Beauty in China is shifting away from being an option to becoming a necessity. With growing awareness of beauty products and a desire to gain social acceptance, more men are turning to beauty products. Even the older generations, who tend to hold onto more stigma regarding beauty products, are slowly adopting them. While skincare is the dominant category in the cosmetics market in China, some men are adopting even more sophisticated routines by visiting high-end, personalized spas dedicated to men. What was once seen as niche or even taboo has become a symbol of social recognition and success—reshaping the male beauty market in China.

Download our report on Chinese beauty consumer pain points

From pop stars to “refined boys”: the icons shaping the male cosmetics culture among youth

In the rapidly rising appearance economy (颜值经济) in China, young male consumers are increasingly adopting beauty products. Beauty is a form of physical attractiveness, linked to both social and professional success.

This trend gained momentum through the influence of “little fresh meat” (小鲜肉). This term is used to describe young, attractive, and delicate-looking male celebrities, including Korean idols and Chinese celebrities such as Cai Xukun, Lu Han, and Zhang Yixing. As these celebrities endorse skincare products, they help normalize male beauty routines and reshape public perception of masculinity.

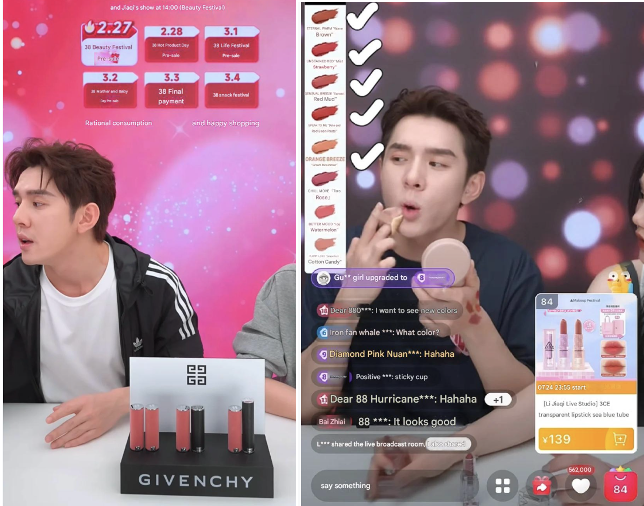

Moreover, the “refined boy” archetype (精致男孩” has been widely embraced by male KOLs on social media. KOLs use it to promote a lifestyle centered on self-care, self-expression, and personal empowerment through beauty regardless of gender. One of the most well-known figures in this movement is influencer Li Jiaqi (李佳琦), famously known as China’s “Lipstick King.” While he is more popular among women, his fame and expertise show how men are embracing more beauty products.

Men seek more functional products

Although older generations in China tend to resist the use of male cosmetics, often associating them with effeminacy (娘) and viewing them as feminine tools for enhancing attractiveness, they still show strong interest in skincare, much like younger generations.

Younger men often focus on oil-control products and basic grooming. Older men, on the other hand, are more likely to seek out anti-aging solutions. However, 2024 data from iiMedia, show that nearly 60% of 1,526 Chinese respondents expressed anti-aging concerns between the ages of 26 and 35. Since 2018, the anti-aging market in China has expanded significantly. It grew from RMB 472 billion in 2018 to RMB 739.8 billion in 2023, and it is projected to reach RMB 887 billion in 2025.

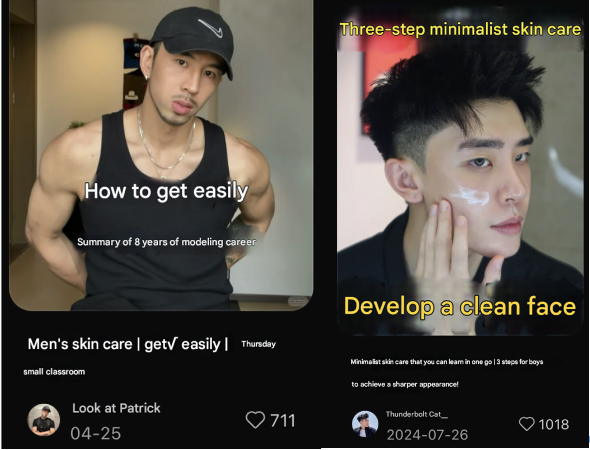

Minimalistic skincare routines drive demand for all-in-one products

Minimalist skincare routines (精简护肤) are gaining popularity on social media. Their appeal lies in simplicity and effectiveness, which are especially important for beginners looking to avoid common skincare mistakes such as over-cleansing or using products with alcohol and harsh fragrances. These routines focus on essential steps like moisturizing and sun protection, helping men build consistent skincare habits that enhance skin health without unnecessary complexity or irritation.

As a result, demand for multifunctional skincare products is on the rise. All-in-one facial creams that offer soothing, repairing, and moisturizing benefits in a single step are particularly favored. With earlier awareness of aging and a growing desire for convenience, multifunctional solutions are becoming the preferred choice for modern Chinese men seeking effective yet streamlined skincare.

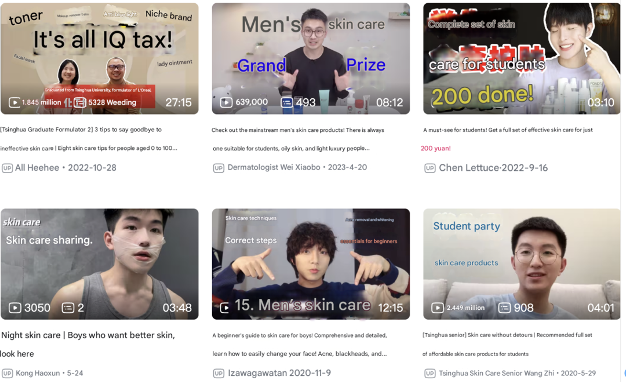

Digital platforms are still the dominant channels for discovering and purchasing male beauty products in China

While female consumers remain significant in introducing men to beauty products through gifting, independent purchases among men are sharply increasing, particularly among Gen Z. Data collected by FeiGua highlights that men in 2023 accounted for approximately 78% of male skincare product consumption in China. Women contributed about 22%, reflecting the ongoing role of women in influencing initial purchases. Social media platforms such as Douyin, RedNote, and BiliBili have also become powerful tools in driving awareness and interest. Tutorials and targeted content focused on male beauty educate men on how to take care of their skin, such as before and after shaving, when preparing for a study party, or when deciding which brands to use.

According to an online survey conducted by Rakuten Insight, based on responses from 3,752 Chinese individuals aged 16 and older, online marketplaces remain the most popular channels for purchasing beauty products in China as of 2024. This strong preference is largely driven by features such as certified authenticity guarantees, and transparent customer reviews. E-commerce platforms like Tmall, Dewu, and Taobao have emerged as key channels targeting male consumers. In 2023, Douyin recorded particularly strong sales in men’s grooming categories. Cleansers accounted for 47.12% of sales, care sets for 31.57%, and facial creams for 10.98%.

The growth of high-end skincare and spa services for Chinese men in urban areas

High-income male consumers, primarily from tier 1 and tier 2 cities in China, dominate the male skincare market. They tend to favor premium global brands, such as L’Oréal, Kiehl’s, and Shiseido, which are known for offering specialized products tailored to men’s skincare needs. For example, Shiseido redesigned the packaging of its top-selling product, the Ultimune Power Infusing Concentrate, changing it from red to black in order to appeal more directly to male consumers.

Men in major cities are increasingly turning to professional skincare centers to better understand their skin types and build personalized routines with expert guidance. These centers are becoming more common in tier 1 and tier 2 cities and are viewed as an accessible, private form of self-care that offers both relaxation and support for maintaining healthy skin. Many of them offer discounted first-time treatments and often collaborate with premium skincare brands. Services typically include deep cleansing, targeted serums, facial masks, and massage.

Centers like JSquared are part of a broader trend emerging in tier 1 and 2 cities. Modern male consumers are becoming more proactive about skincare. By offering first-time discounts and partnering with luxury brands, these skincare centers make premium grooming more accessible and appealing to the growing male beauty market in China.

Face value: why Chinese men are investing in beauty like never before

- Young Chinese men embrace skincare and cosmetics, inspired by polished male idols like “little fresh meat” and “refined boy,” who normalize grooming. Beauty is now seen as confidence, status, and professionalism, reshaping norms of modern masculinity in urban China.

- Minimalist and multifunctional skincare appeals to men with fast-paced schedules. Simple routines focusing on cleansing, moisturizing, and protection help avoid over-complication. It also addresses essential needs like oil control and anti-aging—ideal for young professionals with limited time for self-care.

- Affluent men in cities like Shanghai and Chengdu now visit premium men’s skincare centers. Places like JSquared offer expert care, privacy, and high-end brand collaborations. They elevate grooming into a form of leisure, health, and personal refinement.

- Platforms like BiliBili and RedNote (also known as Little Red Book in China) build trust through influencer-led tutorials and certified product listings. Men discover, learn, and shop skincare online, making beauty both accessible and socially accepted through social media reviews and posts.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.