippled across the industry. The incident scared families away from domestic producers and resulted in a market that was welcoming to foreign firms.

Download our report on how young Chinese Consumers are Finding Themselves

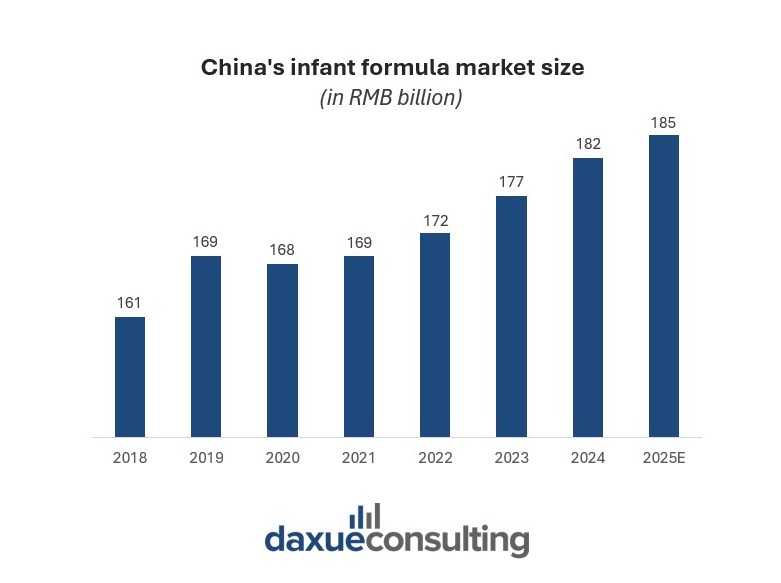

The second shock was a scandal that happened in 2014. Toxic bacteria were found in different imported dairy products from New Zealand. At the time, the demand for baby formula was rising in China. This incident instantly led to distrust in domestic brands, prompting consumers to turn to foreign brands and imported products. With the government’s efforts to promote Chinese producers, the industry began to shift its focus back to local companies. In 2025, the baby milk and infant formula market in China amounted to a total of RMB 129 billion (USD 18.06 billion). Moreover, the market is expected to grow annually by 7.78% (2025-2030), making it the highest revenue-generating market globally.

Slow recovery and growth potential

In the past five years, the infant formula market has experienced three cycles:

1) Increasing both price and volume,

2) Decreasing volume and increasing price,

3) Decreasing volume and decreasing price.

Following these fluctuations, a steady recovery trend has emerged. Although the market is still undergoing an adjustment period, top leading dairy companies such as Feihe and Ausnutria are tapping into the “high-end” and “refined” market.

The National Bureau of Statistics reported that China had 9.54 million newborns in 2024, an increase in birth rates after seven years of decline, and an increase of 520,000 compared to 2023. The government will provide RMB 3,600 (USD 503) a year for each child until they turn three under a nationwide initiative starting in 2025.

Although China replaced its one-child policy in 2016 with a two-child limit and ultimately allowed families to have up to three children in 2021, the cost of raising kids has deterred many Chinese families. This policy did not result in the expected growth of the population. As fewer women and couples desire to create large families, with some opting to have no children at all because of high prices and value changes. According to a report by Frost and Sullivan, the number of children aged 0-3 in China will be about 28.2 million in 2024. This is a decrease from 47.2 million in 2019. This was due to declining birth rates in 2019-2023, and although set to recover, 2024 is too recent to reverse the trend.

Market growth drivers

Even though the number of births in China increased in 2024, it didn’t have an immediate positive impact on the infant formula market, which still declined by 5.6% in 2024. The majority of the market growth is tied to premiumization. This is to signal better quality to the consumers at a higher price point. China’s middle class is one of the fastest-growing in the world where it is projected to grow to 80 million by 2030.

Government regulations and support

In February 2023, the State Administration for Market Regulation in China introduced the Measures for the Administration of Recipe Registration of Infant Formula Products, which included new regulations. The regulations emphasize labeling standards, consumer protection, research and development, and on-site inspection.

Hohhot, the capital of Inner Mongolia, announced a subsidy program in March 2024. It comprise a one-time payment of RMB 10,000 (USD 1,393) with the birth of a family’s first child. The second child is eligible for annual subsidies of RMB 50,000 (USD 6,968) until the age of five, and RMB 100,000 (USD 13,936) for those who have a third child until they turn ten. A Citi analyst reported that the Hohhot subsidies could boost retail sales by an additional 0.2% in the first year. The per capita disposable income of rural residents was RMB 23,119 (USD 3,222) in 2024. Meanwhile, the income of urban residents was twice as high, at RMB 54,188 (USD 7,552).

Major shift in targeted market: from babies to seniors

Chinese dairy companies are compensating for the shrinking baby formula market and instead targeting the growing elderly population. This shift is to produce adult nutrition products to target this demand. Both local and global giants are launching products aimed at adults and seniors. For example, in 2022, Feihe launched four kinds of milk powder for the middle-aged and senior demographic. This is to meet the different needs of these consumers for the improvement of immunity, bone, and cardiovascular health.

In March 2025, Yili announced the launch of China’s first adult milk powder with sleep-aiding effect, to better fit the product to this new demographic. These companies are seizing this opportunity and launching milk powder products covering calcium supplements, sleep aids, fat reduction, and intestinal health.

Safety is a priority for both consumers and officials

With a growing focus on quality and safety, Chinese customers in the baby formula market are becoming more discerning. In general, consumers in China prefer to purchase fewer, higher-quality, but more expensive goods. The recent food safety scandals, shifting health priorities due to the pandemic, and growing disposable wealth all contributed to this change in choice.

The Chinese government has focused on tightening industry safety controls to reassure families. To improve the safety and quality of infant formula, the government implemented strict rules in February 2023. These regulations require producers to spend a lot of money on product reformulation, testing, certification, and re-registration before initiating new marketing campaigns. Most importantly, the standards changed the requirements for nutrient levels and lactose content, and banned certain elements, to match infant formula as closely as possible with breast milk.

This policy will affect the constitution of the market. As a result of these changes, smaller or foreign players are more likely to exit the market. This was due to the resource-intensive registration process, which can last up to one year. The government’s aim is to reduce competition in the market and strengthen the safety standards this way.

Competition within the infant milk powder market

Improved health awareness is driving the premium infant milk formula (IMF) category. Manufacturers are competing to develop IMF that has the same nutritional value as maternal milk. The government’s national standards for infant formula also state this. The market has become more concentrated as some of the smaller players were squeezed out due to the increased cost of compliance.

China has been seeing consumer interest in domestic companies rise in the past few years, owing to the Guochao trend. Now, the newly implemented regulations may help local producers gain even more market share. Feihe, a Chinese brand, is the leader in the industry and has been the top brand for the past six consecutive years since 2019. In 2022, domestic brands already accounted for 60% of the market. However, even though some growth is seen, Chinese companies remain pessimistic about the future of the market: even if their market share grows, the total sales are likely to be reduced.

The current state of China’s baby formula market

- Despite being shaken by safety scandals in 2008 and 2014, China’s baby formula market has reached its highest revenue in years, amounting to RMB 129 billion in 2025.

- The government is attempting to boost the market through eased child policie. However, it is unlikely to lead to the expected growth due to declining birth rates.

- The government is tightening regulations to prioritize safety and quality, which is a response to families’ concerns over product quality.

- With China’s declining birth rate and growing elderly population, leaders in the dairy business are shifting the focus to adult and elderly milk powders that address problems like sleep, immunity, and health.