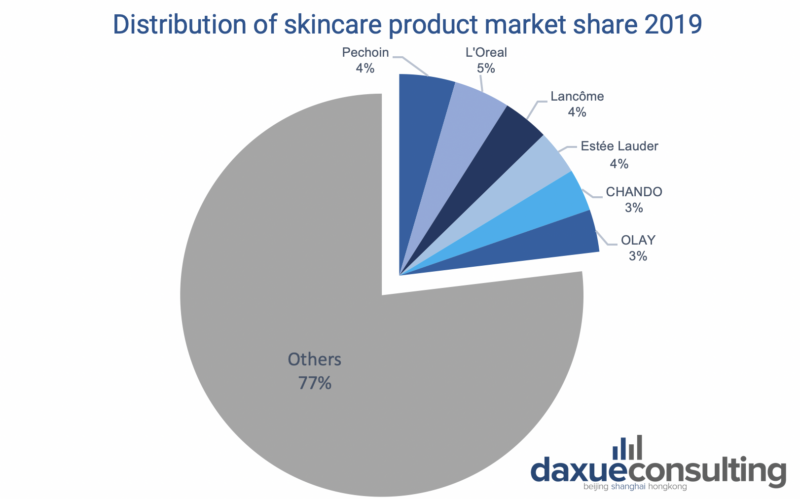

China’s skincare market revenue in 2022 amounts to RMB 110 billion and is expected to grow by 8% annually. 2019 research by AskCI Consulting reveals that Pechoin (百雀羚) accounted for 4.5% of this market. Pechoin retains this position by staying on top of China’s skincare market trends which include embracing Chinese traditions, up to the minute marketing on social media channels, embodying sustainability – all while keeping reasonable pricing.

Pechoin: The beginnings of China’s Skincare market’s largest player

Pechoin a company of Shanghai Pehchaolin Daily Chemical (SPDC), was founded in Shanghai in 1931 by Gu Zhimin, representing China’s first domestic skincare brand. Pechoin’s first product was their moisturizing balm (Pehchaolin), which was widely popular, and even used by the Japanese royal family and the Soong sisters. The Soong sisters, the wives of China’s most powerful men, introduced the product to foreign envoys’ wives. Pechoin prides itself on the healthy and natural ingredients used in its skincare products, a result of great research and application of Chinese herbs. The company survived through major historical moments, facing near bankruptcy several times. Despite this, Pechoin dominates China’s skincare market today.

“Chinese retro”: How Pechoin utilizes Guochao

Guochao(国潮)is the trend of Chinese consumers preferring to shop from local brands that embrace Chinese culture. The word itself means national trend. This trend was fueled by China’s Generation Z – primarily females living in middle to lower-tier cities. In particular, 53% of Guochao cosmetics consumers live in tier-4 and lower cities. Pechoin is a brand that perfectly embodies the Guochao trend. Firstly, slogans like “Beauty of the East” and “Oriental Culture” position Pechoin as a noble Asian brand. In addition, Pechoin still sells its signature moisturizing balm with the same formula from its original 1931 packaging. The classic tin box of Pechoin carries the warm memories of generations which induces a sense of nostalgia in consumers. It is a constant reminder of the company’s long legacy and reputation, and a reassurance of the reliability and safety of the product. In a swiftly evolving skincare market, Pechoin is an anchor of comfort.

Furthermore, Pechoin created a new product line of hand creams featuring modern illustrations of traditional Chinese women on their packaging. Pechoin’s products and advertisements’ refreshing mix of contemporary and vintage elements attracted younger consumers who follow the Guochao trend, implying that Pechoin is not a brand solely targetting older women. On its official website, the brand’s history is celebrated, with a timeline of key events recounting the brand’s most important moments. The latest one is 2021, highlighting the fact that they were announced as the only Chinese brand in the top 15 of the list of the “World’s Most Valuable Personal Care Brand”.

Pechoin’s Social Media Channels: On the forefront of technology and trends

Pechoin’s social media channels contain advertisements featuring Ling – China’s first virtual AI influencer. Ling advertises an anti-aging product manufactured with revolutionary technology. One of Pechoin’s posts expresses that Ling “connects technology with herbs” as she has a “beautiful oriental face”, and is “curious about the past from the future”. These campaigns perfectly captured Pechoin’s strategy to be at the forefront of science and technology while sticking to their deep cultural roots and timeless beauty.

In addition, Pechoin’s Xiaohongshu and Baidu pages feature, young men applying cream on their flawless faces. Though uncommon, since most beauty/skincare products are marketed towards women it is an innovative strategy contrarily flooded with women commenting on the men’s appearances. . One of their ambassadors, Wang Yibo (王一博) features in the women’s day campaign promoting an anti-aging product and giveaway. He asks women when the last time they were not afraid to smile, without fearing wrinkles, and promises that with this product they will be able to keep smiling fearlessly. Netizens were enthusiastic.

Furthermore, Pechoin’s Weibo and Xiaohongshu constantly publish short videos, That are highly favored by netizens. Some of them featured famous KOLs giving detailed tutorials on how to use the products or sharing their personal skincare routines featuring Pechoin’s products.

Healthy for the environment and your skin

Chinese consumers, especially Generation Z, care about sustainability and are conscious of their purchases. 81% of consumers under 20 pay attention to sustainable consumption. However, this does not limit only to the youngsters, since 76.5% of Chinese people over the age of 60 are also concerned about sustainable consumption. Being a natural beauty brand that uses pure herbs from nature instead of synthetic substances, Pechoin is considered a sustainable brand. Pechoin’s products are based on Traditional Chinese Medicine (TCM). TCM-based cosmetic brands’ popularity has been increasing in recent years, particularly among consumers in their 20s – a group that has previously been doubtful of TCM. A TCM-based cosmetic brand’s general manager pointed out that half of their online customers are in their 20s. Further, she added that the “mild nature of the TCM ingredients also caters better to Chinese skin”.

Pechoin’s affordable price allowed it to penetrate the market

Pechoin positions itself as an affordable and accessible brand to secure high volumes. 70% of their products are under RMB 200. Their signature moisturizing balm in their 1931 packaging costs RMB 59. Anti-aging products are priced slightly higher due to more advanced formulas. 57.7% of Chinese consumers mentioned that the Price-Performance ratio is a leading factor in influencing their purchase decision. Perhaps, Pechoin keeping the right Price-Performance ratio has been a crucial factor for its success. L’Oréal, one of Pechoin’s largest competitors, is priced much higher as being a luxury foreign brand, yet still ties with Pechoin in terms of market share in China’s skincare market. This could be due to some Chinese consumers preferring foreign brands over Chinese brands in the luxury market. A local competitor, Herborist, prices its moisturizing cream at RMB 229; despite being high quality and effective, is less popular than Pechoin, once again proving Pechoin’s outstanding and compelling price-performance ratio.

Key Takeaways

- Pechoin, founded in 1931, is China’s first domestic skincare brand

- Pechoin holds the largest market share of China’s skincare industry

- In recent years, Pechoin has become increasingly popular among younger audiences due to the Guochao trend and the use of TMC, which is a natural, “clean”, and sustainable ingredient

- Some of Pechoin’s marketing strategies include releasing product lines that feature modern illustrations of traditional Chinese women and keeping their 1931 original packaging for its signature product

- Pechoin utilized science and technology in its marketing strategy by featuring Chinese virtual AI influencer Ling

- Pechoin is an affordable brand that caters to the mass market while also providing more premium offerings through their newest anti-aging products

Author: Nefeli Georgiou