China, as one of the world’s leading producers of fruits and vegetables, has a strong foundation for developing a robust juice industry. In 2024, the juice market size reached USD 20 billion, a 14.6% YoY growth. With Chinese consumers seeking healthier, more premium options, and more exotic flavors, the juice market in China is expected to experience significant growth in the coming years. Although offline channels remain important, e-commerce platforms in China are rapidly growing and redefining how consumers discover and purchase juice in China.

Download our China’s F&B industry white paper

A key category within the market, as depicted in the graph below, lies beyond traditional fruit juice flavors. Other flavors, juice mixtures, and smoothies generated USD 3.86 billion in revenue in 2024. In terms of consumer preferences in the non-alcoholic market, a 2025 Statista survey reveals that bottled water is the leading beverage of choice (49%), followed closely by juice (42%) and beer (38%).

Consumer demographics and purchasing behavior in China’s juice market

The profile of the typical juice consumer in China is generally young and female. According to data from a 2023 iResearch study focused on not-from-concentrate (NFC) juice, the customer segmentation of the Chinese juice market is 60.3% women, and the 25-35 age group accounts for 52.8% of the market. Additionally, consumers tend to live in higher-tier cities and have families with young children.

Consumption trends show a culture of drinking juice as a beverage to accompany meals or as a snack between meals. Chinese consumers rarely drink juice as a meal replacement. From the perspective of traditional Chinese medicine, drinking fruit juice is believed to have significant health benefits, including improving physical health, promoting metabolism, and aiding immunity.

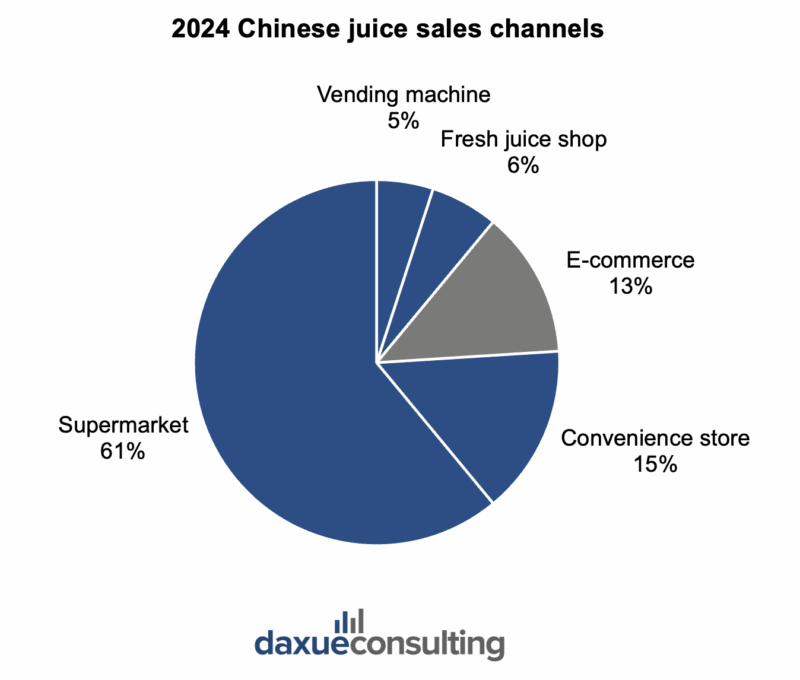

Traditional retail channels continue to dominate the juice market in China, with supermarkets accounting for 61% of total market share. However, the e-commerce sector is the fastest-growing, as consumers increasingly prefer the convenience of purchasing online. Convenience stores are also a significant channel for juice sales, especially as the Chinese convenience store market continues to grow.

Health-conscious juice consumption

A growing health consciousness among Chinese consumers is expanding the market for healthy drinks in China. This trend is also redefining the juice market as consumers shift towards paying more attention towards drink ingredients. According to the 2024 China Food and Beverage Industry White Paper, consumers increasingly demand low-sugar and natural juices without dilution or added sugar. Beverages are at the forefront of this health transformation, as brands focus on creating products with health benefits rather than just taste.

Given the emphasis on slimness within beauty standards in China, the primary focus of Chinese consumers when defining healthy juices is still calorie content. When asking for healthy drink recommendations on Xiaohongshu, netizens tend to prioritize clean ingredients and low calories. They also frequently recommend products found on Pinduoduo, showing a preference for digital retailers.

The demand for healthier juices is part of a broader trend toward no-sugar or low-sugar drinks. According to a 2024 research study conducted by iiMedia on the market value of zero-sugar drinks in China, the zero-sugar beverage market reached 40.16 billion yuan in 2023, with the market experiencing exponential growth since 2017.

However, consumers are no longer satisfied with zero-sugar beverages alone, leading to a shift in demand toward functional and more diversified products. In 2024, the market for protein beverages grew 10.7%, and functional beverages as a whole grew by 12.2%.

Diversification of flavor demand for juice in China

Consumers in the juice market in China are demanding more niche flavors beyond traditional options such as orange and grape. Flavors such as sea buckthorn, plum, and other regional specialty fruits are gaining popularity. Product localization is a key strategy for producers across different CPG markets, as Chinese consumers increasingly seek flavors that incorporate Chinese cultural elements and local ingredients. Examples include the traditional Suanmeitang plum juice and juice made from blueberries grown in Yunnan.

Additionally, the rise of functional juice products for healthier lifestyles has led to a trend of “superfood” juices, which combine a variety of fruits for increased nutrition, along with health-promoting additives such as vitamins, dietary fiber, and antioxidants.

Health and culture continue to drive juice consumption:

- In China’s food and beverage market, juice in China continues to grow alongside the wider non-alcoholic beverage market. This growth phenomenon is accompanied by a restructuring of the market and creation of new juice products to meet shifting consumer priorities.

- In addition to purely prioritizing slimness, Chinese consumers are also becoming more health-conscious, demanding healthier juices with clean ingredients and additional health benefits

- Functional beverages are a step further beyond the trend towards zero-sugar. Juices with additional benefits such as high levels of dietary fiber and antioxidants are gaining popularity among netizens

- Chinese consumers largely see juices as a supplement to a meal or as a snack between meals rather than an overall meal replacement

- Increasing preference for niche and exotic flavors accompanies an emphasis on juices with ingredients and flavors rooted in traditional Chinese culture and local products.