As the top fruit and vegetables producer in the world, one could expect the juice market in China to flourish alongside the country’s economic growth. However, data shows that the Chinese juice market has stagnated in recent years. While exports are booming, domestic consumption of fruit and vegetable juice have stopped the growth it had in the early 2000s’. According to iimedia, the juice market in China was worth 143.5 billion RMB in 2019. But as Chinese consumers are becoming more health-aware, new trends are emerging, and some market segments show new potential for opportunities. Foreign and domestic juice brands are scrambling for innovation as the market becomes increasingly competitive. What are these new trends and which segments of juice in China show the more potential for growth?

Despite domestic stagnation, juice is still a strong export industry

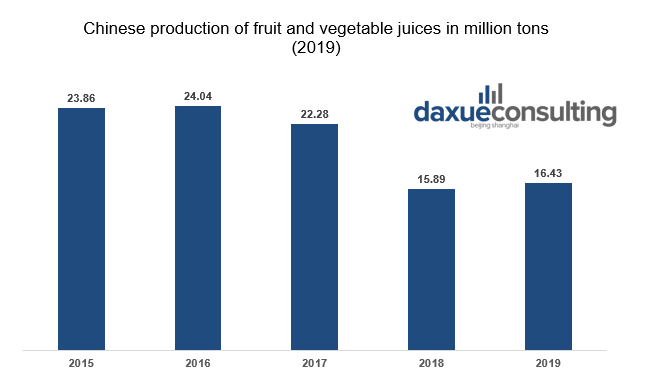

From 2005 to 2013 China’s fruit and vegetable juice industry sales had strong growth. However, sales began to decline gradually after peaking in 2013. From 2013 to 2020, the sales volume CAGR of the juice industry was -3.2%.

In recent years however, there have been signs of gradual stabilization of the domestic consumption of juice in China. Moreover, the overall size of the Chinese juice industry continues to grow thanks to exports. Indeed, according to Chinabgao China’s fruit and vegetable juice export volume was 490,000 tons in 2020, a year-on-year increase of 9.6%. Accounting for over 3% of the juice world’s exports, China’s main partners for fruit juice exports are the United states, Japan, South-Africa, and Russia according to the OEC.

Data source: Chyxx. China’s production of fruit and vegetable juice has slightly rebounded in recent years after a sales stall that started in 2013.

New segments emerge as consumers’ habits are changing

Juice can be classified into FC and NFC juice, and the nutrition value and flavor of two types are different. NFC is the abbreviation of Not From Concentrate, indicating that it contains almost the same nutrition and flavor from a fruit. However, marked disadvantages also emerge. The guarantee of the NFC juice’s quality guarantee period is shorter and low temperature is required for storage. Thus, the price for juice is higher due to higher storage cost. One bottle of 300 ml juice may cost 15-30 RMB in China. In comparison, FC juice is the concentrated juice, requiring normal temperature and are rather at a lower cost, with more additives and water, reducing the nutrition value in the juice.

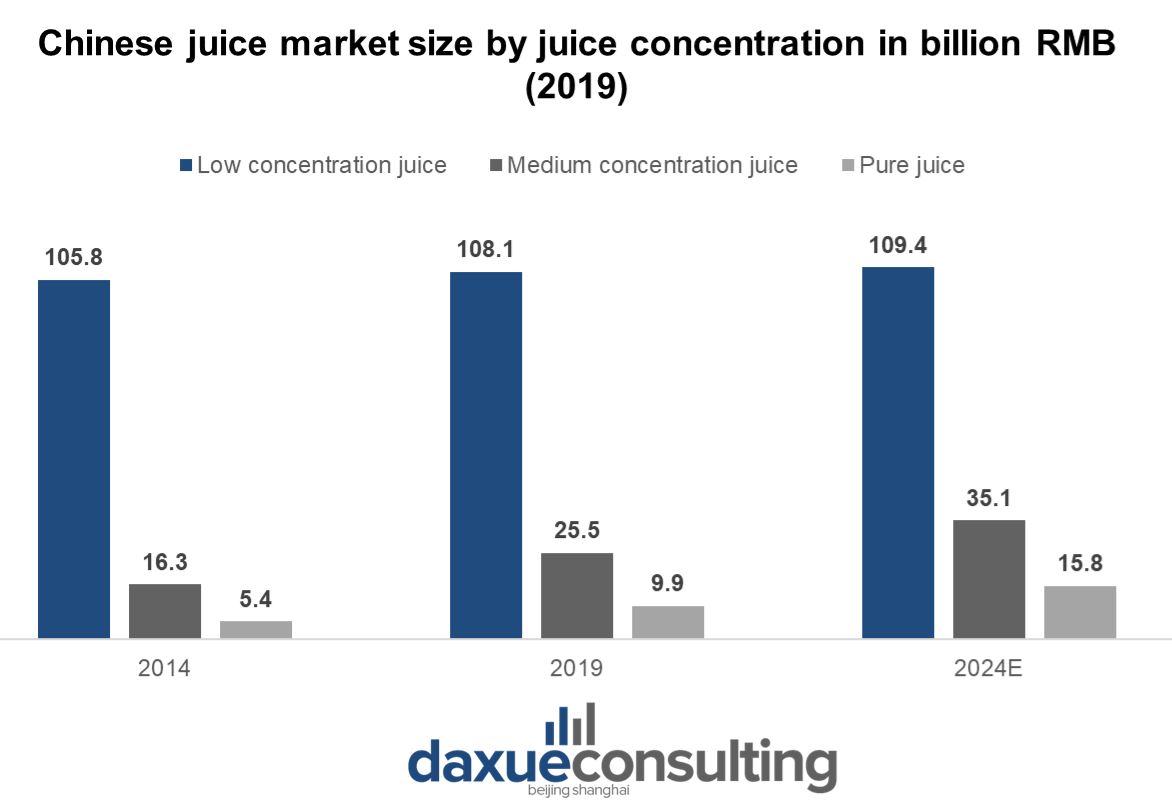

FC juice has historically dominated the Chinese juice market as 75.3% of juice drinks bought in China are low concentrated juices or fruit based ready-to-drink beverages. The domination of low concentration juice on the Chinese market is mainly due to the easier storage conditions of FC juice, allowing more retail outlets to sell them. Because of these restrictions and an overall low demand, small mom-and-pop stores in China have mostly stuck to selling FC juice. While pure juice only represents 0.7% of the market at 9.9 billion RMB, it also has the fastest growth rate. Indeed, the market has almost doubled in size between 2014 and 2019 alongside a 30% rice in medium concentration juice consumption. With the most potential for growth, the increase in consumption of NFC and pure juice in China benefits greatly from the growing health awareness of Chinese consumers.

Data source: iiMedia. While the FC Juice market stagnates, Juices with higher concentration are getting more popular in China.

The healthy food trend boosts sales of pure juice in China

As China is making a shift toward healthy food, there is a growing Chinese customer segment looking for healthy products. There is a growing number of young white-collar Chinese residing in tier 1-3 cities that are willing to spend a premium for healthier product. Brands should not ignore lower tier cities as young residents of developing cities are China’s economy main growth engine today. While younger are richer Chinese generations are more likely to buy healthy, the trend is cross-generational and can be observed at all levels of the Chinese society, especially after the covid 19 pandemic has raised health concerns and awareness.

This trend has impacted the Chinese juice market as consumers are more and more interested in healthier drinks. Consequently, sales of pure juice and juice with less additives have been growing at a fast pace. Juice brands have recently started to adapt their offer by developing new high concentrated based products and advertising their health benefits. The fruit and vegetables juice market in China is expected to continue its’ upwards trend as Chinese consumers are taking more interest in healthy living.

Image: Uni-President advertisement. Juice brands are launching new products to cater to the healthier tastes of Chinese consumers.

Innovation is key and brand recognition are key for success in the juice market in China

Market share in the Chinese juice market are fairly scattered with three distinct groups at the top: foreign, Taiwanese and domestic mainland brands. According to Chyxx, the brands with the highest brand power index in the Chinese juice industry are Minute Maid, Taiwanese brands Master Kong and Uni-President and domestic brand Huiyuan and Nongfu Spring’s Farmer’s Orchard. Coca-cola’s Minute Maid dominates the industry with 9.9% market share thanks to aggressive marketing and a well-established brand name.

Since its’ market entry in 2004, the brand has imposed itself as a market leader, seconded by the powerful Taiwanese juice industry benefiting from the Economic Cooperation Framework Agreement. In 2009, Coca Cola attempted to buy Huiyuan for $2.4 billion but the offer was ultimately rejected by the Chinese government over anti-trust concerns. Domestic beverage companies that have a diversified range of products like Wahaha have struggled to compete in juice market in China since their lack of specialization has failed to provide the innovation required to stay on top.

Data source: Chyxx. Coca-Cola still dominates the Chinese juice market with Minute Maid.

What are the trends of the juice market in China?

- Low concentration juice sales in China have peaked in 2013 and have stagnated ever-since. While exports are still on the rise, domestic consumption has languished. The juice market in China is slowly shifting towards NFC and pure juice products.

- This change to Not-From-Concentrate juice is mainly due to the growing health awareness of Chinese consumers. Marketed as a healthy product, pure and high-concentration juices have greatly benefited from the healthy living craze in China, sporting double digits annual growth while FC juice sales have stagnated.

- While well-established Minute Maid and Taiwan-based brands Master Kong and Uni-President have managed to maintain their market position, some domestic players like Wahaha and Weiquan have struggled. Innovation and strong brand image are key competitive advantages in the Chinese fruit and vegetable juice industry.

Author: Camille Gaujacq

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

We surveyed Chinese consumers on what they think is healthy. See the results!

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast