With more than 70% of China’s population located in tier-3 cities and below, there lies a significant, yet often undervalued, market segment ripe for exploration by international brands. This overlooked demographic consists of Chinese consumers who possess unique consumption habits, profoundly influenced by their pragmatic approach to life and a deeply ingrained sense of patriotism. These characteristics distinguish them markedly from their counterparts in higher-tier cities, necessitating a tailored approach for effective market penetration.

The Chinese city-tier system

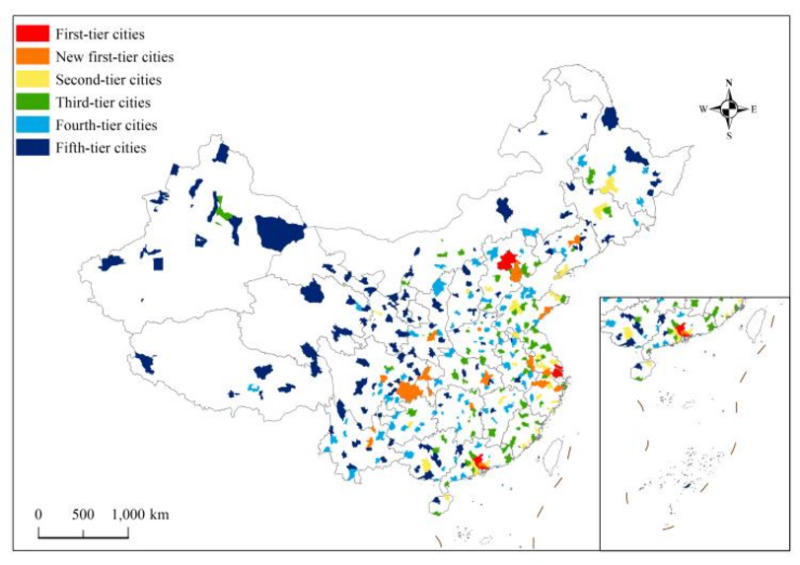

The Chinese city-tier system categorizes cities into different tiers, with “1” representing the highest tier. While some classifications have five tiers, others have four, and the first tier can be further divided into “first tier” and “new first tier.” Factors like GDP, income level, administrative status, and population determine this categorization.

While there is no official government-issued list of city tiers, the system is widely referenced by international media for various purposes, such as commerce, transportation, tourism, and education. Lower-tier cities are typically categorized as tier 3 and below. According to CBN, there are around 70 third-tier cities, 90 fourth-tier cities and 124 fifth-tier cities.

Lower-tier cities: catalysts for demographic and economic transformation

With lower housing prices, costs of living, and more leisure time, lower-tier cities are attractive to many. In 2022, around 70% of China’s 1.4 billion people lived in lower-tier markets, with more than 330 million residing in third-tier cities. This population growth indicates a thriving consumer sector in these frequently underestimated urban regions.

The potential of consumption growth in lower-tier cities is further underscored by their substantial young population. In the 18-30 age group, lower-tier cities host a youth population that is three times bigger than that of higher-tier cities.

Government plans to develop lower-tier cities

The Chinese government has realized the potential of developing lower-tier cities and has undertaken many initiatives to do so. Notably, the government aims to improve the transportation networks for better connectivity and accessibility. The focus is on building rural roads to connect rural areas with their core, highways, and intercity rails to connect with other cities in the region.

Those initiatives are a strategic move to spur economic growth, promote regional development, and address disparities in urbanization. The development of transportation networks in these regions opens possibilities for streamlined shipping of goods, as well as increased accessibility for tourists.

Insights into lower-tier city consumers: employment, lifestyle, and purchasing habits

Employment trends and lifestyle choices

In lower-tier cities, the primary employment avenues for young individuals are self-employment and service industries, with a significant number of people also working in stable professions such as teaching, civil service, or healthcare. The more stable employment opportunities and lower living expenses prompt residents in lower-tier cities to marry and start families at a younger age compared to those in higher-tier cities.

Economically, consumers in lower-tier cities earn a lower average income than their higher-tier city counterparts. Despite that, they often have more disposable income due to lower living costs and shifting consumer attitudes. Additionally, lower-tier city residents enjoy twice as much free time as their higher-tier city counterparts, influencing their spending habits and leisure activities.

Nation’s pride: lower-tier city consumers’ strong affinity for domestic brands

Lower-tier city consumers show a strong preference for domestic brands. Their primary reason for choosing Chinese brands is the higher perceived value for money (80%). The packaging of domestic products also significantly influences their preference.

Accenture China reports a heightened inclination towards local brands among individuals aged 18 to 35, and this preference intensifies as the city tier level decreases. This is due to several reasons, including the relatively lower penetration of foreign brands in lower-tier cities, as well as the lower income, making the usually cheaper local brands more attractive. Notably, this inclination towards domestic brands is particularly pronounced for products like household appliances, consumer electronics, beauty, and skincare items, as well as nutrition and healthcare products. An illustrative example is the Chinese cosmetics brand Florasis (花西子), known for its packaging featuring oriental elements and intricately flower-carved makeup.

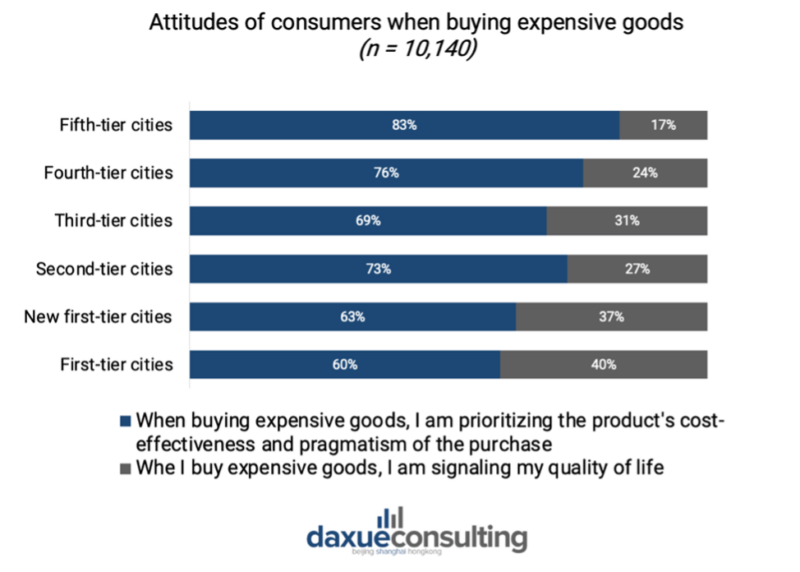

Cost-conscious and pragmatic consumers

Lower-tier city consumers’ purchasing behavior is marked by a focus on cost and pragmatism, making them less impulsive buyers compared to their higher-tier city counterparts. For example, 83% of fifth-tier city respondents reported prioritizing cost-effectiveness when buying expensive goods compared to 60% in first-tier cities. Conversely, only 17% buy expensive products to signal their quality of life. Their pragmatism makes lower-tier city consumers less likely to trust celebrity endorsements than their higher-tier city counterparts. However, they are more likely to follow recommendations from friends and family.

Strategies to reach Chinese consumers from lower-tier cities

Building trust through exceptional customer service

First and foremost, prioritizing exceptional customer service throughout the entire customer journey, both before and after a sale, is essential in the Chinese market. Due to the lower tendency of consumers in second-tier cities and lower to engage in impulsive and high-risk purchases, offering outstanding service becomes particularly valuable in instilling a sense of confidence during their decision-making process.

This approach allows consumers to obtain a more comprehensive understanding of the product’s quality and features, thereby justifying its price. Furthermore, the awareness of accessible pre-sale and after-sale services contributes to an increased level of trust in a specific brand.

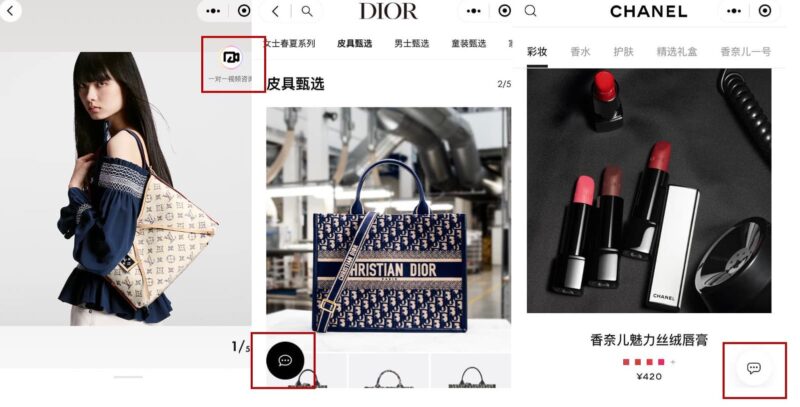

For example, luxury brands Chanel and Dior use WeChat to communicate with individual customers before and after-sales. Consumers browsing on Chanel’s mini-program can ask questions at any time, and receive personalized assistance and product recommendations according to consumer preferences and consumption trends. Louis Vuitton takes customer service to the next level by providing personalized one-on-one video consultations for potential clients.

Establishing an omnichannel presence

A key strategy for engaging lower-tier city consumers in China involves establishing a comprehensive omnichannel presence. This approach aims to keep consumers engaged throughout the buyer decision process by seamlessly integrating various channels of interaction.

Since social media serves as China’s lower-tier cities consumers’ preferred channel for gathering information about brands and product comparisons, maintaining an active presence online can play a crucial role in facilitating the buyer’s decision-making process. Luxury brands like Bottega Veneta already leverage technology such as 3D visualization, allowing customers to closely examine items from every angle and virtually try them on, mirroring the in-store experience of product comparison.

Moreover, post-purchase services can also be seamlessly integrated into the brand’s digital platform, reducing the need for customers to visit physical stores. Brands like Burberry and Chopard have successfully integrated post-purchase services into their WeChat mini-programs, offering services such as item cleaning and maintenance, product exchanges, adjustments, and replacements. This offers lower-tier city consumers, who prioritize accessible after-sale services, a convenient avenue to address any post-purchase needs.

However, maintaining a physical presence remains beneficial, particularly for certain product categories. Physical stores continue to serve as the preferred channel for purchasing items such as food and beverages, medical and healthcare products, and household appliances. This dual approach, combining digital and physical channels, ensures that brands effectively cater to the diverse preferences and needs of lower-tier city consumers in China.

Increase consumer retention with a membership program

Considering the prevalent cost-consciousness among lower-tier city consumers, businesses aiming to establish a presence in these markets could introduce a membership program tailored to their needs. Such programs would offer members exclusive benefits including discounts, gift redemptions, and access to preferential offers. Accenture reports that nearly two-thirds of consumers in lower-tier cities actively participate in brand membership programs, highlighting the appeal and potential impact of such initiatives.

For instance, JD.com’s membership program provides members with complimentary delivery, exclusive discounts, and platform-specific promotions, demonstrating how tailored membership offerings can effectively resonate with lower-tier city consumers and drive engagement.

Strategies for success in China’s lower-tier cities via social and e-commerce platforms

To effectively engage with consumers in lower-tier cities in China, businesses should strategically leverage specific social and e-commerce platforms tailored to the preferences and behaviours of this demographic.

When it comes to social media platforms, Kuaishou, Xigua Video and Douyin Huoshan are popular among lower-tier city consumers, with the two latter being ByteDance products. In 2022, Kuaishou, China’s second-largest short video app, had almost two-thirds of its user base located in third-tier cities and below. Even foreign luxury brands like Coach have recognized the potential of the app to tap into lower-tier city markets.

As for e-commerce platforms, Pinduoduo emerges as a key player, given its appeal in smaller cities due to its emphasis on value-for-money products and group-buying discounts. By 2021, Pinduoduo had exceeded the e-commerce giant JD.com in terms of monthly active users. Among them, 60% came from tier 3 and tier 4 cities.

By strategically utilizing these platforms, businesses can establish a robust online presence, fostering brand awareness and trust among consumers in smaller cities.

What we can learn about lower-tier city consumers in China:

- Lower-tier cities host a youth population which more than triples the number of 18 to 30-year-olds compared to higher-tier cities.

- The government’s initiatives to develop lower-tier cities further solidify the potential in these regions.

- Lower-tier city consumers display a cost-conscious and pragmatic approach to purchasing, emphasizing cost-effectiveness and relying on recommendations from friends and family.

- Offering exceptional customer service, establishing an omnichannel presence, and establishing membership programs can help effectively reach this consumer base.

- Specific platforms like Kuaishou, Xigua Video, Douyin Huoshan, and Pinduoduo are key channels for businesses to engage with lower-tier city consumers in China.

Unlock lower-tier city markets in China with Daxue Consulting

Daxue Consulting provides key insights into China’s lower-tier city markets, offering tailored research and strategic guidance to unlock their potential. With our focused approach on consumer behavior and market dynamics, we equip businesses to engage with and capitalize on these emerging markets effectively. Reach out for expert strategies to navigate and succeed in the vibrant landscape of China’s lower-tier cities.