A well-conceived merger and acquisition process (M&A process) between a Chinese buyer and a foreign target company can produce great value for all stakeholders. This is because Chinese buyers are becoming increasingly proficient and sophisticated in the M&A process, as evidenced by the high volume of international deals executed over the past three years. Forecasts show that China outbound M&A will continue apace. Therefore, foreign companies must accept it and learn to cooperate with their Chinese counterparts. This shouldn’t be a challenge however as it has been proven that merging with a Chinese company can be a win-win, with a variety of mutual benefits including tremendously improved access to the Chinese market.

What are the opportunities and challenges business face with China in an M&A Process?

Undertaking an M&A process is a serious and time-consuming operation. It requires attentive planning, pro-active teams, and the support of both legal and financial advisors to allow CEOs to smoothly understand the transaction’s dynamics. Being backed up by trusted and skilled partners is fundamental to overcome challenges (i.e. cultural mismatch, lack of negotiation skills, etc.) and produce a satisfying outcome. Daxue Consulting is experienced in solving these hitches on a marketing front and identifying other partners that can be brought in to bridge other gaps in the M&A process. By identifying the main advantages of China outbound M&A and debunking common prejudices that still affect the global perception of Chinese buyers, firms like S.J. Grand Financial has helped companies navigate the facets of a transaction with China. They provide a simplified M&A process divided into 8 main steps, developed in the following article. Although the 8 step M&A process described can be found true regardless of the industry or size of the deal, companies must be aware of the key role advisors playing the whole M&A process.

China outbound M&A by the numbers

In recent years, China has become a major player in overseas mergers and acquisitions due to the Government’s encouragement to invest and expand Chinese businesses abroad. Both State-Owned Enterprises and companies from the private sector have been hungry to enter new global markets by either merging with or acquiring foreign complementary enterprises.

2016 was the most dynamic year for China outbound M&A with both the number and value of deals hitting record amounts. Within the U.S. market alone, 225 deals were closed in 2016; while the year after, in 2017, 210 deals were closed to a total value of around USD 35 billion. Regarding China outbound M&A in Europe, the UK ranks first for number of deals, followed by Germany and Italy. Chinese investors spent more than USD 10 billion in the acquisition of German companies, focusing on robotics, manufacturing, machinery, and environmental technology industries. 168 Chinese groups invested in Italy by the end of 2016, attracted not only to the luxury and fashion sectors, but also manufacturing.

China outbound M&A has registered a higher and higher growing trend over history. A report published by Rhodium Group and the Mercator Institute for China Studies (MERICS) shows that Chinese FDIs in the EU totaled more than EUR 35 billion in 2016, a 77% raise from 2015.

The recent decline in global M&A process by China can be explained by the Chinese government’s strengthening of rules to prevent irrational outflows of money leaving the country. In parallel, the Trump’s Administration and some European countries have started monitoring Chinese investments more closely than before. Governments have moved towards taking a more controlling role on one side to protect their national industries, and on the other side to control renminbi fluctuations.

According to Reuters, China outbound M&A declined 41% in value and 11% in number in 2017. Singapore was the largest recipient of new investments, followed by the U.S.A. and the U.K. Forecasts for 2018 predict that M&A process by Chinese companies will pick up, due to not only the Belt and Road Initiative (BRI) but also government encouragement across a multitude of industries. Among these, it is worth noting that food safety, healthcare and services sectors are forecast to grow significantly in China.

The Regulations Behind the M&A Process in China

One of the reasons behind high China outbound M&A numbers is that the Chinese Government and the country’s regulatory framework are in favor of mergers and acquisitions, both domestically and overseas. On one hand, the P.R.C. Government provides domestic companies with the strategic imperative to boost internationalization through M&A process. The guideline has been followed not only by State-Owned Enterprises, which are undergoing a structural reform, but also by private companies, equity funds, and insurance firms. On the other hand, Chinese regulations are flexible and support companies willing to grow organically.

The approval process for Chinese investors looking for international expansion via outbound M&A has been relaxed over time. As of November 2017, Beijing issued new guidelines, targeting outbound M&A process, which will enter in force in 2018. New instructions include:

- List of sensitive and restricted areas of investment;

- Focus on national security and fair competition;

- Limitations to investments in real estate, hostelry, entertainment industries;

- Abolition of the State approval for Chinese companies investing +USD 300 million;

Given the abolition of the State approval for investors spending more than USD 300 million in one deal, it is possible to forecast that Chinese outbound M&A will once again grow considerably for the foreseeable future.

On the contrary, foreign countries’ M&A process regulations are restrictive, especially against China. After the Chinese overseas “shopping” peak in 2016, foreign authorities raised barriers. Germany, the most targeted country for China outbound M&A in 2016, rolled out new restrictions for national security. The Committee on Foreign Investment in the United States (CFIUS) reported that notices filed from 2013 to 2017 kept increasing: from 143 notices in 2015, 172 in 2016, to around 200 in 2017.

The Common Challenges of Chinese Global Acquisitions

Often, if a Chinese company is the acquiring party in an M&A process there will be a multitude of specific challenges to overcome due to different cultural backgrounds and business practices. Some differences between Chinese and Western firms in a given M&A process may include:

- The dynamic value of oral agreements in Chinese culture vs. thestatic value of written contracts in the West.

- The importance of hierarchy in Chinese culture;

- The collectivist way to express plans, strategies, and details typical of China vs. the individualist way of expressing ideas, details, strategies in the West;

- The nature of business relationships, which is personal in China and often less important in the West.

There are strategies to achieve a good level of cultural fit both during the M&A process and, especially, during the integration phase. There are also practical tools that can support these international transactions. Working hand-in-hand with advisory firms experienced with the Chinese market, for example, is often beneficial to structure a long-lasting powerful merger or acquisition in China.

Although obstacles can be daunting, the M&A process is a widely accepted strategy for growth. Chinese investors are becoming more and more proactive and diligent in their dealmaking.

Debunking myths about China M&A

As forecasts predict the involvement of Chinese companies in worldwide cross-border ventures will continue to be strong, foreign companies should be aware of benefits successful China outbound M&A could bring them. Even today, it is still a common misperception that Chinese companies simply go abroad to steal IP and limit local company’s abilityto tap into China and other Asian markets. Management of potential target enterprises may be prejudiced against cash-rich Chinese buyers during the M&A process.

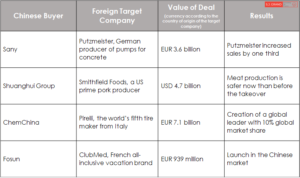

Nevertheless, when analyzing recent cross-border transactions by Chinese companies, results in terms of revenues, production chain’s level of safety, and market share growth may surprise readers.

The table below shows four successful M&A processes conducting by a Chinese buyer and a non-Chinese counterpart.

Not every transaction can reach a satisfactory conclusion. Examples of China outbound M&As that failed to deliver the expected results and intended value are many. Cultural mismatch, inability to get control of operations, falsified finances, and many other situations can turn a once promising deal into an unfortunate failure. This is why the role of M&A advisors is so important: to guide the M&A process as smoothly as possible.

Although failures can happen, taking a risk to increase revenues and enter new markets through M&A could make or break your company.

But you should ask, why would a Western company enter an M&A process with specifically a Chinese company? SJ Grand examined four benefits sellers may find when merging with a Chinese firm. These four advantages should outweigh some of the common prejudices that still influence global recognition over Chinese entrepreneurs.

The Benefits of Acquisition by a Chinese Firm

Access to the Chinese market

Probably the main advantage of merging with a Chinese counterpart is gaining access to the second biggest market in the world. With a middle class of over 420 million people and an ever-raising per capita income (around USD30.000 per year in Shanghai, Beijing, and Tianjin), China represents a fruitful market, especially for companies in specific B2C sectors (such as cosmetics, healthcare, food&beverage, luxury, etc.). Considering as well that China boasts 112,000 km of railways (of which 16,000 are for high speed trains), 7 of the 10 world’s busiest ports, and 218 major civilian airports (as of 2016), the scale of business opportunity for B2B companies is also considerable. Moreover, China’s outbound M&A process has focused on strategic sectors driven by the frameworks outlines by the government in Beijing.

The most targeted sectors for M&A process in China for the period 2014-today have been the following:

- Raw materials and energy;

- Robotics, advanced manufacturing, industrial automation;

- Advanced technology and Internet of Things (IoT).

As China is transforming its economy from being the world’s cheapest factory to one driven by technology, industrial know-how, and internal consumption, the strategic priorities of buyers within China are evolving in a similar ambitious direction.

Retention of Company Control

In most cases, Chinese buyers do not seek to immediately change the target company’s ownership. Even after buying a majority stake, Chinese investors will most likely let the target company’s teams manage and control day-to-day operations. Typically, Chinese buyers have strong interest in retaining local managements. They recognize that local staff are more familiar with the non-Chinese market dynamics business. Also, they positively value the intellectual property a business has developed over years and they prioritize maintaining internal knowledge by retaining talent.

Access to Funds

A big advantage of merging with China is access to funds. Many European companies struggle due to a lack of cashflow. They run on debt, and they strive to invest in new areas to upgrade. Chinese investment represents an attractive option to solve this problem.

However, frequently the origin of Chinese money is not 100% clear. Money could come from Government organizations and investment vehicles, less known private equity funds and other bodies interested in an M&A process. Escrow funding represents a solution to avoid uncertainty and make sure the deal amount as agreed upon will be received, often with the aid of expert attorneys.

Growth Potential

Being acquired by a Chinese company after an M&A process means access to the Chinese market. Consequently, the target company can gain local market share by increasing its consumer base, thus, expanding its global market share. Becoming part of a big corporation can lead to the target company reducing costs by achieving economies of scale. Competition can be disrupted by combining resources, allowing knowledge to flow, and eliminating threats. Navigating successful cross-border M&A processes becomes a competitive advantage for both the buyer and the seller.

What the Chinese Investor Looks for in a Target Company

Merging with a Chinese buyer could result in gaining competitive advantage. Underlining behaviors, trends, and preferences that are recently characterizing a China cross-border M&A process can allow target companies to prepare themselves for a potential acquisition.

Because they are acquiring more and more experience, Chinese investors are becoming thoughtful, diligent and sophisticated. They carefully choose the company to buy based on stringent valuations before the M&A process. This includes due diligence over the target company’s operations, financials, and staff amongst other facets.

Buyers prefer to approach sellers with positive balance sheets, positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), eye-catching product ranges and innovative processes or technologies. Normally, if a potential seller does not stand out of the crowd, Chinese buyers will not spend time in assessing its value during the M&A process. Chinese investors should be considered as legitimate and rational interlocutors.

The M&A Process between a Chinese Buyer and a Foreign Seller

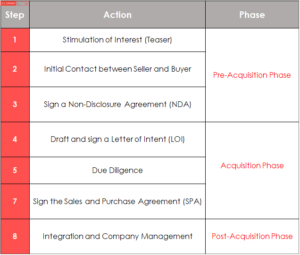

Even if target companies are intimidated by a variety of aspects during the M&A process with a Chinese firm, including cultural mismatch and negotiation setbacks, the cross-border M&A process can be made easier through a standardized approach divided into 8 main steps. These 8 stages include the commitment of a selected advisor and a trusted lawyer. Furthermore, with China involved in the transaction, the importance of both valuation and integration phases must be stressed in the M&A process.

The 8 main steps of the M&A process described below are a simplification. Carrying out a comprehensive M&A process from A to Z requires time, strategy, negotiation and strong technical skills.

M&A Process Main Steps:

The M&A process between a Chinese acquiring company and an overseas entity (target company, target, or the seller) could begin with the hand out of a teaser. A teaser is a short presentation used to solicit the buyer’s (or buyers) interest. Normally, the teaser is prepared by an advisor. Initial steps of a merger and acquisition can either involve:

- one seller/one buyer; or

- one seller/multiple potential buyers.

When there are only two entities involved in the transaction, a first contact can be established after the teaser’s valuation. When the first contact between parties is made, it is of vital importance to sign a Non-Disclosure Agreement (NDA). This document will prevent the possibility to share confidential information with third non-authorized parties. By being authorized to collect data about the target company, the buyer starts picturing the deal’s value. It can initiate visualizing the seller’s positive and negative sides.

At this point, the draft and consequent signature of a Letter of Intent (LOI) is key to communicate the will to proceed with the transaction. Typically, a LOI includes both binding and non-binding provisions. The LOI states the buyer’s interest and gives the seller an idea about the purchasing offer, payment system, and non-competition obligations.

Once both parties agreed and signed the LOI, the Chinese buyer and its advisors can start preparing the Due Diligence phase of the M&A process. This phase is of particular importance as it lets the buyer investigate the seller, acquiring all the necessary information to prepare an offer. More precisely, the information that the buyer should obtain mainly belong to the following areas:

- Financial Department;

- Management and business strategy;

- Operations and supply chain;

- Legal Department;

- Human Resources Department and staff.

Due diligence is a structured process. One should consider as many details as possible to acquire information, reduce uncertainties and prevent unpleasant surprises in the M&A process. The due diligence’s ultimate product is the due diligence report, which summarizes what has been investigated and collects findings.

If the Chinese buyer is satisfied with the due diligence report, it can produce the Sales and Purchase Agreement (SPA). This last document is the definitive acquisition agreement and it can take various forms, depending on the type of transaction itself.

The SPA should contain all the details regarding the transaction, intellectual property rights, warranty, compliance with laws, provisions on the accuracy of financial statements. In addition, it must include the purchase and payment terms, post-closing adjustments, conditions to the closing of the transaction, termination rights (i.e. it can happen that the buyer finds out that the seller did not meet some conditions during the transaction), clauses to protect the seller after the deal’s closure, etc. A Sales and Purchase Agreement should include as many details as possible to protect both parties and should be carefully drafted by a trusted lawyer.

As said, these 8 steps aim simplifying the understanding of any M&A process, which can actually take up to 12 months to be completed. Finding the appropriate price and terms of acquisition is a fine art that involves technical and persuasion skills. The seller must be protected to avoid any potential harm; it must be sure about the transaction price, payment terms, and conditions.

When the transaction process reaches its end, a very delicate phase of the M&A process begins. The integration stage, or post-acquisition, sets out how the new merged or acquired company will work. This is perhaps the most difficult part of the process: teams must be integrated, a common strategy must be pointed out, rules and routines must be defined, and so on. A successful and time-saving solution is to start the integration process when the deal is officially announced. Identify priorities and make important decisions, those that can be immediately addressed, when the transaction is taking place to avoid being lost afterwards.

In any case, it is important for interested parties to take their time, choose their integration team leaders wisely, and commit to one corporate culture.

Looking Forward on the M&A Process in China

As we acknowledge the importance of China in the global M&A landscape, companies should prepare to benefit from the attractive set of values described above. They should get ready to capture the advantages garnered by a transaction with a Chinese counterpart. But they must act with judgment, rationality, and tact. Chinese buyers are growing in experience, sophistication and resourcefulness. Winners in this game will bring bespoke approaches to both the M&A process and its integration phase. Each deal must be tailored according to parties and circumstances as there is no perfect recipe to close every fruitful deal. Nevertheless, the involvement of trusted advisors, who support the M&A process, can make the difference when signing the offer and start running a new entity.

Get in touch with one of SJ Grand’s advisors to gain more insightful information about China outbound M&A and how to take advantage of the lucrative Mainland market.

This article was written by our partner S.J. Grand, see below for more information.

S.J. Grand Company Profile

S.J. Grand Financial and Tax Advisory is a tax & management consulting boutique founded in 2003 in China. S.J. Grand has been advising over 1000 international clients on their development and profitability strategies in the PRC, including BNP Paribas and Bank of the West. Believing in transparency and internal control as tools to succeed in China, the firm delivers practical solutions from accounting and taxation to restructuring and optimization, with a strong reputation in dealing with fraud prevention and risk mitigation.

S.J. Grand created OBK Labs, in which it developed its proprietary APP: a powerful workflow management system that exploits the power of artificial intelligence and data analytics in multilingual environments to boost efficiency, slash costs and root out fraud.

Founded by Stephane J. Grand, alumnus of HEC Paris (MBA), La Sorbonne (Ph.D. in Chinese contract law) and the Fletcher School of Law and Diplomacy (MALD), the firm now counts four offices in China and one liaison-office in Paris.

Follow us on Linkedin and Twitter to learn more about the Chinese market:

Concerns about health make #Chinese people buy more #superfoods.

Interest in #chagamushroom ramps up in #China

https://bit.ly/2vOeSLd pic.twitter.com

— Daxue Consulting (@DaxueConsulting) 26 April, 2018