A new term on the Chinese internet is 成分党, pronounced “cheng fen dang”, which points to the tribe of skincare consumers in China known as “Skintellectuals”. This consumer tribe are ingredients-oriented and thoroughly research skincare products before purchasing. The ingredient-based skincare market in China precisely targets this knowledgeable consumer group.

Like makeup, skincare, selfies, topics about “yanzhi” (颜值) are commonly discussed on Chinese social media. Accordingly, the yanzhi economy, such as makeup products, skincare products, and selfie apps, is rising in China. In addition, one of the rising categories is the premium skincare market in China, specifically, ingredient-based and well-researched consumption.

Download our report on Chinese beauty consumer pain points

What is the ingredient-based skin care market?

Ingredient-based skincare marketing is when brands use the scientific names of ingredients to market a product, rather than simply highlighting the product functions. In contrast to mainstream skincare products which highlight the functions before the ingredients, ingredient-based skincare consumers have done enough research to know which ingredients to buy based on their own needs. This market strategy aims to target skintellectuals in China.

Who are Chinese skintellectuals (成分党)?

These consumers are the ‘self-improvement’ gurus of the skincare world, and even make learning about skincare a hobby. They are highly aware of pollutants in products, and are not as easily convinced by branding. Therefore, many leading brands in the ingredient-based skincare market, such as The Ordinary and HomeFacial Pro, have a minimalist branding approach.

China’s skincare market dominates the cosmetics industry

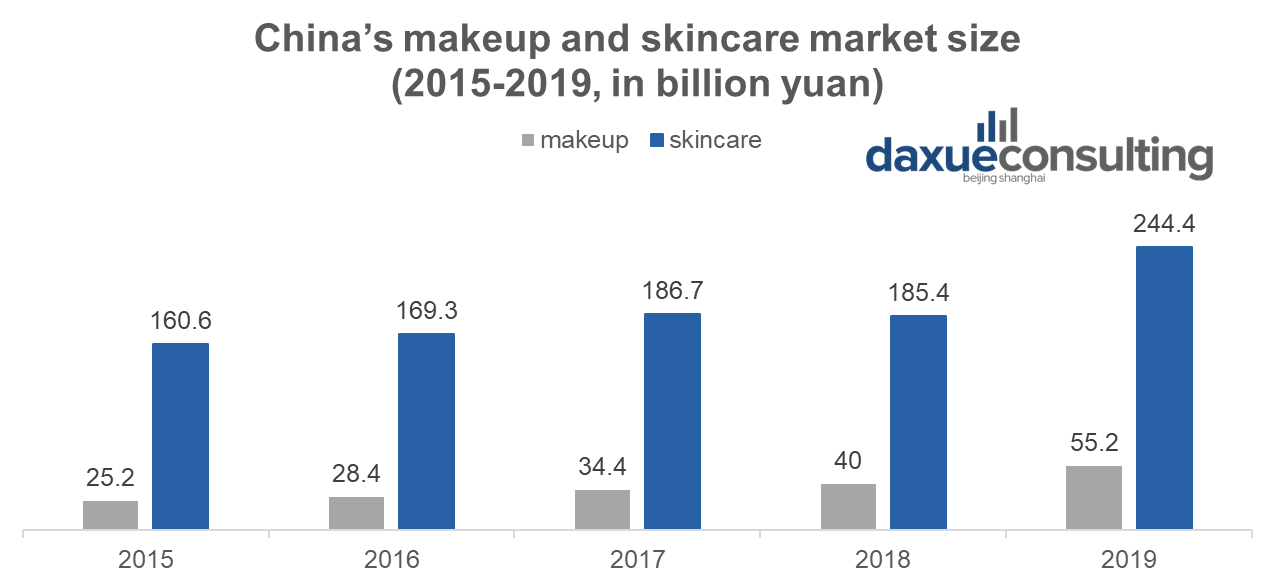

Skincare products, such as face masks, toners and essences, take up the most part of the cosmetics market in China. China’s skincare market size reached 244.4 billion yuan in 2019, which was 4.43 times larger than the makeup market, according to data from the Chinese firm Forward the economist.

Since 2016, China’s beauty consumers have put forward higher requirements for safe, healthy and functional skincare products. With the rise of this awareness, they desire natural and organic ingredient formulations in products, which has propelled the growing need of ingredient-based skincare products in China.

How ingredient-based promotion emerged from China’s premium skincare market

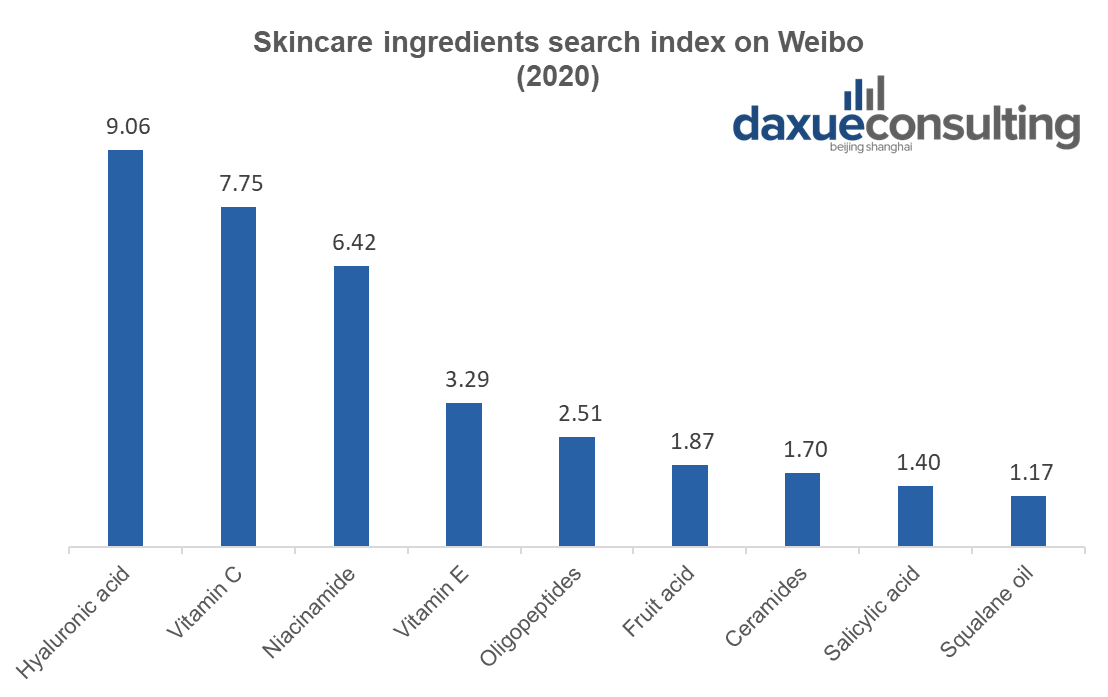

International cosmetics giants like Estee Lauder and Lancôme spend a lot of money on campaigns highlighting their ingredients, trying to take the market through consumer education. At the same time, the new Chinese brand, Home Facial Pro, names their products for popular ingredients directly. Words like Salicylic acid, hyaluronic acid, squalene oil are becoming household names in China. Although mass consumers may not really understand those ingredients, they may have heard of them. For skincare enthusiasts, the ingredients mentioned above have already been frequent topics in beauty communities on Chinese social media.

The growing awareness of skincare ingredients among Chinese urban consumers

Consumers from 1 and 2 -tier Chinese cities are quite knowledgeable about skincare ingredients and are more willing to pay for them than consumers from smaller cities. On the one hand, the ingredients awareness rises because of an increasing number of skin problems in women who live in urban China. For these consumers, staying up late and working under pressure are the main causes of skin problems. On the other hand, after white-collars, 29.96% of skincare ingredient enthusiasts are college students. Because of the higher education background, they have a stronger need for information transparency and pay more attention to the chemical ingredients of skincare products.

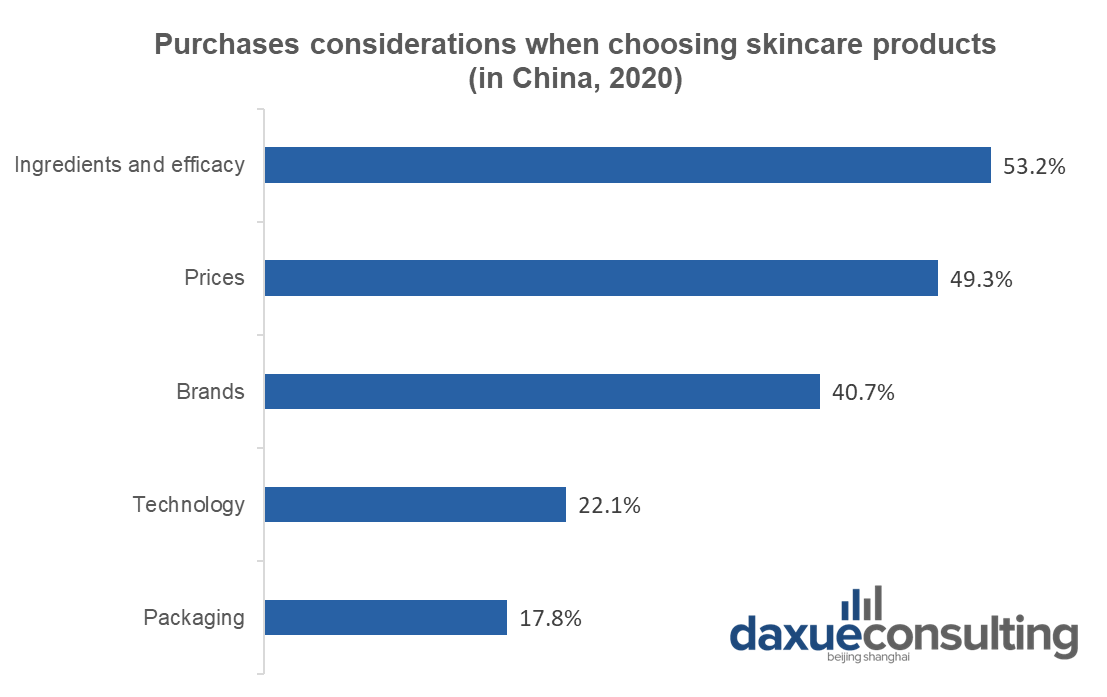

With the growing awareness of skincare ingredients, more and more consumers will not decide on skincare products from the effect that manufacturers claim. Rather, they will ask questions such as “what ingredients are bad for skin?”, “which ingredients brighten the skin?”, and “what ingredients can get rid of acne?”. The ingredients and their efficacy in the product are the most important factors.

Beauty KOLs help to build the bridge between unfamiliar ingredients and consumers

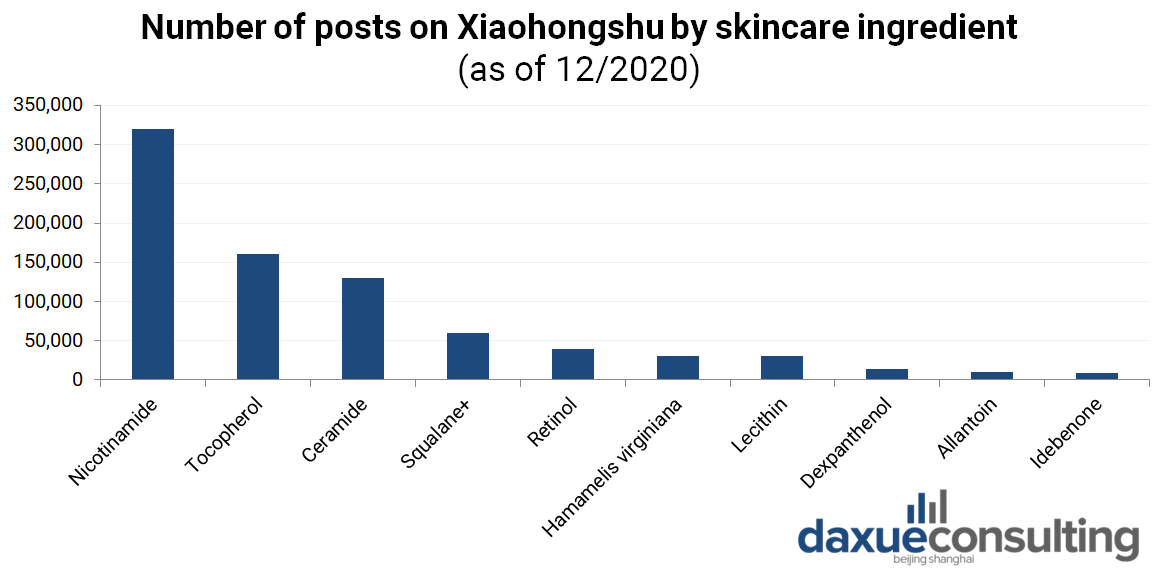

On Chinese social media platforms, there are many recommendations and analyses of skincare ingredients by beauty KOLs. Shua’suan (刷酸), directly translating as “brushing acid”, means using acidic ingredients in the skincare routine. Searching for the keyword “shuasuan” on Xiaohongshu, there are more than 140,000 related notes. For consumers who do not know those professional chemical terms, beauty KOLs have become the bridge for them to learn about different ingredients in various brands.

In addition, understanding the effects of different ingredients allows skincare enthusiasts to personalize their skincare regimens to address their own skin problems. They usually use more than one ingredient-based product to take advantage of each ingredient’s properties. For example, for dry skin consumers, 10 minutes after using a product containing 10% salicylic acid, a product containing vitamin B5 is used to keep the skin hydrated; for sensitive skin consumers, 5% salicylic acid products should be used instead. Therefore, Chinese skincare ingredient enthusiasts spend more than the average on skincare products, as well as more time on searching for information before purchasing.

Both foreign brands and domestic brands are in China’s ingredient-based skin care market

Skincare products are regulated strictly by governments worldwide. To ensure consumers’ safety and distinguish the skincare and cosmetic medicine, the use of “medical”,” medicine”,” pharmaceutical” and other related words is prohibited in China. Unlike consumers in some countries, Chinese consumers do not buy cosmetics products from pharmacy stores or drugstores. At first, skincare brands also were trying not to emphasizing chemical ingredients to avoid unnecessary trouble during the promotion. However, with the improvement of consumers’ education level and the heat of ingredients science, brands put an emphasis on skin science based on ingredients formulation during the promotion.

In the ingredient-based skincare consumption in China, based on the modern medical theory, overseas brands occupied a major share of the market. This trend reflects the strong demand of young consumers for fast effects on skincare products. However, in the past two years, domestic skincare brands that contain Chinese herbal ingredients have also emerged quietly.

Even though the Ordinary, a Canadian ingredients skincare brand, does not have official stores in China, it is the brand that the most commonly mentioned among Chinese skincare enthusiasts. One reason is their full ingredients categories. The Ordinary has earned the Chinese nickname, “raw material bottle” (原料桶), because of their packagings like material glass bottles in the laboratory and their simple names with main ingredients.

Consumers are able to easily find the only main ingredient they need and do not have to think about the impacts of other ingredients like other products that contain many ingredients. Another reason is the price. Most products of the Ordinary are less than 100 yuan, while other products from giant brands containing similar ingredients cost at least 100 yuan.

In terms of Chinese brands, Home Facial Pro has also gained popularity from ingredients enthusiasts. Promotions on skin health and technological ingredients formulation catch young consumers’ minds. Additionally, some Chinese brands, like Yuesai and Pechion, claim the Chinese herbal ingredients, such as lingzhi and Chong Cao (caterpillar fungus) in their products, which attract attention as well.

Top skincare ingredients for Chinese consumers

According to Weibo research data, three benefits of skincare that consumers are most concerned about are hydration, repair and whitening. In turn, hyaluronic acid, vitamin C and niacinamide are three ingredients that consumers are most talked about.

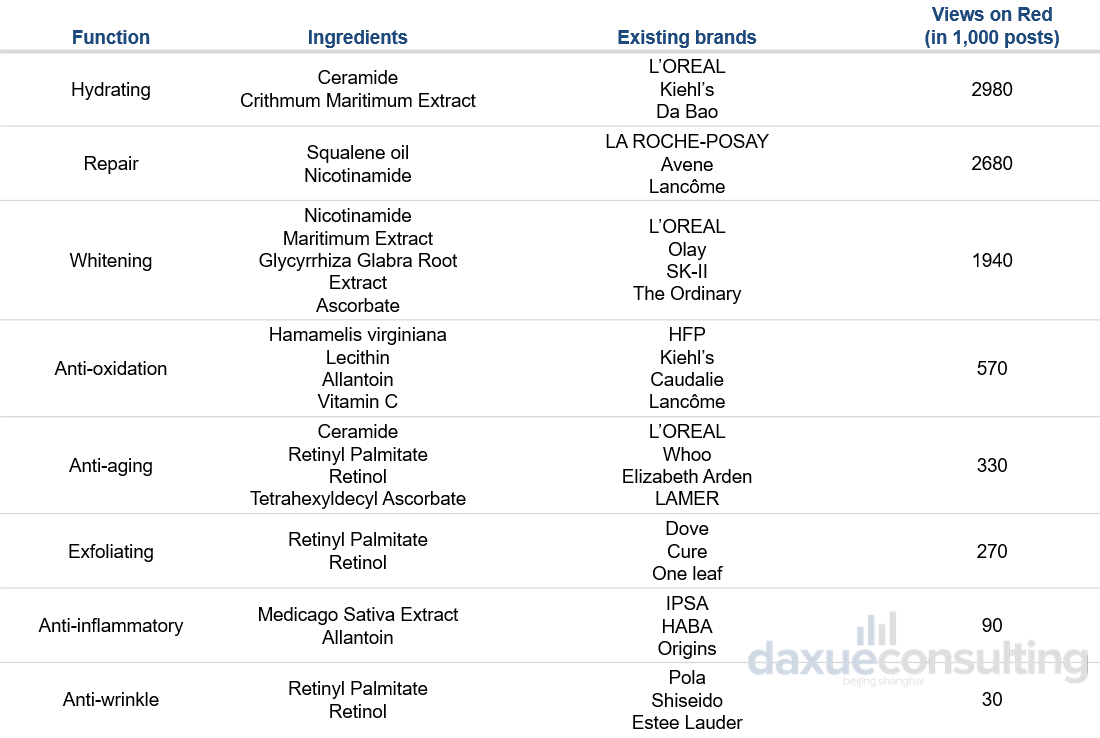

Based on social media listening, these are the function-ingredient pairs in the ingredient-based skincare market in China.

Through social listening, we can also understand the perceived functions of each ingredient.

Hyaluronic acid

Hyaluronic acid provides long-lasting hydration to the skin and also helps reduce the fine lines and wrinkles retaining moisture to the skin. The most frequently used skincare products containing hyaluronic acid in China are face masks. In addition, hyaluronic acid injections are also very common in China’s plastic surgery.

Existing brands in China: Balea, The Ordinary, Filorga, L’OREAL, Timeless

Vitamin C

When talking about vitamin C, there is a word in Chinese skincare consumers “早C晚A“, meaning “using vitamin C in the morning and using vitamin A at night”. Vitamin C can give the skin brightness and reduce acne.

Existing brands in China: DHC, Kiehl’s, Paula’s Choice, Cinque

Niacinamide

Niacinamide, also known as vitamin B3, is most often used in moisturizers and helps repair cells in the skin. In China’s ingredient-based skincare market, niacinamide is also considered to achieve the effect of whitening, but only under the higher concentration of around 5%.

Existing brands in China: The Ordinary, CareVe, Olay, Chando, SK2, Elizabeth Arden, LA ROCHE-POSAY

Vitamin E

Vitamin E is known for its anti-aging function. It can reduce dark spots and inflammation. In the Chinese premium skin care market, both skincare creams and capsules containing vitamin E are popular products.

Existing brands in China: Biao Ting, Vaseline, CeraVe, Da Bao

Oligopeptides

Oligopeptides are a kind of protein and help tighten the skin and smooth eye wrinkles. It often can be used for anti-aging eyes essences. Many consumers in China who have sensitive skin also use oligopeptides, instead of acids, to reduce acne.

Existing brands in China: HomeFacial Pro, EVM

Fruit acid

Fruit acid, including glycolic acid, lactic acid, and salicylic acid, is commonly used in skincare products. Because of the wet weather in southern China, many consumers with oily and acne-prone skin prefer to use fruit acid, particularly in summer.

Existing brands in China: The Ordinary, Dr.Wu, Stridex, Sesderma, Broda, Dr.Dennis Gross

Ceramides

Ceramides help increase skin hydration and improve the skin barrier. They are highly recommended to customers who are sensitive skin on Chinese social media.

Existing brands in China: Tunemakers, L’OREAL, Elizabeth Arden, Curel, Pien Tez Huang

Squalane oil

Squalane oil also can help the skin hydrated and has anti-aging properties. Essences with squalene oil from are popular with customers in China.

Existing brands in China: HABA, The Ordinary, Elizabeth Arden, Chilan, Broda

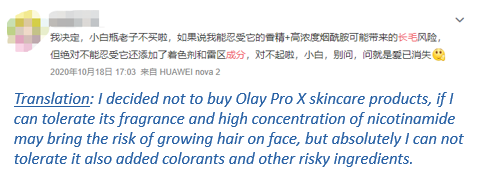

Harmful ingredients keep consumers with sensitive skin away from certain skincare products

In addition to those ingredients that beneficial for the skin, some of the ingredients in skincare products may cause acne, redness and other problems, which keep Chinese consumers distance away from them.

According to iResearch, 43% of respondents admitted that they had sensitive skin, and 23% said that they had worse troubles like tingles and swelling on the skin. The more sensitive the skin is, the higher the requirements for skincare ingredients. They often avoid the ingredients like high concentrations of salicylic acid, polyethylene glycol and potassium hydroxide. Alcohol-free and fragrance-free items are a must for them.

During the COVID-19 period consumers focused on skincare over cosmetics, and had more time to research ingredients

The outbreak of COVID-19 has dramatically affected the cosmetics market. The growth rate of China’s skincare market was expected to grow by only 4% in 2020. However, it is due to the pandemic that consumers have time to recover their skin health at home.

Also, China’s spas often use premium, ingredient-oriented skincare products. As spas were closed during the quarantine period, some consumers were interested in getting the same result at home. For ingredient-based skincare brands, it is an opportunity to help consumers to understand which ingredients to use and improve awareness at the same time.

What brands should know about China’s ingredient-based skin care market

- Social listening is incredibly important to tap into the Chinese skintellectual consumer base. The reason is because these consumers are constantly doing research online and discussing products and ingredients with each other. As members of the same tribe, they are more likely to trust each others’ product reviews than a brand marketing message.

- Simplicity is key in branding. The success of The Ordinary among Chinese netizens can teach us that these consumers do appreciate straightforward branding.

- Less is more for ingredient formulas. As there are both ‘must-have’ ingredients along with ‘must-avoid’ ingredients, attempting to perfect a product by adding a scent or adding alcohol will drive sensitive skin consumers away.

- KOC marketing is crucial for ingredient-based consumers. As these consumers are looking for real reviews and not brand promotions, it’s important for them to hear from authentic members of the community to learn about products, for this reason, KOL marketing is riskier.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about the marketing strategies of C-beauty brands

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast