Laopu Gold has rewritten the rules in the Chinese luxury jewelry market. In 2024, Laopu’s single-store efficiency soared to 459 million RMB, with a growth rate of 200.8% in the first half of 2025, outperforming every domestic and international competitor. With an average of 77% of its customer base overlapping with Hermès, Tiffany, Cartier, and Bulgari, Laopu has deeply captured the minds of high-net-worth Chinese consumers. With its rapid growth, sky-high margins, and resounding 1600% stock price surge, this exclusively hand-forged heritage jewelry Chinese brand has the potential to become what its founder and CEO said: “Hermes of Gold”.

Chinese luxury market in transition

Over the past two decades, China has emerged as the single most important growth engine for the global luxury industry. In 2001, Chinese consumers represented barely 1% of worldwide luxury spending. By 2025, that figure is expected to reach nearly 30%, making China not only the largest but also the most dynamic luxury market in the world.

Historically, this spending power accrued to Western maisons such as Hermès, Cartier, and Tiffany. These brands dominate by offering global recognition and the ability to signal status through iconic logos. Domestic players, by contrast, competed largely on value-for-money, with limited cultural resonance or pricing power.

That dynamic is shifting. Younger Chinese consumers are moving away from logo-driven consumption toward authenticity, heritage, and cultural identity. This shift reflects rising national confidence and a willingness to support homegrown luxury brands. Within this context, Laopu Gold has emerged as a leading beneficiary, positioning itself at the intersection of Chinese tradition and modern exclusivity.

A commoditized Chinese gold jewelry sector

China had already become the world’s largest consumer of gold jewelry, but the sector was structured as a commodity business. Pricing revolved around “weight + labor cost”, the grams of gold plus the hours of craftsmanship, which left limited scope for brand differentiation.

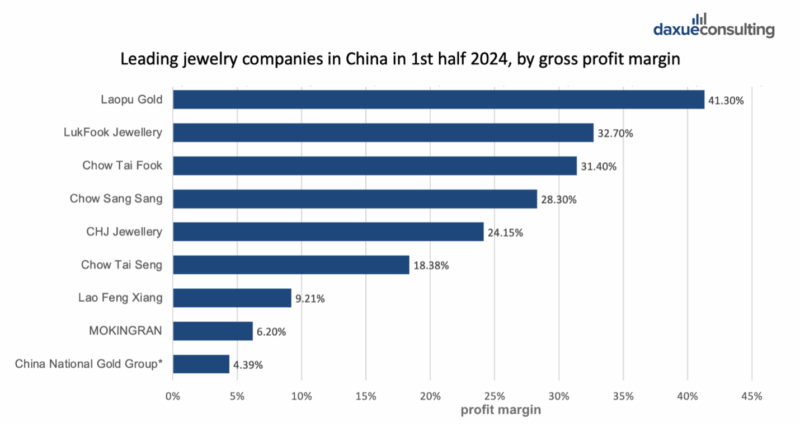

Market leaders such as Chow Tai Fook, Luk Fook, and Lao Feng Xiang scaled aggressively, operating thousands of outlets nationwide. Their business model relied on high volume and thin margins (around 10%), while consumers largely sought the lowest markup on gold rather than paying a premium for brand value. The result was an intensely competitive environment with weak brand power and limited ability to sustain premium pricing.

Laopu’s Strong position in the Chinese jewelry market

It was against this backdrop that Laopu Gold entered in 2009. And it pursued a differentiated positioning from the inception of embedding heritage, craftsmanship, and exclusivity into its identity. As a result, the company experienced a remarkable 251% year-on-year revenue increase, reaching RMB 12.35 billion in the first half of 2025. While Laopu Gold’s rapid growth is closely linked to soaring gold prices, its success is grounded in the way it is systematically building a distinctive competitive advantage.

Product& brand differentiation

Laopu is the first to create the concept of heritage gold jewelry, a type of gold product featuring the texture of ancient royal jewelry, and applying Chinese traditional handmade gold crafting techniques.

Laopu is dedicated to creating products that are backed by craftsmanship and cultural storytelling. Upon opening Laopu Gold’s official website, its promotional video immediately showcases images of veteran artisans meticulously hand-engraving in dimly lit workshops. Laopu Gold specifically notes that its goldsmithing techniques originate from master artisans at Beijing Gongmei Filigree Factory, tracing their lineage back to the imperial workshops of the Qing Dynasty. More than a regular investment, Laopu is trying to position its gold products as cultural artifacts and status symbols.

They heavily market how they preserved endangered techniques (花丝镶嵌、錾刻搂胎、错金烧蓝) while pioneering new methods (pure gold diamond setting 2019, pure gold enamel 2021).

In 2025, Laopu launched its “Seven Sons Gourd” collection, featuring a technically demanding high-temperature seven-color enamel process that serves not only as an innovative product expression but also as a cultural tribute to the widely recognized Huluwa folklore. Laopu balances respect for classical heritage with contemporary aesthetics, reinforcing its position as a product development leader in China’s jewelry industry.

Premium pricing differentiation

Unlike mass-market peers that price jewelry by weight plus a labor fee, Laopu has adopted a fixed-price model that integrates craftsmanship and brand narrative directly into cost, allowing consumers to pay not just for the gold itself but for the brand’s premium value.

Laopu’s 18.2g gourd diamond pendant retails at RMB¥30,530 (~¥1,677/g), a significant premium to Chow Tai Fook’s RMB~¥1,009/g benchmark.

This approach generates high premiums and industry-leading margins while elevating perceived value. Driving long queues outside boutiques and mirroring the playbook of Western luxury houses such as Hermès and Tiffany.

Store experience differentiation

Laopu Gold is utilizing a selective distribution model, steadily expanding into China’s top luxury malls with placements in SKP, MixC, Shanghai’s Grand Gateway 66, Hong Kong’s IFC Mall, Xintiandi, and Plaza 66. By situating itself alongside the world’s most recognized high-end luxury brands, the brand reinforces its positioning as China’s answer to Hermès or Tiffany. Unlike competitors that operate thousands of stores and focus on low-tier cities, Laopu has built its reputation on scarcity and efficiency, thriving with only ~40 boutiques that each generate over a billion RMB in sales.

Each boutique serves as a retail space and a showcase for Chinese culture, featuring interiors with rosewood cabinets, coffered ceilings, and curated displays that highlight craftsmanship and heritage. This style is often referred to by the younger generation as Chinese Old Money (中式老钱风).

All staff members wear uniform attire for easy recognition and communication with customers. For VIP clients, Laopu offers VIP lounges, bespoke services, and private tasting events, following the international luxury brands’ rules and customs.

The result is that every Laopu store is reinforcing brand equity and deepening loyalty among high-net-worth consumers.

The broader shift in Chinese luxury

China’s once breakneck luxury boom has slowed sharply, with global giants like LVMH, Kering, and Richemont reporting steep declines in their China sales. UBS and Bernstein now forecast negative luxury growth for 2025, reflecting a consumer pivot away from “fast” consumption, logo-chasing, hype-driven drops, and price hikes, toward “slow” consumption grounded in reliability, longevity, and cultural resonance. Laopu Gold epitomizes this shift: by embedding cultural symbolism into products and positioning gold as both a safe-haven asset and an expression of identity, it has captured a frustrated middle class seeking spiritual fulfillment and long-term value. This evolution signals a broader redefinition of luxury in China, where heritage, meaning, and cultural pride increasingly outweigh conspicuous display.

Challenges ahead

Despite its rise, Laopu also faces harsh headwinds as China’s luxury market stalls, with Bain forecasting flat growth in 2025 after a sharp deceleration through 2024.

The brand’s equity gap remains evident. Laopu is less than 30 years old compared with Hermès or Tiffany’s century-long legacies, and cultivating durable trust will take time.

Moreover, consumers continue to view gold primarily as an asset, which will limit Laopu’s position as a luxury brand: in resale markets, Laopu pieces often trade at weight-only prices, undermining its ability to command the same premiums as luxury handbags. This secondary-market weakness is compounded by skepticism from luxury resellers, who hesitate to classify Laopu as “true luxury” amid concerns over homogenized craftsmanship, influencer-driven hype, and limited value retention.

Equity markets have echoed these doubts: after peaking above HK$1,000, the stock fell to HK$748 by August 2025, erasing over HK$60 billion in market value and raising questions about sustainability.

Laopu Gold in China: Toward a Chinese Hermès?

- Laopu has pioneered heritage gold jewelry, embedding cultural storytelling and craftsmanship into a differentiated luxury category.

- Its fixed-price model and selective distribution have delivered industry-leading margins and billion-RMB store efficiency.

- Growth aligns with China’s pivot from “fast luxury” toward long-termism, cultural pride, and identity-driven consumption.

- Risks remain: a young brand history, weak secondary-market pricing, and recent stock volatility question sustainability.

- Laopu’s path highlights both the opportunity and uncertainty in creating a truly Chinese Hermès., mentorship, and the active support of hundreds of purpose-drive