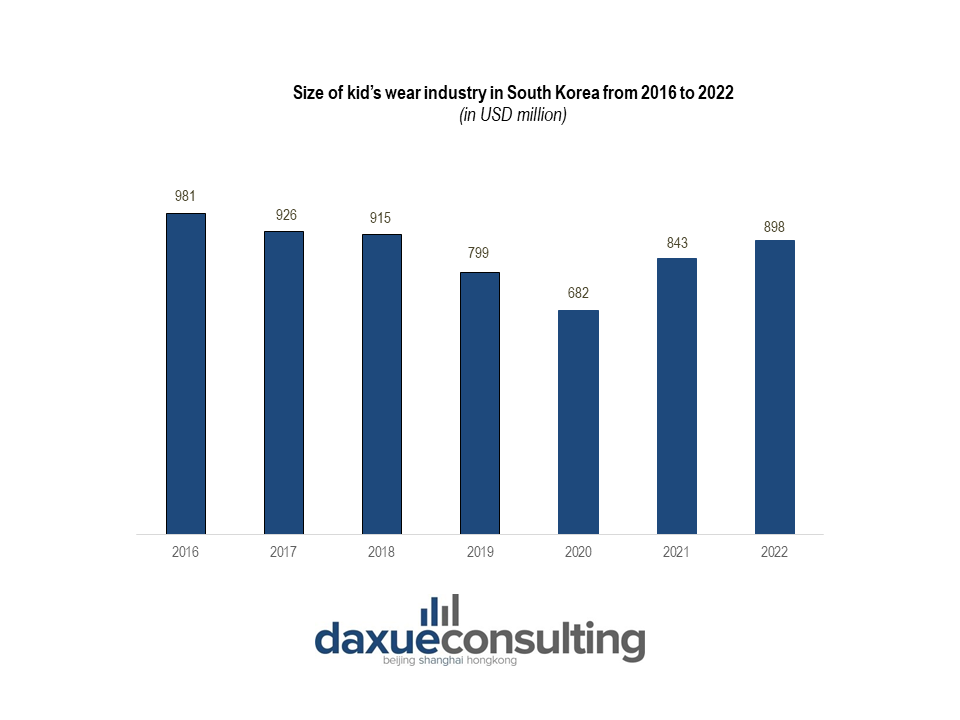

Despite the low fertility rate and the impact of the Covid-19 outbreak, the domestic kid’s wear market in South Korea has been on the decline since 2016. However, a positive shift has been observed since 2020, marked by an increased demand for premium kid’s wear products and a diversification of offerings within the children’s wear sector, which is now emerging as a prominent segment in South Korea’s fashion industry. Notably, the children’s wear industry in South Korea has experienced a significant 31% increase over the past three years, growing from USD 682 million in 2020 to USD 898 million in 2022.

Read our Korea’s MZ Generation report

Premium kid’s wear products are gaining popularity with declining number of children

With more Korean couples having only one child, children are becoming the center of the family. The “ten pocket (텐 포켓)” phenomenon, where ten adults are opening their pockets just for one kid, is becoming increasingly prevalent in South Korea. Having fewer children to take care of, parents are focusing more on their only child and trying to provide the best for them. MZ Generation parents, particularly Millennials, are directing their focus toward premium brands, prioritizing brand safety and fabric quality over price.

Capitalizing on such aspects, department stores are bringing in premium kid’s wear brands from overseas. Hyundai Department Store (현대백화점) launched Moncler Enfant and Givenchy Kids, while Shinsegae Department Store (신세계백화점) brought in premium brands like Baby Dior and Burberry Children. Hyundai also opened its own premium multi-label kid’s wear store “Boon Jr (분 주니어)”. With such trend, sales in kid’s categories at South Korea’s top three department stores have all increased by more than 20% in 2022 compared to 2021, while foreign premium kid’s products have increased by an average of 41.6%.

Kid’s wear industry is driven by Millennial parents

Compared to previous generations, Korean Millennials are more aware of fashion trends and are willing to invest more in kid’s wear. Fashion trends like family look is gaining popularity as it embraces the idea of dressing in matching styles among family members. This trend goes beyond individual fashion choices, emphasizing a collective look that foster a sense of unity and shared identity within the family unit. In addition, as digital natives, more Millennial parents are not only interested in dressing their children but are also eager to share and learn different kind of kid’s fashion style within digital space. In fact, on Instagram, the hashtag #키즈패션 (kid’s fashion) garnered over two million posts on Instagram as of February 2024. Moreover, kid’s fashion is not about being cute anymore. It embraces trending styles and fashion designs too, similar to the adult fashion landscape.

With growing demand for diversity in kid’s fashion, more brands are jumping into the kid’s wear industry. In 2022, Nike in Korea opened its first offline Nike Kids store and instantly gained popularity with more than 20,000 consumers visiting the store in October alone. In 2024, NBA Kids decided to expand offline stores in South Korea, followed by increasing demand for family look from Millennial parents who are NBA fans. Domestic sportswear brand Xexymix also launched its first collection of kid’s wear in 2022, focusing on sports casual and functional sportswear for children.

Furthermore, Millennial parents drive the demand for eco-friendly consumption in South Korea, prompting brands like Black Yak Kids and The North Face to expand their sustainable children’s wear offerings.

Increasing online shopping for kid’s wear

As the MZ Generation enthusiastically embraces online shopping, prominent kid’s platforms in Korea, such as BoriBori (보리보리) and KIDIKIDI (키디키디), are gaining substantial popularity. KIDIKIDI, in particular, has actively leveraged social media platforms like Instagram, frequently used by Millennial parents, to promote its products. This strategic effort has resulted in a remarkable surge in KIDIKIDI’s transaction amount, soaring from USD 22.7 million in 2020 to USD 151 million in the first half of 2023.

Even major e-commerce platforms like Coupang and fashion platform Musinsa have dedicated kid’s wear categories. Coupang, for instance, offers a comprehensive range of children’s wear, meticulously categorized to cater to diverse age groups.

Online kids’ wear brands are utilizing pop-up stores as a strategy to promote their brand. Rototobebe (로토토베베) and GLGK have achieved success in their pop-up stores by leveraging the brand loyalty of their online consumers. By presenting stylish street fashion outfits for children through these temporary physical spaces, these online fashion brands have established a tangible channel to meet the needs of their online consumers. This approach not only enhances brand visibility but also enriches the overall shopping experience for parents and consumers.

Key takeaways on kid’s wear market in South Korea

- South Korea’s kid’s wear industry has faced difficulties due to decreasing fertility rate and Covid-19. However, with increasing demand for premium and stylish kid’s wear, the industry has increased by 31% from 2020 to 2022.

- With fewer children, parents are willing to provide the best quality outfit for their only child.

- Domestic kid’s wear industry is propelled by preference of the Millennial generation. In response to their penchant for fashionable kid’s wear and heightened awareness of eco-friendly practices, brands are catering to meet these needs.

- Children’s platforms are witnessing significant growth, propelled by the increasing adoption of online shopping among Millennial parents and a rising interest in purchasing children’s clothing.

- Major e-commerce platforms such as Coupang and fashion platforms like Musinsa are allocating dedicated sections for children’s wear, responding to the escalating demand in this category.